TIDMPSN

RNS Number : 3820W

Persimmon PLC

18 August 2020

PERSIMMON PLC

HALF YEAR RESULTS FOR THE SIX MONTHSED 30 JUNE 2020

This announcement contains inside information.

Persimmon Plc today announces its half year results for the six

months ended 30 June 2020.

Dave Jenkinson, Group Chief Executive, said:

" The Group, governed by its clear purpose and values, reacted

responsibly, swiftly and effectively to the challenges of the

Covid-19 pandemic, with the safety and wellbeing of our workforce,

customers and local communities our first priority. Taking an early

decision not to take advantage of the furlough scheme for any

colleagues, we maintained good momentum in the business, continuing

to serve our customers, making detailed preparations for a safe

return to work and, when it was appropriate, restarting our build

programmes efficiently. Build rates were back at pre-Covid levels

by the end of the period.

"Despite the significant disruption, the Group's preparedness,

agility and strength ensured a robust first half performance with

4,900 new home completions and further good progress made on our

customer care improvement plan.

"The Group has had an excellent start to the second half with a

c. 49% year on year increase in average weekly private sales rates

per site since the start of July and a current forward order book

of c. GBP2.5bn, a 21% increase on last year. Our strong opening

work in progress position and excellent build rate through the

summer give us confidence in a positive second half outturn. We

expect that by the end of September, we will have delivered c. 45%

of our anticipated second half new home legal completions.

"As a result of the continuing strong performance of the

business through this challenging period, together with our

cautious optimism on the Group's prospects for the second half, we

are pleased to announce that the Board is proposing a modest

interim dividend of 40p per share. Further dividend payments this

year will remain under close review.

"Our reaction to the Covid disruption showed very clearly the

exceptional quality of our colleagues throughout the business and

I'm very proud of their response to the recent challenges. Our

team, together with our strong balance sheet, high quality land

holdings, significant investment in work in progress, a transformed

customer care programme and a 5-star HBF rating now within reach,

gives Persimmon a strong platform from which to deliver the homes

the country needs, support the UK's economic recovery and drive

long-term sustainable value for all our stakeholders."

Highlights

H1 2020 H1 2019

Home completions 4,900 7,584

-------------- ---------------

New home average selling price GBP225,066 GBP216,942

-------------- ---------------

Total Group revenues GBP1,190m GBP1,754m

-------------- ---------------

New housing gross margins (1) 31.3% 33.8%

-------------- ---------------

Profit before tax GBP292.4m GBP509.3m

-------------- ---------------

Cash at 30 June GBP828.9m GBP832.8m

-------------- ---------------

Land holdings at 30 June - plots owned

and under control 89,232 95,086

-------------- ---------------

Current number of developments across c.340 c. 345

the UK

-------------- ---------------

Current forward sales position GBP2,483m GBP2,048m

-------------- ---------------

Current customer satisfaction score

(2) 89.6% 83.1%

-------------- ---------------

Dividend 40p per share 235p per share

in the year

-------------- ---------------

Entering the second half with a strong platform to deliver the

homes the country needs

- Strong market positioning across 31 businesses providing the

operational capacity to support future growth

- A range and choice of homes in the right locations at affordable

prices for our customers, with a private average selling price

of GBP246,208 (2019: GBP242,912) which is c. 17% below the UK

national average(3)

- Strong total forward sales, including legal completions in the

second half so far, 21% up on last year

- Substantial work in progress investment with c. 14% more equivalent

new home units over last year

- Strong liquidity with current cash of GBP821m

- High quality land holdings underpinning future production

- Customer care improvement plan operational within the business

- Highly experienced, agile and flexible management team

Continued careful management of housing cycle risk

- Persimmon's strong sense of purpose supports the Group's sustainable

business model that: delivers long-term sustainable benefits

in the best interest of all stakeholders through the cycle, maintains

high quality land holdings, judges capital deployment at the

right time in the cycle and minimises financial risk

- Land replacement over the last two years running at c. 55% of

consumption level, with all acquisitions meeting the Group's

strict criteria

Operational Highlights

Continuing to support our customers

- Customer care improvement plan initiatives continue to drive

improvements in our quality and service

- Throughout 2020, Persimmon's HBF survey rating(4) has been trending

ahead of the five star threshold

- 12 months since the successful launch of the Group's industry

leading Homebuyer Retention Scheme with over 40% of new customers

taking advantage of the Scheme in the first half of the year

- The 'Persimmon Way', the consolidation of the Group's approach

to new home construction, will be fully operational by the end

of the year

- FibreNest, the Group's internet service provider, unique in the

industry, is supporting over 8,000 customers with full fibre

to the home broadband service

Building and supporting our communities

- c. 50% of our private legal completions in the six months to

30 June 2020 were to first time buyers

- Persimmon is a signatory to the Covid-19 Business Pledge supporting

colleagues, customers and communities through the crisis

- Persimmon is industry lead to the Social Mobility Pledge which

encourages businesses to boost social mobility in the UK

- Invested over GBP675m in local communities over the last eighteen

months, including the delivery of 4,263 new homes for lower income

families to our housing association partners

- The Group supports c.50,000(5) jobs across our communities and

within our wider supply chain

- Dedicated resources focusing on reducing our environmental impact

with work underway to review setting a science-based carbon reduction

target

Covid-19 Update

- The wellbeing of the Group's workforce, customers and local communities

remains a key priority

- Effective Covid-19 safe operating procedures, maintaining the

stringent two metre social distancing rules, are fully embedded

across all Group operations

- All colleagues were retained on full pay, without recourse to

Government funding, throughout the lockdown period continuing

to drive the business forward, serving our customers, progressing

site preparation works and completing remote training courses

Outlook

- Short term outlook robust with strong start to the second half

and healthy level of forward orders, well supported by a strong

work in progress position

- Potential medium term risks to demand associated with Covid-19,

rising unemployment and Brexit remain but long-term housing market

fundamentals continue to be strong

- Persimmon is well placed to navigate potential future challenges

and deliver superior long-term sustainable returns in the best

interests of all its stakeholders

Footnotes

1 Stated on new housing revenues of GBP1,102.8m (2019:

GBP1,645.3m) and gross profits of GBP345.2m (2019: GBP555.5m)

2 The Group participates in a National New Homes Survey, run by

the Home Builders Federation. The Survey year covers the period

from 1 October to 30 September. The rating system is based on the

number of customers who would recommend their builder to a friend.

The current customer satisfaction score is based on the results

from 1 October 2019 to 17 August 2020.

3 National average selling price for newly built homes sourced

from the UK House Price Index as calculated by the Office for

National Statistics from data provided by HM Land registry.

4 Based on the results from the National New Homes Survey, run

by the Home Builders Federation from January 2020.

