TIDMTRAF

RNS Number : 0042R

Trafalgar Property Group PLC

25 June 2020

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

25 June 2020

TRAFALGAR PROPERTY GROUP PLC

("Trafalgar" or the "Company")

GBP750,000 Conditional Placing and Subscription

Debt Conversion and Issue of Convertible Loan Notes

Notice of General Meeting

Highlights

-- Proposed GBP750,000 placing and subscription at 0.08p per share (the "Placing");

-- Net proceeds will allow the part repayment of existing

indebtedness and position the Company to take advantage of new

opportunities;

-- The Placing and Subscription Shares will represent

approximately 65.78 per cent of the issued share capital of the

Company, as enlarged by the issue of the Placing and Subscription

Shares;

-- Issuance of new Convertible Loan Notes ("CLNs"), convertible

at 0.2p per share, 2.5 times the Placing Price;

-- Conversion and part repayment of debt to convertible loan notes;

-- Placing and Subscription is conditional, inter alia, on the

approval of shareholders at a general meeting of the Company to be

held on 13 July 2020 (the "GM") of resolutions to, inter alia,

effect a Share Reorganisation;

-- Warrants over ordinary shares will be issued on the basis of

one for every Placing and Subscription Share and upon conversion of

the CLN, exercisable at 0.2p for 2 years, conditional, inter alia,

on all resolutions being passed at the General Meeting

Paul Treadaway, Chief Executive Officer of Trafalgar, said : "

The funds raised and the substantial readjustment in the PLC's debt

profile, further strengthens our financial position as we have a

stronger balance sheet and far better placed to ensure that

Trafalgar can take advantage of the increasing opportunities that

we see ahead. I'm pleased that in this extremely challenging time

our existing investors, as well as new investors, have shown

their support for this fundraise, our strategy and our future. "

1. Introduction

The Company announces that it is posting a circular to

shareholders today containing details of a conditional placing and

subscription with investors and Directors, to raise GBP750,000

before expenses through the issue of 937,500,000 New Ordinary

Shares at the Issue Price (the "Placing and Subscription

Shares").

The purpose of the circular is to provide details of the Placing

and Subscription, to explain the background to and the reasons for

the Placing and Subscription and why the Directors recommend that

Shareholders vote in favour of the Resolutions to be proposed at

the General Meeting. As the Issue Price is below the nominal value

of the Company's Existing Ordinary Shares, the Company needs to

effect the Share Reorganisation to facilitate the Placing and

Subscription, and further details of the Share Reorganisation are

set out in paragraph 5 below. In addition, the Company has agreed

to convert GBP600,000 of its intercompany debt into a CLN, and

further details of the CLN are set out in paragraph 4 below.

The Proposals are each conditional, inter alia, on the passing

of the Resolutions by Shareholders at the General Meeting, notice

of which is set out at the end of the circular. If the Resolutions

are passed, admission of the Placing and Subscription Shares to

trading on AIM is expected to occur at 8.00 a.m. on 14 July

2020.

2. Background to and reasons for the Placing and Subscription

The Directors believe that it is prudent for the Company to seek

further capital at this time to fund the Group's business. The use

of proceeds of the Placing and Subscription are set out in

paragraph 6 below.

The Directors believe the Placing and Subscription to be the

most appropriate way to provide the capital necessary to meet the

Company's future requirements. As at 23 June 2020, the Company held

cash and cash equivalents of approximately GBP114,338 (unaudited),

and all bank debt is held within its subsidiaries, there is

therefore is no bank debt at the PLC level.

3. Details of the Placing and Subscription

3.1. Placing and Subscription

Peterhouse has conditionally raised GBP750,000 before expenses

through the Placing and Subscription. All Placees and the

Subscriber will receive a one for one warrant exercisable at 0.2p

until the second anniversary of issue. Application will be made to

the London Stock Exchange for the New Ordinary Shares, including

the Placing Shares and the Subscription Shares, to be admitted to

trading on AIM and it is expected that Admission will become

effective and that dealings in the New Ordinary Shares, will

commence on AIM at 8.00 a.m. on 14 July 2020. Assuming no options

or warrants are exercised prior to Admission, the Placing and

Subscription Shares will represent approximately 65.78 per cent of

the ordinary share capital of the Company in issue immediately

following Admission.

Conditional on the Resolutions being approved by Shareholders at

the General Meeting, the Company has agreed to issue Peterhouse

Capital Limited a warrant which is exercisable over 3 per cent. of

the Company's issued share capital from time to time. This warrant

will be exercisable at the Issue Price until the second anniversary

of issue.

