Experian Says It Was Resilient in 1Q; Total Revenue Fell 1%

16 Julio 2020 - 2:01AM

Noticias Dow Jones

By Anthony O. Goriainoff

Experian PLC said Thursday that it was resilient in the first

quarter of fiscal 2021 amid the coronavirus pandemic, and that due

to the level of uncertainty stemming from the virus it wasn't

providing guidance for the fiscal year.

The company said it expects acquisitions to add around 2% to

revenue growth for the rest of the fiscal year, and that it sees

organic revenue for the year ending March 31, 2021, in the range of

flat to 5%.

The London-listed consumer-credit reporting agency said total

revenue fell 1% at constant exchange rates for the three months

ended June 30. On an organic basis, revenue fell 2%, and 5% at

actual exchange rates due to the weakness of the Brazilian real

against the U.S. dollar.

In the U.K. and Ireland total and organic revenue at constant

exchange rates fell 15%. The company said peak volume declines were

witnessed in April, and that there was some recovery off the lows

in May and June as some lenders resumed their activity once the

lockdown started to ease.

The company said North America performed exceptionally well with

total and organic revenue increasing by 4% and a very strong

performance in consumer services.

EMEA and Asia Pacific posted a 15% fall in total revenue at

constant exchange rates during the quarter, while organic revenue

fell by 20%.

"If recent foreign-exchange rates persist, we expect a headwind

to benchmark earnings before interest and taxes for the year ending

March 31, 2021 of 4%," the company said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

July 16, 2020 02:46 ET (06:46 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

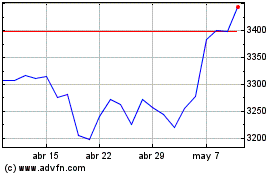

Experian (LSE:EXPN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Experian (LSE:EXPN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024