5 Estimated using an economic toolkit

For further information please contact:

Dave Jenkinson, Group Chief Executive Kevin Smith Tel: +44 (0) 7710 815

924

Mike Killoran, Group Finance Director Jos Bieneman: Tel: + 44 (0) 7834

336 650

Persimmon Plc Ellen Wilton Tel: +44 (0) 7921 352

851

Enquiries via Citigate Dewe Rogerson

on the day

Tel: +44 (0) 1904 642199 (thereafter)

A presentation to analysts and investors will be available from

07.00 am on 18 August 2020. To view the presentation, please use

the webcast link below:

Webcast link: https://edge.media-server.com/mmc/p/r32xzfb7

There will also be a Q&A session with management, hosted by

Group Chief Executive, Dave Jenkinson and Group Finance Director,

Mike Killoran via conference call at 8.30am. Analysts may join the

call by using the details below:

Dial in: +44 (0) 20 3003 2666

Passcode: Persimmon

An audiocast of the call will be available on

www.persimmonhomes.com/corporate from this afternoon.

HALF YEAR REPORT - TUESDAY 18 AUGUST 2020

CHAIRMAN'S STATEMENT

Persimmon's agile and comprehensive response to the Covid-19

pandemic has delivered a resilient first half performance, putting

the safety of our workforce, our customers and our local

communities first. The strength of the Group coming into the

pandemic, the result of a long established strategy which

recognises the cyclical nature of the housing market, has enabled

it to respond effectively to the current challenges continuing to

deliver the homes the country needs and supporting its local

communities and the UK economy.

Our decision not to take advantage of the furlough scheme for a

single member of staff enabled us to maintain an effective

workforce, on full pay without recourse to Government assistance,

which has been instrumental in ensuring we were able to continue to

support all our stakeholders, including our suppliers and

subcontractors, and serve our customers. During the lockdown period

we were able to deliver homes to customers who would otherwise have

been left in a vulnerable position, to support our teams working

from home and continue to take sales reservations remotely and to

perform site preparation work while we continued to drive our

customer care improvement plan initiatives forward, embedding them

within the business. Investment in workforce training has also

continued with c. 5,700 training days delivered in the period

including over 330,000 minutes of online training courses.

Strategy

Persimmon's strong sense of purpose supports the Group's

sustainable business model. With the interests of customers and the

communities they live in at the centre of the business, the Group

will continue to pursue its strategy of maintaining high quality

land holdings, minimising financial risk, and carefully judging

capital deployment at the right time in the housing market cycle.

This strategy recognises the risks associated with the cyclical

nature of the housing market and ensures that the business

generates superior sustainable returns in the best interests of all

its stakeholders over the long-term. Over the last 20 years, the

Group's average return on capital has been 21.9% reflecting the

sustainable performance of the business. Total shareholder returns

have been 2,711% over the same extended period (FTSE 100:

101%).

Results and Outlook

The Group had a strong start to the year, with the decisive

December 2019 General Election providing improved market sentiment

after a number of years of instability following the EU referendum

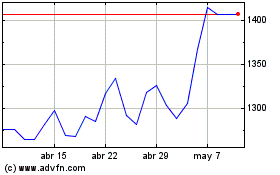

on leaving the European Union in 2016. The Group had a c. GBP1.4bn

forward order book at the start of the year and its first 11 weeks

of sales showed a c. 10% increase on the average private sales rate

per site compared with the same period in 2019. The build delays

caused by the onset of the Covid-19 pandemic resulted in a 35%

reduction in the Group's first half new home legal completions

compared with last year. The disruption was mitigated by the

Group's ability to maintain a good degree of operational continuity

throughout the period and Persimmon ultimately delivered a robust

performance for the period despite the unprecedented

circumstances.

Profit before tax was GBP292.4m (2019: GBP509.3m). As

anticipated, the Group's new housing gross margin remained

resilient at 31.3% (1) (2019: 33.8%). This reflects the quality of

the Group's development sites whilst including the impact of

reduced build and site overhead cost efficiencies caused by legal

completion and build delays during the period of reduced production

due to the Covid-19 response measures. Similarly, with the Group

continuing to maintain its investment in its operational

infrastructure, the Group's industry leading new housing operating

margin was 26.6% (2) (2019: 31.0%) which includes the lower

indirect overhead efficiencies resulting from the period of

disruption.

The Group continues to invest in its work in progress levels

supporting our strong forward order book and ensuring our

construction teams are able to manage build and quality assurance

programmes effectively, with c. 14% more equivalent units carried

forward at 30 June 2020 compared with last year. At the end of

June, the Group had strong liquidity with a cash balance of

GBP828.9m (2019: GBP832.8m) and its owned and controlled land

holdings totalled 89,232 plots (December 2019: 93,246 plots).

The Group has a strong platform moving into the second half of

the year with an experienced and agile management team, excellent

levels of forward build, a healthy forward order book and strong

average weekly private sales rates. Our strong opening work in

progress position and excellent build rate through the summer give

us confidence in a positive second half outturn. We expect that by

the end of September, we will have delivered c. 45% of our

anticipated second half new home legal completions.

As we look further ahead, a number of factors make it unusually

difficult to assess the outlook beyond the short term. Uncertainty

related to the future impact of Covid-19 on UK economic conditions

persists with, in particular, concerns over a potential second wave

and over UK employment levels following the end of the Government's

furlough scheme in the Autumn. Uncertainties also remain with

respect to the outcome of negotiations on a future trade deal with

the European Union. Each of these has the potential to impact

negatively on customer confidence and the demand for new homes in

the medium term.

However, the Group's successful strategy and strong operating

platform place it in an excellent position to continue to drive the

business forward and manage a range of future economic

scenarios.

Capital Return Plan

A key element of the Board's strategy remains the return of any

capital that is surplus to the reinvestment needs of the business

to shareholders through the Group's Capital Return Plan. With the

major social and economic disruption resulting from the action

taken to mitigate the onset of the Covid-19 pandemic, after careful

assessment of the capital needs of the business, the Board

concluded that the return of surplus capital by way of a 125p per

share interim dividend previously scheduled to be paid to

shareholders on 2 April 2020 would be cancelled. In addition, the

Board postponed the payment of the final dividend for the 2019

financial year of 110p per share that was previously scheduled to

be paid on 6 July 2020. This preserved the Company's ability to

re-invest this capital in the business should appropriate

opportunities arise, generating enhanced value over the longer term

in the best long-term interests of all stakeholders.

As indicated at the Company's AGM on 29 April 2020, in relation

to the final dividend for 2019, the Board has continued to assess

the Group's capital requirements in the context of the progress

made by the business through this challenging period, together with

the outlook for the market and the wider UK economy. Given the

strong progress the business has made, together with our cautious

optimism on the Group's prospects for the second half, the Board is

pleased to announce a modest interim dividend of 40p per share

which will be paid on 14 September 2020 to shareholders on the

register on 28 August 2020. Recognising the importance of dividend

receipts to pension schemes in supporting retired workers and their

families, the Board will continue to assess whether a further

dividend may be paid prior to the end of the current financial year

in satisfaction of the Board's previously indicated final dividend

for 2019.

Board changes

The Board would like to welcome Joanna Place, Chairman of the

Sustainability Committee, and Annmarie Durbin, Chairman of the

Remuneration Committee, who joined the Board on 1 April and 1 July

2020 respectively. Marion Sears resigned from the Board on 30 June

2020 and the Board would like to thank her for her significant

contribution to Persimmon during her tenure with the Company.

The Board announced the appointment of Dean Finch as the Group's

next Group Chief Executive on 24 June 2020 and look forward to

welcoming him to the Group later in the year when he will succeed

Dave Jenkinson.

