TIDMWYN

RNS Number : 8525Q

Wynnstay Group PLC

24 June 2020

24 June 2020

AIM: WYN

Wynnstay Group Plc

("Wynnstay" or the "Group" or the "Company")

Interim Results

For the six months ended 30 April 2020

Resilient Results in Exceptionally Challenging Market

Conditions

Key points

Financial

-- Resilient results, with increased profitability, despite exceptionally

challenging market conditions caused by coronavirus crisis,

subdued farmgate prices, and ongoing Brexit uncertainty

- results benefited from the Group's balanced spread of agricultural

activities, which provide a natural hedge against sector

variation

-- Revenue of GBP229.29m (2019: GBP260.57m), reflecting commodity

price deflation

-- Adjusted operating profit(1) up 8% to GBP4.78m (2019: 4.43m)

-- Reported profit before tax up 4% to GBP4.30m (2019: GBP4.12m)

-- Basic earnings per share up 3% to 17.50p (2019: 17.01p)

-- Net debt on comparable basis to last year reduced to GBP2.54m

at period end (2019: GBP14.70m), helped by commodity price

deflation

- IFRS 16 creates additional lease liabilities of GBP6.42m,

which increase total debt to GBP8.96m

-- Net assets increased to GBP96.84m at period end (2019: GBP92.97m),

which represents c.GBP4.87 per share

-- Short-term and committed bank facilities amounting to GBP20m

recently renewed

-- Interim dividend of 4.60p per share maintained (2019: 4.60p),

reflecting Board's confidence in the strength of the underlying

business

[1] Note 20. Explanation of Non GAAP measure

Operational

-- Agriculture Division - revenue of GBP166.41m (2019: GBP195.05m),

operating profit of GBP1.81m (2019: GBP1.79m)

- extreme wet weather adversely affected winter planting season,

reducing demand for arable inputs

- feed performance improved, although volumes reduced in line

with national market trends

- tight market for grain trading activities with margins under

pressure

-- Specialist Agricultural Merchanting Division - revenue of GBP62.83m

(2019: GBP65.48m), operating profit of GBP3.02m (2019: GBP2.67m)

- 'Order & collect' system established across depot network

to ensure staff and customer safety during coronavirus 'lockdown',

affected some ancillary sales. Nearly all depots have now

resumed more normal trading protocols while ensuring social

distancing

- profitability increased, helped by cost efficiency programme

commenced last year

Outlook

-- Board expects trading backdrop to remain under pressure for

the remainder of the year in light of the coronavirus crisis

and ongoing Brexit-related uncertainties

-- Wynnstay is well-positioned financially and operationally to

navigate the near term challenges and will continue with investment

programme

Gareth Davies, Chief Executive of Wynnstay, commented:

"These resilient results in the face of the headwinds created by

the coronavirus pandemic, continuing Brexit uncertainty and subdued

farmgate prices, demonstrate the robustness of the business.

Wynnstay's broad spread of agricultural activities is a significant

strength, acting as a natural hedge against sector variations.

"We are proud of the way staff responded to the challenges of

trading under the Government's emergency 'lockdown' measures, which

meant that we were able to maintain the supply of products and

services to customers, albeit with necessary adaptations.

"The Group is well-placed financially and operationally to

navigate the ongoing coronavirus crisis. While we expect the

remainder of the year to remain challenging, our confidence in the

long-term prospects for Wynnstay remain undiminished."

Enquiries:

Wynnstay Group Plc Gareth Davies, Chief T: 020 3178 6378

Executive (today)

Paul Roberts, Finance T: 01691 827 142

Director

KTZ Communications Katie Tzouliadis / Dan T: 020 3178 6378

Mahoney

Shore Capital (Nomad Stephane Auton / Patrick T: 020 7408 4090

and Broker) Castle / John More

CHAIRMAN'S STATEMENT

INTRODUCTION

We are pleased to report a resilient trading performance in what

was an exceptionally challenging period. Adjusted operating profit

before non-recurring items(1) in the six months to 30 April 2020

increased by 8% to GBP4.78m (2019: GBP4.43m) on lower revenue of

GBP229.29m (2019: GBP260.57m), largely impacted by commodity price

deflation. Reported profit before tax was 4% higher at GBP4.30m

(2019: GBP4.12m). Both the Agriculture and Specialist Agricultural

Merchanting divisions contributed to this recovery in performance,

which also benefited from the efficiency programme we introduced a

year ago.

The outbreak of the coronavirus and subsequent global pandemic

created significant social and economic disruption. Our overriding

priority has been to ensure the welfare of our colleagues,

customers and supplier partners as well as to mitigate risk for the

wider community. We are very proud of the way in which Wynnstay

colleagues responded to the challenges. Remote working arrangements

were put in place, and as an essential service provider we

continued to trade across all areas of activity. Our depots

initially adjusted to an 'order & collect' process to minimise

infection risks, and our feed, seed and fertiliser processing

activities and other distribution operations continued to function

to plan. All depots, except for three, have now returned to more

normalised operating procedures, with appropriate safe working

practises in place.

These issues and restrictions impacted business opportunities

over the first half, and additional costs were incurred, including

extra short-term resource to cover for those colleagues unavailable

to work because of shielding or isolation requirements. We have not

had to make use of the Government's Coronavirus Job Retention

Scheme and as such no colleagues have been furloughed.

The pandemic created further pressures for farmers, in

particular because of its effect on food distribution channels with

the closure of restaurants and other food service outlets. Some

milk producers were asked to dispose of their milk, rather than

sell it into the market, for a short period of time. This together

with ongoing Brexit uncertainty affected farmer confidence,

constraining spending.

The mild but abnormally wet winter weather conditions inhibited

demand for many of the Group's core product categories,

particularly for arable inputs since many farmers were unable to

sow winter cereal seed due to the heavy rain. Spring cereal seed

was sown towards the end of March, but it has a lower yield and

lower input requirement than winter cereals. Some land that would

have normally been cultivated was also left fallow.

While we expect the remainder of the financial year to remain

challenging, Wynnstay is well-positioned financially and

operationally. Our balanced business model, supplying inputs to

both arable and livestock farmers, provides a natural hedge. We

will continue with our investment programme, upgrading facilities,

systems, and processes, together with efficiency initiatives.

FINANCIAL RESULTS

Revenue for the six months to 30 April 2020 decreased by 12% to

GBP229.29m (2019: GBP260.72m), with commodity price deflation

accounting for an estimated 60% of the year-on-year decrease. The

balance of the decrease reflected lower volumes of certain product

categories adversely affected by the wet weather and some sales

that were impacted by the trading restrictions in the depot

merchanting business as a result of the coronavirus crisis. The

Agriculture Division contributed GBP166.41m to overall revenue

(2019: GBP195.05m) and the Specialist Agricultural Merchanting

Division contributed GBP62.83m (2019: GBP65.48m). Other activity

contributed revenue of GBP0.05m (2019: GBP0.05m).

