Unilever Shows It Can Still Scrub Up Well -- Heard on the Street

23 Julio 2020 - 7:19AM

Noticias Dow Jones

By Carol Ryan

Unilever is playing a poor hand well. A big food-service

business and exposure to emerging markets will remain a problem,

but the company showed new strengths in its second quarter.

The maker of Dove soap and Hellman's mayonnaise said Thursday

that sales in the three months through June were roughly flat

compared with the same period of 2019, stripping out the impact of

currency and portfolio changes. That easily beat the 4.3% decline

that analysts covering the stock were expecting. Unilever's shares

jumped 8% in early trading, making it the biggest gainer in

London's blue chip FTSE 100 index.

Unilever met the strong demand for its food and hygiene products

as consumers do more cooking and cleaning at home. Sales of hand

sanitizer -- previously a minor part of its business -- grew more

than 20,000% in the quarter. In less than six months, Unilever's

hand-sanitizer business has grown larger than the market leader

last year.

Sales in North America increased 9.5% and Unilever is gaining

market share again in this important market. Free cash flow almost

doubled to EUR2.9 billion ($3.35 billion) in the first half thanks

to working capital improvements. And operating margins grew as

Unilever saved money on marketing. While management expects to

spend more on advertising as lockdowns are lifted, the company

should get more bang for its buck as media rates have fallen.

Unilever still has major challenges. It makes 60% of total

revenue in developing countries, where consumers aren't stockpiling

household essentials at the same rate as in Europe and the U.S.

That puts it at a disadvantage to the likes of Nestlé, which made

42% of revenue in emerging markets last year. Divisions that rely

on food being consumed outside the home -- such as its ice-cream

brands and catering supplies -- will be depressed for some time.

Even before the pandemic hit, the company's 2019 sales growth was

below the low end of its 3-5% target.

After Thursday's share price jump, Unilever still trades at a

roughly 14% discount to competitors Nestlé and Procter & Gamble

as a multiple of projected earnings. That looks justified given a

trickier outlook. For now though, Unilever is making the best of

what it can control.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

July 23, 2020 08:04 ET (12:04 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

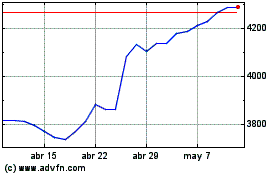

Unilever (LSE:ULVR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

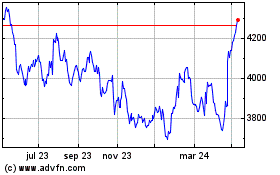

Unilever (LSE:ULVR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024