The Board would also like to take this opportunity to thank all

of the Group's employees, workers, sub-contractors and suppliers

for their commitment, determination and resilience during this

challenging time. The Group is well placed to deliver long-term

success for all our stakeholders. Persimmon's fundamental

strengths: placing customers at the centre of our business, our

strong liquidity position, robust balance sheet and high quality

land holdings will ensure that we continue to play an important

role in providing the good quality, affordable family homes that

the country needs over future years.

Roger Devlin

Chairman

17 August 2020

Footnotes

1 Stated on new housing revenues of GBP1,102.8m (2019: GBP1,645.3m)

and gross profits of GBP345.2m (2019: GBP555.5m).

2 Stated before goodwill impairment (2020 : GBP1.6m, 2019 : GBP4.1m)

TRADING PERFORMANCE

Total revenues for the first half of the year were GBP1.19bn

(2019: GBP1.75bn), with new housing revenues of GBP1.10bn being 33%

lower than the prior period (GBP1.65bn). The Group completed 4,900

new homes (2019: 7,584) in the first six months at an average

selling price of GBP225,066 (2019: GBP216,942).

4,029 of the Group's completions (2019: 5,963) were to private

owner occupiers at an average selling price of GBP246,208, an

increase of 1.4% (2019: GBP242,912). 51% of our private completions

were across our northern businesses (2019: 56%). The Group's

Persimmon brand completed 3,655 new homes (2019: 5,470) and the

Charles Church brand completed 374 homes (2019: 493) in the

period.18% of the Group's new home completions (2019: 21%), at a

value of over GBP110m (2019: over GBP196m), were delivered to our

housing association partners in the first half with an average

selling price of GBP127,266 (2019: GBP121,413).

The Group's new housing gross profit for the first half was

GBP345.2m (2019: GBP555.5m) generating a new housing gross margin

of 31.3% (1) (2019: 33.8%). The 2.5% reduction in margin includes

the impact of delays to both the legal completion of sales and

development site build progress, incurred as a result of the

operational disruption caused by the Covid-19 response measures. To

allow the introduction of new safe operating procedures, the Group

began an orderly shutdown of its sites from the end of March with

work focused on making all developments safe and secure and

completing homes for customers who would otherwise have been left

in a vulnerable position.

The total cost impact of this Covid-19 disruption was GBP11.3m,

GBP9.9m of which is included in the Group's work in progress

balance representing the direct costs and site overheads incurred

in completing site development. This treatment is consistent with

prior reporting periods under the Group's accounting policies where

we have suffered build delays under various circumstances, for

example during instances of particularly bad weather. This

consistent treatment is currently estimated to reduce the Group's

future gross margins over the remaining current active site cycle

by c. 17 basis points. In the ordinary course of business, we will

seek to mitigate this future gross margin erosion.

The strength of the Group's new housing gross margins is

supported by high quality consented land holdings with land cost

recoveries of 14.1% of housing revenues (2019: 13.9%). At 30 June,

the Group's cost to revenue ratio (2) for its owned land holdings

of 70,208 plots (2019: 75,444 plots) was 12.5% (2019: 13.1%).

The Group has seen a c. 1% increase in build costs in the period

compared with the last six months of 2019. The Group's off-site

manufacturing capabilities mitigate the impact of supply chain and

build cost pressures. Tileworks, the Group's own concrete roof

plant, began supplying roof tiles to our sites in March 2020.

Underlying operating profit (3) for the Group was GBP293.2m

(2019: GBP510.1m). The Group's underlying new housing operating

margin (3) of 26.6% was 4.4% below last year (2019: 31.0%)

reflecting Persimmon's continuing investment in all of its

workforce and operations throughout the period.

The Group generated a profit before tax of GBP292.4m in the

period (2019: GBP509.3m).

Balance Sheet

The Group's balance sheet is strong, supported by high quality

land holdings, a reduction in deferred land commitments of GBP60.7m

(December 2019: GBP435.2m) and further investment in work in

progress carried at GBP1,223.7m (December 2019: GBP1,094.6m). The

Group's defined benefit net pension asset has reduced to GBP23.1m

at 30 June 2020 (December 2019: GBP77.6m) largely due to the fall

in corporate bond yields over the period. Total equity increased to

GBP3,450.6m from GBP3,258.3m at 31 December 2019. Reported net

assets per share of 1,081.9p represents a 5.9% increase from

1,021.7p at 31 December 2019. Underlying return on average capital

employed(4) as at 30 June was 27.8% (2019: 40.5%) mainly reflecting

the consequences of the increase in capital invested in the

business due to the impact of the Covid-19 disruption. Underlying

basic earnings per share(3) for the first six months of 2020 of

75.1p reduced by 42.5% compared to the prior year (2019:

130.6p).

Our land holdings

At 30 June 2020, the Group owned and controlled 89,232 plots in

its consented land holdings (December 2019: 93,246). 70,208 of

these plots are owned with an estimated gross margin of GBP5.1bn.

47,053 of these owned plots, have detailed planning consent and are

all under development. In addition to its consented land the Group

owns and controls c. 15,900 acres of strategic land.

The Group has visibility over a further c. 43,800 plots, c.

29,300 being plots held under option that are proceeding through

planning and an additional c. 14,500 plots which are controlled and

allocated in local plans.

During the last couple of years, in recognition of the cyclical

nature of the housing market, the Group has been increasingly

cautious in its assessment of potential land opportunities and has

continued to judge each opportunity on its own merits and against

our strict viability assessments. The Group has maintained this

approach over the last six months, bringing 886 new plots of land

into the business. The Group's land spend in the first half was

GBP167m (2019: GBP239m), including GBP107m of land creditors.

Cash and liquidity

The Group held GBP828.9m of cash at 30 June 2020 (December 2019:

GBP843.9m) and had deferred land commitments of GBP374.5m (December

2019: GBP435.2m). Of the Group's current land creditors, c. GBP130m

is to be paid by 31 December 2020 (2019: GBP115m paid in the six

months to 31 December 2019) resulting in an estimated GBP245m to

remain at the end of the year supporting the Group's strong

liquidity.

In addition, in March, the Group renewed its GBP300m Revolving

Credit Facility which has a five year term out to 31 March 2025.

This facility has not been utilised in the period.

OPERATIONAL REVIEW

Continuing to support our customers

The Group is committed to providing good quality, affordable

family homes in places where people wish to live and work across

the UK. Our customer care improvement plan initiatives, aimed at

driving through improvements in build quality and customer care,

are now operating within the business and are delivering the

anticipated results.

The Persimmon Way, the consolidation of the Group's 'end to end'

approach to new home construction, aims to ensure we consistently

provide good quality homes to all of our customers. It is a

comprehensive programme covering pre-start programmes, standardised

Group wide technical specifications and build processes,

complimentary technology, detailed quality assurance processes and

workforce training and support. All aspects of its development have

significantly progressed this year. The pilot study has

successfully completed and the process is now being rolled out

across the Group. Once established, an external audit of the

process will be performed to provide further quality assurance.

Our industry leading Homebuyer Retention Scheme, utilised by

over 40% of our private new home customers from 1 January 2020, has

further driven behavioural change throughout the business. Prior to

the onset of the Covid-19 outbreak, the Scheme and the Group's

investment in customer care resource and training had led to a c.