During the period, the Group adopted the IFRS 16 accounting

standard in relation to Leases, which now requires the recognition

of 'right-of-use' property assets on the balance sheet. The Group

has chosen not to restate comparative figures, so on adoption there

has been an overall comparative negative impact on net

profitability of GBP71,471 in the period. Operating profit shows a

comparative increase of GBP99,445 as some costs, previously

expensed as rental payments, have now been classified as interest

payable.

Adjusted operating profit, before non-recurring corporate

restructuring costs, increased by 8% to GBP4.78m (2019: GBP4.43m).

Operating profit in the Agricultural Division was GBP1.81m (2019:

GBP1.79m), which reflected lower arable product demand due to the

wet weather, offset by an improved feed performance. Fertiliser and

agrochemical sales were very late to commence, in March/April, both

for core farmer customers and within our Glasson business. Grain

volumes and margins were lower due to farmer reluctance to sell

ahead of expected price increases. Operating profit at the

Specialist Agricultural Merchanting Division increased by 13.1% to

GBP3.02m (2019: GBP2.67m), helped by the cost efficiency programme

introduced over the last twelve months. Other activities incurred

an operating loss of GBP0.09m (2019: loss of GBP0.08m). As in prior

years, the contribution from our Joint Ventures will be

consolidated in the second half of our full year results.

Corporate restructuring expenses relating to the efficiency

programme amounted to GBP0.18m (2019: GBP0.09m)(2) , and net

finance costs increased to GBP0.26m (2019: GBP0.16m), which mainly

reflected the adoption of the IFRS 16 interest charges.

The resultant reported profit before tax was GBP4.30m (2019:

GBP4.12m), up 4%. The tax charge for the period was GBP0.82m (2019:

GBP0.76m) and profit after tax increased by 3% to GBP3.48m (2019:

GBP3.36m). Basic earnings per share increased by 3% to 17.50p

(2019: 17.01p).

Net assets at 30 April 2020 increased by 4% to GBP96.84m (2019:

GBP92.97m), which represents approximately GBP4.87 per share (2019:

GBP4.70 per share). The weighted average number of shares in issue

during the period was 19.90m (2019: 19.77m).

Net debt at 30 April 2020 calculated on a comparable basis to

last year reduced by 83% to GBP2.54m (2019: GBP14.70m)(3) .

However, the impact of adopting IFRS 16 has been to create

additional lease liabilities of GBP6.42m, which are now technically

classified as debt, and to increase the balance sheet reported net

borrowings and lease liabilities at the period end to a total of

GBP8.96m. While the Group's cash requirements are at their highest

during the spring months, particularly in April, working capital

utilisation benefitted strongly from the commodity deflation driven

lower revenues in this period. The lower levels of fertiliser

activity have also strongly contributed to this lower cash

requirement, which is a considerable reversal to the trading

pattern experienced last year.

The Group's robust liquidity position is further supported by

recently renewed short-term and committed bank facilities amounting

to GBP20m.

DIVID

The Board is pleased to declare an interim dividend of 4.60p per

share (2019: 4.60p), equivalent to last year's. This reflects the

Board's continuing confidence in the underlying business while

recognising the broader economic uncertainty.

The interim dividend will be paid on 30 October 2020 to

shareholders on the register at the close of business on 25

September 2020. As in previous years, the Scrip Dividend

alternative will continue to be available, with the last day for

election for this scheme being 16 October 2020.

REVIEW OF OPERATIONS

AGRICULTURE DIVISION

Many of the elements affecting UK farmer confidence in our last

financial year, including subdued farmgate prices, extreme weather,

and political uncertainty over Brexit, continued into the current

financial year, and the impact of the global coronavirus pandemic

has heightened farmer caution.

Feed Products

Feed performance improved over the same period last year,

benefiting from higher gross margin, which offset the slight

reduction in overall volumes. While the winter was generally mild,

the extremely wet weather prevented the early turn out of animals

seen in 2019, and we saw a recovery in volumes of sheep feed sold.

Other ruminant categories saw small volume reductions as many

customers switched to straight feeds away from manufactured

compounds in reaction to lower farmgate prices. Through our

dedicated team of poultry specialists, we maintain a significant

presence in the local free-range egg manufactured feed market,

where demand is generally very stable. Our ruminant youngstock team

continued to grow market share within the milk replacer sector at

farm level.

Arable Products

The extreme and prolonged wet weather, which dominated the early

months of 2020, hampered all forms of arable farming. Much of the

winter cereal seed, bought in the autumn, could not be planted and

unused product remains on farm to be sown this autumn. However, we

benefitted from strong demand for spring cereal seed varieties when

the weather improved in April. These spring crops have a shorter

growing period, yield less grain, and require a lower level of

agricultural inputs than winter crops. This was reflected in

reduced demand for fertilisers and agrochemicals, and the grassland

fertiliser market was also delayed due to the wet weather.

While grass seed sales were similarly delayed by the weather, we

took advantage of our strong market presence in this sector once

demand picked up in the drier spring period and volumes were higher

year-on-year.

Grain trading activities started the year well, with good

volumes available from last year's harvest. However, forecast

shortages of grain for next year encouraged farmers to delay

marketing of their grain to take advantage of anticipated higher

prices. This in turn tightened competition for remaining volumes,

pressurising margins. We expect this to continue for the rest of

the current season, and anticipate reduced volumes from the 2020

harvest, reflecting the lower yields from spring sown crops. This

will adversely affect income from grain trading in the fourth

quarter of the financial year.

Glasson Grain

Glasson Grain operates in three main areas, feed raw materials,

fertiliser production and the manufacture of specialist animal feed

products.

Glasson generated a good performance, in line with budget. Feed

activities performed satisfactorily. Demand for fertiliser was

significantly delayed in the first half, however, in April, as

planting conditions improved, volumes rebounded and matched last

year's level over the same period. The sharp drop in oil prices

following the coronavirus outbreak resulted in lower fertiliser

prices and created margin pressure since raw material commitments

needed realising before lower replenishment values could come

through.

SPECIALIST AGRICULTURAL MERCHANTING DIVISION

Specialist Agricultural Merchanting

The Group's chain of 55 depots mainly cater for the needs of

farmers, although rural dwellers also form part of the customer

base. They operate very closely with our Agricultural Division,

providing a strong channel to market for our products.

Total sales decreased slightly during the period, affected by

wet weather and the restricted trading protocols that were

introduced following the coronavirus outbreak. However, the

Division delivered an improved financial contribution, which was

underpinned by the cost efficiency programme commenced last

year.

From the end of March when the Government's 'lockdown' came into

effect, the Division traded as an essential service provider,

albeit adjusting swiftly to an 'order & collect' process, with

customers pre-ordering goods for collection from depots. This meant

that some ancillary sales (such as household, clothing, gardening

and some pet lines) were lost. All but three of our depots have now

returned to more normalised operating procedures, with appropriate

safe working practises in place. Two depots continue to operate

under 'order & collect', and a small depot in South Wales

remains closed.

