TIDMTYMN

RNS Number : 2271U

Tyman PLC

28 July 2020

TYMAN PLC

RESULTS FOR THE SIX MONTHSED 30 JUNE 2020

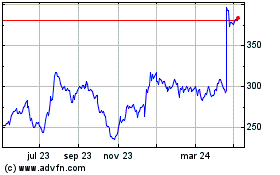

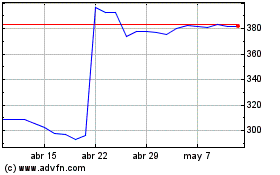

Tyman plc (TYMN.L) announces results for the six months ended 30

June 2020.

Summary Group results

LFL(1)

GBPm unless stated H1 2020 H1 2019 Change (adj*)

---------------------------------- -------- -------- -------- --------

Revenue 254.1 301.9 -16% -17%

Adjusted operating profit* 31.3 41.9 -25% -26%

Adjusted operating margin* 12.3% 13.9% -160bps

Operating profit 21.0 18.5 +14%

Adjusted profit before taxation* 24.7 34.7 -29%

Profit before taxation 14.7 11.0 +34%

Adjusted EPS* 9.9p 13.1p -25%

Basic EPS 6.4p 4.1p +57%

Dividend per share - 3.9p -100%

Leverage* (2) 1.8x 2.2x -0.4x

Return on capital employed* 10.8% 12.7% -190bps

---------------------------------- -------- -------- -------- --------

* Alternative performance measures. These "Adjusted" metrics are

before amortisation of acquired intangible assets, impairment of

acquired intangible assets, impairment of goodwill, and exceptional

items. These measures provide additional information to

shareholders on the underlying performance of the business and are

used consistently through the statement. Further details can be

found on page 48

(1) LFL = constant currency like-for-Like (see APMs on page

48)

(2) Leverage is calculated in accordance with the debt covenant

methodology

Highlights:

-- COVID-19 impact contained to 17% LFL revenue decline

-- Solid performance at start of 2020

-- Better than expected recovery since operations resumed; June

recovered to 92% of prior year, with further momentum continuing

into July

-- LFL adjusted operating profit down 26% due to revenue

shortfall largely mitigated by cost reduction resulting in only

modest margin deterioration

-- Decisive action taken to preserve cash leading to strong cash conversion of 106%

-- Robust balance sheet with leverage of 1.8x and liquidity

headroom of GBP159m; covenant relaxation agreed at Dec 2020 and Jun

2021

-- Good progress on self-help measures:

-- Encouraging level of North American customer wins

-- Operational improvements at Statesville site

-- Successful execution of planned footprint realignments

-- Reduction in safety incidents of 72% indicative of operational excellence progress

Jo Hallas, Chief Executive Officer, commented :

"COVID-19 had a significant impact on the Group in the period. I

would like to thank our people who have done an exceptional job of

managing through the intensity of the COVID-19 crisis, with

diligent focus on safeguarding our colleagues and communities and

servicing our customers. We have taken action to maintain a robust

balance sheet and we believe that the crisis has demonstrated the

resilience of the Tyman business model. I am encouraged by the

better than expected recovery since the easing of restrictions,

although much uncertainty remains.

"Despite the crisis, we have continued to strengthen our base

and progress our strategic growth initiatives. Our demonstrated

resilience and inherent strengths, including market-leading brands,

innovation capabilities and deep customer relationships, continue

to position the Group well to capitalise on opportunities arising

as the global economy recovers and as we progressively emerge from

a period of intense operational focus."

28 July 2020

Enquiries

Tyman plc investor.relations@tymanplc.com

Jo Hallas - Chief Executive Officer

Jason Ashton - Chief Financial Officer

MHP Communications 020 3128 8100

Reg Hoare / Rachel Mann / Ailsa Prestige tyman@mhpc.com

Analyst and investor presentation

Tyman will host an analyst and investor presentation at 9.30

a.m. today, Tuesday 28 July 2020, which will be webcast at:

https://webcasting.brrmedia.co.uk/broadcast/5f16bdc74c167c12157980b0

The audio conference call details are:

Number +44 (0) 330 336 9126

Confirmation code 7997871

Notes to editors

Tyman (TYMN: LSE) is a leading international supplier of

engineered fenestration components and access solutions to the

construction industry. The company designs and manufactures

products that enhance the comfort, sustainability, security, safety

and aesthetics of residential homes and commercial buildings.

Tyman's portfolio of leading brands serve their markets through

three divisions: North America (AmesburyTruth), UK and Ireland

(ERA) and International (SchlegelGiesse). Headquartered in London,

the Group employs approximately 3,900 people with facilities in 18

countries worldwide. Further information is available at

www.tymanplc.com .

OVERVIEW OF RESULTS

Performance in H1 2020

The Group's performance in H1 2020 was inevitably impacted by

COVID-19. Revenue for the period was GBP254.1 million (H1 2019:

GBP301.9 million), a decrease of 16% on a reported basis, and 17%

on a LFL basis. Reported revenue benefitted from the relative

weakness of Sterling compared with H1 2019.

The Group had a solid start to the year before the impact of

COVID-19 took effect, achieving LFL growth in Q1 in North America,

where markets continued to be buoyant in line with the momentum

experienced in Q4 2019. The UK reported LFL sales growth across

January and February following the decisive election result in

December 2019. The International division had a more challenging

start to the year, with markets continuing to be weak as expected

coming into the year, and China and Italy impacted by COVID-19

earlier than other territories.

From mid-March until early May, trading was progressively

impacted as increasingly stringent lockdowns took effect in our

core markets. We responded accordingly, temporarily closing our

facilities in Italy from the middle of March until the middle of

April and in the UK from late March until early May. Apart from the

two facilities in Juarez which were closed for most of May, the

North American sites continued to operate throughout the period but

saw a marked reduction in order intake through April and May. Most

of the International division distribution and sales office sites

were closed for various time periods in accordance with local

guidelines. All operating facilities across the Group are now

currently open.

As can be seen in the table below, April was the most severely

impacted month, with LFL revenue 41% lower than 2019. Since

operations began to resume from late April, trading has been better

than expected and we have outperformed our base case scenario in

each month. June recovered to 92% of 2019 and this recovery trend

has continued into July, with average sales per day currently 3%

ahead of 2019, although some of this improvement is likely to be

driven by customer restocking and pent-up demand.

LFL Q1 April May June H1 July*

revenue 2020

vs

2019

North

America +2% -25% -37% -8% -12% +4%

UK

&

Ireland -1% -93% -58% -15% -28% +8%

International -17% -50% -28% -2% -22% -8%

Group -2% -41% -38% -8% -17% +3%

=============== ===== ====== ===== ===== ====== ======

* Month to date average sales per day

The swift cost management actions taken, as well as the

self-help initiatives which were already in progress or completed

in 2019, partially mitigated the impact of the sales shortfall and

additional COVID-19 related bad debt charges of GBP0.5m, resulting

in a decrease in LFL adjusted operating profit of 26% to GBP31.3

million. Reported adjusted operating profit decreased 25%,

benefiting from the favourable impact of exchange. Adjusted

operating margin fell from 13.9% to 12.3%, a credible performance

in light of the impact of COVID-19.

Supporting our stakeholders through COVID-19

The Group's first priority has been ensuring the health and

safety of our employees, their families and our communities. We

acted quickly to implement enhanced hygiene and social distancing

measures across the Group. Hygiene measures included reinforcing

good personal hygiene practices; installing hand sanitiser

dispensers; enhanced workplace cleaning regimes; and temperature

monitoring for all people arriving to site. Where possible,

infrastructure was put in place and employees were transitioned to

remote homeworking. Social distancing measures included amending

shift patterns as necessary and installing plastic screens or

providing PPE where appropriate. Regular communications with all

employees were established throughout the crisis, including

reminding employees of mental wellbeing assistance available to

them. In certain locations, the Group has provided or expanded

company transportation to avoid employees being exposed to public

transport and ensure social distancing.