20% reduction in the time taken to resolve snagging items for our

customers.

The Group has invested an additional GBP129.1m in work in

progress since the end of 2019, as we continue to strive to provide

our customers with improved availability of new homes at more

advanced stages of construction and ensure that our improved

quality assurance programmes and inspection regimes can be

effectively implemented, whilst also anticipating an increase in

customer activity as the current Help to Buy scheme approaches its

conclusion. Our work in progress levels at 30 June 2020 represented

7,015 new homes of construction inventory, an increase of c. 14%

than at the same point last year.

The Group has continued to invest in improving communication

with our customers and our comprehensive customer portal, which

will support customers from the point of reserving their new home,

will be introduced in early Q4.

These initiatives have led to demonstrable improvements. In

March 2020, Persimmon was awarded a Four Star rating (5) for the

year to 30 September 2019 by the Home Builders Federation ('HBF')

and, since the start of 2020, has been trending ahead of the Five

Star threshold.

The Group's ultrafast, full fibre broadband service, FibreNest,

which aligns with current Government strategy to deliver modern

technology to new homes, now serves over 8,000 of our homeowners

across 154 of our developments. The service is highly rated and we

will continue to roll it out across our new homes and sites for the

benefit of our customers.

Our workforce

The flexibility, diligence and commitment of our workforce have

been key to generating the Group's robust six month performance.

The Group employs 5,155 people, including c. 2,000 tradespeople,

across the UK. The welfare of the Group's workforce has been

paramount during this time. Effective Covid-19 safe operating

procedures were implemented across all Group operations. Persimmon

has also provided additional mental health support and resources to

colleagues over this challenging period.

Over the last year, the Group had c. 750 trainees and

apprentices across the business maintaining its long-standing

commitment to provide career opportunities to talented people

wishing to enter the construction industry. The Group continues to

invest significantly in its training programmes and has delivered

c. 5,700 training days in the period including over 330,000 minutes

of on-line training since the start of April.

Building and supporting our communities

The Group provides 'homes for all' with a wide range and choice

of new homes across all of our developments. Our private average

selling price of GBP246,208 is c. 17% lower than the UK national

average (6) and we support more first time buyers into the housing

market than any other UK housebuilder with c. 50% of our new

private homes being sold to first time buyers in the first half of

the year.

Since the launch of the Group's long-term strategy in 2012, the

Group has delivered c. 118,000 new homes and invested c. GBP2.8bn

in local communities including delivering c. 20,600 homes to our

housing association partners. Our activities support approximately

50,000 (7) jobs across our communities and within our wider supply

chain. Our financial strength will ensure that we can play our part

in our communities' recovery from the impact of Covid-19. The Group

is a signatory to the Covid-19 Business Pledge supporting

colleagues, customers and communities through the crisis and is

industry lead to the Social Mobility Pledge which encourages

businesses to boost social mobility in the UK.

Guided by dedicated resource, Persimmon has adopted a measured

and structured approach to its sustainability strategy promoting

greater awareness across all Group operations and disciplines. The

Group continues to focus on carbon reduction and work is currently

underway to establish an appropriate science-based carbon reduction

target. In addition, the Group has appointed five regional

champions to implement and enhance its environmental policies and

processes across all developments, providing additional targeted

resource in this important area.

Persimmon places great importance on the wider support it offers

its communities. The Group's 'Building Futures' campaign, joining

forces with Team GB, is continuing for a second year and will

donate c. GBP1m in 2020 to local community projects which benefit

young people across the UK. In addition, our Community Champions

campaign has donated over GBP370,000 in the first half of the year

and, from 1 April 2020, began to target its support to charities

that assist the over-70s, a group that has been particularly

affected by the pandemic.

Covid-19 update

Our response to the Covid-19 pandemic was led by the overriding

responsibility of ensuring the wellbeing of our customers,

workforce and local communities. In addition, serving the best

interests of all stakeholders, the Group has ensured our customers

remained at the centre of our business and maintained strong

stewardship of the financial strength of the business.

At the initial onset of the pandemic, on 25 March 2020, the

Group announced a controlled and orderly shutdown of its sites,

sales offices, and off-site manufacturing facilities. Regional

offices also closed, with a skeleton staff supporting colleagues

working from home.

During the shutdown period, the Group successfully maintained

operational momentum, with colleagues working from home progressing

planning and construction management work. Our sales teams also

remained fully operational, serving our customers using online

resources, including virtual viewings and our digital sales

reservation platform. This momentum has proved crucial in securing

an efficient and effective re-start to our construction activities,

a strong forward order book and encouraging average weekly net

reservation rates.

The Group continued to support our communities throughout the

period, supplying personal protective equipment to local hospitals

and maintaining our charitable programmes through the Group's

Community Champions and Building Futures campaigns. In addition,

Persimmon has signed up to the Covid-19 Business Pledge as part of

our ongoing commitment to support our workforce, customers and

communities through the crisis.

By the end of April, the Group had introduced effective Covid-19

secure operating procedures, aligned with Government guidelines,

covering all of its sites, offices and manufacturing facilities.

Our sites in England and Wales commenced a phased re-opening on 27

April 2020 and on 15 June 2020 in Scotland for construction

operations and on 15 May 2020 in England, 22 June 2020 in Wales and

29 June 2020 in Scotland for site-based sales activity.

The Group's strong Covid-19 safety protocols, which continue to

maintain the stringent two metre social distancing rules set at the

height of the outbreak, are embedded within all of our operations.

Our current build programmes, incorporating these protocols, have

returned to normal levels. These robust processes will ensure that

we can maintain our build programmes and continue to provide the

homes the country needs and support the recovery of the UK

economy.

Outlook

The Group has strong market positioning provided by its current

network of c. 340 sites in great locations across the UK and its

range and choice of affordable homes for its customers. We plan to

start construction on c. 55 new sites in the second half of the

year adding to this strength. This large and geographically diverse

network, supported by the Group's 31 regional businesses, provides

the Group with the operational infrastructure and capacity to

deliver future growth.

The forward order book, including legal completions taken in the

second half, is 21% stronger year on year with new home forward

sales of c. GBP2.5bn. In the last seven weeks, since the start of

July, the average weekly net reservations per site is c. 49% higher

than the equivalent period last year. At 30 June 2020, the Group

was carrying a c. 14% increase in the number of equivalent new home

units built compared with the same point last year and build

programmes have continued to progress well throughout the summer.

This strong position, together with our current projection that c.

45% of our anticipated second half new home legal completions will

complete by the end of September, c. 25% of which have completed in

Q3 so far, provide confidence over the Group's ability to deliver a

second half legal completion outturn that will at least be in line

with the second half of 2019.

The continuing healthy level of Persimmon's trading through this

period of major disruption in the UK economy and housing market

serves to remind us that demand for high quality new homes in

sustainable communities remains resilient. Consistently low

interest rates, good mortgage availability and supportive

Government policies provide reassurance for the housing market.

However, we also recognise the potential risks over the medium term

posed by further Covid-19 disruption, rising unemployment and the

potential impact of the outcome of a future trade deal with the

European Union and the rest of the world.

The Group regularly monitors external market factors and their

impact on demand and pricing and manages its working capital

investment in mitigation of adverse economic events.

