TIDMHSD

RNS Number : 8158T

Hansard Global plc

23 July 2020

23 July 2020

Hansard Global plc

New business results for the year ended 30 June 2020

Hansard Global plc ("Hansard" or "the Group"), the specialist

long-term savings provider , issues its new business results for

the financial year ended 30 June 2020 ("FY 2020").

Summary

-- New business for the year ended 30 June 2020 was GBP159.8m in

PVNBP ("Present Value of New Business Premiums") terms, up 2.5%

from FY 2019 of GBP155.9m.

-- New business for Q4 2020 was GBP41.3m, 13.2% lower than Q4 2019 of GBP47.6m.

-- The Covid-19 environment presented challenges for our

distribution network to meet clients and conclude sales activity

during Q4 2020. While this impacted our Q4 2020 new business, our

technology-based processes

and business continuity preparedness helped greatly to mitigate against these challenges.

-- Our Latin American region was the highlight for new business

growth over the course of FY 2020, finishing up 44.0% compared to

FY 2019.

-- Assets under administration recovered in Q4 2020 after the

global stock market sell-off in March and totalled GBP1.09bn at 30

June 2020, up from GBP1.08bn at 30 June 2019.

-- The Group remains well capitalised with highly liquid shareholder funds.

Gordon Marr, Group Chief Executive Officer, commented:

"In one of the most challenging periods in living memory,

Hansard has delivered a resilient new business result for the year,

finishing 2.5% up on 2019. Our staff and distribution partners have

dealt admirably with the challenges presented and have shown that

with flexibility, innovation and technology, many hurdles can be

overcome.

While the outlook for new business depends largely on the

severity of on-going Covid-19 restrictions, our core strategic

projects of Japan and our systems upgrade continue to make

progress. Importantly, we still plan to launch our new proposition

in Japan before the end of this calendar year."

For further information:

Hansard Global plc +44 (0) 1624 688 000

Gordon Marr, Group Chief Executive Officer

Tim Davies, Chief Financial Officer

Email: investor-relations@hansard.com

Camarco +44 (0) 203 757 4980

Ben Woodford, Rebecca Noonan

Hansard Global plc

NEW BUSINESS RESULTS FOR THE YEARED 30 JUNE 2020

OVERVIEW

The Group continues to focus on the distribution of regular and

single premium products in a range of jurisdictions around the

world, seeking to achieve well diversified new business growth.

In light of the significant challenges presented by the Covid-19

pandemic, new business for Q4 2020 was down 13.2% to GBP41.3m in

Present Value of New Business Premiums ("PVNBP") terms. The result

for the full year to 30 June 2020 remained positive with new

business up 2.5% on FY 2019 to GBP159.8m. The primary area of

growth during the year came from increased sales of regular savings

products in Latin America.

COVID-19 UPDATE

We noted in our last trading update released on 7 May 2020 that

our workforce moved to working remotely during March and that

restrictions around the globe presented significant difficulties

for our Independent Financial Advisor ("IFA") network in meeting

clients, providing advice and concluding sales.

While Hansard is well supported by recurring income streams via

regular premium products and asset-based annual management charges,

the fourth quarter was, as expected, a challenging one for new

business.

Where possible we sought to deploy technology to navigate a

number of challenges. For example, we successfully rolled out

additional tools to allow customers and IFAs to provide and sign

documentation electronically. Our back-office systems and

infrastructure served us well. With a seamless transition to

homeworking, we were able to operate all our client servicing and

processing activities remotely, with little impact to turn-around

times.

The Isle of Man had significant success in containing and

eradicating all known cases of the Covid-19 virus during Q4 which

has meant a return of Isle of Man based employees to our

head-office in mid-June.

We are committed to supporting and working with our customers

where they may be experiencing personal financial difficulties, for

example by allowing for premium holidays without incurring any

additional charges or penalties.

We expect, like many industries, that a small number of IFAs

will experience financial difficulty. We are carefully monitoring

credit risk exposures with our IFA network and have not to date

seen any material concerns. We do plan however to make some modest

provisions in our year-end results for irrecoverable broker

balances, currently estimated to be in the region of GBP0.2m.

Assets under administration ("AuA") were impacted quite

significantly by the stock market declines in March 2020.

Encouragingly the markets have since recovered over the course of

Q4 and as at 30 June 2020 were slightly up on the level at 30 June

2019. Initial risks to asset-based fee income levels have therefore

subsided although clearly significant market risks will continue to

exist for the coming year.