An employee survey was conducted in early June to get feedback

on the Company's handling of the pandemic. Two-thirds (over 2,500

employees) of the global workforce responded, and it was pleasing

that over 80% of employees agreed that the Company has put in place

the right safety protocols, cared about their well-being, kept

employees informed, and that leaders have acted proactively and

decisively during the crisis.

The Group has supported customers through the crisis, with

enhanced communication to understand changes in demand and manage

service levels, implementing paperless and non-contact delivery

services, providing advice on implementing hygiene and social

distancing measures, and agreeing payment plans to help customers

trade through where needed. In the absence of being able to visit

customers, technology was used to maintain engagement , with

webinars and virtual workshops being held.

Even during the early part of the crisis in China, our supply

chain has not been a constraint to the business. Close contact has

been maintained with suppliers throughout to assist in managing

demand. Initial relaxations of payment terms were agreed with some

suppliers; however, all suppliers are now being paid in line with

terms.

The Group has also supported the fight against COVID-19, with

one of the UK seals plants resuming operations early to produce

Q-Lon seals for the partitions used in emergency hospital builds

around the world, including London and Istanbul. Donations of face

masks were also made to local hospitals.

Decisive actions taken to reduce costs and preserve cash

Swift and decisive action was taken to put in place a broad

range of measures with focus on optimisation of cashflow via cost

savings, working capital reduction, tight management of capital

expenditure and cancellation of the final 2019 dividend (worth

GBP16.3 million).

The Group made use of available government employee job

retention schemes in its countries of operation, with usage

diminishing as operations resumed and demand returned. The total

benefit received across all markets in the period was GBP3.3

million, of which GBP2.0 million was in the UK. Whilst there may be

selective redundancies in areas where opportunities have been

identified to improve efficiency, such as through greater use of

technology, use of these schemes has allowed the Group to protect

more jobs than would otherwise have been possible. The Group does

not foresee further use of government job retention schemes beyond

the end of July and does not expect to make use of the UK

government's job retention bonus.

As part of the leadership's response, the Board and senior

management elected to take a temporary base salary reduction of 25%

and 20% respectively from 1 April. The 2020 management bonus scheme

was also cancelled. Many of our employees also took temporary

salary and benefit reductions, tapered according to seniority. The

amount sacrificed through salary reductions was approximately

GBP2.1 million, with further savings from reduced bonus accruals.

The Board fully recognises the impact of these decisions and

appreciates the support and dedication of our people in this

difficult time. With employee salaries progressively reinstated

across June and July, senior management and Board salaries will be

reinstated at full pay from 1 August.

Balance sheet and funding

Net debt at the period end was GBP219.8 million (H1 2019:

GBP289.8 million). Adjusted net debt, which excludes lease

liabilities and unamortised finance arrangement fees was GBP160.5

million (H1 2019: GBP230.0 million). The Group had cash of GBP79.9

million and an undrawn RCF available of GBP78.6 million. In

addition, the Group has potential access to an uncommitted

accordion facility of GBP70 million and has obtained eligibility to

draw up to GBP100 million under the Bank of England's Covid

Corporate Financing Facility (CCFF). The Group does not currently

intend to use this facility, but it provides further assurance in

the event of a severe deterioration in market conditions. The Group

generated GBP33.2 million of operational cash flow in the period

and achieved operating cash conversion of 106%. The Group had

significant headroom on its banking covenants at 30 June 2020, with

leverage of 1.8x and interest cover of 8.4x.

The Group has conducted ongoing scenario planning as the

COVID-19 situation has evolved. The Group has modelled a base case

scenario and a severe but plausible downside scenario. In both

scenarios modelled, the Group would retain significant liquidity

headroom. Although covenant headroom would be maintained under the

base case scenario, in order to provide increased headroom during

the period of uncertainty, the Group has agreed a relaxation of the

leverage covenant from 3.0x adjusted EBITDA to 3.5x at 31 December

2020 and 4.0x at 30 June 2021. The Group continues to monitor the

evolution of the crisis and will adjust plans accordingly to

maintain balance sheet strength.

Dividend

As significant uncertainty remains, the Board is adopting a

prudent approach to shareholder distributions and is not declaring

an interim dividend payment. The Board will determine the timing

for the resumption of dividends once the ongoing impact of COVID-19

becomes clearer. Once dividend payments are restored, t he Board

intends to revert to a progressive dividend policy.

Chair search

As previously announced, progress is being made recruiting a new

chair; this process was inevitably slowed by the UK social

distancing measures but is well underway and we hope to appoint a

successor in the coming months.

Strategic progress

Tyman's strategy of focus, define, grow will strengthen the

Group and further enhance our portfolio of world class brands and

differentiated products to deliver meaningful value to our

customers and thereby create shareholder value. Although the

primary focus since February has inevitably been intensive

management of the COVID-19 crisis, good progress has also been made

on these strategic priorities. The Group believes the strategy

continues to be the right one in the context of COVID-19 and that

there are opportunities to accelerate aspects of the strategy as we

emerge from the crisis.

Focus

The activities to focus our operations through streamlining and

strengthening the base for future growth have progressed as

planned. The strengthening of operational and leadership resources

and continuous improvement activities at the Statesville facility

have delivered improvements in metrics compared to H1 2019,

although the benefits have been masked by COVID-19 in the period.

An accelerated rate of improvement for the second half is expected

based on accomplishments in the first half and continued lean

excellence work.

The various initiatives to streamline operations, including

closure of the Fremont (Nebraska) and Singapore facilities, and

ceasing of manufacturing in Australia and China, have been executed

as planned with no customer disruption. Other continuous

improvement activities have included inter-site line transfers as

the North American manufacturing "centres of excellence" are

further optimised.

Integration of acquisitions has also continued to progress.

Product portfolio harmonisation across the Amesbury, Truth and

Ashland brands is underway and Ashland is on track to deliver the

$5 million annualised synergy target this year. Ashland and Zoo

have both significantly exceeded the 14% return on acquisition

target after two years of ownership.

Define

The define element of the strategy, which centres on building

cultural cohesion across the Group to facilitate ongoing synergy

extraction, has continued to gain momentum. A Group conference was

held virtually in June for 85 senior managers, with a significant

focus on building cohesion across the Group through a shared

purpose, set of values and culture.

Safety excellence is our beachhead for driving culture change,

supported by our 'safety is our first language' engagement

programme. The Group-wide two-day safety leadership training

programme launched in January, with 20% of people managers having

completed this prior to lockdown and work underway to transition to

a digital format to continue deployment. Pleasingly, the lost time

incident frequency rate reduced by 72% to 1.5 incidents per million

hours worked (H1 2019: 5.3), indicative of improved operational

excellence and demonstrating the benefits of a Group-wide

excellence system.

Lean excellence activity is also building across the Group, with

several kaizens conducted in H1 at Statesville, value analysis and

value engineering (VAVE) work undertaken in ERA and continued

investment in Industry 4.0 process automation in Budrio. The Group

seeks to embed lean excellence practices to develop 'best in class'

operations and drive margin expansion through improved quality and

productivity.

Grow

The grow element of the strategy will near-term have most impact

from the divisional organic initiatives underway, including share

gain through executing well in serving our customers, accelerating

new product launches and expanding our existing channels to market.

Despite COVID headwinds, the strengthened North American sales team

has achieved net customer wins of c. $3 million annualised revenue

in H1 2020, following net gains in H2 2019. In the UK and Ireland

division, the partnering with online retailers has served the

business well during the COVID crisis and developing e-commerce

routes to market will continue to be a focus area, including

leveraging the existing ERA Everywhere platform.

