TIDMPTAL

RNS Number : 0786Q

PetroTal Corp.

16 June 2020

PetroTal Announces 2019 Year-End Financial and Operating

Results

Record levels of oil production, cash flow and income

Calgary and Houston - June 15, 2020 - PetroTal Corp. ("PetroTal"

or the "Company") (TSX--V: TAL and AIM: PTAL) is pleased to

announce its financial and operating results for the year and the

three months ("Q4") ended December 31, 2019.

Selected financial, reserves and operational information is

outlined below and should be read in conjunction with the Company's

audited consolidated financial statements ("Financial Statements"),

management's discussion and analysis ("MD&A") and annual

information form ("AIF") for the year ended December 31, 2019,

which are available on SEDAR at www.sedar.com and the Company's

website at www.petrotal-corp.com . Reserves numbers presented

herein were derived from an independent reserves report (the "NSAI

Report") prepared by Netherland, Sewell & Associates, Inc.

("NSAI") effective December 31, 2019. All amounts herein are in

United States dollars ("USD") unless otherwise stated.

2019 highlights

The Company reached several key operational and financial

achievements during 2019 as described below:

Q4 Highlights

- Drilled and completed the Company's first horizontal well

(4H), having a 500 meter lateral and utilizing autonomous inflow

control device ("AICD") valves to maximize oil production;

- Drilled and completed the 5H well, the longest horizontal well

drilled in Peru. The well reached the target Vivian formation at a

vertical depth of 2,696 meters and then with an 863 meter

horizontal section inside the main productive oil reservoir;

- Commissioning of the new $31.6 million Central Production

Facility ("CPF") commenced on December 22, 2019 with the successful

hydrostatic test of the new 20,000 barrel oil storage tank;

- Earned net income of $18.2 million ($0.03 per share basic)

compared to a net loss of $2.2 million in Q4 2018;

- Higher operating net back of $28.6 million compared to $2.3 million in Q4 2018;

- For Q4 2019 the Company recognized funds flow generated of

$22.2 million, as compared to utilization of negative $1.9 million

in Q4 2018;

- Achieved a record quarterly oil production of 7,767 bopd, an

increase of 670% over Q4 2018 (1,158 bopd), and an increase of 63%

over Q3 2019 (4,760 bopd);

- Q4 2019 sales volumes averaged 9,509 bopd compared to 1,199 bopd in Q4 2018; and,

- Capital expenditures were $26.9 million in Q4 2019 compared to $4.4 million in Q4 2018.

2019 Operational Highlights

- At December 31, 2019 , six producing wells and one water

disposal were operating, inclusive of the initial water disposal

that was converted to an oil producer;

- The Company invested $88.4 million to drill five producing oil

wells, a water disposal well and build production facilities,

nearly a three fold increase from capital expenditures of $23.2

million in 2018;

- The Company achieved an exit rate production of 13,300 bopd at

the end of 2019 with the Q4 average being 7,767 bopd. PetroTal

produced a total of 1.5 million barrels of oil in 2019,

representing average oil production of 4,131 bopd, an increase of

431% from the average production of 958 bopd realized in 2018;

- NSAI Report shows increases in all reserve categories:

o Proved ("1P") reserves of 21.5 million barrels ("mmbbl"), an increase of 20% from the

17.9 mmbbl recorded at the end of 2018;

o Proved plus Probable ("2P") reserves of 47.7 mmbbl, an increase of 21% from the 39.4

mmbbl recorded at the end of 2018; and,

o Proved plus Probable and Possible ("3P") reserves of 84.8 mmbbl, an increase of 8%

from the 78.7 mmbbl recorded at the end of 2018;

- Net Present Value (before tax, discounted at 10%) ("NPV-10")

represents $434 million ($20.19/bbl) for 1P reserves, $1.1 billion

($23.02/bbl) for 2P reserves and $1.9 billion ($22.11/bbl) for 3P

reserves; and,

- Original oil in place ("OOIP") estimates for each category of

reserves also increased, with the 2P estimate increasing from 329

mmbbl to 364 mmbbl.