3.2. General

All Placing and Subscription Shares will be issued credited as

fully paid and will rank pari passu in all respects with the

Ordinary Shares in issue from time to time, including the right to

receive all dividends and other distributions declared on or after

the date on which they are issued.

For details as to the expected date and times by which certain

events (e.g. Admission, the crediting of CREST accounts and the

dispatch of share certificates) are expected to happen in relation

to the Placing and Subscription Shares and the Share

Reorganisation, please refer to the information on page 4 (Expected

Timetable of Principal Events) of the circular.

4. The CLN

The Company has an intercompany debt of GBP758,000 which is owed

to TNH. To clear this outstanding debt, the Company has entered

into an agreement under which, conditional upon the passing of the

resolutions at the General Meeting and completion of the Placing

and Subscription, TNH has agreed with the Company to write off

GBP600,000 of this debt in consideration for the Company agreeing

to issue a convertible loan note for GBP600,000 to Mr Johnson, in

consideration for which Mr Johnson agrees to write off GBP600,000

of his outstanding loans to TNH.

The CLN is convertible into 300,000,000 New Ordinary Shares at

0.2p per ordinary share for a period of two years and, upon

conversion a one for one warrant will be issued exercisable at 0.2p

until the second anniversary of issue. The CLN is unsecured with

nil coupon and can be converted at any time by Mr Johnson, subject

to his entire holding being less than 29.99 per cent. Should Mr

Johnson convert the entire CLN, his holding would increase to 28.22

per cent. of the Fully Enlarged Share Capital.

The balance of this intercompany debt, being GBP158,000, will be

paid in cash from the Placing and Subscription Proceeds to TNH, who

will pay this directly to Mr Johnson. Following these steps, Mr

Johnson will still be owed approximately GBP1,415,000 by Trafalgar

New Homes Limited.

5. Share Reorganisation

5.1. General

The nominal value of the Existing Ordinary Shares is currently

0.1p per share. As a matter of English law, the Company is unable

to issue the Placing and Subscription Shares at an issue price

which is below their nominal value. It is therefore proposed to

sub-divide the entire existing share capital, consisting of

487,690,380 Ordinary Shares of 0.1p nominal value each, into

487,690,380 Ordinary Shares of 0.01p nominal value each and

487,690,380 Deferred Shares of 0.09p nominal value each, thus

enabling the Company to lawfully implement the Placing and the

Subscription at the Issue Price. The Deferred Shares would be

consolidated into 48,769,038 New Deferred Shares of 0.9p and will

rank pari passu with the Existing Deferred Shares.

Each New Ordinary Share resulting from the Share Reorganisation

will have the same rights (including voting and dividend rights and

rights on a return of capital) as each Existing Ordinary Share

except that they will have a nominal value of 0.01 pence each.

The New Deferred Shares will, as their name suggests, have very

limited rights which are deferred to the Ordinary Shares and will

effectively carry no value as a result. Accordingly, the holders of

the New Deferred Shares will not be entitled to receive notice of,

attend or vote at general meetings of the Company, nor be entitled

to receive any dividends or any payment on a return of capital

until at least GBP100,000 has been paid on each Ordinary Share. No

application will be made for the New Deferred Shares to be admitted

to trading on AIM.

The Company will also be given power to arrange for all the New

Deferred Shares to be transferred to a custodian or to be purchased

for nominal consideration only without the prior sanction of the

holders of the Deferred Shares. No share certificates for the New

Deferred Shares will be issued.

No new certificates for the Existing Ordinary Shares will be

dispatched if the Share Reorganisation becomes effective.

A request will be made to the London Stock Exchange to reflect

on AIM the sub-division of the Existing Ordinary Shares into New

Ordinary Shares of 0.01 pence each. Each Existing Ordinary Share

standing to the credit of a CREST account will be subdivided into

one New Ordinary Share of 0.01 pence each and one Deferred Share of

0.9 pence each at 6.00 p.m. on 13 July 2020.

Following the Share Reorganisation, the ISIN code for the

Ordinary Shares will remain unchanged.

The Directors intend to seek a share consolidation at the next

Annual General Meeting to reduce the overall number of ordinary

shares in issue.

5.2. Taxation

Any person who is in any doubt as to his tax position or who is

subject to tax in a jurisdiction other than the United Kingdom is

strongly recommended to consult his professional tax adviser

immediately.

6. Use of Proceeds

The Company is raising funds for working capital, to pay the

balance of the loan outstanding with TNH and seeking other

acquisition opportunities.

