TIDMWBI

RNS Number : 0908U

Woodbois Limited

27 July 2020

Woodbois Limited

("Woodbois", the "Group" or the "Company")

(AIM: WBI)

Further Conversion of the Convertible Bonds

The Company is pleased to provide an update on its proposal to

purchase further Convertible Bonds, as indicated in the

announcements dated 14, 15 and 16 July 2020.

Additional Capitalisation of Convertible Bonds

The Company has extended the Capitalisation by agreeing terms

with Rhino Ventures Limited ( a company affiliated with Miles

Pelham and Pelham Limited) to repurchase all remaining Convertible

Bonds held by it (including those newly acquired and referred to in

the announcement dated 16 July 2020), and by agreeing with certain

other bondholders (including Paul Dolan, Chairman and CEO of the

Company) to repurchase the Convertible Bonds held by them, in each

case at the Placing Price. The aggregate additional principal

amount of Convertible Bonds being purchased is $6,448,800, and the

total additional number of Capitalisation Shares to be issued in

exchange for the Convertible Bonds (plus the accrued interest

liability) is 266,178,196. Further details of the purchases

(including the previously announced purchase from Rhino Ventures

Limited) are set out in the following table:

Bondholder Principal Amount Number of Capitalisation Number of Capitalisation

of Convertible Ordinary Shares Non-Voting Shares

Bonds ($)

Rhino Ventures

Limited 26,047,600* 123,765,652** 951,365,095

DHC Investments

Limited 1,943,200 80,206,778

Martina Thierfelder 557,600 23,015,284

Paul Dolan 400,400 16,526,757

* This figure comprises the $22.5m previously announced, plus an

additional $3,547,600 now agreed to be purchased.

** The Company agreed with Rhino Ventures Limited that all

Capitalisation Non-Voting Shares required to be issued in order to

keep the aggregate interest in voting rights of the concert party

(as described in the announcement published on 20 September 2019)

below 28% would be issued to Rhino Ventures Limited, and other

bondholders would just be issued Capitalisation Ordinary Shares.

This has resulted in the number of Capitalisation Ordinary Shares

issued to Rhino Ventures Limited on completion of the

Capitalisation being lower than previously announced.

Following completion of the Capitalisation, an aggregate

principal amount of $1,051,200 Convertible Bonds will remain

outstanding and due for repayment in mid-2023. As a result of the

remaining amount being much lower than originally envisaged, the

Company proposed a further variation to the Convertible Bond

removing the restriction on the Company on entering into any loan

arrangements that are secured or which otherwise would rank ahead

of the Convertible Bonds. This required an "Extraordinary

Resolution" of bondholders holding not less than 75% of the

principal amount of the Convertible Bond, which has been passed,

and the variation of the Convertible Bond (including the variations

detailed in the announcement dated 14 July 2020) has been duly

entered into.

Completion of the proposed purchase of further Convertible Bonds

will be conditional upon, inter alia, the approval by Shareholders

of the Resolutions to be proposed at a General Meeting of the

Company on 5 August, therefore the timetable for completion of the

Capitalisation is unchanged.

Following the completion of the proposed Fundraise and Debt

Restructuring, the Company's issued share capital will comprise of

2,382,117,052 shares, of which 1,430,751,958 are voting shares and

951,365,095 are non-voting shares.

Related Party Transactions:

Miles Pelham

The Capitalisation of additional Convertible Bonds by Rhino

Ventures Limited constitutes a related party transaction under the

AIM Rules as Miles Pelham (through his affiliate companies) is a

substantial shareholder (within the meaning of the AIM Rules).

The Directors, other than Paul Dolan who is deemed a member of

the concert party, consider, having consulted with Canaccord

Genuity, the Company's nominated adviser, that the terms of the

related party transaction are fair and reasonable in so far as its

Shareholders are concerned.

Paul Dolan

The Capitalisation of Convertible Bonds by Paul Dolan

constitutes a related party transaction under the AIM Rules as he

is a director of the Company.

The Directors, other than Paul Dolan who is not deemed

independent, consider, having consulted with Canaccord Genuity, the

Company's nominated adviser, that the terms of the related party

transaction are fair and reasonable in so far as its Shareholders

are concerned.

Concert Party:

As set out in the announcement published on 20 September 2019,

the original owners of the Convertible Bonds are deemed to be

acting in concert pursuant to the rules of the Takeover Code.

Following the proposed Fundraise and Debt Restructuring , the

concert parties will have the following interest in the share

capital of the Company as set out below:

Number of Ordinary % of Voting Share Capitalisation % of Non-Voting

Concert Party Shares Capital Non-Voting Shares Share Capital

Paul Dolan 75,400,032 5.3% 0 0%

Miles Pelham 204,555,935 14.3% 951,365,095 100%

Other Convertible Bond

Holders 106,347,062 7.4% 0 0%

Total 386,303,029 27.0%

The Concert Party will also own $1,051,200 worth Convertible

Bonds which remain outstanding and due for repayment in

mid-2023.

Paul Dolan, Chairman and CEO of Woodbois, said:

" I'm delighted to report that holders of almost 97% of the

Woodbois Convertible Bond have now elected to switch into equity,

delivering a radical improvement to the debt profile of the Company

and aligning their interests with those of all shareholders. We are

looking forward to the General Meeting to be held on 5 August 2020

and keeping shareholders informed of our progress thereafter. "

Terms and definitions used in this announcement shall have the

same meaning as ascribed to them in the announcement dated 14 July

2020 unless otherwise stated.

Enquiries:

Woodbois Limited

Paul Dolan - Chairman and CEO

www.woodbois.com

+44 (0)20 7099 1940

Canaccord Genuity (Nominated Adviser and Broker)

Henry Fitzgerald-O'Connor

James Asensio

Thomas Diehl

+44 (0)20 7523 8000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEANXKALNEEFA

(END) Dow Jones Newswires

July 27, 2020 02:00 ET (06:00 GMT)

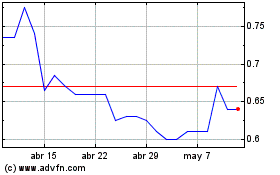

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024