Youngs Animal Feeds

Revenues at our specialist equine feeds business increased in

the period. This largely reflected customer coronavirus-linked

stockpiling, and, in the short-term, the cancellation of many

summer equine events and shows is expected to restrain sales. The

business is relaunching the Company's manufactured fibre feed range

under the Sweet Meadow brand, which represents an exciting new

opportunity.

JOINT VENTURES AND ASSOCIATES

Results from the Group's joint ventures and associate companies

are not included in this half year report. They will be

consolidated into Wynnstay's full year results as in previous

years.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG")

We recognise that our activities have an impact on the

environment and can also affect the wider community. We therefore

incorporate environmental, social and governance factors into

decision-making processes. Furthermore, we also believe that

Wynnstay can play an important role in assisting our customers with

environmental and sustainability objectives.

The Group seeks to operate all its activities in an

environmentally sustainable manner. This includes investing in

energy saving opportunities, reducing all forms of consumables,

securing relevant accreditation for its operations where possible,

and sourcing sustainable products for our supply chain. We are

engaging with the National Farmers Union's goal of reaching 'net

zero' greenhouse gas emissions across the whole of agriculture in

England and Wales by 2040.

Making a positive contribution to the communities we serve is

important and, as well as seeking to be an equitable employer, the

Group provides educational support, charitable contributions and

backs regional social initiatives including agricultural shows,

community events and project support.

The Wynnstay Board is committed to the highest standards of

appropriate corporate and commercial governance so as to deliver

long term shareholder value and ensure the maximum positive impact

it can have on other important stakeholder groups including

colleagues, customers and suppliers. Doing the right thing is the

only way we can be confident of long-term success.

OUTLOOK

There is considerable uncertainty both in the wider economy and

in our specific sector, created by the coronavirus crisis and

Brexit. As we look over the remainder of the year therefore, we

expect the trading backdrop to remain difficult. However, as the

Group's results have shown, we have a resilient business model and

our spread of activities across the arable and feed enterprises

continues to provide a hedge against sector variation.

Notwithstanding the immediate challenges, we view medium and

long-term prospects positively. Our strong balance sheet and

liquidity supports our ongoing programme of investment in

infrastructure and systems to improve operational efficiencies and

reduce cost. We remain focused on aligning ourselves closely with

the changing needs and requirements of our customer base. This

covers all aspects of the business, including the provision of

advisory services direct to farm via our specialist sales team, as

well as through our product offering and routes to our market.

The Board retains its positive view of the opportunities

available to the Group and UK Agriculture.

Jim McCarthy

Chairman

[1] Note 20. Explanation of Non GAAP measure.

(2) Note 10

(3) Note 11

WYNNSTAY GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 April 2020

Unaudited Unaudited Audited

six months six months year ended

ended ended 31 October

30 April 30 April 2019

2020 2019

Note GBP'000 GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue 229,288 260,572 490,602

Cost of sales (197,781) (228,397) (428,621)

------------ ------------ ------------

Gross profit 31,507 32,175 61,981

Manufacturing, distribution

and selling costs (23,333) (24,381) (48,177)

Administrative expenses (3,561) (3,541) (6,434)

Other operating income 9 168 180 385

------------------------------------- ----- ------------ ------------ ------------

Adjusted operating profit4 20 4,781 4,433 7,755

Amortisation of acquired intangible

assets and share -based payment

expense 10 (44) (59) (77)

Non-recurring items 10 (185) (96) (301)

------------------------------------- ----- ------------ ------------ ------------

Group operating profit 4,552 4,278 7,377

Interest income 55 52 164

Interest expense (310) (209) (348)

Share of profits in joint ventures

and associate accounted for

using the equity method 2 - - 463

Share of tax incurred in by

joint venture and associate - - (103)

Profit before taxation 4,297 4,121 7,553

Taxation 4 (817) (758) (1,421)

Profit for the period and other

comprehensive income attributable

to the equity holders 3,480 3,363 6,132

============ ============ ============

Basic earnings per ordinary

share (pence) 17.50 17.01 30.95

Diluted earnings per ordinary

share (pence) 17.43 16.98 30.95

4 Adjusted operating profit is after adding back amortisation of

acquired intangible assets, share-based payment expense and

non-recurring items - note 20

WYNNSTAY GROUP PLC

CONDENSED CONSOLIDATED BALANCE SHEET

For the six months ended 30 April 2020

Unaudited Unaudited Audited

as at 30 as at 30 as at

April 2020 April 2019 31 October

2019

Note GBP'000 GBP'000 GBP'000

------------------------------------ ----- ------------ ------------ ------------

ASSETS

NON-CURRENT ASSETS

Goodwill 14,968 14,964 14,968

Investment property 2,372 2,372 2,372

Property, plant and equipment 17,964 23,274 23,225

Right-of-use asset 11,264 - -

Investments accounted for

using the equity method 3,175 2,863 3,175

Intangibles 243 281 261

------------------------------------ ----- ------------ ------------ ------------

49,986 43,754 44,001

------------------------------------ ----- ------------ ------------ ------------

CURRENT ASSETS

Inventories 42,002 46,479 42,239

Trade and other receivables 75,501 83,757 63,887

Financial assets - loans

to joint ventures 4,929 3,089 4,413

Cash and cash equivalents 11 3,452 423 10,608

125,884 133,748 121,147

------------------------------------ ----- ------------ ------------ ------------

TOTAL ASSETS 175,870 177,502 165,148

LIABILITIES

CURRENT LIABILITIES

Financial liabilities - borrowings (1,860) (11,648) (3,686)

Lease Liabilities (3,539) - -

Trade and other payables (65,202) (67,987) (62,113)

Current tax liabilities (991) (1,092) (894)

(71,592) (80,727) (66,693)

------------------------------------ ----- ------------ ------------ ------------

NET CURRENT ASSETS 54,292 53,021 54,454

------------------------------------ ----- ------------ ------------ ------------

NON-CURRENT LIABILITIES

Financial liabilities - borrowings (313) (3,468) (3,078)

Lease liabilities (6,701) - -

Trade and other payables (199) (206) (201)

Deferred tax liabilities (228) (132) (228)

(7,441) (3,806) (3,507)

------------------------------------ ----- ------------ ------------ ------------

TOTAL LIABILITIES (79,033) (84,533) (70,200)

------------------------------------ ----- ------------ ------------ ------------

NET ASSETS 96,837 92,969 94,948

------------------------------------ ----- ------------ ------------ ------------

EQUITY

Share capital 6 5,002 4,963 4,974

Share premium 30,509 30,170 30,284

Other reserves 3,455 3,431 3,429

Retained earnings 57,871 54,405 56,261

TOTAL EQUITY 96,837 92,969 94,948

------------------------------------ ----- ------------ ------------ ------------

WYNNSTAY GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

For the six months ended 30 April 2020

Share Share Other Retained Total

Capital Premium Reserves Earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 November 2018 4,943 29,941 3,377 52,812 91,073

Profit for the period - - - 3,363 3,363

------------------------------ --------- --------- ---------- ---------- ----------

