TIDMPTAL

RNS Number : 7909P

PetroTal Corp.

12 June 2020

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, JAPAN, NEW

ZEALAND, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH

RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE: (A) A PROSPECTUS OR OFFERING MEMORANDUM; (B) AN

ADMISSION DOCUMENT PREPARED IN ACCORDANCE WITH THE AIM RULES; OR

(C) AN OFFER FOR SALE OR SUBSCRIPTION OF ANY SECURITIES IN THE

COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR CONTAIN ANY

INVITATION, SOLICITATION, RECOMMATION, OFFER OR ADVICE TO ANY

PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE OF ANY

SECURITIES OF PETROTAL CORP. IN ANY JURISDICTION IN WHICH ANY SUCH

OFFER OR SOLICITATION WOULD BE UNLAWFUL.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATION (REGULATION 596/2014/EU). UPON

PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION

SERVICE THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

CAPITALISED TERMS ARE AS DEFINED AT THE OF THIS

ANNOUNCEMENT.

June 12, 2020

PetroTal Corp.

Proposed Placing to raise GBP14.1 million

Calgary and Houston - June 12, 2020-PetroTal Corp. ("PetroTal"

or the "Company") (TSX--V: TAL and AIM: PTAL), the Peruvian focused

E&P company, is pleased to announce a placing of 141.2 million

Placing Units at a price of 10p per unit to raise gross proceeds of

GBP14.1 million (approximately US$18 million). Each Placing Unit

will be comprised of one new Common Share and one half of one

Warrant.

Placing highlights

-- The Placing was significantly oversubscribed.

-- The Company intends to use the net proceeds of the Placing

for ongoing development of the Bretana oilfield and to enhance

working capital. In particular, the net proceeds will be deployed

by the Company in connection with the proposed reopening of the

Bretana oilfield which is anticipated to occur in July.

-- With a stronger balance sheet, PetroTal will be able to

finalize a credit facility for day-to-day operations and structure

derivatives to minimize the impact of future oil price

fluctuations.

-- Auctus Advisors is acting as sole bookrunner on the Placing.

Strand Hanson is acting as Nominated and Financial Adviser to the

Company.

Background to and reasons for the Placing

As recently announced, PetroTal has entered into a financial

arrangement with PETROPERU S.A. ("Petroperu") relating to the

contingent liability due to Petroperu which will see the entire

contingent liability resolved on a one-time basis and see the

obligation paid evenly over a three year period, at an annual

interest rate of 6.5%.

Meanwhile, however, the Bretana oil field remains shut down

awaiting opening of the Northern Oil Pipeline ("ONP") by Petroperu.

PetroTal is coordinating with Petroperu to reopen the Bretana oil

field in July 2020, with the expectation that the ONP restarts

pumping oil very shortly thereafter. Both PetroTal and Petroperu

will fully abide by the health directives issued by the Peruvian

government in order to safely restart operations during the ongoing

Covid-19 pandemic.

In this period of uncertainty in the context of the Covid-19

pandemic, the Directors consider that strengthening its balance

sheet with additional working capital is a prudent action.

Details of the Placing

The Company will raise gross proceeds of GBP14.1 million

pursuant to the Placing. The Placing will result in the issue of a

total of 141,203,891 new Common Shares and 70,601,945 Warrants. The

Placing Shares will represent approximately 17.3 per cent. of the

Enlarged Share Capital.

The Placing Price represents a discount of approximately 11 per

cent. to the closing mid-market price per existing Common Share of

11.25 pence on June 11, 2020, being the last practicable trading

day prior to release of this announcement.

The Placing Shares will, when issued, be subject to the Articles

and By Laws, be credited as fully paid and non-assessable and rank

equally in all respects with each other and with the Existing

Common Shares, including the right to receive all dividends and

other distributions declared, made or paid in respect of the Common

Shares after the date of issue of the Placing Shares.

Warrants

Each Placing Unit will comprise one Placing Share and one half

of one Warrant.

A whole Warrant (comprised of two half Warrants) will have an

exercise price of 16p per Common Share, which equates to a 60%

premium above the Placing Price, and will be capable of being

exercised at any time from and after the date of Admission until

the third anniversary of Admission. The Warrants can only be

exercised for cash.

The Warrant exercise price and the number of shares issuable

upon exercise of the Warrants will be adjusted in certain

circumstances, including if the Company effects a subdivision or

consolidation of its Common Shares, declares a dividend or

distribution, or there is a reorganisation of its Common

Shares.