Innovations that create differentiated value for our customers

have also progressed well in H1, including the smartware range

which addresses the accelerating adoption of connected home

products, a range of anti-microbial coated product to support the

increased focus on surface hygiene, expansion of the minimalist

product range to capitalise on this growing trend, and

sustainability-enhancing products such as those with Cradle to

Cradle Certification and a thermally broken smoke vent.

Cross-divisional teams have been established to investigate

specific opportunities to better leverage the Group's portfolio,

brands and technologies across our markets. As an early win, the

global seals excellence team have collaborated to create a further

$4 million of door seals capacity, which will be used to both

support current customers and win new business for high value,

differentiated applications.

Mid-term, Tyman continues to be the natural consolidator in a

fragmented market and we would intend to supplement our organic

growth with acquisitions that either bring products and

technologies of future strategic importance, or synergistically

balance out our geographic strength across our core markets.

Outlook

Although the recovery has so far exceeded expectations, this has

been driven in part by the abnormally low activity during lockdown

leaving the underlying market trends less clear. Longer term, the

outlook remains uncertain as the macro-economic impact of the

crisis is masked by government support measures, heightened in the

US by support for the economy in the run-up to the presidential

election later this year. The ending of various employment support

schemes is already having a significant impact on unemployment and

accordingly household income levels and consumer confidence. There

are also indications that this is leading to tightening of the

mortgage market, impacting house moves which generally correlate to

refurbishment projects.

On the other hand, structural industry growth drivers remain

positive and emerging from the crisis there are several factors

which could support the housing markets that the Group is exposed

to worldwide. Lockdowns have been noted to increase savings levels,

with consumer spending on travel and entertainment significantly

reduced. This could benefit building products spend, especially

large-ticket items such as windows and doors that tend to have

lagged general RMI spend in recent years . Housing and other

infrastructure construction is also likely to be a priority for

fiscal stimulus, and this has been seen in China and the UK, with

reductions to stamp duty and investment in 'green' schemes recently

announced.

There are also several trends emerging, which the Group is well

placed to capitalise on. The additional time spent at home and

shift to work-from-home creates a likelihood that homeowners will

prioritise investment in the home. A trend towards "urban flight"

is also being noted, particularly in the US as people seek more

space. This favours growth in single-family housing to which the

Group is most exposed as well as generating additional repair and

remodelling work.

Given there remains significant uncertainty over the ongoing

impact that COVID-19 will have on the macro-economic environment,

we are unable to resume guidance at this stage.

Summary

Whilst COVID-19 has had a significant impact on the Group's

results in the period, the hard work of our employees in continuing

to serve our customers under challenging circumstances has helped

our performance consistently exceed our base case assumptions. The

Group has also navigated the uncertainty by taking decisive action

to reduce costs and preserve cash.

The crisis has emphasised the strength of the Tyman business

model, with the diversification across geographies and markets

providing resilience, our innovation capabilities allowing us to

quickly adapt to changing trends, and the cash generative nature of

the business supporting our balance sheet. Despite the impact of

COVID-19, good progress has been made on self-help measures and

strategic initiatives, with further improvements made at the

Statesville facility, an encouraging level of new business wins

generated in North America, and successful execution of footprint

realignments in both the International and North American

divisions.

In the second half, the focus will continue to be on navigating

through the challenges and opportunities arising from the COVID-19

crisis, implementing self-help measures, and driving share gain

through new product launches and excellent execution. The

resilience of our business model and our inherent strengths

including market-leading brands, innovation capabilities and deep

customer relationships continue to position the Group well for

future growth once the current crisis recedes.

Jo Hallas

Chief Executive Officer

North America (AmesburyTruth)

GBPm except where stated H1 2020 H1 2019(1) Change LFL

--------------------------- -------- ----------- -------- -----

Revenue 168.2 187.0 -10% -12%

Adjusted operating profit 24.8 31.4 -21% -22%

Adjusted operating margin 14.7% 16.8% -210bps

--------------------------- -------- ----------- -------- -----

1. Prior year divisional figures have been amended for

comparability to reflect a change to the presentation of

inter-divisional sales in 2019. For further details, see segment

note on pages 34 to 36.

Q1 April May June H1 2020 July*

---------------- ---- ------ ----- ----- -------- ------

LFL revenue vs

2019 +2% -25% -37% -8% -12% +4%

================ ==== ====== ===== ===== ======== ======

* Month to date average sales per day

Markets

US residential and commercial markets started the year strongly,

with growth until late March when COVID-19 started to take effect.

Even though construction was classed as an essential industry in

most of the United States, lockdown restrictions impacted demand.

Since mid-May, the market has subsequently rebounded as

restrictions were eased. Total housing starts grew +1% in H1 2020

compared to H1 2019, with single family starts, to which the

division has proportionally higher exposure being down -1%, albeit

with single family building permits being up +4% in H1 2020, giving

some indication of likely future growth in housing starts.

Conditions in the US residential repair and remodelling market have

improved, with the NAHB RMI average index significantly higher at

73, having grown from 48 at the end of Q1 2020 (H1 2019: 55).

Commercial construction markets were significantly weaker in the

period, with non-residential building starts down 22% compared to

H1 2019.

In Canada, the construction industry was subject to restrictions

in some provinces and accordingly housing starts were down 5.3%

although single-family homes were up 1.3%.

Business performance and developments

The North America division had a strong start to the year, with

LFL revenue to the end of March 2020 2% ahead of the equivalent

period in 2019, despite the carry-over effect of the H1 2019

customer losses associated with the door seal product line and

footprint-related issues. In April, there was a marked reduction in

demand due to COVID-19, resulting in LFL sales for the month being

25% below 2019. With the exception of the facilities in Juarez,

Mexico, which were closed for the majority of May, all facilities

in North America remained open, albeit running at reduced capacity.

Demand rebounded through May and June, with sales in June

recovering to a level 8% below 2019. Overall for H1 2020, LFL

revenue was 12% below H1 2019, reflecting the carry-over effect of

the H1 2019 customer losses, partially offset by new business wins,

and the impact of COVID-19. The favourable impact of exchange

resulted in reported revenue of GBP168.2 million, which was 10%

below H1 2019.

Swift action was taken to manage production levels and costs in

line with demand, including temporary lay-offs, salary reductions

and tight control of discretionary spend. However, additional costs

of c.$1 million were incurred as a result of COVID-19. These costs

included additional PPE, installation of protective screens,

enhanced sanitation, employee transport costs, as well as costs of

temporarily transferring production of certain products from Juarez

to other facilities to ensure continued supply through the

shutdown. In line with government requirements, in Mexico these

costs also included the division continued paying salaries both for

employees deemed vulnerable and unable to work through the crisis,

and for all employees during the shutdown period. Overall, adjusted

operating profit declined 22% on a LFL basis to GBP24.8

million.

Further progress has been made in resolving the operational

inefficiencies at the Statesville facility. Operational and

leadership resources have been further strengthened in the period

and continuous improvement activities, including a series of kaizen

events, have driven improvements in margin compared to H1 2019.

However, the disruption arising from COVID-19 has meant that the

benefits of the actions taken have not been realised at the

expected levels to date. An accelerated rate of improvement for the

second half is expected based on accomplishments in the first

half.

The strengthening and refocussing of the sales team, as well as

improvements in customer service levels has resulted in an

encouraging level of new business wins. The momentum generated in

late 2019 and early 2020 accelerated through the COVID crisis, in

part due to the strength of service provided through the crisis

relative to peers. This enabled the division to capture share,

generating net wins of c. $3 million annualised revenue in H1 2020.

