OPG Power Ventures plc Issue of Debentures, Prepayment of Term Loans (9620Q)

24 Junio 2020 - 6:38AM

UK Regulatory

TIDMOPG

RNS Number : 9620Q

OPG Power Ventures plc

24 June 2020

24 June 2020

OPG Power Ventures plc

("OPG", the "Group" or the "Company")

Private Placement of Non-Convertible Debentures

Prepayment of Term Loans

OPG Power Ventures PLC is pleased to announce that the Group's

operating subsidiary, OPG Power Generation Pvt Limited ("OPG PG")

has raised Rs2.0 billion (approx. GBP21.2 million) through a

placing of 2,000 Secured Redeemable Non-Convertible Debentures

("NCDs"). The key terms of the NCDs are:

-- 9.85 per cent interest rate, payable semi-annually

-- repayable after three years

-- face value of each NCD of Rs1,000,000

-- NCDs to be listed on the 'Wholesale Debt Market' segment of the Bombay Stock Exchange.

Proceeds of the funds raised through NCDs were utilised to

finance principal repayments on the Group's existing term loans

through to June 2022.

In June 2020, in addition to repayment of Rs2.0 billion (approx.

GBP21.2 million) of term loans from the proceeds of the NCDs, the

Company also made a further prepayment of Rs0.61 billion (approx.

GBP6.5 million) funded from the Company's existing resources.

The issue of the NCDs will have a material positive impact upon

the Group's cash flow during the current uncertain trading period,

through a significant deferment of principal payments and the NCDs'

interest coupon is lower by c.1 per cent in comparison with the

existing term loans interest rate.

Following these transactions, the Company's long-term debt

amounts to GBP44.6 million, comprised of GBP21.2 million of NCDs

and GBP23.4 million of existing term loans, with scheduled

repayments spread from June 2022 to June 2024.

As previously announced COVID-19 and the lockdown has had a

severe impact on overall industrial activity in India as a result

of which electricity demand in the country has seen a significant

reduction during the first three months of FY21. However, power

generation is expected to increase gradually over the coming months

following the lifting of the second COVID-19 lockdown. The Company

has continued operations during the lockdown albeit with limited

plant load factor.

Arvind Gupta, Executive Chairman of OPG, commented:

"The issue of GBP21.2 million (Rs2 billion) of non-convertible

debentures has significantly improved OPG's liquidity position

which will enable the Group to improve management of its cash flows

during these uncertain times. Additionally, it will enable OPG to

resume cash dividend payments to the Company's shareholders in the

medium term. I am pleased to report that our long term, profitable

and sustainable business model remains unchanged."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014.

For further information, please visit www.opgpower.com or

contact:

+91 (0) 44 429

OPG Power Ventures PLC 11211

Arvind Gupta / Dmitri Tsvetkov

Cenkos Securities plc (Nominated Adviser +44 (0) 20 7397

& Broker) 8900

Russell Cook / Stephen Keys

+44 (0) 20 7920

Tavistock (Financial PR) 3150

Simon Hudson / Barney Hayward

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IODSELFFLESSEDM

(END) Dow Jones Newswires

June 24, 2020 07:38 ET (11:38 GMT)

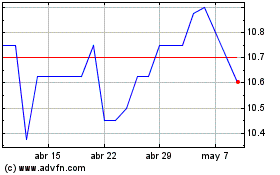

Opg Power Ventures (LSE:OPG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Opg Power Ventures (LSE:OPG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024