Total comprehensive income

for the period - - - 3,363 3,363

------------------------------ --------- --------- ---------- ---------- ----------

Transactions with owners

of the Company, recognised

directly in equity

Shares issued during the

period 20 229 - - 249

Own shares disposed by ESOP

trust - - 3 - 3

Dividends - - - (1,770) (1,770)

Equity settled share-based

payment transactions - - 51 - 51

------------------------------ --------- --------- ---------- ---------- ----------

Total contributions by and

distributions to owners

of the Group 20 229 54 (1,770) (1,467)

------------------------------ --------- --------- ---------- ---------- ----------

At 30 April 2019 4,963 30,170 3,431 54,405 92,969

------------------------------ --------- --------- ---------- ---------- ----------

Profit for the period - - - 2,769 2,769

------------------------------ --------- --------- ---------- ---------- ----------

Total comprehensive income

for the period - - - 2,769 2,769

------------------------------ --------- --------- ---------- ---------- ----------

Transactions with owners

of the Company, recognised

directly in equity

Shares issued during the

period 11 114 - - 125

Dividends - - - (913) (913)

Equity settled share-based

payment transactions - - (2) - (2)

------------------------------ --------- --------- ---------- ---------- ----------

Total contributions by and

distributions to owners

of the Group 11 114 (2) (913) (790)

------------------------------ --------- --------- ---------- ---------- ----------

At 31 October 2019 4,974 30,284 3,429 56,261 94,948

------------------------------ --------- --------- ---------- ---------- ----------

Profit for the period - - - 3,480 3,480

------------------------------ --------- --------- ---------- ---------- ----------

Total comprehensive income

for the period - - - 3,480 3,480

------------------------------ --------- --------- ---------- ---------- ----------

Transactions with owners

of the Company, recognised

directly in equity

Shares issued during the

period 28 225 - - 253

Dividends - - - (1,870) (1,870)

Equity settled share-based

payment transactions - - 26 - 26

------------------------------ --------- --------- ---------- ---------- ----------

Total contributions by and

distributions to owners

of the Group 28 225 26 (1,870) (1,591)

------------------------------ --------- --------- ---------- ---------- ----------

At 30 April 2020 5,002 30,509 3,455 57,871 96,837

------------------------------ --------- --------- ---------- ---------- ----------

WYNNSTAY GROUP PLC

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 30 April 2020

Unaudited Unaudited Audited

six months six months year ended

ended ended 30 31 October

30 April April 2019 2019

2020

Note GBP'000 GBP'000 GBP'000

-------------------------------- ----- ------------ ------------ ------------

Cash flow from operating

activities

Cash (used in)/generated

from operations 13 (1,062) (7,498) 14,756

Interest received 55 52 164

Interest paid (310) (209) (348)

Tax paid (720) (914) (1,680)

Net cash (used in)/generated

from operating activities (2,037) (8,569) 12,892

-------------------------------- ----- ------------ ------------ ------------

Cash flows from investing

activities

Acquisition of subsidiaries

(net of cash acquired) (68) (264) (893)

Proceeds on sale of property,

plant and equipment 6 159 288

Purchase of property, plant

and equipment (505) (1,829) (2,412)

Own shares disposed of by

ESOP trust - 3 3

Dividends received from

Associates - - 132

Net cash used by investing

activities (567) (1,931) (2,882)

-------------------------------- ----- ------------ ------------ ------------

Cash flows from financing

activities

Net proceeds from the issue

of ordinary share capital 253 249 374

Principle paid on lease

liabilities (30 April 2019

and 31 October 2019: finance

lease principle repayments) (2,066) (886) (1,798)

Repayments of loans (869) (980) (1,971)

Dividends paid to shareholders (1,870) (1,770) (2,683)

-------------------------------- ----- ------------ ------------ ------------

Net cash used in financing

activities (4,552) (3,387) (6,078)

-------------------------------- ----- ------------ ------------ ------------

Net decrease in cash and

cash equivalents (7,156) (13,887) 3,932

-------------------------------- ----- ------------ ------------ ------------

Cash and cash equivalents

at beginning of period 10,608 6,676 6,676

-------------------------------- ----- ------------ ------------ ------------

Cash and cash equivalents

at end of period 11 3,452 (7,211) 10,608

-------------------------------- ----- ------------ ------------ ------------

WYNNSTAY GROUP PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

GENERAL INFORMATION

Wynnstay Group Plc has a number of operations. These are

described in the segment analysis in note 8.

Wynnstay Group Plc is a company incorporated and domiciled in

the United Kingdom. The address of its registered office is shown

in note 3.

1. BASIS OF PREPARATION

The Interim Report was approved by the Board of Directors on 23

June 2020.

The condensed financial statements for the six months to the 30

April 2020 have been prepared in accordance with International

Accounting Standard (IAS) 34 Interim Financial Reporting except as

disclosed in note 2.

The financial information for the Group for the year ended 31

October 2019 set out above is an extract from the published

financial statements for that year which have been delivered to the

Registrar of Companies. The auditor's report on those financial

statements was not qualified and did not contain statements under

section 498(2) or 498(3) of the Companies Act 2006. The information

contained in this document does not constitute statutory accounts

within the meaning of section 434 of the Companies Act 2006.

The financial information for the six months ended 30 April 2020

and for the six months ended 30 April 2019 are unaudited.

The consolidated financial statements are presented in sterling,

which is also the Group's functional currency. Amounts are rounded

to the nearest thousand, unless otherwise stated.

The condensed consolidated interim financial statements should

be read in conjunction with the annual consolidated financial

statements for the year ended 31 October 2019, which have been

prepared in accordance with IFRS as adopted by the EU.

The Directors have prepared the condensed consolidated interim

financial statements on a going concern basis, having satisfied

themselves from a review of internal budgets and forecasts and

current banking facilities that the Group has adequate resources to

continue in operational existence for the foreseeable future. The

impact of the coronavirus crisis is discussed under 'Critical

accounting estimates and judgements'.

2. CONSOLIDATION OF SHARE OF RESULTS IN JOINT VENTURES AND ASSOCIATES

The Group has a policy of using audited accounts for the

consolidation of its share of the results of Joint Venture and

Associate activities. No such consolidation has occurred during the

six months to 30 April 2020. Although this is not in accordance

with IFRS the impact on the financial statements is not material.

Relevant results will be accounted for during the second half of

the financial year.

3. SIGNIFICANT ACCOUNTING POLICIES

The condensed financial statements have been prepared under the

historical cost convention other than shared-based payments, which

are included at fair value and certain financial instruments which

are explained in the annual consolidated financial statements for

the year ended 31 October 2019.

The same accounting policies, presentation and methods of

computation are followed in these condensed financial statements as

were applied in the preparing of the Group's financial statements

for the year ended 31 October 2019 except as disclosed in note 2

and note 19. A copy of these financial statements is available from

the Company's Registered Office at Eagle House, Llansantffraid,

Powys, SY22 6AQ.

New standards issued but not yet effective

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are e

ective in future accounting periods that the group has decided not

to adopt early.