7. Shareholder Approval

For the Proposals to proceed, Shareholder approval is required

to:

(a) effect the Share Reorganisation; and

(b) give the Directors the authority to allot the Placing and

Subscription Shares and to dis-apply statutory pre-emption rights

in respect thereof, and to provide headroom up to an aggregate

nominal amount of GBP500,000 for future share issues including upon

any conversion of the CLN and/or warrants.

In order to obtain the necessary Shareholder approval, a General

Meeting of the Company is to be held at which the Resolutions will

be proposed. Further information regarding the General Meeting is

set out in paragraph 9 below.

The Directors believe the Placing and Subscription to be the

most appropriate way to provide the capital necessary to meet the

Company's future requirements. Should the Placing and Subscription

not proceed for any reason, the Company would need to find

alternative funding and face future uncertainty. The Directors urge

Shareholders to vote in favour of the Resolutions set out in the

Notice.

8. Related Party Transaction

Paul Treadaway , who is a Director, will subscribe for 81,2

50,000 Subscription Shares and be given a one for one warrant as

part of his subscription . In addition, Christopher Johnson, who is

a substantial shareholder, has agreed to convert GBP600,000 of his

outstanding loan with TNH into GBP600,000 CLNs convertible at 0.2p

and a one for one warrant exercisable at 0.2p until the second

anniversary of issue. The Subscription and the issue of the CLN ,

which are conditional on the passing of the Resolutions and

Admission, constitute related party transaction s under Rule 13 of

the AIM Rules for Companies. The Independent Director s , being

Norman Lott and James Dubois consider, having consulted with SPARK,

the Company's Nominated Adviser, that the terms of Subscription and

the issue of the CLN are fair and reasonable insofar as the

Company's Shareholders are concerned.

Following the issue of the Placing and Subscription Shares, Paul

Treadaway's holding will increase to 187,734,658 New Ordinary

Shares which represents approximately 13.13 per cent of the

Enlarged Issued Share Capital.

9. General Meeting

A notice convening the General Meeting to be held at the offices

of Peterhouse Capital Limited, 3(rd) Floor, 80 Cheapside, London

EC2V 6EE at 9.00 a.m. on 13 July 2020 is set out at the end of the

circular. Due to current restrictions on public gatherings, it will

not be possible for shareholders to attend the General Meeting in

person unless both the coronavirus (COVID-19) situation and the

applicable guidance have changed by the date of the meeting. The

Company will provide any status update on its website at

www.trafalgarproperty.group, but Shareholders should assume that

they will not be permitted entry if they turn up at the General

Meeting.

10. Recommendation

The Directors consider that the Proposals will promote the

success of the Company for the benefit of its members as a whole.

Accordingly, the Directors unanimously recommend Shareholders to

vote in favour of the Resolutions at the General Meeting as they

intend to do in respect of their own beneficial holdings of

110,984,658 Ordinary Shares representing approximately 22.76 per

cent. of the Existing Ordinary Shares in issue as at the last

practicable date before publication of the circular.

Enquiries:

Trafalgar Property Group Plc

James Dubois +44 (0) 1732 700 000

Spark Advisory Partners Ltd -AIM Nominated

Adviser

Matt Davis +44 (0) 20 3368 3550

Peterhouse Capital Limited - Broker

Duncan Vasey/Lucy Williams +44 (0) 20 7409 0930

GLOSSARY

The following definitions apply throughout this document unless

the context otherwise requires:

"Act" the Companies Act 2006;

"Admission" the admission of the Placing Shares to

trading on AIM having become effective

in accordance with the AIM Rules;

"AIM" the AIM Market, a market operated by the

London Stock Exchange;

"AIM Rules" together, the rules published by the London

Stock Exchange governing the admission

to, and the operation of, AIM, consisting

of the AIM Rules for Companies (including

the guidance notes thereto) and the AIM

Rules for Nominated Advisers, published

by the London Stock Exchange from time-to-time;

"Articles" the articles of association of the Company

(as amended from time to time);

"Board" or "Directors" the board of directors of the Company,

as at the date of this document, whose

names are set out on page 9 of this document

;

"Circular" or "this this document, including the Notice at

Document" the end of this document and the Form of

Proxy;

"City Code" City Code on Takeover and Mergers;

"CLN" the GBP600,000 convertible loan note between

the Company and Christopher Johnson;

"CLN Shares" 300,000,000 New Ordinary Shares to be issued

to Christopher Johnson upon conversion

of the CLN into New Ordinary Shares;

"Company" or "Trafalgar" Trafalgar Property Group Plc, incorporated

and registered in England & Wales under

the Companies Act 1985, registered number

04340125 and having its registered office

at Chequers Barn, Chequers Lane, Bough

Beech, Edenbridge, Kent, TN8 7PD;