In addition, capacity of urethane door seals was expanded by c. $4

million annualised revenue through incremental production as well

as partnering with the Tyman International division. This is being

used to both support current door seals customers and win new

business for high value, differentiated applications.

Other self-help initiatives, including footprint realignments

covering $20 million of revenue, were successfully executed with no

customer disruption. This included the closure of the Fremont,

Nebraska facility, through which c. $3m of low margin,

non-fenestration business was also exited. In addition, planned

transfers of manufacturing activities between four facilities were

accelerated due to COVID-19, as the North American "centres of

excellence" are further optimised. These initiatives will generate

cost-savings in the second half of c. $1 million.

The division's access solutions business, Bilco, was more

resilient in the period as commercial construction has largely

continued through the COVID-19 crisis, although sales have been

slightly impacted due to some destocking by our distributors. LFL

revenue declined 9% in H1 2020.

New product development

The division continues to achieve success in bringing new

products to market, with products launched in 2019 performing well,

including the SafeGard(TM) child safety device, which has exceeded

expected sales since launch. During H1 2020, two commercial access

products were introduced, including an enhanced acoustical smoke

vent, which has an industry-leading sound rating, and a new

thermally broken smoke vent which is designed to comply with a new

energy efficiency code. The Quad Roller product which provides easy

and smooth gliding of large sliding doors was also brought to

market. These products have been well-received and there is a

healthy pipeline for further launches in the second half.

Good progress has also been made on the product rationalisation

and repositioning initiative, particularly in the sash window

hardware category which will be complete by the end of 2020.

Outlook

There is significant uncertainty over the ongoing impact

COVID-19 and the resulting high unemployment rates will have on

demand through the second half, albeit that this unemployment is

disproportionately concentrated amongst house-renters rather than

owners. The rebound in housing demand in May and June provides some

optimism, with low interest rates and a long-term supply shortfall

driving both new housing construction and repair and remodelling

activity.

The US commercial construction market is expected to contract

due to a slow-down in commercial building starts and planning

activity, with the Dodge Momentum Index down 22% to 121.5 at 30

June 2020 compared to 31 December 2019.

With the market better supplied at the start of the crisis, the

Canadian housing market is expected to recover slowly, with the

CMHC predicting housing starts will only begin to recover towards

the end of 2020.

The division's main areas of focus in the second half will

continue to be strengthening operational excellence to expand

margin, re-building customer trust to drive share gain, and

completion of the first phase of the product portfolio

harmonisation initiative.

UK and Ireland (ERA)

GBPm except where stated H1 2020 H1 2019(1) Change LFL

--------------------------- -------- ----------- -------- -----

Revenue 39.1 54.0 -28% -28%

Adjusted Operating Profit 3.8 7.0 -46% -46%

Adjusted Operating Margin 9.7% 13.0% -330bps

--------------------------- -------- ----------- -------- -----

1 Prior year divisional figures have been amended for

comparability to reflect a change to the presentation of

inter-divisional sales in 2019. For further details, see segment

note on pages 34 to 36.

Q1 April May June H1 2020 July*

---------------- ---- ------ ----- ----- -------- ------

LFL revenue vs

2019 -1% -93% -58% -15% -28% +8%

================ ==== ====== ===== ===== ======== ======

* Month to date average sales per day

Markets

The UK market for doors and windows started the year positively,

with the IHS Markit/CIPS UK Construction PMI rising to a reading of

53 in February 2020 and residential property transactions up 4%

over the first two months of the year. The lockdown measures

introduced in late March by the UK government in response to

COVID-19 led to the temporary closure of the majority of

construction sites and prevented all but essential repair RMI

activity. In early May, construction activity began to resume with

social-distancing measures in place, and good momentum built across

June as pent-up demand from the lockdown period was released.

Nevertheless, COVID-19 has led to a significant contraction in the

UK and Ireland market in H1 2020 compared to H1 2019.

Business performance and developments

The UK and Ireland division had a strong start to the year,

achieving LFL revenue growth of 8% to the end of February, with

March also starting strongly. This reflected increased consumer

confidence driving the Hardware business, as well as strong project

activity in the Access 360 business. From late March, all sites

were temporarily closed until early May. Activity gradually resumed

throughout May and June as lockdown measures were eased.

Consequently, LFL revenue declined 28% compared to H1 2019.

Encouragingly, there has been a steady recovery in sales and orders

since early May, with June sales for the division 15% below

2019.

In addition to the significant sales shortfall, profitability

was impacted by additional bad debt charges of GBP0.5 million as a

result of three customers falling into administration, as well as

continued strategic investments in smartware. This was partially

mitigated by tight cost control measures, including salary

reductions, elimination of discretionary spend and use of the UK

Government's Coronavirus Job Retention Scheme.

Despite the inevitable focus over the last few months being on

managing through COVID-19, the division has continued to progress

its strategic initiatives.

The stronger market in the first two months of the year resulted

in growth in hardware sales into both the OEM and distribution

channels. In particular, the division benefitted from exposure to

trade distributors who have a strong online presence, given that

lockdown has accelerated the trend to online sales. There was also

benefit from the carry-over of the new product launches in 2019.

Hardware sales in the first two months were 7% above 2019 and sales

in both channels have recovered well, with June hardware sales

being just 13% below 2019. Manufacturing of multi-point locks was

transferred from the Far East to the UK in the period, with

inventory benefits and cost-savings now being realised. Further

opportunities to onshore manufacturing or assembly of certain

products are being explored to reduce stock levels and ensure

robustness of the supply chain.

Access 360, the division's commercial access portfolio, achieved

strong revenue growth of 23% in the first two months of the year,

reflecting the stronger projects pipeline and operational

execution. Since construction activity recommenced in early May,

sales have rebounded well, with sales in the month of June being

slightly ahead of 2019. Progress has been made in resolving the

operational bottlenecks which arose in Profab in H2 2019, with the

management team strengthened, however this activity will continue

in the second half of the year.

The smartware offering continues to gain momentum, with the ERA

Protect(TM) range being selected by a key national distributor to

replace an incumbent competitor range from Q3 2020. Encouraging

early interest has also been received from other key account

customers. Several extensions to the range originally planned for

H1 2020 will now be launched in H2 2020 to benefit from the market

momentum post-lockdown. This includes the WindowSense(TM) product

which is targeted at the OEM market as a pre-installed product and

therefore expected to create further traction for the rest of the

integrated range, all of which can be controlled through a single

smartphone app. The ERA website is in the process of being upgraded

to support homeowners who are seeking the ease and reassurance of

ERA's distinctive accredited installer network to source a leading

home security solution at an affordable price point. The ERA

Protect(TM) range remains the only home security portfolio to

receive the BSI IoT Kitemark.

The division's sash window refurbishment business, Ventrolla,

achieved encouraging growth in residential enquiries prior to the

lockdown and generated several commercial project wins. Given the

nature of its in-home installation, COVID-19 has had a more

significant impact on Ventrolla, with the business only able to

gradually recommence operations during June, albeit with enquiry

levels in last two weeks of June back to long-term historic

levels.

New product development

Several new products are due for launch in the second half of

the year, including the Hydrogen spiral balance and the twin cam

offset window lock. The Hydrogen balance has a lower operating

force and makes opening and closing a sash window easier. The twin

cam offset window lock enhances the speed and ease of installation

for fabricators, while also providing improved security for the

householder through the multiple locking points.

Outlook

Since lockdown measures were eased, demand in the residential

RMI and new housing market has rebounded more quickly than expected

as door and window fabricators and housebuilders have processed

order backlogs. UK government measures to increase the stamp-duty

threshold and incentivise "green homes" investment are expected to

support both housing transactions and RMI spend. However, there

remains significant uncertainty over the impact of COVID-19 on

unemployment, consumer confidence and thereby the housing

market.