The following amendments are e ective for the period beginning 1

January 2020:

IAS 1 Presentation of Financial Statements and IAS 8 Accounting

Policies, Changes in Accounting Estimates and Errors (Amendment -

De nition of Material)

IFRS 3 Business Combinations (Amendment - De nition of Business)

Revised Conceptual Framework for Financial Reporting

In January 2020, the IASB issued amendments to IAS 1, which

clarify the criteria used to determine whether liabilities are

classi ed as current or non-current. These amendments clarify that

current or non-current classi cation is based on whether an entity

has a right at the end of the reporting period to defer settlement

of the liability for at least twelve months after the reporting

period. The amendments also clarify that 'settlement' includes the

transfer of cash, goods, services, or equity instruments unless the

obligation to transfer equity instruments arises from a conversion

feature classi ed as an equity instrument separately from the

liability component of a compound nancial instrument. The

amendments are e ective for annual reporting periods beginning on

or after 1 January 2022.

Wynnstay Group Plc is currently assessing the impact of these

new accounting standards and amendments. The Group does not believe

that the amendments to IAS 1 will have a signi cant impact on the

classi cation of its liabilities.

The Group does not expect any other standards issued by the

IASB, but not yet e ective, to have a material impact on the

Group.

New standards and interpretations

IFRS 16 Leases was adopted on 1 November 2019 and has given rise

to changes in the Group's accounting policies. Details of the

impact of this standard has had are given in note 19.

Other new and amended standards and Interpretations issued by

the IASB that will apply for the rst time in the next annual

nancial statements are not expected to impact the Group as they are

either not relevant to the Group's activities or require accounting

which is consistent with the Group's current accounting

policies.

Critical accounting estimates and judgements

The Group makes certain estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historic experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may di er from

these estimates and assumptions. The estimates and assumptions that

have a signi cant risk of causing a material adjustment to the

carrying amount of assets and liabilities with the next nancial

year are unchanged from those disclosed in the nancial statements

for the year ended 31 October 2019 except in relation to the

outbreak of the coronavirus crisis.

The coronavirus outbreak occurred during this nancial reporting

period and conditions continue to evolve since the end of the

reporting period (30 April 2020). Wynnstay is classi ed as

operating in a key industry, and as such has been able to continue

activities throughout the crisis adhering, with appropriate

government guidance. The most signi cant impact on trading has been

in the depots within the Special Agricultural Merchanting segment,

which for safety reasons moved to an order and collect trading

policy, temporarily stopping customers coming into the branches

from 27 March 2020. Following risk assessments and modi cations to

working practises to facilitate social distancing requirements a

rolling programme of depot re-opening commenced on 1 June 2020.

Consideration has been given to the assets and liabilities as at

30 April 2020 and an evaluation has been made that there are no

coronavirus connected impairments to record at the time of

authorising these nancial statements. The situation continues to

evolve and as more information becomes available it is possible

that in the future actual experience may di er and hence these

matters are key judgement for these nancial statements.

4. TAXATION

The tax charge for the six months ended 30 April 2020 and 30

April 2019 is based on an apportionment of the estimated tax charge

for the full year.

The effective tax rate is 19.0% (6 months ended 30 April 2019:

18.4%) which is the same as the standard rate of 19.0% (2019:

19.0%).

5. EARNINGS PER SHARE

Basic earnings per 25p ordinary share has been calculated by

dividing profit for the period attributable to ordinary

shareholders by the weighted average number of ordinary shares in

issue during the period. For diluted earnings per share the

weighted average number of ordinary shares is adjusted to assume

conversion of all dilutive potential ordinary shares (share options

and warrants) taking into account their exercise price in

comparison with the actual average share price during the year.

Unaudited six Unaudited six

months ended months ended

30 April 2020 30 April 2019

Weighted average number of shares

in issue: basic 19,896,621 19,772,234

Weighted average number of shares

in issue: diluted 19,978,002 19,797,827

6. SHARE CAPITAL

During the current period a total of 111,564 (2019: 79,189)

shares were issued with an aggregate nominal value of GBP27,891

(2019: GBP19,797) fully paid up for equivalent cash of GBP253,811

(2019: GBP248,653). Included in these issues were 111,564 (2019:

79,189) shares allotted to shareholders exercising their rights to

receive dividends under the Company's scrip dividend scheme. No

other shares were allocated during the current or prior period. As

at 30 April 2020 a total of 20,007,572 shares are in issue (2019:

19,850,985).

7. DIVIDS

During the period ended 30 April 2020 an amount of GBP1,870,225

(2019: GBP1,769,575) was charged to reserves in respect of equity

dividends paid. An interim dividend of 4.60p per share (2019:

4.60p) will be paid on 30 October 2020 to shareholders on the

register on the 25 September 2020. New elections to receive Scrip

Dividends should be made in writing to the Company's Registrars

before 16 October 2020.

8. SEGMENTAL REPORTING

IFRS 8 requires operating segments to be identified on the basis

of internal financial information about the components of the Group

that are regularly reviewed by the chief operating decision-maker

("CODM") to allocate resources to the segments and to assess their

performance.

The chief operating decision-maker has been identified as the

Board of Directors ('the Board'). The Board reviews the Group's

internal reporting in order to assess performance and allocate

resources. The Board has determined that the operating segments,

based on these reports are Agriculture, Specialist Agricultural

Merchanting, and Other.

The Board considers the business from a product/service

perspective. In the Board's opinion, all of the Group's operations

are carried out in the same geographical segment, namely the United

Kingdom.

Agriculture - manufacturing and supply of animal feeds,

fertiliser, seeds and associated agricultural products.

Specialist Agricultural Merchanting - supplies a wide range of

specialist products to farmers, smallholders, and pet owners.

Other - miscellaneous operations not classi ed as Agriculture or

Specialist Agricultural Merchanting.

The Board assesses the performance of the operating segments

based on a measure of operating pro t. Non-recurring costs and

nance income and costs are not included in the segment result that

is assessed by the Board. Other information provided to the Board

is measured in a manner consistent with that in the nancial

statements. No segment is individually reliant on any one

customer.

Details on how IFRS 16 has impacted operating profit and

interest charged in the period ended 30 April 2020 are contained in

note 20. The periods ending 30 April 2019 and 31 October 2019 have

not been restated.