Related Party Transaction

As at June 11, 2020, Meridian Capital International Fund

("Meridian") held approximately 11.8 per cent. of the Existing

Share Capital and, as such, is considered to be a related party of

the Company as defined by the AIM Rules.

Meridian is participating in the Placing for an amount of GBP7.5

million and this participation constitutes a related party

transaction pursuant to AIM Rule 13 and Multilateral Instrument

61-101 Protection of Minority Security Holders in Special

Transactions ("MI 61-101"). Following completion of the Placing,

Meridian and its linked parties will hold 19.42 per cent. of the

Enlarged Share Capital.

The Directors, other than Mr. Gavin Wilson, who represents

Meridian on the Board, having consulted with the Company's

nominated adviser, Strand Hanson Limited, consider that the terms

of the participation by Meridian are fair and reasonable insofar as

the shareholders of the Company are concerned. In its consideration

and approval of the Placing, the Directors determined that it was

exempt from the formal valuation and minority approval requirements

of MI 61-101 on the basis that the fair market value of the Placing

to Meridian did not exceed 25% of the market capitalization of

PetroTal, in accordance with Sections 5.5 and 5.7 of MI 61-101.

The terms of the Warrants issued to Meridian will provide that,

subject to certain exceptions, Meridian shall not exercise any

Warrants where such exercise would result in Merdian's beneficial

ownership, direction or control of the issued and outstanding

Common Shares at the time of exercise exceeding 19.99%.

Placing Agreement

The Company and Auctus have entered into the Placing Agreement

pursuant to which (a) the Company has appointed Auctus as the

Company's agent to use its reasonable endeavours to procure

subscribers for the Placing Units at the Placing Price. The Placing

is not underwritten. The Company has agreed to pay Auctus certain

commissions in connection with the Placing.

The Placing is conditional on, amongst other things, Admission

of the Placing Shares occurring on or before 8.00 a.m. on June 18,

2020 (or such later time and/or date as the Company and Auctus may

agree, being not later than 8.00 a.m. on June 26, 2020).

The Placing Agreement contains certain customary warranties

given by the Company concerning the accuracy of the information in

this Announcement as well as other matters relating to the Group

and its business. The Placing Agreement is terminable by Auctus in

certain circumstances prior to Admission, including for force

majeure or in the event of a material adverse change to the

business of the Company or the Group. The Company has also agreed

to provide a market standard indemnity and undertakings to

Auctus.

Admission

Application will be made to: (a) the London Stock Exchange for

Admission of the Placing Shares to trading on AIM; and (b) the TSXV

for listing of the Placing Shares for trading on the facilities of

the TSXV.

It is expected that Admission will become effective at 8.00 a.m.

on June 18, 2020 (or such later date as the Company and Auctus may

agree, being not later than 8.00 a.m. on June 26, 2020) and that

dealings in the Placing Shares will also commence at that time.

The Warrants will not be admitted to trading on AIM or listed

for trading on the facilities of the TSXV.

Without prior written approval of the TSXV and compliance with

all applicable Canadian securities laws, the Placing Shares,

Warrants and Common Shares issuable on the exercise of Warrants may

not be sold, transferred, hypothecated or otherwise traded on or

through the facilities of TSXV or otherwise in Canada or to or for

the benefit of a Canadian resident until the date that is four

months and a day after the date of issuance.

The relevant clearances have not been, nor will they be,

obtained from the securities commission of any province or

territory of Canada; no prospectus has been lodged with or

registered by, the Australian Securities and Investments Commission

or the Japanese Ministry of Finance; and the Placing Shares and

Warrants have not been, nor will they be, registered or qualified

for distribution, as applicable under or offered in compliance with

the securities laws of any state, province or territory of United

States, Australia, New Zealand, Canada, Japan or South Africa.

Accordingly, the Placing Units may not (unless an exemption under

the relevant securities laws is applicable) be offered, sold,

resold or delivered, directly or indirectly, in or into the United

States, Australia, New Zealand, Canada, Japan or South Africa or

any other jurisdiction outside the United Kingdom.

Manolo Zuniga, President and Chief Executive Officer,

commented:

"In light of the recent fall in global oil prices and the

temporary shut in of the Bretana oil field, we have sought to

preserve liquidity and are taking the opportunity to strengthen the

Company's balance sheet via this fundraise.

The Placing and the arrangement announced with Petroperu today

will give PetroTal greater financial strength and sufficient

flexibility to prepare for the reopening of the Bretana field,

which is expected to occur in July. Additionally, the Petroperu

arrangement and support by the Peruvian government, demonstrates

that Peru provides an excellent investment climate.