In the commercial sector, the value of construction project

awards and new project tender enquiries dropped significantly

during the lockdown, and this could impact demand later in the

year. However, this sector may benefit from government stimulus

targeted at infrastructure projects.

The division's focus in H2 2020 will continue to be driving

momentum with new product launches, optimising the cost base

through continued integration of recent acquisitions and adjusting

the business model to reflect the realities post-COVID including

driving online sales through the e-commerce platform.

International (SchlegelGiesse)

GBPm except where stated H1 2020 H1 2019(1) Change LFL

--------------------------- -------- ----------- -------- -----

Revenue 46.8 60.9 -23% -22%

Adjusted Operating Profit 4.6 7.7 -40% -39%

Adjusted Operating Margin 9.8% 12.6% -280bps

--------------------------- -------- ----------- -------- -----

1. Prior year divisional figures have been amended for

comparability to reflect a change to the presentation of

inter-divisional sales in 2019. For further details, see segment

note on pages 34 to 36.

Q1 April May June H1 2020 July*

---------------- ----- ------ ----- ----- -------- ------

LFL revenue vs

2019 -17% -50% -28% -2% -22% -8%

================ ===== ====== ===== ===== ======== ======

* Month to date average sales per day

Markets

The weakness seen in core markets in the second half of 2019

continued into early 2020, with challenging macroeconomic

conditions in continental Europe, Latin America and Australia, and

ongoing liquidity constraints in the Middle East. As of early

February, all markets were progressively impacted by COVID-19, with

each market being affected at different times as the virus spread.

Construction activity and customer operations were suspended in

most markets for varying time periods in line with the lockdown

measures imposed in each territory. The division's three largest

markets of Italy, Spain, and China were subject to stringent

lockdown measures between February and April.

Since restriction measures have been eased in most territories,

there has been an encouraging improvement in demand. In China,

which was the first market affected, government investment and

growing confidence has already resulted in a strong market recovery

particularly in the commercial sector. Momentum is building in the

other core markets, with the IHS Markit Eurozone Construction PMI

back up to 48 in June from its low of 15 in April.

Business performance and developments

LFL revenue for the international division declined 22% in H1

2020 compared to H1 2019, with slight foreign exchange headwinds

resulting in reported revenue down 23%. The division had a

challenging start to the year due to the weak market conditions.

The division was significantly impacted by COVID-19, with the

division's third largest market, China, being impacted in January,

followed by most other core markets from mid-March. April was the

worst-affected month, with sales being 50% below the prior year.

Since lockdown measures have been eased in each territory, there

has been a steady improvement in sales and order levels, with

revenue in June recovering to just 2% below 2019.

A reduction in overheads, including savings from the reduction

in personnel costs which took effect in the second half of 2019,

combined with additional cost management actions taken and

utilisation of available government schemes partially offset the

impact of the sales shortfall on adjusted operating profit. LFL

adjusted operating profit was 39% below H1 2019 and adjusted

operating margin fell from 12.6% to 9.8%.

Despite some inevitable delays caused by COVID-19, the division

has made good progress on its strategic initiatives. Momentum

continued with the 'all in one' strategy, with the launch of a new

fully-integrated SchlegelGiesse website that brings together all of

the division's brands and products and supports driving further

penetration of the portfolio including showcasing new products.

During the lockdown period, webinars and virtual innovation

workshops were delivered to distributors and window makers to

maintain relationships and further progress the channel expansion

strategic initiative.

Self-help initiatives have progressed as planned. The

restructuring programme to streamline operations in Australia,

China and Singapore has largely been executed with no customer

disruption. Manufacturing was ceased and the business transitioned

to a distribution model in each of Australia and China in H1. As a

result of COVID-19, the move of the China distribution operation to

a new facility was delayed but is now planned for September. The

ASEAN market was migrated to being served as an export territory

during H1, with the lease for the Singapore facility due to be

exited at the end of July. These restructuring activities have

resulted in a reduced fixed cost-base, the avoidance of future

significant capital expenditure and increased management bandwidth

across the region.

The integration of Reguitti, which was acquired in August 2018,

has further progressed, albeit at a slower rate than planned due to

lockdown measures. Cross-selling activities have gained traction

following integration of the sales force, with many customers now

buying both product portfolios. A suite of value-engineered

products was launched in the Italian market, with fully refreshed

marketing materials and product repositioning to address the

specific low-cost competition which arose in 2019. A new mid-price

point brand for the German market is due for launch in H2 2020,

which will provide a full good, better, best range to capture a

growing segment of the market.

New product development

The division continues to focus on innovation, although there

have been delays to the launch of certain products due to COVID-19.

New products launched in the period include the new Brio Evo range

of flat handles which provides fast and simple assembly for

installers, a modern clean design, with an ergonomic handle for

easier manoeuvring for the end user. Further innovative new

solutions for doors and sliding windows are due for launch in the

second half of the year, including a pull and slide door system,

which combines minimalist profiles with high weathertight

performance and ease of use. The value-engineered range of bespoke

products for the Chinese RMI market is also due for launch in early

2021, which supports the division's focus on this growing channel

and will ensure it is well-placed to capture share as this market

recovers. In addition, there are a number of existing products

expected to achieve the environmentally friendly Cradle to Cradle

certification in H2 2020. The division continues to invest in

developing and expanding its range of innovative products as a key

driver of future growth.

Outlook

The recovery that has begun in core markets in Q2 is expected to

continue in Q3, however the ongoing impact of COVID-19 and the

wider macro-economic environment creates significant

uncertainty.

The main priorities of the business in H2 2020 are to drive

share gain in core markets by capitalising on the activities

undertaken to integrate and extend the division's offer; and to

continue to pursue operational efficiencies.

FINANCIAL REVIEW

Income statement

Revenue and profit

Reported revenue in the period decreased by 15.8 % to GBP254.1

million (H1 2019: GBP301.9 million), largely reflecting a

significant reduction in volume of GBP43.8 million driven by the

impact of COVID-19, the drag-through effect of the 2019 North

America footprint consolidation related customer losses of c.

GBP6.8 million, and a reduction in US tariffs of GBP1.6 million,

offset by favourable foreign exchange movements of GBP3.7 million.

On a LFL basis, revenue declined 16.8% compared to the prior

year.

Adjusted administrative expenses decreased to GBP 48.6 million

(H1 2019 restated: GBP61.4 million), due to the benefit of

self-help measures implemented in the second half of 2019 as well

as cost-management actions taken to mitigate the impact of

COVID-19. This included significant curtailment of discretionary

expenditure, salary reductions, cancellation of the senior

management bonus scheme, as well as utilisation of available

government job retention schemes in various territories. The Group

received a total of GBP3.3 million in the period from government

job retention schemes across various territories.

Adjusted operating profit decreased by 25.3 % to GBP 31.3

million (H1 2019: GBP41.9 million) and declined 26.0% on a

like-for-like basis. This was negatively impacted by GBP17.7

million from the reduction in volumes driven by COVID-19 and by c.

GBP2.5 million from the drag-through effect of the 2019 North

America footprint consolidation related customer losses, offset by

receipts from government job retention schemes of GBP3.3 million, a

reduction of GBP5.2 million in input costs due to moderation of

materials costs and cost-management actions, as well as

productivity improvements of GBP1.6 million. The Group's adjusted

operating margin decreased 160 bps to 12.3 % (H1 2019: 13.9%).

Adjusted profit before taxation decreased by 28.8 % to GBP 24.7

million (H1 2019: GBP34.7 million) and declined 29.4 % on a LFL

basis. Reported profit before taxation increased by 33.6 % to GBP

14.7 million (H1 2019: GBP11.0 million), primarily due to a

significant reduction in exceptional items from GBP9.9 million to

GBP0.8 million.