The segment results for the period ended 30 April 2020 and

comparative periods are as follows:

Agriculture Specialist Other Total

Agricultural

Merchanting

Unaudited for the six months GBP'000 GBP'000 GBP'000 GBP'000

ended

30 April 2020:

------------------------------------ ------------ -------------- -------- --------

Revenue from external customers 166,409 62,834 45 229,288

Segment results

Group operating profit before

non-recurring items 1,811 3,017 (91) 4,737

Share of result of Associates

and Joint Ventures - - - -

1,811 3,017 (91) 4,737

Non-recurring items (note

10) (185)

Interest income 55

Interest expense (310)

--------

Profit before taxation 4,297

Taxation (817)

--------

Profit for the period attributable

to shareholders 3,480

--------

Agriculture Specialist Other Total

Agricultural

Merchanting

Unaudited for the six months GBP'000 GBP'000 GBP'000 GBP'000

ended 30 April 2019 for

continuing operations:

------------------------------------ ------------ -------------- -------- --------

Revenue from external customers 195,052 65,475 45 260,572

Segment results

Group operating profit before

non-recurring items 1,791 2,667 (84) 4,374

Share of result of Associates

and Joint Ventures - - - -

------------------------------------ ------------ -------------- -------- --------

1,791 2,667 (84) 4,374

Non-recurring items (note

10) (96)

Interest income 52

Interest expense (209)

--------

Profit before taxation 4,121

Taxation (758)

--------

Profit for the period attributable

to shareholders 3,363

--------

Agriculture Specialist Other Total

Agricultural

Merchanting

Audited for the year ended GBP'000 GBP'000 GBP'000 GBP'000

31 October 2019 for continuing

operations:

------------------------------------ ------------ -------------- -------- --------

Revenue from external customers 358,687 131,843 72 490,602

Segment results

Group operating profit before

non-recurring items 2,417 5,240 21 7,678

Share of result of Associates

and Joint Ventures 534 4 (75) 463

------------------------------------ ------------ -------------- -------- --------

2,951 5,244 (54) 8,141

Non-recurring items (note

10) (301)

Interest income 164

Interest expense (348)

--------

Profit before taxation 7,656

Taxation (1,524)

--------

Profit for the year attributable

to shareholders 6,132

--------

9. OTHER OPERATING INCOME

Unaudited six Unaudited six Audited year

months ended months ended ended

30 April 2020 30 April 2019 31 October

2019

GBP'000 GBP'000 GBP'000

--------------- --------------- --------------- -------------

Rental Income 168 180 385

10. AMORTISATION OF ACQUIRED INTANGIBLE ASSETS AND SHARE-BASED

PAYMENTS AND NON-RECURRING ITEMS

Unaudited six Unaudited six Audited year

months ended months ended ended

30 April 2020 30 April 2019 31 October

2019

GBP'000 GBP'000 GBP'000

----------------------------- --------------- --------------- -------------

Amortisation of acquired

intangible assets and

share-based payments

Amortisation of intangibles 18 8 28

Cost of share-based

reward 26 51 49

----------------------------- --------------- --------------- -------------

44 59 77

----------------------------- --------------- --------------- -------------

Non-recurring items

Business re-organisation

costs 185 92 297

Business combination

expenses - 4 4

185 96 301

----------------------------- --------------- --------------- -------------

Business re-organisation costs relate to the redundancy related

expenses of colleagues leaving the business as a result of

re-organising operations.

Business combination expenses relate to business combinations in

the prior year.

11. CASH AND CASH EQUIVALENTS AND BORROWINGS

Unaudited Unaudited Audited year

six months six months ended 31

ended ended October 2019

30 April 30 April

2020 2019

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------ --------------

Cash and cash equivalents per

balance sheet 3,452 423 10,608

Bank overdrafts - (7,634) -

--------------------------------------- ------------ ------------ --------------

Cash and cash equivalents per

cash flow statement 3,452 (7,211) 10,608

Bank loans due within one year

or on demand (1,176) (1,860) (1,457)

Loan capital (684) (686) (683)

Lease liabilities (30 April 2019

and 31 October 2019: Net obligations

under finance leases) (3,539) (1,468) (1,546)

--------------------------------------- ------------ ------------ --------------

Net (debt)/cash due within one

year (1,947) (11,225) 6,922

Bank loans due after one year (313) (1,486) (902)

Lease liabilities (30 April 2019

and 31 October 2019: Net obligations

under finance leases) (6,701) (1,982) (2,176)

--------------------------------------- ------------ ------------ --------------

Net (debt) due after one year (7,014) (3,468) (3,078)

--------------------------------------- ------------ ------------ --------------

Total net debt (8,961) (14,693) 3,844

--------------------------------------- ------------ ------------ --------------

On 1 November 2019 net debt increased by GBP7,251,000 as a

result of implementing IFRS 16 (note 18). At 30 April 2020 the

value of these lease liabilities were GBP6,421,000, therefore total

net debt would have been (GBP2,540,000) if IFRS 16 had not been

implemented.

12. RECONCILIATION OF LIABILITIES FROM FINANCING TRANSATIONS

Non-current Current Total Non-current Current Total

loans and loans and loans lease lease Lease

borrowings borrowings and liabilities liabilities liabilities

borrowings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------------------ ------------ ----------- ----------- ------------ ------------ ------------

As at 30 April 2019

(unaudited) 3,468 11,648 15,116 - - -

Cash-flows

* Repayment of overdrafts - (7,634) (7,634) - - -

* Repayment of borrowings - (1,903) (1,903) - - -

Non cash-flows

* New finance leases 879 306 1,185 - - -

- - -

* Finance leases acquired through business combinations - - -

* Non-current becoming current (1,269) 1,269 - - - -

------------------------------------------------------------------ ------------ ----------- ----------- ------------ ------------ ------------

As at 31 October 19

(audited) 3,078 3,686 6,764 - - -

Cash-flows

* Repayments - (869) (869) - (2,066) (2,066)

Non cash-flows

* IFRS 16 ROU - - - 5,116 2,135 7,251

* Finance leases transferring to lease liabilities (2,176) (1,546) (3,722) 2,176 1,546 3,722

* New leases - - - 979 355 1,334

* Non-current becoming current (589) 589 - (1,569) 1,569 -

------------------------------------------------------------------ ------------ ----------- ----------- ------------ ------------ ------------

As at 30 April 2020 313 1,860 2,173 6,702 3,539 10,241

------------------------------------------------------------------ ------------ ----------- ----------- ------------ ------------ ------------

13. CASH (USED IN)/GENERATED FROM OPERATIONS

Unaudited Unaudited Audited year

six months six months ended

ended ended 31 October

30 April 30 April 2019

2020 2019

GBP'000 GBP'000 GBP'000

---------------------------------------- ------------ ------------ -------------

Profit for the period 3,480 3,363 6,132

Adjustments for:

Taxation 817 758 1,421

Depreciation of tangible fixed

assets 1,138 1,723 3,579

Amortisation of other intangible

fixed assets 18 8 28

Amortisation of right-use-assets 1,856 - -

(Profit) on disposal of property,

plant and equipment (6) (99) (170)

Profit from distribution from

Associate - - (84)

Interest income (55) (52) (164)

Interest expense 310 209 348

Share of results of joint ventures

and associate - - (360)

Share-based payment expenses 26 51 49

Changes in working capital (excluding

effects of acquisitions and disposals

of subsidiaries)

(Decrease) in short term loan

to joint venture (516) (277) (1,601)

Decrease in inventories 237 5,931 10,171

(Increase)/decrease in trade and

other receivables (11,596) (12,517) 7,426

Increase/(decrease) in trade and

other payables 3,229 (6,596) (12,019)

Cash (used in)/generated from

operations (1,062) (7,498) 14,756

---------------------------------------- ------------ ------------ -------------

During the six months to 30 April 2020, the Group purchased

property, plant and equipment of GBP1,747,000 (2019: GBP3,079,000)

of which GBP1,665,000 relates to right-of-use assets (2019:

GBP1,665,000) relates to assets acquired under finance leases.