"CREST" the relevant system for paperless settlement

of share transfers and the holding of shares

in uncertificated form, which is administered

by Euroclear UK & Ireland Limited;

"CREST Regulations" the Uncertificated Securities Regulations

2001 (S.I. 2001/3755), as amended from

time to time;

"Effective Time" 6.00 p.m. on 13 July 2020 (or, if the General

Meeting is adjourned, 6.00 p.m. on the

date of the adjourned General Meeting);

"Enlarged Deferred the 287,144,228 New Deferred Ordinary Shares

Share Capital" in issue following the Share Reorganisation;

"Enlarged Share the 1,425,190,380 New Ordinary Shares in

Capital" issue following the Placing and the Subscription;

"Existing Deferred the 238,375,190 ordinary shares of 0.9p

Shares" each in issue at the date of this document;

"Existing Ordinary the 487,690,380 ordinary shares of 0.1p

Shares" each in issue at the date of this document;

"FCA" the Financial Conduct Authority;

"Form of Proxy" the form of proxy for use by the Shareholders

in connection with the General Meeting

"Fully Enlarged the 1,725,190,380 New Ordinary Shares in

Share Capital" issue following the Placing, Subscription

and the CLN Shares;

"General Meeting" the General Meeting of the Shareholders

or "GM" of the Company to be held at 13 July 2020

at 9.00 a.m.;

"Group" the Company together with its subsidiaries,

both directly and indirectly owned;

"Issue price" 0.08 pence per Placing and Subscription

Share;

"London Stock Exchange" London Stock Exchange plc;

"New Deferred Shares" 48,769,038 deferred shares of 0.9 pence

each in the capital of the Company following

the passing of the Resolutions;

"New Ordinary Shares" the ordinary shares of 0.01 pence each

in the capital of the Company upon the

Share Reorganisation becoming effective

at the Effective Time;

"Notice" the notice of the General Meeting, which

is set out at Part II of this document;

"Ordinary Shares" ordinary shares in the capital of the Company

having a nominal value of 0.1p each prior

to the Share Reorganisation becoming effective

at the Effective Time and having a nominal

value of 0.01 pence upon the Share Reorganisation

becoming effective at the Effective Time;

"Peterhouse" Peterhouse Capital Limited, the Company's

Broker;

"Placee" a subscriber for Placing Shares under the

Placing;

"Placing" the conditional placing of the Placing

Shares by Peterhouse with certain institutional

and other investors at the Issue Price;

"Placing Shares" the 856,250,000 New Ordinary Shares to

be issued pursuant to the Placing;

"Proposals" the Placing, the Subscription, the issue

of the CLN and the Share Reorganisation;

"Resolutions" the resolutions to approve the Proposals,

which are set out in the Notice at the

end of this document;

"Share Reorganisation" the proposed subdivision of each Existing

Ordinary Share with a nominal value of

0.1p into one New Ordinary Share with a

nominal value of 0.01p and one Deferred

Share with a nominal value of 0.09p. Those

Deferred Shares are then consolidated with

a nominal value of 0.9p, further details

of which are set out in paragraph 5 of

the Letter from the Chairman in this document;

"Shareholder(s)" holder(s) of the Ordinary Shares;

"SPARK" SPARK Advisory Partners Limited, the Company's

Nominated Adviser;

"Subscriber" Paul Treadaway;

"Subscription" the conditional subscription of 81,250,000

New Ordinary Shares by Paul Treadaway at

the Issue Price;

"TNH" Trafalgar New Homes Limited, a wholly owned

subsidiary of the Company;

"United Kingdom" the United Kingdom of Great Britain and

or "UK" Northern Ireland; and

"Uncertificated" recorded on the register of Ordinary Shares

or "in Uncertificated as being held in uncertificated form in

Form" CREST, entitlement to which by virtue of

the CREST Regulations, may be transferred

by means of CREST.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFZGZVLDNGGZM

(END) Dow Jones Newswires

June 25, 2020 02:00 ET (06:00 GMT)

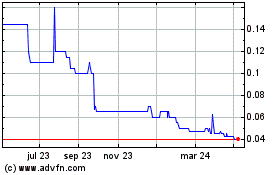

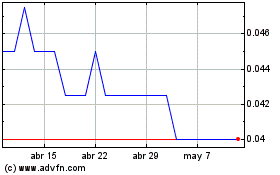

Trafalgar Property (LSE:TRAF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Trafalgar Property (LSE:TRAF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024