Materials and input costs

GBPm except where stated FY 2019 Materials(1) Average(2) Spot(3)

-------------------------- --------------------- ----------- --------

Aluminium 23.2 (8.4)% (7.4)%

Polypropylene 34.8 (21.0)% (36.6)%

Stainless steel 52.8 +1.2% +4.9%

Zinc 33.4 (17.9)% (15.9)%

Far East components(4) 45.2 (8.0)% (5.4)%

-------------------------- --------------------- ----------- --------

(1) FY 2019 materials cost of sales for raw materials,

components and hardware for overall category. Only major materials

categories are presented

(2) Average H1 2020 tracker price compared with average H1 2019 tracker price

(3) Spot tracker price as at 30 June 2020 compared with spot tracker price at 30 June 2019

(4) Pricing on a representative basket of components sourced

from the Far East by the UK & Ireland division

Raw material costs continued to moderate in H1 2020 with average

prices across all commodity categories except stainless steel lower

than H1 2019. Steel purchases in North America continue to be

impacted by the direct and indirect effect of US tariffs and

surcharges are in place to recover these costs.

Exceptional items

Certain items have been drawn out as exceptional such that the

effect of these items on the Group's results can be better

understood and to enable a clearer analysis of trends in the

Group's underlying performance.

GBPm H1 2020 H1 2019

----------------------------------- -------- --------

Footprint restructuring - costs - (3.3)

Footprint restructuring - credits - 0.6

----------------------------------- -------- --------

Footprint restructuring - net - (2.7)

----------------------------------- -------- --------

M&A and integration - costs (0.5) (1.9)

M&A and integration - net (0.5) (1.9)

Redundancy and restructuring (0.3) -

Impairment charges - (5.3)

(0.8) (9.9)

----------------------------------- -------- --------

Footprint restructuring

The footprint restructuring costs in prior periods related to

directly attributable costs incurred in the multi-year North

American footprint consolidation project, which is now

substantially complete, as well as provisions for costs associated

with the closure of the Fremont, Nebraska facility and streamlining

the international satellite operations which commenced in late

2019. This included the exit of manufacturing in Australia and

China, with these markets transitioned to distribution centres and

closure of our operations in Singapore with this region now served

as an export market.

M&A and integration

M&A and integration costs of GBP0.5 million relate to costs

associated with the integration of businesses acquired in 2018,

predominantly Ashland.

Redundancy and restructuring

Redundancy and restructuring costs of GBP0.3 million relate

primarily to costs associated with a workforce reduction.

Impairment charges

Impairment charges in 2019 relate to the write down of assets

and inventory associated with the slower than expected uptake of

the new door seal product in North America.

Finance costs

Net finance costs decreased to GBP6.3 million (H1 2019: GBP7.5

million).

Interest payable on bank loans, private placement notes and

overdrafts decreased to GBP5.0 million (H1 2019: GBP5.6 million),

predominantly reflecting lower interest rates following reductions

in the US federal interest rate and UK official bank rate. Interest

on lease liabilities of GBP1.5 was flat against the prior period

(H1 2019: GBP1.5 million).

Non-cash movements charged to net finance costs in the period

include amortisation of capitalised borrowing costs of GBP0.3

million (H1 2019: GBP0.3 million) and pension interest cost of

GBP0.1 million (H1 2019: GBP0.1 million).

Taxation

The Group reported an income tax charge of GBP2.3 million (H1

2019: GBP3.1 million), comprising a current tax charge of GBP2.9

million (H1 2019: GBP3.3 million) and a deferred tax credit of

GBP0.6 million (H1 2019: GBP0.2 million).

The adjusted tax charge was GBP5.4 million (H1 2019: GBP9.1

million) representing an effective adjusted tax rate of 21.7% (H1

2019: 26.2%). The reduction in the adjusted effective tax rate of

450bps reflects, the release of an excess provision and utilisation

of available tax credits. This is the Group's current best estimate

of the adjusted tax rate for the 2020 full year.

During the period, the Group paid corporation tax of GBP1.3

million (H1 2019:

GBP7.1 million), with the reduction largely relating to payment

deferrals granted by the US and Italian governments in light of the

COVID-19 pandemic.

Earnings per share

Basic earnings per share increased by 56.6% to 6.4 pence (H1

2019: 4.1 pence). Adjusted earnings per share decreased to 9.9

pence (H1 2019: 13.1 pence).

There is no material difference between these calculations and

the fully diluted earnings per share calculations.

Cash generation, funding and liquidity

Cash and cash conversion

H1 2019

(restated(1)

GBPm H1 2020 )

----------------------------------------- -------- --------------

Net cash generated from operations 33.6 16.3

Add: Pension contributions 0.2 0.5

Add: Income tax paid 1.3 7.1

Less: Purchases of property, plant and

equipment (3.7) (5.5)

Less: Purchases of intangible assets (0.4) (0.4)

Add: Proceeds on disposal of PPE - 1.2

----------------------------------------- -------- --------------

Operational cash flow after exceptional

cash costs 31.0 19.2

Exceptional cash costs 2.2 6.9

----------------------------------------- -------- --------------

Operational cash flow 33.2 26.1

Less: Pension contributions (0.2) (0.5)

Less: Income tax paid (1.3) (7.1)

Less: Net interest paid(1) (6.6) (7.4)

Less: Exceptional cash costs (2.2) (6.9)

----------------------------------------- -------- --------------

Free cash flow 22.9 4.2

----------------------------------------- -------- --------------

(1) Net interest paid in H1 2019 has been restated to include

interest paid on lease liabilities to align with the current period

calculation of free cash flow

Operational cash flow in the period increased by 27.2% to

GBP33.2 million, predominantly due to tight management of working

capital and capital expenditure. This is after adding back GBP2.2

million (H1 2019: GBP6.9 million) of exceptional costs cash settled

in the period, which related to settlement of costs associated with

the footprint realignments provided for in 2019 and costs

associated with the integration of Ashland. Operating cash

conversion in H1 2020 was very strong at 106.0% (H1 2019:

62.3%).

Free cash flow in the period was significantly higher than H1

2019 at GBP22.9 million (H1 2019 restated: GBP4.2 million) as a

result of the higher operational cash flow, lower levels of income

tax payments on account, lower interest payments and lower levels

of exceptional cash flows.

Debt facilities

Bank and US private placement facilities available to the Group,

as at 30 June 2020, were as follows:

Facility Maturity Currency Committed Uncommitted

----------------- --------- -------------- ---------- ------------

2018 Facility Feb 2024 Multicurrency GBP240.0m GBP70.0m

4.97 % USPP Nov 2021 US$ US$55.0m -

5.37 % USPP Nov 2024 US$ US$45.0m -

Other facilities Various EUR EUR0.6m -

----------------- --------- -------------- ---------- ------------

In addition to this, the Group has received eligibility to draw

up to GBP100 million through the Bank of England CCFF.

Liquidity

At 30 June 2020 the Group had gross outstanding borrowings of

GBP240.4 million (H1 2019: GBP279.6 million), cash balances of

GBP79.9 million (H1 2019: GBP49.6 million) and committed but

undrawn facilities of GBP78.6 million (H1 2019: GBP56.1 million).

This provides immediately available liquidity of GBP158.5 million.

The Group also has potential access to the uncommitted GBP70.0

million accordion facility and the GBP100 million CCFF facility,

albeit the intention is not to draw down on this.

Net debt at the period end was GBP219.8 million (H1 2019:

GBP289.8 million). Adjusted net debt, which excludes lease

liabilities and unamortised finance arrangement fees was GBP160.5

million (H1 2019: GBP230.0 million), reflecting the strong

operational cash generation and cancellation of the final 2019

dividend. There was also a benefit from deferred government

payments of c. GBP4 million.