New Business Flows

New business flows for FY 2020 are summarised as follows :

Three months Year ended

ended

30 June 30 June

2020 2019 % 2020 2019 %

Basis GBPm GBPm change GBPm GBPm change

------------------------------- ----- ----- -------- ------ ------ -------

Present Value of New Business

Premiums 41.3 47.6 (13.2%) 159.8 155.9 2.5%

Annualised Premium Equivalent 5.0 6.9 (27.5%) 24.0 24.7 (2.8%)

------------------------------- ----- ----- -------- ------ ------ -------

The present value of new business premiums is influenced, among

other factors, by the Group's expectations of future premium

collections on regular premium contracts issued during the year.

Where these expectations at year end are different from the

assumptions used in the calculation in prior quarters, the

assumptions are amended in Q4 to better report the cumulative value

of new business. This adjustment is reflected in the Q4 reported

new business figures.

The impact of assumption changes in the current year, the

largest of which relates to improved experience with paid-up

policies, has been to increase PVNBP for the year by GBP8.5m

compared with the assumptions used in the previous year. Excluding

those updated assumptions, cumulative new business flows for FY

2020 would have been reported as GBP151.3m (a decline of 3.0% from

FY 2019) and new business in Q4 2020 would have been reported as

GBP32.8m (a decline of 31.1% from Q4 2019).

In APE terms, new business was down 2.8% for the year and 27.5%

for the quarter. APE figures are unaffected by the updated

assumptions above.

New business flows on the basis of PVNBP are broken down as

follows:

Three months ended Year ended

30 June 30 June

2020 2019 % 2020 2019 %

PVNBP by product type GBPm GBPm change GBPm GBPm change

----------------------- ------ ----- -------- ------ ------ --------

Regular premium 26.0 28.5 (8.8%) 102.0 85.5 19.3%

Single premium 15.3 19.1 (19.9%) 57.8 70.4 (17.9%)

----------------------- ------ ----- -------- ------ ------ --------

Total 41.3 47.6 (13.2%) 159.8 155.9 2.5%

----------------------- ------ ----- -------- ------ ------ --------

Three months ended Year ended

30 June 30 June

2020 2019 % 2020 2019 %

change

--------

PVNBP by geographical area GBPm GBPm GBPm GBPm change

---------------------------- ------ ----- -------- ------ ------ --------

Middle East and Africa 18.6 18.2 2.2% 63.3 57.4 10.3%

Rest of World 12.4 14.8 (16.2%) 48.5 52.7 (8.0%)

Latin America 7.6 8.4 (9.5%) 37.3 25.9 44.0%

Far East 2.7 6.2 (56.5%) 10.7 19.9 (46.2%)

Total 41.3 47.6 (13.2%) 159.8 155.9 2.5%

---------------------------- ------ ----- -------- ------ ------ --------

Despite a challenging final quarter due to Covid-19, the year

finished 2.5% higher than FY 2019.

Our largest region, Middle East & Africa, proved resilient

despite the challenges of Covid-19 restrictions. New business was

up 2.2% in Q4 2020 compared to Q4 2019 and up 10.3% for the full

year.

The Rest of World region was down 16.2% in Q4 2020 compared to

Q4 2019 and down 8% for the full year. The reduction was primarily

due to a lower number of high value single premium cases.

New business in Latin America was down 9.5% in Q4 2020 compared

to Q4 2019 as the region was hit particularly hard by Covid-19.

Strong growth earlier in the year resulted in the full year still

being up an impressive 44%. Our subsidiary in The Bahamas, Hansard

Worldwide Limited, continues to be well received since its launch

in 2019 and has allowed us to build on our key distribution

relationships and deploy targeted initiatives to encourage

adoption.

As outlined in previous reports, our current focus in the Far

East region is to develop and bring our new Japanese proposition to

market. We are still planning to achieve this before the end of

calendar year 2020. We are also working with our existing

distribution network to develop additional new business via our

licence in Labuan, Malaysia.

In terms of business mix, we continue to focus on higher margin

regular premium savings while selectively pursuing single premiums

where the margin is acceptable. This has resulted in our regular

premiums rising 19.3% and single premiums falling 17.9% for the

year.

Assets under Administration ("AUA")

The composition and value of AuA is based upon the assets

selected by or on behalf of contract holders to meet their savings

and investment needs. Reflecting the wide geographical spread of

the Group's customer base, the majority of premium contributions

and of AuA are designated in currencies other than sterling. Over

60% of Group AuA are denominated in US dollars.

The total of such assets is affected by the level of new premium

contributions received from new and existing policy contracts, the

amount of assets withdrawn by contract holders, charges and the

effect of investment market and currency movements. These factors

ultimately affect the level of fund-based income earned by the

Group.

Net withdrawals are typically experienced in Hansard Europe dac

("Hansard Europe"), which closed to new business in 2013.