2019 Financial Highlights

- Generated revenue of $77 million ($52.32/bbl) compared to $10 million ($59.10/bbl) in 2018;

- Royalties to the Peruvian government were $3.4 million (4% of

revenue) during 2019 compared to $0.5 million (5% of revenue) for

2018;

- Generated funds from operations of $51.9 million compared to

$30 thousand in 2018, as a result of the significant increase in

revenue generation;

- Operating and transportation costs, were $31.9 million

($21.68/bbl) for 2019 compared to $4.9 million ($27.60/bbl) for

2018, an improvement of 22% on a per barrel basis;

- Net operating income (netback) in 2019 was $41.4 million

($28.09/bbl) compared to $5.1 million ($28.72/bbl) in 2018;

- Cash flow generated was $29.7 million compared to negative

$3.4 million in 2018. Cash flow represents netback inclusive of

G&A costs, realized gain (losses) on commodity contracts and

all other cash transactions; and,

- At December 31, 2019, the Company had cash of $21.1 million,

compared to $26.3 million at the end of 2018.

2019 Other Highlights

- On November 4, 2019, the Company announced the addition of Mr.

Douglas Urch, as Executive Vice President and Chief Financial

Officer of the Company;

- On December 12, 2019, the Company's board of directors

declared its inaugural dividend of $0.9 million to shareholders of

record on December 20, 2019; and,

- On December 19, 2019, Ms. Eleanor Barker and Dr. Roger Tucker

were appointed as Independent Non-Executive Directors.

The following table summarizes key financial and operating

highlights associated with the Company's performance for the years

ended December 31, 2019 and 2018. See the Financial Statements,

MD&A and AIF for further details.

December December

31 31

Results at a glance 2019 2018

=================================== ================================= ====================================

Financial

Crude oil revenues 77,024 10,487

Royalties (3,394) (493)

Commodity price derivatives 367 -

loss

Net operating income 41,719 5,096

Net income (loss) 20,152 (4,621)

Basic and diluted (US$/share) 0.03 (0.01)

Funds generated from

operations 51,061 30

Capital expenditures 88,763 23,207

Operating

Average production (bopd) 4,131 958

Average sales (bopd) 4,033 964

Average Brent oil price

(US$/barrel) 64.31 63.84

Average realized price

(US$/barrel) 52.32 59.10

Netback (US$/barrel) 28.09 28.72

Cash flow 29,692 (3,362)

=================================== ================================= ====================================

Balance sheet

Cash 21,101 26,259

Working Capital (11,762) 26,053

Total assets 194,181 96,097

Current liabilities 59,286 9,582

Equity 121,057 77,527

=================================== ================================= ====================================

Q4-19 FY 2019 Q4-18 FY 2018

$/bbl $/bbl $/bbl $/bbl

======== ================

Average

Production

SALES: (bopd) 7,767 4,131 1,158 958

Bbls Sold 874,802 1,472,042 110,287 177,465

Average Brent price

($/bbl) 63.26 64.31 63.84 63.84

Quarterly Difference

Variation price (%) -17.0% -18.6% -12.1% -7.4%

========================= ========== =================== ========== =================== ========== =================== ========== ====================

Average sold (bopd) 9,509 4,033 1,199 964

Oil revenue $52.49 $45,916 $52.32 $77,024 $56.09 $6,186 $59.10 $10,487

Less: Royalties $2.07 $1,813 $2.31 $3,394 $3.04 $336 $2.78 $493

Operating expense $6.91 $6,047 $9.73 $14,319 $22.82 $2,516 $19.73 $3,501

Transportation expense $11.09 $9,702 $11.95 $17,592 $9.32 $1,028 $7.87 $1,397

Derivative loss (income) -$0.24 ($213) $0.25 $367 $0.00 $0 $0.00 $0

========== =================== ========== =================== ========== =================== ========== ====================

NET OPERATING INCOME $32.65 $28,566 $28.09 $41,352 $20.91 $2,306 $28.72 $5,096

========== =================== ========== =================== ========== =================== ========== ====================

Netback as % of Revenue 62.2% 53.7% 37.3% 48.6%

========================= ========== =================== ========== =================== ========== =================== ========== ====================

G &

A $6.91 $6,048 $7.33 $10,789 $36.95 $4,075 $44.18 $7,840

Accretion expense $0.14 $126 $0.28 $416 $0.81 $89 $3.48 $618

Finance expense $0.27 $238 $0.31 $455 $0.00 $0 $0.00 $0

CASH FLOW $22,154 $29,692 ($1,858) ($3,362)

========== ========== ========== ==========

Deferred income taxes $0.05 $45 $0.06 $86 -$7.18 ($792) -$4.46 ($792)

Depletion and

depreciation $4.30 $3,760 $5.79 $8,528 $7.39 $815 $7.91 $1,404

Impairment and foreign

exchange $0.14 $126 $0.63 $927 $2.75 $303 $3.65 $647

========================= ========== =================== ========== =================== ========== =================== ========== ====================

Net Income (loss) $18,223 $20,152 ($2,184) ($4,621)

========================= ========== =================== ========== =================== ========== =================== ========== ====================

Manuel Pablo Zuniga-Pflucker, President and Chief Executive

Officer, commented:

"As a Company, we achieved a great deal in 2019. We set

ourselves a number of ambitious targets at the beginning of the

year and were able to meet or exceed all of them. We were also able

to generate significant value for our shareholders by increasing

our production by 431% year-on-year. Our ability to deliver an exit

rate of 13,300 bopd for 2019 is a testament to the expertise and

hard work of PetroTal's workforce during the period.

