TIDMHOTC

RNS Number : 9482T

Hotel Chocolat Group PLC

24 July 2020

24 July 2020

HOTEL CHOCOLAT GROUP PLC

(" Hotel Chocolat ", the "Company" or the " Group ")

Trading Update

Hotel Chocolat Group plc, a premium British chocolatier and

omni-channel retailer, today announces a post-close trading update

for the 52 weeks ended 28 June 2020 ("FY20"), and an update on

recent trading, the Group's financial position and outlook.

FY20 TRADING UPDATE

-- Revenue of GBP136 million, an increase of 3 per cent

compared to the 52 weeks ended 30 June 2019:

o In the first half of the year, Group sales of GBP92m

were an increase of 14 per cent year-on-year.

o In the second half of the year, Group sales of GBP45m

were a decline of 14 per cent year-on-year.

-- All UK physical locations were closed for a period of

12 weeks from 22 March to 15 June. This period coincided

with Easter and Mother's Day, two of the three largest

gifting seasons for the Group. The business was able

to migrate a significant proportion of these sales to

online. The team demonstrated great agility by collecting

Easter inventory from over 100 retail locations, temporarily

reducing the online product range, and introducing pre-selected

product bundles so that the Distribution Centre could

safely handle as much of the surge in online demand as

possible.

-- In total, digital sales accelerated to over 200% year-on

year in the fourth quarter. In addition to increased

gifting sales, digital sales growth throughout the period

was supported by a 47% year-on year increase in the sales

of subscriptions and recurring purchases, including Hot

Chocolat refills for the Velvetiser in-home system.

-- The factory in Cambridgeshire was temporarily closed

for eight weeks whilst adaptations were made to ensure

Covid-secure working. It re-opened in May and is now

operating at 90% of normal capacity.

-- Whilst the actions above led to some material additional

short-term costs in the second half of the year, both

in the form of lower gross margins due to re-handling

of inventory, and increased overheads due to the adoption

of new working practices, it has led to improved agility

and resilience of the ongoing business.

-- The Group anticipates underlying pre-tax profit to be

in line with expectations. In the light of current and

anticipated trading performance the carrying value of

existing fixed assets is being reviewed. This review

may give rise to a higher than historic impairment charge,

but any such adjustment will be a non-cash charge and

will be confirmed at the release of preliminary results,

scheduled for 29 September 2020.

RECENT TRADING & OUTLOOK

-- Since early March, the Group has been focused on managing

both the immediate and longer-term impact of Covid-19

on the business. The foremost priority throughout this

period has remained the safety and wellbeing of colleagues,

customers, and communities.

-- 119 of 125 UK locations are currently open for business.

Sales in "High Street" locations are performing more

strongly than in city-centre "commuter" locations. Whilst

total sales from physical locations are lower year-on-year,

digital growth remains very strong and Group-wide sales

since the end of the period remain in line with management

expectations. A similar pattern has been seen in both

the USA, and in Japan, which is operated by a joint-venture

partner.

-- The Board remains confident in the resilience of the

Brand, and the potential for growth and success in the

future but it also acknowledges less visibility than

usual for FY21, given the uncertain severity and duration

of the Covid-19 impact.

FINANCIAL POSITION

-- The Group remains well capitalised with GBP25m cash on

hand, giving GBP60m of headroom within its agreed banking

facilities.

-- Having raised GBP22m investment capital in March, the

Group has continued to invest, as planned, for future

growth, and has recently:

o Signed a new 5-year lease on an enlarged Distribution

Centre in Cambridgeshire, and commenced fitting out,

which will increase supply-chain capacity by over

100% for FY21.

o Continued to invest in increasing UK manufacturing

capacity.

o Upgraded digital, launching a new VIP loyalty app,

with further developments under way for launch in

FY21 including gift-sending app capability and new

subscription concepts.

Angus Thirlwell, Co-Founder and Chief Executive Officer of Hotel

Chocolat, said:

" I've been hugely impressed by how our team have responded,

culturally, professionally and ethically during the pandemic . The

acceleration of change in the retail landscape has galvanised us to

speed up our plans and investments in the opportunities we were

already pursuing.

" Our physical retail usually accounts for over 70% of sales in

the second half , but all locations were closed for the entire

Easter period this year and beyond. It is a testament to our lovely

customers' loyalty that they switched in droves to online and we

contained the Group impact to only -1 4 % in the half.

"Online, our brand is now set to a significantly faster growth

trajectory, delivering gifts, subscriptions and household

indulgence . Some of this is attributable to Covid-accelerated

change , but new concept launches, and digital enhancements h ave

also supported growth . The Velvetiser in-home drinks system, the

VIP loyalty programme , and new subscriptions capability will

continue to generate growth in the years ahead.

" We remain positive about the unparalleled leisure experience a

physical Hotel Chocolat can deliver within our multi-channel direct

- to - consumer model. All we need is footfall , and so far we are

seeing that return at different rates . Residential areas are

stronger, with city centres more subdued without as many commuters

and tourists.

" We pledged at the beginning to keep the Hotel Chocolat family

together through this, and that i s what we have done. We are

confident about the prospects for our business and are actively

creating 200 new jobs this year, primarily roles in our UK

chocolate - making factory and enlarged distribution centre.

" We're excited about our upcoming new Latte coffees for our

Velvetiser in-home system, and a complete range of Nutmilk truffles

and pralines, which just happen to be totally vegan too. In

September, we will launch the Wonka-esque 'Inventing Room Panel' ;

a limited - membership subscription experience with privileged

access to try all of our potential new ideas, with voting rights on

whether they should be launched.

" Our new businesses in Japan and the US have adapted nimbly and

we remain confident about our opportunities overseas in the year s

ahead."

Enquiries:

Hotel Chocolat Group Limited Tel: +44 (0) 1763 257 746

Angus Thirlwell, Co-Founder

and CEO

Peter Harris, Co-Founder and

Development Director

Matt Pritchard, CFO

Liberum (Nominated Adviser and Tel: +44 (0) 20 3100 2000

Sole Broker)

Clayton Bush

James Greenwood

Citigate Dewe Rogerson Tel: + 44 (0) 20 7638 9571

Angharad Couch

Ellen Wilton

Kieran Farthing

Notes to Editors:

Hotel Chocolat is a premium British chocolatier with a strong

and distinctive brand. The business was founded in 1993 by Angus

Thirlwell and Peter Harris and has traded under the Hotel Chocolat

brand since 2003. The Group sells its products online and through

physical locations in the UK and abroad. The Group has a cocoa farm

and eco-escape hotel in Saint Lucia, offering complete cocoa

immersion through tree-to-bar experiences and wellness treatments.

The Group also has a flagship restaurant and cacao roastery in

London's Borough Market: Rabot 1745. The Group was admitted to

trading on AIM in 2016.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTFLFFTDTIVFII

(END) Dow Jones Newswires

July 24, 2020 02:00 ET (06:00 GMT)

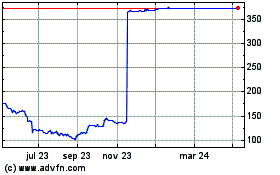

Hotel Chocolat (LSE:HOTC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Hotel Chocolat (LSE:HOTC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024