During Q4 2020 AuA increased by GBP131.7m or 14%, reflecting the

recovery of global stock markets since the sell-off experienced

during March 2020. Total AuA at 30 June 2020 were GBP1,085.2m, up

GBP5.5m since the start of the financial year, of which GBP987.5m

relates to Hansard International.

Three months Year ended

ended

30 June 30 June

2020 2019 2020 2019

GBPm GBPm GBPm GBPm

----------------------------------------- -------- -------- -------- --------

Deposits to investment contracts

- regular premiums 21.4 20.2 85.8 79.8

Deposits to investment contracts

- single premiums 14.7 13.5 57.2 64.6

Withdrawals from contracts and

charges (29.9) (31.0) (143.6) (147.9)

Effect of market and currency movements 125.5 50.9 6.1 47.2

----------------------------------------- -------- -------- -------- --------

Increase in period 131.7 53.6 5.5 43.7

Opening balance 953.5 1,026.1 1,079.7 1,036.0

----------------------------------------- -------- -------- -------- --------

Assets under Administration at

30 June 1,085.2 1,079.7 1,085.2 1,079.7

----------------------------------------- -------- -------- -------- --------

The movement in AuA is split as follows between Hansard

International and Hansard Europe:

Year ended

30 June

2020 2019

GBPm GBPm

----------------------- --- --------- -------

Hansard International 22.1 51.8

Hansard Europe (16.6) (8.1)

------------------------------ --------- -------

Increase in period 5.5 43.7

------------------------------ --------- -------

RESULTS FOR YEAR ENDED 30 JUNE 2020

Full trading results for the year are scheduled to be announced

on 24 September 2020.

Outlook

While restrictions related to Covid-19 have started to relax to

varying degrees around the world, the economic environment remains

uncertain and fragile. Although our technology-driven platform and

processes offer significant advantages, it remains challenging for

our distributors to sell international savings and investment

products without face to face meetings, especially when many

customers have concerns over their personal financial situation.

The range of outcomes for new business in financial year 2021 is

therefore particularly difficult to foresee . Our strong back-book

and assets-driven income streams do however provide offsetting

stability and cash flow during these challenging times and

encouragingly assets under administration were marginally higher at

30 June 2020 than the corresponding period last year.

We also continue to invest for the future through the on-going

development of our Japanese proposition and the upgrade of our

systems environment. We still plan to launch our new product in

Japan before the end of the calendar year .

Notes to editors:

-- Hansard Global plc is the holding company of the Hansard

Group of companies. The Company was listed on the London Stock

Exchange in December 2006. The Group is a specialist long-term

savings provider, based in the Isle of Man.

-- The Group offers a range of flexible and tax-efficient

investment products within a life assurance policy wrapper,

designed to appeal to affluent, international investors.

-- The Group utilises a controlled cost distribution model via a

network of independent financial advisors, and the retail

operations of certain financial institutions who provide access to

their clients in more than 170 countries. The Group's distribution

model is supported by Hansard OnLine, a multi-language internet

platform, and is scalable.

-- The principal geographic markets in which the Group currently

services contract holders and financial advisors are the Middle

East & Africa, the Far East and Latin America. These markets

are served by Hansard International Limited and Hansard Worldwide

Limited.

-- Hansard Europe dac previously operated in Western Europe but

closed to new business with effect from 30 June 2013.

-- The Group's objective is to grow by attracting new business

and positioning itself to adapt rapidly to market trends and

conditions. The scalability and flexibility of the Group's

operations allow it to enter or develop new geographic markets and

exploit growth opportunities within existing markets without the

need for significant further investment.

Forward-looking statements:

This announcement may contain certain forward-looking statements

with respect to certain of Hansard Global plc's plans and its

current goals and expectations relating to future financial

condition, performance and results. By their nature forward-looking

statements involve risk and uncertainties because they relate to

future events and circumstances which are beyond Hansard Global

plc's control. As a result, Hansard Global plc's actual future

condition, performance and results may differ materially from the

plans, goals and expectations set out in Hansard Global plc's

forward-looking statements. Hansard Global plc does not undertake

to update forward-looking statements contained in this announcement

or any other forward-looking statement it may make. No statement in

this announcement is intended to be a profit forecast or be relied

upon as a guide for future performance.

This announcement contains inside information which is disclosed

in accordance with the Market Abuse Regime.

Legal Entity Identifier: 213800ZJ9F2EA3Q24K05

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBRGDRUXDDGGD

(END) Dow Jones Newswires

July 23, 2020 02:00 ET (06:00 GMT)

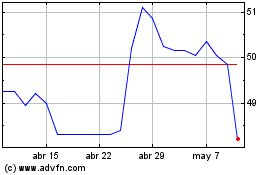

Hansard Global (LSE:HSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Hansard Global (LSE:HSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024