14. FINANCIAL INSTRUMENTS

IFRS 13 requires nancial instruments that are measured at fair

value to be classi ed according to the valuation technique

used:

-- Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities

-- Level 2 - inputs, other than level 1 inputs, that are

observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived form prices)

-- Level 3 - unobservable inputs

-- Derivatives

All derivative nancial assets and liabilities are classi ed as

Level 1 instruments as they are quoted market prices.

-- Contingent consideration

Contingent consideration is measured at fair value using Level 3

inputs such as entity projections of future probability. The amount

recognised relates to the ongoing pro tability of the business

acquired and criteria for this are set out in the sale and purchase

agreements. Consequently, adjustments would only be made if the

business did not perform as originally anticipated, and further

sensitivity analysis is not considered to be required.

Transfers between levels are deemed to have occurred at the end

of the reporting period. There were no transfers between levels in

the above hierarchy in the period.

Reconciliation of movements in Level 3 nancial instruments

Total

GBP000

--------------------------------- -------

As at 30 April 2019 (unaudited) (888)

Additions -

Payment 552

--------------------------------- -------

As at 31 October 2019 (audited) (336)

Additions -

Payments 50

As at 30 April 2020 (unaudited) (286)

--------------------------------- -------

15. OTHER RESERVES

Included in Other reserves are share-based payments; as the

Group issues equity-settled share-based payments to certain

employees. Equity-settled share-based payments are measured at fair

value at the date of the grant. The fair value determined at the

grant date of the equity-settled share-based payments is expensed

on a straight-line basis over the vesting period, based on the

Group's estimate of shares that will eventually vest.

The Group operates a number of share option and 'Save As You

Earn' schemes and fair value is measured by use of a recognised

valuation model. The expected life used in the model has been

adjusted, based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations.

At the 30 April 2020 the ESOP Trust, which is consolidated

within the Group financial statements, held 16,834 (2019: 16,834)

Ordinary Shares in the Group.

16. GROUP FINANCIAL COMMITMENTS

As at the 30 April 2020, the Group's contingent liabilities in

respect of bank guarantees for one of its Associates amounts to

GBP125,000 (2019: GBP125,000).

17. CAPITAL COMMITMENTS

As at 30 April 2020 the Group had capital commitments as

follows:

Unaudited Unaudited Audited as

as at 30 as at 30 April at

April 2020 2019 31 October

2019

GBP'000 GBP'000 GBP'000

----------------------------------- ------------ ---------------- ------------

Contracts placed for future

capital expenditure not provided

in the financial statements 38 248 808

18. RELATED PARTIES

Transactions between the Company and its subsidiaries, which are

related parties have been eliminated on consolidation and are not

disclosed in this note. Transactions between the Group and its

Joint Ventures and Associates are described below:

Transaction value Balance outstanding

Unaudited Unaudited Audited Unaudited Unaudited Audited

six months six months year ended as at as at as at

ended ended 31 October 30 April 30 April 31 October

30 April 30 April 2019 2020 2019 2019

2020 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------ ------------ ------------ ---------- ---------- ------------

Sales of goods

to joint ventures

and associate 2,786 3,137 5,651 799 1,109 -

Purchases of

goods from joint

ventures and

associate 35 100 215 - 6 96

Loans with joint

ventures 1,840 277 - 4,929 3,089 4,413

-------------------- ------------ ------------ ------------ ---------- ---------- ------------

19. EFFECTS OF CHANGES IN ACCOUNTING POLICIES

The Group adopted IFRS 16 Leases with a transition date of 1

November 2019. The Group has chosen not to restate comparatives on

adoption of IFRS 16, and therefore, the revised requirements are

not re ected in the prior year nancial statements. Rather, these

changes have been processed at the date of initial application

(i.e. 1 November 2019) and recognised in the opening equity

balances. Other new and amended standards and Interpretations

issued by the IASB did not impact the Group as they are either not

relevant to the Group's activities or require accounting which is

consistent with the Group's current accounting policies.

IFRS 16 Leases

E ective 1 November 2019, IFRS 16 has replaced IAS 17 Leases and

IFRIC 4 Determining whether an Arrangement Contains a Lease.

IFRS 16 provides a single lessee accounting model, requiring the

recognition of assets and liabilities for all leases, together with

options to exclude leases where the lease term is 12 months or

less, or where the underlying asset is of low value. IFRS 16

substantially carries forward the lessor accounting in IAS 17, with

the distinction between operating leases and nance leases being

retained. The Group does not have signi cant leasing activities

acting as a lessor.

Transition Method and Practical Expedients Utilised

The Group adopted IFRS 16 using the rst variation of the modi ed

retrospective approach, and therefore at initial application

recognised a right-of-use asset and lease liability of GBP7.3m

using the Group incremental borrowing rate at 1 November 2019.

Hence there was no impact to net assets on 1 November 2019. The

Group elected to apply the practical expedient to not reassess

whether a contract is, or contains a lease at the date of initial

application. Contracts entered into before the transition date that

were not identi ed as leases under IAS 17 and IFRIC 4 were not

reassessed. The de nition of a lease under IFRS 16 was applied only

to contracts entered into or changed on or after 1 November

2019.

IFRS 16 provides for certain optional practical expedients,

including those related to the initial adoption of the standard.

The Group applied the following practical expedients when applying

IFRS 16 to leases previously classi ed as operating leases under

IAS 17:

(a) Apply a single discount rate to a portfolio of leases with

reasonably similar characteristics;

(b) Exclude initial direct costs from the measurement of

right-of-use assets at the date of initial application for leases

where the right-of-use asset was determined as if IFRS 16 had been

applied since the commencement date;

(c) Reliance on previous assessments on whether leases are

onerous as opposed to preparing an impairment review under IAS 36

as at the date of initial application; and

(d) Applied the exemption not to recognise right-of-use assets

and liabilities for leases with less than 12 months of lease term

remaining as of the date of initial application.

As a lessee, the Group previously classi ed leases as operating

or nance leases based on its assessment of whether the lease

transferred substantially all of the risks and rewards of

ownership. Under IFRS 16, the Group recognizes right-of-use assets

and lease liabilities for most leases. However, the Group has

elected not to recognise right-of-use assets and lease liabilities

for some leases of low value assets based on the value of the

underlying asset when new or for short-term leases with a lease

term of 12 months or less.