We are also closely engaging with our suppliers to manage our

supply chains and maintain stock levels where necessary. The

vertical integration afforded by our own Brickworks, Tileworks and

Space4 production mitigate availability and cost risks further.

The Group's strategy of minimising financial risks and deploying

capital at the right time in the cycle together with Persimmon's

dedicated, experienced and agile management team provides a strong

platform to continue to deliver superior long-term sustainable

returns for the benefit of all its stakeholders through the

cycle.

The person responsible for the release of this announcement on

behalf of the Group is Tracy Davison, Company Secretary.

Footnotes

1 Stated on new housing revenues of GBP1,102.8m (2019: GBP1,645.3m)

and gross profits of GBP345.2m (2019: GBP555.5m).

2 Land cost value for the plot divided by the anticipated future revenue

of the new home sold.

3 Stated before goodwill impairment (2020 : GBP1.6m, 2019 : GBP4.1m)

4 12 month rolling average stated before goodwill impairment and includes

land creditors.

5 The Group participates in a National New Homes Survey, run by the

Home Builders Federation, the rating system is based on the number

of customers who would recommend their builder to a friend.

6 National average selling price for newly built homes sourced from

the UK House Price Index as calculated by the Office for National

Statistics from data provided by HM Land registry.

7 Estimated using an economic toolkit.

PERSIMMON PLC

Condensed Consolidated Statement of Comprehensive Income

For the six months to 30 June 2020

Six months Six months Year to 31

to 30 June to 30 June December 2019

2020 2019

Note Total Total Total

GBPm GBPm GBPm

---------------------------------------- ---------- -------- ------------ ---------------

Total revenue 3 1,190.5 1,754.0 3,649.4

Cost of sales (845.3) (1,198.5) (2,518.7)

---------------------------------------- ---------- -------- ------------ ---------------

Gross profit 345.2 555.5 1,130.7

Other operating income 3.4 5.1 8.8

Operating expenses (57.0) (54.6) (110.1)

Profit from operations before

impairment of intangible assets 293.2 510.1 1,036.7

Impairment of intangible assets (1.6) (4.1) (7.3)

---------------------------------------- ---------- -------- ------------ ---------------

Profit from operations 291.6 506.0 1,029.4

Finance income 5.1 8.5 20.5

Finance costs (4.3) (5.2) (9.1)

---------------------------------------- ---------- -------- ------------ ---------------

Profit before tax 292.4 509.3 1,040.8

Tax 4 (54.8) (98.1) (192.0)

---------------------------------------- ---------- -------- ------------ ---------------

Profit after tax (all attributable

to equity holders of the parent) 237.6 411.2 848.8

---------------------------------------- ---------- -------- ------------ ---------------

Other comprehensive expense

Items that will not be reclassified

to profit:

Remeasurement losses on defined

benefit pension schemes 11 (54.9) (3.6) (27.0)

Tax 4 8.9 0.6 4.6

---------------------------------------- ---------- -------- ------------ ---------------

Other comprehensive expense for

the period, net of tax (46.0) (3.0) (22.4)

---------------------------------------- ---------- -------- ------------ ---------------

Total recognised income for the

period 191.6 408.2 826.4

---------------------------------------- ---------- -------- ------------ ---------------

Earnings per share

Basic 5 74.6p 129.3p 266.8p

Diluted 5 74.4p 129.0p 266.3p

---------------------------------------- ---------- -------- ------------ ---------------

PERSIMMON PLC

Condensed Consolidated Balance Sheet

As at 30 June 2020 (unaudited)

30 June 30 June 31 December

2020 2019 2019

Note GBPm GBPm GBPm

--------------------------------- ----- ---------- ---------- ------------

Assets

Non-current assets

Intangible assets 184.5 189.3 186.1

Property, plant and equipment 86.7 74.3 82.0

Investments accounted for using

the equity method 2.1 2.1 2.1

Shared equity loan receivables 8 50.2 62.9 59.2

Trade and other receivables 7.1 7.1 7.1

Deferred tax assets 6.7 7.5 6.6

Retirement benefit assets 11 23.1 87.8 77.6

--------------------------------- ----- ---------- ---------- ------------

360.4 431.0 420.7

--------------------------------- ----- ---------- ---------- ------------

Current assets

Inventories 7 3,227.3 3,145.2 3,156.8

Shared equity loan receivables 8 12.5 10.8 9.4

Trade and other receivables 97.3 150.4 58.5

Cash and cash equivalents 10 828.9 832.8 843.9

--------------------------------- ----- ---------- ---------- ------------

4,166.0 4,139.2 4,068.6

--------------------------------- ----- ---------- ---------- ------------

Total assets 4,526.4 4,570.2 4,489.3

--------------------------------- ----- ---------- ---------- ------------

Liabilities

Non-current liabilities

Trade and other payables (173.7) (220.4) (178.0)

Deferred tax liabilities (17.8) (27.2) (25.2)

Partnership liability (27.0) (30.7) (31.6)

--------------------------------- ----- ---------- ---------- ------------

(218.5) (278.3) (234.8)

--------------------------------- ----- ---------- ---------- ------------

Current liabilities

Trade and other payables (848.8) (1,012.8) (911.7)

Capital Return liability - (350.1) -

Partnership liability (5.5) (5.5) (5.5)

Current tax liabilities (3.0) (86.0) (79.0)

--------------------------------- ----- ---------- ---------- ------------

(857.3) (1,454.4) (996.2)

--------------------------------- ----- ---------- ---------- ------------

Total liabilities (1,075.8) (1,732.7) (1,231.0)

--------------------------------- ----- ---------- ---------- ------------

Net assets 3,450.6 2,837.5 3,258.3

--------------------------------- ----- ---------- ---------- ------------

Equity

Ordinary share capital issued 31.9 31.8 31.9

Share premium 19.8 16.4 19.2

Capital redemption reserve 236.5 236.5 236.5

Other non-distributable reserve 276.8 276.8 276.8

Retained earnings 2,885.6 2,276.0 2,693.9

--------------------------------- ----- ---------- ---------- ------------

Total equity 3,450.6 2,837.5 3,258.3

--------------------------------- ----- ---------- ---------- ------------

PERSIMMON PLC

Condensed Consolidated Statement of Changes in Shareholders'

Equity

For the six months to 30 June 2020 (unaudited)

Share Share Capital Other non-distributable Retained Total

capital premium redemption reserve earnings

reserve

GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------------- --------- --------- ------------ ------------------------ ---------- --------

Six months ended 30

June 2020:

Balance at 1 January

2020 31.9 19.2 236.5 276.8 2,693.9 3,258.3

Profit for the period - - - - 237.6 237.6

Other comprehensive

expense - - - - (46.0) (46.0)

Transactions with owners:

Issue of new shares - 0.6 - - - 0.6

Exercise of share options/share

awards - - - - (0.2) (0.2)

Share-based payments - - - - 2.4 2.4

Net settlement of share-based

payments - - - - (2.3) (2.3)

Satisfaction of share

options from own shares

held - - - - 0.2 0.2

--------------------------------- --------- --------- ------------ ------------------------ ---------- --------

Balance at 30 June

2020 31.9 19.8 236.5 276.8 2,885.6 3,450.6

--------------------------------- --------- --------- ------------ ------------------------ ---------- --------