Whilst we are currently focusing on balance sheet strength and

liquidity, in light of the difficult trading environment, we remain

well placed to deliver value for all our stakeholders. In closing,

I would like to thank PetroTal's shareholders, directors, employees

and contractors for their continued support. We look forward to

announcing further developments as the year progresses."

ABOUT PETROTAL

PetroTal is a publicly--traded, dual--quoted (TSXV: TAL and AIM:

PTAL) oil and gas development and production company domiciled in

Calgary, Alberta, focused on the development of oil assets in Peru.

PetroTal's flagship asset is its 100% working interest in Bretaña

oil field in Peru's Block 95 where oil production was initiated in

June 2018 and in early 2020, became the second largest crude oil

producer in Peru. Additionally, the Company has large exploration

prospects and is engaged in finding a partner to drill the Osheki

prospect in Block 107. The Company's management team has

significant experience in developing and exploring for oil in

Northern Peru and is led by a Board of Directors that is focused on

safely and cost effectively developing the Bretaña oil field.

For further information, please see the Company's website at

www.petrotal-corp.com , the Company's filed documents at

www.sedar.com , or contact:

Douglas Urch

Executive Vice President and Chief Financial Officer

Durch@PetroTal-Corp.com

T: (713) 609-9101

Manuel Pablo Zuniga-Pflucker

President and Chief Executive Officer

Mzuniga@PetroTal-Corp.com

T: (713) 609-9101

Celicourt Communications

Mark Antelme / Jimmy Lea

petrotal@celicourt.uk

T : 44 (0) 208 434 2643

Strand Hanson Limited (Nominated & Financial Adviser)

James Spinney / Ritchie Balmer

T: 44 (0) 207 409 3494

Stifel Nicolaus Europe Limited (Joint Broker)

Callum Stewart / Simon Mensley / Ashton Clanfield

Tel: +44 (0) 20 7710 7600

Numis Securities Limited (Joint Broker)

John Prior / Emily Morris

T: +44 (0) 207 260 1000

READER ADVISORIES

FORWARD--LOOKING STATEMENTS: This press release contains certain

statements that may be deemed to be forward--looking statements.

Such statements relate to possible future events, including, but

not limited to: PetroTal's business strategy, objectives, strength

and focus; drilling and completion activities and the results of

such activities; construction of production facilities; the ability

of the Company to achieve drilling success consistent with

management's expectations; anticipated future production and

revenue; future development and growth prospects; and the Company's

ability to resume operations in accordance with developing public

health efforts to contain COVID-19. All statements other than

statements of historical fact may be forward--looking statements.

In addition, statements relating to expected production, reserves,

recovery, costs and valuation are deemed to be forward-looking

statements as they involve the implied assessment, based on certain

estimates and assumptions that the reserves described can be

profitably produced in the future. Forward-- looking statements are

often, but not always, identified by the use of words such as

"anticipate", "believe", "expect", "plan", "estimate", "potential",

"will", "should", "continue", "may", "objective" and similar

expressions. The forward--looking statements are based on certain

key expectations and assumptions made by the Company , including,

but not limited to, expectations and assumptions concerning the

ability of existing infrastructure to deliver production and the

anticipated capital expenditures associated therewith, reservoir

characteristics, recovery factor, exploration upside, prevailing

commodity prices and the actual prices received for PetroTal's

products, the availability and performance of drilling rigs,

facilities, pipelines, other oilfield services and skilled labour,

royalty regimes and exchange rates, the application of regulatory

and licensing requirements, the accuracy of PetroTal's geological

interpretation of its drilling and land opportunities, current

legislation, receipt of required regulatory approval, the success

of future drilling and development activities, the performance of

new wells, the Company's growth strategy, general economic

conditions and availability of required equipment and services .

