Woodbois Limited Company Update (4365Q)

19 Junio 2020 - 1:00AM

UK Regulatory

TIDMWBI

RNS Number : 4365Q

Woodbois Limited

19 June 2020

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

19 June 2020

Woodbois Limited

("the Group" or "the Company")

AIM "WBI"

Conditional Debt and Balance Sheet Restructuring

Updated Strategy

Gabon Sawmill Operations Recommence

The Company is pleased to provide the following update regarding

operations, strategy and its proposed balance sheet

restructuring.

Proposed Debt and Balance Sheet Restructuring

Discussions with the majority holder of the Company's 2024

convertible bonds ("Convertible") have continued, and the Company

is pleased to have now reached an agreement in principle with the

major bondholder such that not less than 75% of the $30 million

notional outstanding of the Convertible will be exchanged into

voting and non-voting equity and with the balance restructured into

a zero coupon convertible bond. Such agreement in principle will be

conditional upon the Company raising additional equity and

finalisation of the definitive legal documentation to enable it to

continue to build on the substantial investments made over the last

couple of years and is intended to hasten sustained positive

operating cash flow.

The Company has initiated discussions with the majority holders

of its internal trade finance facility ("ITF"). Lombard Odier,

which is both a substantial shareholder and holder of approximately

$5.5m of the ITF, has indicated its ongoing commitment to the

business by agreeing, subject to final terms to be a cornerstone

investor in the planned equity fundraise, which itself will be of

sufficient quantum to right size the balance sheet and unlock

material growth. The discussion with other holders of the ITF are

continuing and the Company is intending to have completely retired

the ITF as part of the planned restructuring and fundraise.

Further announcement regarding the restructuring and potential

equity fundraising will be made in due course.

Updated Strategy

At this stage the Company expects to prioritise additional capex

of c$3-5 million to increase the capacity at its existing

operations in Gabon and in particular increase its veneer

production, which is intended to increase current gross production

capacity by approximately a further 50% whilst materially improving

its gross margin from 24% achieved in 2019. The Company also

intends to materially expand its trading operations where it

believes it can become a leading operator through its extensive

network and deployment of proprietary trading technology. Since May

the Group's operations in Mozambique recommenced and are operated

under an agreement whereby profits are shared 50:50 with it having

no cash funding obligation. To date operations have progressed as

expected and the Directors are pleased with the development

plans.

The Directors believe that sustainable forestry and the

production of sawn timber and veneer is a market with strong

structural support, underpinned by population growth in our target

markets. Capturing a fraction of the African Export Market which is

estimated to be worth over $4billion pa is expected by the

Directors to enable Woodbois to deliver on its ambitious growth

targets.

The current crisis has exaggerated the scarcity of capital

available to support the production cycle, and Woodbois believes it

would be ideally placed to increase not only its own sustainable

production but to source and secure dedicated third party supply

throughout West Africa without the operational constraints to

growth that proprietary production can face when scaling up.

The Directors believe that timber is the perhaps last natural

resource largely unrepresented on global exchanges or capital

markets. The Directors believe that Woodbois' restructured balance

sheet will provide a fundamental step towards a leading position

within a sector suitable for consolidation and disruption through

the introduction of innovative sales and trading technology for

sustainably sourced and traceable timber which the Company is

developing.

In recent weeks management has met a broad range of investors

with a view to raising awareness of Woodbois, the sustainable

nature of its operations and the opportunity to deliver very

significant growth with the appropriate balance sheet and access to

capital to develop its production and trading businesses. Whilst

the Company's plans and the ultimate shape of the restructuring are

not yet finalised and as such there is no certainty that the

restructuring and an injection of further equity will proceed, the

Directors are optimistic that potential and existing stakeholders

share a vision of the relevance of a well-funded, sustainable

timber business listed on the London Stock Exchange. The Directors

believe that with ESG (Environmental, Social and Governance)

considerations throughout the natural resources sector increasingly

becoming front and centre of investors' asset allocation thought

process, the sustainability-driven Woodbois business model should

expect to receive recognition from a broad and growing set of

stakeholders.

Gabon Sawmill Operations Recommence

Further to the announcement on 11(th) June 2020 where it was

announced that timber harvesting had restarted, the Company is

pleased to confirm that sawmill operations have recommenced in

Gabon. Throughout the current pandemic, the welfare of our staff

has been a key priority: the Company is one of the largest

employers in the town of Mouila in Gabon, and the ability to

restart operations provides a vital lifeline for many of the

Company's loyal staff and the community. With exports continuing

through the port in Libreville, the Company looks forward to

increasing the number of workers permitted on site as government

covid-19 guidelines further evolve.

Enquiries:

Woodbois Limited

Paul Dolan - Chairman and CEO

www.woodbois.com

+44 (0)20 7099 1940

Canaccord Genuity (Nominated Adviser and Broker)

Henry Fitzgerald-O'Connor

James Asensio

Thomas Diehl

+44 (0)20 7523 8000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDFPMLTMTMBBMM

(END) Dow Jones Newswires

June 19, 2020 02:00 ET (06:00 GMT)

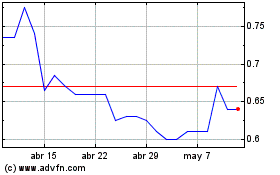

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024