Six months ended 30

June 2019:

Balance at 1 January

2019 31.7 15.5 236.5 276.8 2,634.0 3,194.5

Profit for the period - - - - 411.2 411.2

Other comprehensive

expense - - - - (3.0) (3.0)

Transactions with owners:

Dividends on equity

shares - - - - (747.8) (747.8)

Issue of new shares 0.1 0.9 - - - 1.0

Exercise of share options/share

awards - - - - (0.5) (0.5)

Share-based payments - - - - 3.9 3.9

Net settlement of share-based

payments - - - - (22.3) (22.3)

Satisfaction of share

options from own shares

held - - - - 0.5 0.5

--------------------------------- --------- --------- ------------ ------------------------ ---------- --------

Balance at 30 June

2019 31.8 16.4 236.5 276.8 2,276.0 2,837.5

--------------------------------- --------- --------- ------------ ------------------------ ---------- --------

Year ended 31 December

2019:

Balance at 1 January

2019 31.7 15.5 236.5 276.8 2,634.0 3,194.5

Profit for the year - - - - 848.8 848.8

Other comprehensive

expense - - - - (22.4) (22.4)

Transactions with owners:

Dividends on equity

shares - - - - (747.8) (747.8)

Issue of new shares 0.2 3.7 - - - 3.9

Exercise of share options/share

awards - - - - (0.5) (0.5)

Share-based payments - - - - 8.2 8.2

Net settlement of share-based

payments - - - - (26.9) (26.9)

Satisfaction of share

options from own shares

held - - - - 0.5 0.5

--------------------------------- --------- --------- ------------ ------------------------ ---------- --------

Balance at 31 December

2019 31.9 19.2 236.5 276.8 2,693.9 3,258.3

--------------------------------- --------- --------- ------------ ------------------------ ---------- --------

PERSIMMON PLC

Condensed Consolidated Cash Flow Statement

For the six months to 30 June 2020 (unaudited)

Six months Six months Year to 31

to 30 June to 30 June December 2019

2020 2019

Note GBPm GBPm GBPm

--------------------------------------- ----- ------------ ------------ ---------------

Cash flows from operating activities:

Profit for the year 237.6 411.2 848.8

Tax charge 4 54.8 98.1 192.0

Finance income (5.1) (8.5) (20.5)

Finance costs 4.3 5.2 9.1

Depreciation charge 7.1 6.5 13.3

Impairment of intangible assets 1.6 4.1 7.3

Share-based payment charge 2.8 1.5 3.7

Net imputed interest income (0.6) 1.7 7.7

Other non-cash items (3.9) (3.6) (7.6)

--------------------------------------- ----- ------------ ------------ ---------------

Cash inflow from operating activities 298.6 516.2 1,053.8

Movement in working capital:

Increase in inventories (65.7) (80.9) (87.7)

(Increase)/Decrease in trade and

other receivables (41.8) (63.9) 6.3

Decrease in trade and other payables (70.0) (85.0) (225.6)

Decrease in shared equity loan

receivables 7.9 17.6 31.4

--------------------------------------- ----- ------------ ------------ ---------------

Cash generated from operations 129.0 304.0 778.2

Interest paid (2.5) (2.3) (4.2)

Interest received 2.6 3.2 5.6

Tax paid (129.7) (63.6) (159.6)

--------------------------------------- ----- ------------ ------------ ---------------

Net cash (outflow)/inflow from

operating activities (0.6) 241.3 620.0

--------------------------------------- ----- ------------ ------------ ---------------

Cash flows from investing activities:

Joint venture net funding movement - 0.9 0.9

Purchase of property, plant and

equipment (10.1) (13.1) (27.5)

Proceeds from sale of property,

plant and equipment 0.5 0.3 0.7

--------------------------------------- ----- ------------ ------------ ---------------

Net cash outflow from investing

activities (9.6) (11.9) (25.9)

--------------------------------------- ----- ------------ ------------ ---------------

Cash flows from financing activities:

Lease capital payments (1.8) (2.0) (3.8)

Payment of Partnership liability (3.6) (3.4) (3.4)

Net settlement of share-based

payments - (42.6) (47.2)

Share options consideration 0.6 1.0 3.9

Dividends paid 6 - (397.7) (747.8)

--------------------------------------- ----- ------------ ------------ ---------------

Net cash outflow from financing

activities (4.8) (444.7) (798.3)

--------------------------------------- ----- ------------ ------------ ---------------

Decrease in net cash and cash

equivalents 10 (15.0) (215.3) (204.2)

--------------------------------------- ----- ------------ ------------ ---------------

Cash and cash equivalents at the

beginning of the period 843.9 1,048.1 1,048.1

--------------------------------------- ----- ------------ ------------ ---------------

Cash and cash equivalents at the

end of the period 10 828.9 832.8 843.9

--------------------------------------- ----- ------------ ------------ ---------------

Notes

1. Basis of preparation

The half year condensed financial statements for the six months

to 30 June 2020 have been prepared in accordance with the

Disclosure Guidance and Transparency Rules of the Financial Conduct

Authority and with International Accounting Standard 34 Interim

Financial Reporting, as adopted by the European Union. The half

year financial statements are unaudited, but have been reviewed by

the auditors whose report is set out at the end of this report.

This report should be read in conjunction with the Group's annual

financial statements for the year ended 31 December 2019, which

have been prepared in accordance with IFRSs as adopted by the

European Union.

The comparative figures for the financial year ended 31 December

2019 are not the company's statutory accounts for that financial

year. Those accounts have been reported on by the company's

auditors and delivered to the Registrar of Companies. The report of

the auditors was (i) unqualified, (ii) did not include a reference

to any matters to which the auditors drew attention by way of

emphasis without qualifying their report and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act

2006.

Except as described below, the accounting policies applied are

consistent with those of the annual financial statements for the

year ended 31 December 2019, as described in those financial

statements.

The following new standards and amendments to standards are

mandatory for the first time for the financial year beginning 1

January 2020:

-- Amendments to IFRS 3 Business Combinations

-- Amendments to IFRS 9, IAS 39 and IFRS 7: Interest Rate Benchmark

reform

-- Amendments to IAS 1 and IAS 8: Definition of Material

-- Amendments to References to the Conceptual Framework in IFRS Standards

The effects of the implementation of these amendments have been

limited to disclosure amendments.

There are no new standards or amendment to standards, which are

EU endorsed but not yet effective.

Going concern

The Group entered this challenging time from a position of

strength. Its long term-strategy, which focuses on the risks

associated with the housing cycle and on minimising financial risk

and maintaining financial flexibility, has equipped the business

with strong liquidity and a robust balance sheet.

Despite the significant disruption caused by the Covid-19

pandemic, the Group delivered a resilient trading performance in

the six months to 30 June 2020, completing 4,900 new homes (2019:

7,584) and generating a profit before tax of GBP292.4m (2019:

GBP509.3m). At 30 June 2020, the Group had a strong balance sheet

with GBP829m of cash (2019: GBP833m), high quality land holdings

and reduced land creditors of GBP374.5m (December 2019: GBP435.2m).

In addition, the Group has an undrawn Revolving Credit Facility of

GBP300m, which has a five year term out to 31 March 2025.