Although the Company believes that the expectations and assumptions

on which the forward--looking statements are based are reasonable,

undue reliance should not be placed on the forward--looking

statements because the Company can give no assurance that they will

prove to be correct. Since forward--looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks. These include, but are not limited to, risks

associated with the oil and gas industry in general (e.g.,

operational risks in development, exploration and production;

delays or changes in plans with respect to exploration or

development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses; and health, safety and

environmental risks), commodity price volatility, price

differentials and the actual prices received for products, exchange

rate fluctuations, legal, political and economic instability in

Peru, access to transportation routes and markets for the Company's

production, changes in legislation affecting the oil and gas

industry and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures. In addition, the Company cautions

that current global uncertainty with respect to the spread of the

COVID-19 virus and its effect on the broader global economy may

have a significant negative effect on the Company. While the

precise impact of the COVID-19

virus on the Company remains unknown, rapid spread of the

COVID-19 virus may continue to have a material adverse effect on

global economic activity, and may continue to result in volatility

and disruption to global supply chains, operations, mobility of

people and the financial markets, which could affect interest

rates, credit ratings, credit risk, inflation, business, financial

conditions, results of operations and other factors relevant to the

Company. Please refer to the risk factors identified in the AIF and

MD&A which are available on SEDAR at www.sedar.com. The

forward--looking statements contained in this press release are

made as of the date hereof and the Company undertakes no obligation

to update publicly or revise any forward--looking statements or

information, whether as a result of new information, future events

or otherwise, unless so required by applicable securities laws.

FOFI DISCLOSURE: This press release contains future--oriented

financial information and financial outlook information

(collectively, "FOFI") about PetroTal's prospective results of

operations, production, NPV-10, future net revenue, future

development costs, temporary shut down of operations, the

anticipated resumption of operations, storage capacity, cost

reductions and components thereof, all of which are subject to the

same assumptions, risk factors, limitations and qualifications as

set forth in the above paragraphs. FOFI contained in this press

release was approved by management as of the date of this press

release and was included for the purpose of providing further

information about PetroTal's anticipated future business

operations. PetroTal disclaims any intention or obligation to

update or revise any FOFI contained in this press release, whether

as a result of new information, future events or otherwise, unless

required pursuant to applicable law. Readers are cautioned that the

FOFI contained in this press release should not be used for

purposes other than for which it is disclosed herein.

PRESENTATION OF OIL AND GAS INFORMATION: The reserves

information herein sets forth PetroTal's reserves as at December

31, 2019, as presented in the independent reserves report prepared

by NSAI, in accordance with the standards contained in the Canadian

Oil and Gas Evaluation Handbook (the "COGE Handbook") and the

reserve definitions contained in National Instrument 51-101 -

Standards of Disclosure for Oil and Gas Activities ("NI 51-101").

In addition to the summary information disclosed in this

announcement and the press release dated February 18, 2020, more

detailed information is included in the AIF. This press release

contains metrics commonly used in the oil and natural gas industry,

such as operating netbacks (calculated on a per unit basis as oil

revenues less royalties and barging, pipeline and lifting costs).

These terms have been calculated by management and do not have a

standardized meaning and may not be comparable to similar measures

presented by other companies, and therefore should not be used to

make such comparisons. Management uses these oil and gas metrics

for its own performance measurements and to provide shareholders

with measures to compare PetroTal's operations over time. All oil

and gas disclosure contained in this press release complies with

the requirements of NI 51-101. The term original oil in place

(OOIP) is equivalent to total petroleum initially in place

("TPIIP"). TPIIP, as defined in the Canadian Oil and Gas Evaluation

Handbook, is that quantity of petroleum that is estimated to exist

in naturally occurring accumulations. It includes that quantity of

petroleum that is estimated, as of a given date, to be contained in

known accumulations, prior to production, plus those estimated

quantities in accumulations yet to be discovered. A portion of the

TPIIP is considered undiscovered and there is no certainty that any

portion of such undiscovered resources will be discovered. If

discovered, there is no certainty that it will be commercially

viable to produce any portion of such undiscovered resources. With

respect to the portion of the TPIIP that is considered discovered

resources, there is no certainty that it will be commercially

viable to produce any portion of such discovered resources. A

significant portion of the estimated volumes of TPIIP will never be

recovered.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this press release.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR EASKKFAAEEEA

(END) Dow Jones Newswires

June 16, 2020 02:00 ET (06:00 GMT)

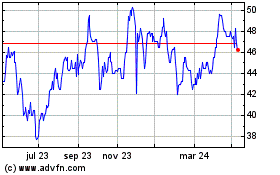

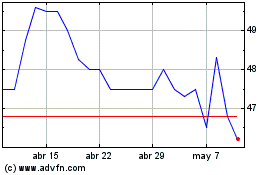

Petrotal (LSE:PTAL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Petrotal (LSE:PTAL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024