On adoption of IFRS 16, the Group recognised right-of-use assets

and lease liabilities as follows:

Classification Classification under IFRS 16

before IFRS 16

Right-of-use assets Lease liabilities

--------------------------------- ----------------------------------

Operating leases Land and buildings: Right-of-use Measured at the present

assets are measured at value of the remaining

an amount equal to the lease payments, discounted

lease liability, adjusted using the Group's incremental

by the amount of any prepaid borrowing rate as at 1

or accrued lease payments. November 2019. The Group's

incremental borrowing

All other: the carrying rate is the rate at which

value that would have a similar borrowing could

resulted from IFRS 16 be obtained from an independent

being applied from the creditor under comparable

commencement date of the terms and conditions.

leases, subject to the The weighted-average rate

practical expedients noted applied was 4.43%.

above.

--------------------------------- ----------------------------------

Finance leases Carrying values brought Carrying values brought

forward, reclassi ed from forward from nancial liabilities

property, plant and equipment - borrowings into lease

into right-of-use assets liabilities

--------------------------------- ----------------------------------

The following table presents the impact of adopting IFRS 16 on

the statement of nancial position as at 1 November 2019:

ASSETS Adjustments As originally IFRS 16 1 November

presented 2019

at

31 October

2019

------------------------- ------------- -------------- -------- -----------

GBP000 GBP000 GBP000

NON-CURRENT ASSETS

Property, plant and

equipment a 23,225 (4,533) 18,692

Right-of-use assets b - 11,784 11,784

LIABILITIES

Current Liabilities

Borrowings c (3,686) 1,546 (2,140)

Lease liabilities d - (3,037) (3,037)

NON-CURRENT LIABILITIES

Borrowings c (3,078) 2,176 (902)

Lease liabilities d - (7,936) (7,936)

Equity

------------------------- ------------- -------------- -------- -----------

Retained earnings e 56,261 - 56,261

------------------------- ------------- -------------- -------- -----------

(a) Property, plant and equipment was adjusted to reclassify

leases previously classi ed as nance type to right-of-use assets.

The adjustment reduced the cost of property, plant and equipment by

GBP6.5m and accumulated amortisation by GBP2.0m for a net

adjustment of GBP4.5m

(b) The adjustment to Right-of-use assets is comprised of

GBP4.5m Finance type leases and GBP7.3m Operating type leases,

resulting in a total adjustment of GBP11.8m

(c) Loans and borrowings were adjusted to reclassify leases

previously classified as finance type to lease liabilities.

(d) The following table reconciles the minimum lease commitments

disclosed in the Group's 31 October 2019 annual financial

statements to the amount of lease liabilities on 1 November

2019

Land and buildings

GBP000

-------------------------------------------------- -------------------

Minimum operating lease commitments at 31

October 2019 7,726

Less: short-term leases not recognised under

IFRS 16 (2)

Less: low value leases not recognised under

IFRS 16 (38)

Undiscounted lease payments 458

-------------------------------------------------- -------------------

8,144

Less: e ect of discounting using the incremental

borrowing rate as at the date of initial

application (893)

-------------------------------------------------- -------------------

Lease liabilities for leases classi ed as

operating type under IAS 17 7,251

Plus: leases previously classi ed as nance

type under IAS 1 3,722

-------------------------------------------------- -------------------

Lease liability as at 1 November 2019 10,973

-------------------------------------------------- -------------------

e) Retained earnings were not impacted as a result of IFRS

16.

20. ALTERNATIVE PERFORMANCE MEASURES

On the Board's preferred alternative performance measure

referred to as Adjusted operating profit which is Group operating

profit adding back amortisation of acquired intangible assets,

share-based payment expense and non-recurring items, the Group

achieved GBP4.78m (2019: GBP4.43m).

Reconciliation with the reported income statement for this

measure, Operating profit before non-recurring items and Underlying

pre-tax profit and the Profit before tax shown on the Condensed

Statement of Comprehensive Income, together with reasons for their

use is given below.

On 1 November 2019 the Group implemented IFRS 16 which resulted

in an increase to operating profit of GBP99,445 and an increase to

finance costs of (GBP170,916); resulting in a net decrease to

profit before tax of (GBP71,471). The following alternative

performance measures for the six months ended 30 April 2019 and the

year ended 31 October 2019 are included as originally presented and

have not been restated to reflect IFRS 16 accounting changes.

Unaudited Unaudited Audited

as at 30 as at 30 as at 31

April 2020 April 2019 October

2019

GBP'000 GBP'000 GBP'000

----------------------------------------- ------------ ------------ ----------

Profit before tax 4,297 4,121 7,553

Share of tax incurred by joint ventures

and associate - - 103

Non-recurring items (note 10) 185 96 301

Net finance costs 255 157 184

Share of results from joint ventures

and associates before tax - - (463)

----------------------------------------- ------------ ------------ ----------

Operating profit before non-recurring

items (note 8) 4,737 4,374 7,678

Share of results from joint ventures

and associate before tax - - 463

----------------------------------------- ------------ ------------ ----------

Segment results plus share of results

from joint ventures and associate

before tax (note 8) 4,737 4,374 8,141

Share-based payments 26 51 49

Net finance charges (255) (157) (184)

----------------------------------------- ------------ ------------ ----------

Underlying pre-tax profit 4,508 4,268 8,006

----------------------------------------- ------------ ------------ ----------

Profit before tax 4,297 4,121 7,553

Share of results from joint ventures

and associate - - (463)

Share of tax incurred by joint ventures

and associate - - 103

Net finance charges 255 157 184

Share-based payments 26 51 49

Amortisation of intangibles 18 8 28

Non-recurring items (note 10) 185 96 301

----------------------------------------- ------------ ------------ ----------

Adjusted operating profit 4,781 4,433 7,755

----------------------------------------- ------------ ------------ ----------

The Board uses alternative performance measures as it believes

the underlying commercial performance of the current trading

activities is better reflected, and provides investors and other

users of the accounts with an improved view of likely future

performance by making adjustments to the IFRS results for the

following reasons:

-- Share of results from joint ventures and associate

Provides a fuller understanding of activities directly under

management control and those incorporated from joint ventures and

associates.

-- The add back of tax incurred by joint ventures and

associate

The Board believes the incorporation of the gross result of

these entities provides a fuller understanding of their combined

contribution to the Group performance.

-- Net finance charges

Provides an understanding of results before interest received

and paid.

-- Share-based payments

This charge is calculated using a standard valuation model, with

the assessed non-cash cost each year varying depending on new

scheme invitations and the number of leavers from live schemes.

These variables can create a volatile non-cash charge to the income

statement, which is not directly connected to the trading

performance of the business.

-- Amortisation of acquired intangible assets

This charge relates to intangible assets created from prior

business combinations, hence provides a fuller understanding of

current operating performance.

-- Non-recurring items

The Group's accounting policies include the separate

identification of non-recurring material items on the face of the

income statement, which the Board believes could cause a

misinterpretation of trading performance if not disclosed.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SEIFMDESSEIM

(END) Dow Jones Newswires

June 24, 2020 02:00 ET (06:00 GMT)

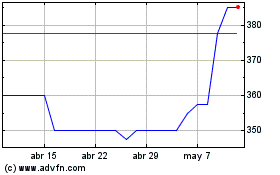

Wynnstay (LSE:WYN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Wynnstay (LSE:WYN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024