Covenant performance

Performance Headroom Headroom

At 30 June 2020 Test (1) (2) (2)

----------------- -------- ------------ --------- ---------

Leverage < 3.0x 1.8x 36.4m 41.3%

Interest Cover > 4.0x 8.4x 46.2m 52.3%

----------------- -------- ------------ --------- ---------

(1) Calculated covenant performance consistent with the Group's

banking covenant test (banking covenants set on a frozen GAAP basis

and not impacted by IFRS 16)

(2) The approximate amount by which adjusted EBITDA would need

to decline before the relevant covenant is breached

At the half year, the Group retained significant headroom on its

banking covenants. Leverage at the period end was 1.8x (H1 2019:

2.2x), reflecting the lower level of net debt. Interest cover at

the period end was 8.4x (H1 2019: 8.9x), reflecting the lower

interest expense offset by a reduction in adjusted EBITDA.

Subsequent to the period end, in order to provide additional

headroom during the period of uncertainty, the Group agreed a

temporary relaxation of the leverage covenant with its lenders from

3.0x adjusted EBITDA to 3.5x at December 2020 and 4.0x at 30 June

2021.

Balance sheet - assets and liabilities

Working capital

GBPm FY 2019 Mvt FX H1 2020

----------------------- -------- ------ ------ --------

Inventories 88.6 2.0 4.5 95.1

Trade receivables 60.5 (0.8) 2.8 62.5

Trade payables (46.6) 5.7 (2.3) (43.2)

----------------------- -------- ------ ------ --------

Trade working capital 102.5 6.9 5.0 114.4

----------------------- -------- ------ ------ --------

Trade working capital at the half year, net of provisions, was

GBP114.4 million (H1 2019: GBP148.1 million; FY 2019: GBP102.5

million). The trade working capital build to the half year at

average exchange rates was GBP6.9 million (H1 2019: GBP23.2

million).

The inventory build to the half year at average exchange rates

was GBP2.0 million

(H1 2019: GBP10.2 million). The much lower than normal seasonal

inventory build largely reflects tight management of inventory

levels in light of the impact of COVID-19 on demand. Production

levels began to ramp up in June as demand returned.

Trade receivables and trade payables reduced in the period due

to lower levels of trading in the first half of 2020.

Of the year to date increase in trade working capital, GBP5.0

million related to exchange.

Capital expenditure

Gross capital expenditure decreased to GBP4.1 million (H1 2019:

GBP5.9 million) or 0.6x depreciation (H1 2019: 0.8x), as a result

of deferring most non-essential expenditure in light of COVID-19.

Investment is planned to increase in the second half to support

future growth.

Balance sheet - equity

Shares in issue

At 30 June 2020, the total number of shares in issue was 196.8

million (H1 2019: 196.8 million) of which 0.5 million shares were

held in treasury (H1 2019: 0.5 million).

Employee Benefit Trust purchases

At 30 June 2020, the EBT held 1.1 million shares (H1 2019: 1.4

million). During the period, the EBT purchased 0.1 million shares

in Tyman plc at a total cost of GBP0.3 million to satisfy vested

share awards as well as future obligations under the Group's

various share plans.

Other financial matters

Return on capital employed

ROCE fell by 190 bps to 10.8% (H1 2019: 12.7%) as a result of

the reduction in LFL adjusted operating profit in light of

COVID-19.

Returns on Acquisition Investment

Original ROAI at

Acquisition Acquisition H1 2020

Date Investment (1)

----------------- ------------- ------------- ---------

Ashland(2) March 2018 US$102.4m 17.9%

Zoo Hardware(2) May 2018 GBP18.7m 19.7%

Profab July 2018 GBP4.1m 8.1%

Reguitti August 2018 EUR16.2m 4.9%

----------------- ------------- ------------- ---------

(1) See Alternative Performance Measures on page 48

(2) Ashland and Zoo Hardware reached the end of the two-year

ROAI measurement period in March and May respectively. Ashland ROAI

is measured over the last twelve months to the end of February 2020

and Zoo ROAI is measured over the last twelve months to the end of

April 2020.

Ashland and Zoo Hardware have continued to perform well, with

both exceeding the 14% minimum target return threshold after two

years of ownership. Ashland exceeded the expected US$5m of

annualised synergy benefits from 2020.

Profab suffered from operational bottlenecks in the second half

of 2019, impacting productivity and was significantly impacted in

H1 2020 by COVID-19 lockdown measures. The ROAI is therefore

significantly below the target threshold. Improvements in

productivity are being achieved and sales and orders have rebounded

well since re-opening. The ROAI is therefore expected to improve in

the second half.

The performance of Reguitti has been significantly impacted by

COVID-19, as well as being impacted by some specific low-cost

competition in Italy, resulting in an ROAI significantly below the

target threshold. A suite of value-engineered products was launched

in the Italian market, with a full marketing refresh and product

repositioning to address the low-cost competition. The benefit of

these measures and improving demand following easing of lockdown

measures are expected to improve the ROAI in the second half.

Currency

Currency in the consolidated income statement

The principal foreign currencies that impact the Group's results

are the US Dollar, the Euro, the Australian Dollar and the Canadian

Dollar. In H1 2020, the Sterling was slightly weaker against the US

dollar, essentially flat against the Euro and Canadian dollar, and

stronger against the Australian Dollar when compared with the

average exchange rates in H1 2019.

Translational exposure

Currency US$ Euro AUS$ CA$ Other Total

----------------------- -------- ------- ------ ------- ------ ------

% mvt in average rate (2.6)% (0.1)% 4.8% (0.4)%

GBPm Revenue impact 4.2 - (0.2) - (1.1) 3.0

GBPm Profit impact

(1) 1.4 - - - (0.1) 1.3

1c decrease impact GBP173k GBP24k GBP2k GBP5k

(2)

----------------------- -------- ------- ------ ------- ------ ------

(1) Adjusted Operating Profit impact

(2) Defined as the approximate favourable translation impact of

a 1c decrease in the Sterling exchange rate

of the respective currency on the Group's Adjusted Operating

Profit

The net effect of currency translation caused revenue and

adjusted operating profit from ongoing operations to increase by

GBP3.0 million and GBP1.3 million respectively compared with H1

2019.

Transactional exposure

Foreign exchange hedges have resulted in a gain on revaluation

in H1 2020 of GBP0.6 million (H1 2019: GBPnil).

The Group's other transactional exposures generally benefit from

the existence of natural hedges and are immaterial.

PRINCIPAL RISKS AND UNCERTAINTIES

The Group's principal risks and uncertainties, which could

impact the Group for the remainder of the current financial year,

are identified on pages 38 to 45 of the Group's Report and Accounts

for the year ended 31 December 2019, which is available at the

Group's website. These risks are as follows: market conditions,

competitors, loss of major customers, financial risks, liquidity

and credit risks, information security, raw material costs and

supply chain failures, footprint rationalisation and key executives

and personnel.

The Directors have reviewed these principal risks and

uncertainties and have made the following amendments for the period

ended 30 June 2020:

Major pandemic

COVID-19 was identified as an emerging risk in the 2019 annual

report and the main threat was seen to be to our supply chain in

China. Since then COVID-19 has evolved rapidly into a global crisis

and has resulted in heightened risk to the health, safety and

wellbeing of our employees as well as reduced demand for our

products, particularly during the second quarter of 2020. The Group

was able to respond rapidly to safeguard our employees, protect our

operations, reduce costs and preserve cash. The Group has further

expanded its liquidity headroom by establishing eligibility for the

Bank of England Covid Corporate Financing Facility ("CCFF").

Further details of the impact of this and the mitigation actions

taken are set out within the overview of results on pages 3 to

8.