I would like to thank our investors for their continued support,

as seen with the Placing being oversubscribed, and I look forward

to keeping the market appraised on developments at Bretana over the

coming months."

ABOUT PETROTAL

PetroTal is a publicly -- traded, dual -- quoted (TSXV: TAL and

AIM: PTAL) oil and gas development and production company domiciled

in Calgary, Alberta, focused on the development of oil assets in

Peru. PetroTal's flagship asset is its 100% working interest in

Bretaña oil field in Peru's Block 95 where oil production was

initiated in June 2018, and in early 2020 became the second largest

oil producer in Peru. Additionally, the Company has large

exploration prospects and is engaged in finding a partner to drill

the Osheki prospect in Block 107. The Company's management team has

significant experience in developing and exploring for oil in

Northern Peru and is led by a Board of Directors that is focused on

safely and cost effectively developing the Bretaña oil field.

For further information, please see the Company's website at

www.petrotal-corp.com, the Company's filed documents at

www.sedar.com, or contact:

Douglas Urch

Executive Vice President and Chief Financial Officer

Durch@PetroTal-Corp.com

T: (713) 609-9101

Manolo Zuniga

President and Chief Executive Officer

Mzuniga@PetroTal-Corp.com

T: (713) 609-9101

Auctus Advisors LLP (Sole Bookrunner to the Placing)

Jonathan Wright / Rupert Holdsworth Hunt / Harry Baker

Tel: +44 (0) 7711 627449

Celicourt Communications

Mark Antelme / Jimmy Lea

petrotal@celicourt.uk

T: 44 (0) 208 434 2643

Strand Hanson Limited (Nominated & Financial Adviser)

James Spinney / Ritchie Balmer / Rory Murphy

T: 44 (0) 207 409 3494

Stifel Nicolaus Europe Limited (Joint Broker)

Callum Stewart / Simon Mensley / Ashton Clanfield

Tel: +44 (0) 20 7710 7600

Numis Securities Limited (Joint Broker)

John Prior / Emily Morris

T: +44 (0) 207 260 1000

FURTHER INFORMATION

DEFINITIONS

The following definitions apply throughout this Announcement

unless the context otherwise requires:

Admission the admission of the Placing Shares

to trading on AIM becoming effective

in accordance with Rule 6 of the

AIM Rules

AIM the market of that name operated

by the London Stock Exchange

-----------------------------------------

AIM Rules the AIM Rules for Companies published

by the London Stock Exchange as they

may be amended and replaced from

time to time

-----------------------------------------

Articles the articles of amalgamation of the

Company (as amended from time to

time)

-----------------------------------------

Auctus or Auctus Advisors Auctus Advisors LLP, sole bookrunner

to the Placing

-----------------------------------------

By Laws the by-laws of the Company adopted

on December 18, 2017 (as amended

from time to time)

-----------------------------------------

Common Shares common shares in the capital of the

Company

-----------------------------------------

Company or PetroTal PetroTal Corp., a public company

incorporated under the laws of Alberta

with corporate access number 2020869455

and whose registered office is at

c/o Stikeman Elliott LLP Suite 4300,

888 3rd Street S.W., Calgary Alberta

T2P 5C5

-----------------------------------------

Directors the directors of the Company

-----------------------------------------

Enlarged Share Capital together, the Existing Common Shares

and the Placing Shares

-----------------------------------------

Existing Common Shares the 673,351,810 Common Shares in

issue at the date of this Announcement

-----------------------------------------

London Stock Exchange London Stock Exchange plc

-----------------------------------------

Meridian Meridian Capital International Fund

-----------------------------------------

Petroperu PETROPERU S.A.