Major pandemic is now recognised as a principal risk and

uncertainty for the Group and is expected to remain so for the

remainder of 2020 and for 2021, due to the potential for further

waves of the pandemic and need for additional lockdowns.

Markets

COVID-19 has had a serious impact on demand in our markets in

2020. Current recovery trends are encouraging but risk remains as

to the size and length of this recovery and the danger of further

waves of infection. This, combined with the end of the Brexit

transition deal with the EU and the potential for a no deal

scenario at the end of 2020, has heightened the risk in respect of

the UK market. The risk trend since December 2019 is seen as

increasing.

Information security

Information security remains an increasing risk for the Group.

Cyber threats have an increased potency when combined with the

disruptions of remote working in a COVID-19 environment. Remote

working practices have been reviewed to ensure internal controls

have not been compromised and phishing testing and awareness

training has been increased.

Risk watchlist

Climate change and sustainability remains on our risk watchlist

as an emerging source of risk as well as opportunity in the future.

Work continues to better understand the likely scale, impact and

velocity of this area of risk.

Risks and uncertainties facing the Group

In the opinion of the Directors, the principal risks and

uncertainties as at the date of this report, consist of the

principal risks and uncertainties set out in the 2019 Report and

Accounts, together with the risk associated with the impact of

COVID-19 and the increased unmitigated risk level associated with

information security.

28 July 2020

Tyman plc

Condensed consolidated income statement

Six months

ended

Six months 30 June 2019

ended (unaudited) Year ended

30 June (Restated(2) 31 December

2020 (unaudited) ) 2019 (audited)

Note GBPm GBPm GBPm

------------------------------------- ----- ------------------ -------------- ----------------

Revenue 3 254.1 301.9 613.7

Cost of sales (174.2) (198.6) (408.1)

------------------------------------- ----- ------------------ -------------- ----------------

Gross profit 79.9 103.3 205.6

Administrative expenses (58.9) (84.8) (165.1)

------------------------------------- ----- ------------------ -------------- ----------------

Operating profit 21.0 18.5 40.5

Analysed as:

------------------------------------- ----- ------------------ -------------- ----------------

Adjusted(1) operating profit 3 31.3 41.9 85.4

Exceptional items 4 (0.8) (9.9) (18.9)

Amortisation of acquired intangible

assets 9 (9.5) (13.5) (23.5)

Impairment of acquired goodwill 9 - - (2.5)

------------------------------------- ----- ------------------ -------------- ----------------

Operating profit 21.0 18.5 40.5

Finance income 5 0.6 - -

Finance costs 5 (6.9) (7.5) (15.7)

------------------------------------- ----- ------------------ -------------- ----------------

Net finance costs 5 (6.3) (7.5) (15.7)

------------------------------------- ----- ------------------ -------------- ----------------

Profit before taxation 14.7 11.0 24.8

Income tax charge 6 (2.3) (3.1) (7.1)

Profit for the period 12.4 7.9 17.7

------------------------------------- ----- ------------------ -------------- ----------------

Basic earnings per share 7 6.36p 4.06p 9.08p

Diluted earnings per share 7 6.35p 4.04p 9.05p

------------------------------------- ----- ------------------ -------------- ----------------

Non-GAAP alternative performance

measures(1)

Adjusted(1) operating profit 31.3 41.9 85.4

------------------------------------- ----- ------------------ -------------- ----------------

Adjusted(1) profit before

taxation 24.7 34.7 71.0

------------------------------------- ----- ------------------ -------------- ----------------

Basic Adjusted earnings per

share 7 9.91p 13.14p 27.46p

------------------------------------- ----- ----------------

Diluted Adjusted earnings

per share 7 9.89p 13.10p 27.35p

------------------------------------- ----- ------------------ -------------- ----------------

(1) Before amortisation of acquired intangible assets, deferred

taxation on amortisation of acquired intangible assets, impairment

of goodwill, exceptional items, gains and losses on the fair value

of derivative financial instruments, amortisation of borrowing

costs, and the associated tax effect. See definitions on page 48

for non-GAAP alternative performance measures.

(2) Depreciation on manufacturing assets was reclassified from

administrative expenses to cost of sales for year end 2019 to

better reflect the nature of this charge. For comparability, the

comparatives for the six months ended 30 June 2019 have been

amended to reflect the new classification. See note 2.2.3.

Tyman plc

Condensed consolidated statement of comprehensive income

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2020 (unaudited) 2019 (unaudited) 2019 (audited)

GBPm GBPm GBPm

------------------------------------------- ------------------ ------------------ ----------------

Profit for the period 12.4 7.9 17.7

------------------------------------------- ------------------ ------------------ ----------------

Other comprehensive (expense)/income

Items that will not be reclassified

to profit or loss

Remeasurements of post-employment

benefit obligations (0.8) (0.4) (1.0)

Total items that will not be reclassified

to profit or loss (0.8) (0.4) (1.0)

------------------------------------------- ------------------ ------------------ ----------------

Items that may be reclassified

subsequently to profit or loss

Exchange differences on translation

of foreign operations 19.9 1.0 (11.9)

Effective portion of changes in

value of cash flow hedges 0.2 0.2 -

Total items that may be reclassified

to profit or loss 20.1 1.2 (11.9)

------------------------------------------- ------------------ ------------------ ----------------

Other comprehensive income for

the period 19.3 0.8 (12.9)

------------------------------------------- ------------------ ------------------ ----------------

Total comprehensive income for

the period 31.7 8.7 4.8

------------------------------------------- ------------------ ------------------ ----------------

Tyman plc

Condensed consolidated statement of changes in equity

Share Share Treasury Hedging Translation Retained Total

capital premium reserve reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------------------- --------- --------- --------- --------- ------------ ---------- --------

At 1 January 2019

(audited) 9.8 132.2 (4.9) (0.3) 71.4 225.5 433.7

Change in accounting

policy(1) - - - - - 2.4 2.4

----------------------------- --------- --------- --------- --------- ------------ ---------- --------

At 1 January 2019

(audited) 9.8 132.2 (4.9) (0.3) 71.4 227.9 436.1

Total comprehensive

income/(expense) - - - 0.2 1.0 7.5 8.7

Profit for the period - - - - - 7.9 7.9

Other comprehensive

income/(expense) - - - 0.2 1.0 (0.4) 0.8

----------------------------- --------- --------- --------- --------- ------------ ---------- --------

Transactions with

owners - (132.2) 0.6 - - 114.1 (17.5)

Share-based payments(2) - - - - - 0.6 0.6

Dividends paid - - - - - (16.1) (16.1)

Capital reduction - (132.2) - - - 132.2 -

Issue of own shares

from EBT - - 2.6 - - (2.6) -

Purchase of own shares

for EBT - - (2.0) - - - (2.0)

----------------------------- --------- --------- --------- --------- ------------ ---------- --------

At 30 June 2019 (unaudited) 9.8 - (4.3) (0.1) 72.4 349.5 427.3

Total comprehensive

income - - - (0.2) (12.9) 9.2 (3.9)

Profit for the period - - - - - 9.8 9.8

Other comprehensive

(expense) - - - (0.2) (12.9) (0.6) (13.7)

----------------------------- --------- --------- --------- --------- ------------ ---------- --------

Transactions with

owners - - - - - (7.1) (7.1)

Share-based payments(2) - - - - - 0.4 0.4

Dividends paid - - - - - (7.5) (7.5)

At 31 December 2019

(audited) 9.8 - (4.3) (0.3) 59.5 351.6 416.3

Total comprehensive

income - - - 0.2 19.9 11.6 31.7

Profit for the period - - - - - 12.4 12.4

Other comprehensive

income/(expense) - - - 0.2 19.9 (0.8) 19.3