-----------------------------------------

Placees those persons who subscribe for Placing

Shares and/or acquire Sale Shares

pursuant to the Placing

-----------------------------------------

Placing the placing of the Placing Units

at the Placing Price by Auctus as

agent for and on behalf of the Company

pursuant to the terms and conditions

of the Placing Agreement

-----------------------------------------

Placing Price 10 pence per Placing Unit

-----------------------------------------

Placing Agreement the conditional placing agreement

dated June 12, 2020 relating to the

Placing and entered into between

the Company and Auctus

-----------------------------------------

Placing Shares the 141,203,891 new Common Shares

to be issued to Placees pursuant

to the Placing

-----------------------------------------

Placing Unit One Placing Share and one half of

one Placing Warrant to be subscribed

for as a unit by the Placees at the

Placing Price

-----------------------------------------

Strand Hanson Strand Hanson Limited, the Company's

Nominated and Financial Adviser

-----------------------------------------

TSXV TSX Venture Exchange

-----------------------------------------

United States or US the United States of America, its

territories and possessions, any

state of the United States and the

District of Columbia and all other

areas subject to its jurisdiction

-----------------------------------------

GBP or Sterling pounds sterling, the basic currency

of the United Kingdom

-----------------------------------------

US$ United States dollar, the legal currency

of the United States

-----------------------------------------

Warrants warrants to subscribe for new Common

Shares

-----------------------------------------

READER ADVISORIES

FORWARD -- LOOKING STATEMENTS: This press release contains

certain statements that may be deemed to be forward -- looking

statements. Such statements relate to possible future events,

including, but not limited to: PetroTal's business strategy,

objectives, strength and focus; the Company's ability to resume

operations in accordance with developing public health efforts to

contain COVID-19; the financial arrangement with Petroperu relating

to certain contingent liabilities; and the Placing, including with

respect to size, timing and use of proceeds. All statements other

than statements of historical fact may be forward -- looking

statements. Forward -- looking statements are often, but not

always, identified by the use of words such as "anticipate",

"believe", "expect", "plan", "estimate", "potential", "will",

"should", "continue", "may", "objective" and similar expressions.

The forward -- looking statements are based on certain key

expectations and assumptions made by the Company. Although the

Company believes that the expectations and assumptions on which the

forward -- looking statements are based are reasonable, undue

reliance should not be placed on the forward -- looking statements

because the Company can give no assurance that they will prove to

be correct. Since forward -- looking statements address future

events and conditions, by their very nature they involve inherent

risks and uncertainties. Actual results could

differ materially from those currently anticipated due to a

number of factors and risks. These include, but are not limited to,

risks associated with the oil and gas industry in general (e.g.,

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses; and health, safety and

environmental risks), commodity price volatility, price

differentials and the actual prices received for products, exchange

rate fluctuations, legal, political and economic instability in

Peru, access to transportation routes and markets for the Company's

production, changes in legislation affecting the oil and gas

industry and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures. In addition, the Company cautions

that current global uncertainty with respect to the spread of the

COVID-19 virus and its effect on the broader global economy may

have a significant negative effect on the Company. While the

precise impact of the COVID-19 virus on the Company remains

unknown, rapid spread of the COVID-19 virus may continue to have a

material adverse effect on global economic activity, and may

continue to result in volatility and disruption to global supply

chains, operations, mobility of people and the financial markets,

which could affect interest rates, credit ratings, credit risk,

inflation, business, financial conditions, results of operations

and other factors relevant to the Company. Please refer to the risk

factors identified in the Company's annual information form for the

year ended December 31, 2018 and management's discussion and

analysis for the nine months ended September 30, 2019 which are

available on SEDAR at www.sedar.com. The forward -- looking

statements contained in this press release are made as of the date

hereof and the Company undertakes no obligation to update publicly

or revise any forward -- looking statements or information, whether

as a result of new information, future events or otherwise, unless

so required by applicable securities laws.

FOFI DISCLOSURE: This press release contains future -- oriented

financial information and financial outlook information

(collectively, "FOFI") about PetroTal's temporary shut down of

operations, adequacy of financial resources during the shut down,

the anticipated resumption of operations, the settlement of the

contingent liability with Petroperu, working capital, balance sheet

strength, the Placing and components thereof, all of which are

subject to the same assumptions, risk factors, limitations and

qualifications as set forth in the above paragraphs. FOFI contained

in this press release was approved by management as of the date of

this press release and was included for the purpose of providing

further information about PetroTal's anticipated future business

operations. PetroTal disclaims any intention or obligation to

update or revise any FOFI contained in this press release, whether

as a result of new information, future events or otherwise, unless

required pursuant to applicable law. Readers are cautioned that the

FOFI contained in this press release should not be used for

purposes other than for which it is disclosed herein.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this press release.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOESFFSIEESSELM

(END) Dow Jones Newswires

June 12, 2020 02:05 ET (06:05 GMT)

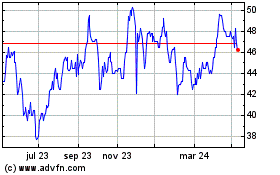

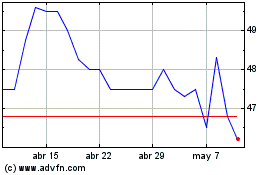

Petrotal (LSE:PTAL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Petrotal (LSE:PTAL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024