The Group's forward order book, including legal completions

taken in the second half, is 21% stronger year on year with new

home forward sales of c. GBP2.5bn. In the last seven weeks, since

the start of July, average weekly net reservations are c. 49%

higher than the equivalent period last year.

The Directors have carried out a robust assessment of the

principal risks facing the Group, as discussed in note 12 of this

announcement. The impact of the ongoing social distancing

restrictions, introduced by the UK and devolved Governments to

contain the spread of Covid-19 and the risk of a new pandemic, have

been included as a new principal risk for the Group. The Directors

have considered this risk and its potential impact on the other

principal risks facing the Group including how they may threaten

the Group's strategy, business model, future operational and

financial performance, solvency and liquidity. The Group has

considered the impact of these risks on the going concern of the

business by performing a range of sensitivity analyses including

severe but plausible scenarios materialising together with the

likely effectiveness of mitigating actions that would be executed

by Directors (1) .

The scenarios emphasise the potential impact of severe market

disruption, for example including the effect of the Covid-19

pandemic, on short to medium term demand for new homes. The

scenarios' emphasis on the impact on the cash inflows of the Group

through reduced new home sales is designed to allow the examination

of the extreme cash flow consequences of such circumstances

occurring. The Group's cash flows are less sensitive to supply side

disruption given the Group's sustainable business model, flexible

operations, agile management team and off-site manufacturing

facilities.

In the first scenario modelled, the combined impact is assumed

to cause a 44% reduction in volumes and a 15% reduction in average

selling prices through to 2021. As a result of these factors, the

Group's housing revenues were assumed to fall by c. 52% during this

period. The assumptions used in this scenario reflect the

experience management gained during the Global Financial Crisis

('GFC') from 2007 to 2010, it being the worse recession seen in the

housing market since World War Two. The scenario assumes a

subsequent recovery occurs over a similar extended period as in the

GFC.

A second, even more extreme, scenario assumes a significant and

enduring depression of the UK economy and housing market over the

next five years causing a reduction of 53% in new home sales

volumes and a 45% fall in average selling prices through to 2021.

As a result of these factors, the Group's housing revenues were

assumed to fall by c. 74% during this period. It assumes that

neither volumes nor average selling prices recover from this point

through to 2025.

In each of these scenarios cash flows were assumed to be managed

consistently ensuring all relevant land, work in progress and

operational investments were made in the business at the

appropriate time to deliver the projected legal completions. The

Directors assumed they would continue to make well judged decisions

in respect of capital return payments, ensuring that they

maintained financial flexibility throughout.

In addition, due to the level of uncertainty surrounding the

impact of the Covid-19 pandemic, the Directors have also assessed

the impact of a complete shutdown of the housing market for the

period to 31 December 2021. This extended "lockdown" scenario

assumes that the Group does not receive any further sales receipts

for the period whilst maintaining its current level of fixed

costs.

Throughout each of these scenarios, the Group maintains

substantial liquidity with a positive cash balance and no

requirement to access the Group's GBP300m Revolving Credit

Facility. The payment of the current proposed dividend of 40p per

share has been factored into the models.

Having considered the Group's forecasts, sensitivity analysis

and the Group's significant financial headroom, the Directors have

a reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in

preparing these condensed consolidated half year financial

statements.

Footnote 1

See also Viability Statement on pages 64 and 65 of the Group's

annual financial statements for the year ended 31 December 2019,

which provides more detail regarding the approach and process the

Directors follow in assessing the long-term viability of the

business.

Estimates and judgements

The preparation of these half year condensed financial

statements requires management to make judgements and estimations

of uncertainty at the balance sheet date. The key areas where

judgements and estimates are significant to the financial

statements are land and work in progress (see note 7), shared

equity loan receivables (see note 9), goodwill, brand intangibles

and pensions as disclosed in note 3 of the Group's annual financial

statements. The estimates and associated assumptions are based on

management expertise and historical experience and various other

factors that are believed to be reasonable under the

circumstances.

In light of the Covid-19 pandemic, at 30 June 2020, management

performed an impairment review of the Group's land and work in

progress portfolio (see note 7) and goodwill and brand intangibles

assets (see below) which indicated that no impairment was

required.

Goodwill and brand intangibles

The key sources of estimation uncertainty in respect of goodwill

and brand intangibles are disclosed in notes 3 and 13 of the

Group's annual financial statements for the year ended 31 December

2019.

The goodwill allocated to the Group's acquired strategic land

holdings is further tested by reference to the proportion of

legally completed plots in the period compared to the total plots

which are expected to receive satisfactory planning permission in

the remaining strategic land holdings, taking account of historic

experience and market conditions. This review resulted in an

underlying impairment charge of GBP1.6m recognised during the

period. This regular impairment charge reflects ongoing consumption

of the acquired strategic land holdings and is consistent with

prior years.

2. Segmental analysis

The Group has only one reportable operating segment, being

housebuilding within the UK, under the control of the Executive

Board. The Executive Board has been identified as the Chief

Operating Decision Maker as defined under IFRS 8 Operating

Segments.

3. Revenue

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

GBPm GBPm GBPm

--------------------------------------------- -------------------- ----------------------- ------------------------

Revenue from the sale of new

housing 1,102.8 1,645.3 3,420.1

Revenue from the sale of part

exchange

properties 86.7 108.7 228.6

Revenue from the provision of

internet

services 1.0 - 0.7

--------------------------------------------- -------------------- ----------------------- ------------------------

Revenue from the sale of goods

and services

as reported in the statement of

comprehensive

income 1,190.5 1,754.0 3,649.4

--------------------------------------------- -------------------- ----------------------- ------------------------

4. Tax

Analysis of the tax charge for the period

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

GBPm GBPm GBPm

--------------------------------------------- -------------------- ----------------------- ------------------------

Tax charge comprises:

UK corporation tax in respect of

the

current period 56.7 97.4 196.7

Adjustments in respect of prior

years (2.3) - (8.2)

--------------------------------------------- -------------------- ----------------------- ------------------------

54.4 97.4 188.5

--------------------------------------------- -------------------- ----------------------- ------------------------

Deferred tax relating to

origination

and reversal of temporary

differences 0.4 0.7 3.2

Adjustments recognised in the

current

year in respect of prior years'

deferred

tax - - 0.3

--------------------------------------------- -------------------- ----------------------- ------------------------

0.4 0.7 3.5

--------------------------------------------- -------------------- ----------------------- ------------------------

54.8 98.1 192.0

--------------------------------------------- -------------------- ----------------------- ------------------------

Deferred tax recognised in other comprehensive income

Six months Six months Year

to 30 to 30 June to

June 2020 2019 31

December

2019

GBPm GBPm GBPm

------------------------------------------------ -------------------- ----------------------- ---------------------

Recognised on remeasurement charges

on

pension schemes (8.9) (0.6) (4.6)

------------------------------------------------ -------------------- ----------------------- ---------------------

Tax recognised directly in equity

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

GBPm GBPm GBPm

--------------------------------------------- -------------------- ----------------------- ------------------------

Arising on transactions with

equity participants

Current tax related to equity

settled

transactions (0.6) (7.8) (9.9)

Deferred tax related to equity

settled

transactions 1.0 5.3 5.4

--------------------------------------------- -------------------- ----------------------- ------------------------

0.4 (2.5) (4.5)

--------------------------------------------- -------------------- ----------------------- ------------------------

At 30 June 2020, the Group has recognised deferred tax assets on

deductible temporary differences at 19%, the rate enacted at the

end of the reporting period.

5. Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue during the

period (excluding those held in the employee benefit trusts and any

treasury shares, all of which are treated as cancelled) which were

318.7m (June 2019: 317.9m; December 2019: 318.1m).

Diluted earnings per share is calculated by dividing the profit

for the period attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue adjusted to

assume conversion of all potentially dilutive ordinary shares from

the start of the period, giving a figure of 319.5m (June 2019:

318.9m; December 2019: 318.8m).

Underlying earnings per share excludes goodwill impairment. The

earnings per share from continuing operations were as follows:

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

Basic earnings per share 74.6p 129.3p 266.8p

Underlying basic earnings per

share 75.1p 130.6p 269.1p

Diluted earnings per share 74.4p 129.0p 266.3p

Underlying diluted earnings per

share 74.9p 130.2p 268.6p

--------------------------------------------- -------------------- ----------------------- ------------------------

The calculation of the basic and diluted earnings per share is

based upon the following data:

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

GBPm GBPm GBPm

--------------------------------------------- -------------------- ----------------------- ------------------------

Underlying earnings attributable

to shareholders 239.2 415.3 856.1

Goodwill impairment (1.6) (4.1) (7.3)

--------------------------------------------- -------------------- ----------------------- ------------------------

Earnings attributable to

shareholders 237.6 411.2 848.8

--------------------------------------------- -------------------- ----------------------- ------------------------

At 30 June 2020 the issued share capital of the Company was

318,941,892 ordinary shares (31 December 2019: 318,902,385 ordinary

shares).

6. Dividends/Return of capital

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

GBPm GBPm GBPm

-------------------------------------------- --------------------- ----------------------- ------------------------

Amounts recognised as

distributions to

capital holders in the period:

2018 dividend to all

shareholders of

125p per share paid 2019 - 397.7 397.7

2018 dividend to all

shareholders of

110p per share paid 2019 - - 350.1

Total capital return to

shareholders - 397.7 747.8

-------------------------------------------- --------------------- ----------------------- ------------------------

After careful assessment of the capital needs of the business,

and in light of the major social and economic disruption resulting

from the action taken to introduce measures to mitigate the onset

of the Covid-19 pandemic, the Board concluded that the return of

surplus capital by way of a 125p per share interim dividend payment

previously scheduled to be paid to shareholders on 2 April 2020

would be cancelled. In addition, the Board postponed the payment of

the final dividend for the 2019 financial year of 110p per share

that was previously scheduled to be paid on 6 July 2020.

As indicated at the Company's AGM on 29 April 2020, in relation

to the final dividend for 2019, the Board has continued to assess

the Group's capital requirements in the context of the progress

made by the business through this challenging period, together with

the outlook for the market and the wider UK economy. Given the

strong progress the business has made, together with our cautious

optimism on the Group's prospects for the second half, the Board is

pleased to announce a modest interim dividend of 40p per share

which will be paid on 14 September 2020 to shareholders on the

register on 28 August 2020.

7. Inventories

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm

------------------------------------- ------------------- ------------------- -----------------------

Land 1,896.6 2,013.0 1,938.6

Work in progress 1,223.7 1,024.0 1,094.6

Part exchange properties 55.2 61.8 71.8

Showhouses 51.8 46.4 51.8

------------------------------------- ------------------- ------------------- -----------------------

3,227.3 3,145.2 3,156.8

------------------------------------- ------------------- ------------------- -----------------------

The Group has conducted a further review of the net realisable

value of its land and work in progress portfolio at 30 June 2020.

Our approach to this review has been consistent with that conducted

at 31 December 2019 and was fully disclosed in the financial

statements for the year ended on that date. The key judgements and

estimates in determining the future net realisable value of the

Group's land and work in progress portfolio are future sales

prices, house types and costs to complete the developments. Sales

prices and costs to complete were estimated on a site by site

basis. There is currently no evidence or experience in the market

to inform management that expected selling prices used in the

valuations are materially incorrect.

Net realisable value provisions held against inventories at 30

June 2020 were GBP29.6m (2019: GBP36.2m). Following the review,

GBP8.2m of inventories are valued at fair value less costs to sell

rather than historical cost (2019: GBP14.3m).

8. Shared equity loan receivables

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

GBPm GBPm GBPm

--------------------------------------------- -------------------- ----------------------- ------------------------

Shared equity loan receivables at

beginning

of period 68.6 86.9 86.9

Settlements (7.9) (17.6) (31.4)

Gains 2.0 4.4 13.1

--------------------------------------------- -------------------- ----------------------- ------------------------

Shared equity loan receivables at

end

of period 62.7 73.7 68.6

--------------------------------------------- -------------------- ----------------------- ------------------------

All gains/losses have been recognised through finance income in

profit and loss for the period of which GBP0.9m was unrealised

(June 2019: GBP1.3m; December 2019: GBP7.1m).

9. Financial instruments

In aggregate, the fair value of financial assets and liabilities

are not materially different from their carrying value.

Financial assets and liabilities carried at fair value are

categorised within the hierarchical classification of IFRS 7

Revised (as defined within the standard) as follows:

30 June 30 June 31 December

2020 2019 2019

Level 3 Level 3 Level 3

GBPm GBPm GBPm

------------------------------------------- ------------------- ------------------- -----------------------

Shared equity loan receivables 62.7 73.7 68.6

------------------------------------------- ------------------- ------------------- -----------------------

Shared equity loan receivables

Shared equity loan receivables represent loans advanced to

customers secured by way of a second charge on their new home. They

are carried at fair value. The fair value is determined by

reference to the rates at which they could be exchanged by

knowledgeable and willing parties. Fair value is determined by

discounting forecast cash flows for the residual period of the

contract by a risk adjusted rate.

There exists an element of uncertainty over the precise final

valuation and timing of cash flows arising from these assets. As a

result, the Group has applied inputs based on current market

conditions and the Group's historic experience of actual cash flows

resulting from such arrangements. These inputs are by nature

estimates and as such, the fair value has been classified as level

3 under the fair value hierarchy laid out in IFRS 13 Fair Value

Measurement.

Significant unobservable inputs into the fair value measurement

calculation include regional house price movements based on the

Group's actual experience of regional house pricing and management

forecasts of future movements, weighted average duration of the

loans from inception to settlement of ten years (2019: ten years)

and a discount rate of 5% (2019: 9%). The reduction in discount

rate reflects the continued fall in interest rates and is based on

current observed market interest rates offered to private

individuals on secured second loans.

The discounted forecast cash flow calculation is dependent upon

the estimated future value of the properties on which the shared

equity loans are secured. Adjustments to this input, which might

result from a change in the wider property market, would have a

proportional impact upon the fair value of the asset. Furthermore,

whilst not easily accessible in advance, the resulting change in

security value may affect the credit risk associated with the

counterparty, influencing fair value further.

10. Reconciliation of net cash flow to net cash and analysis of

net cash

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

GBPm GBPm GBPm

--------------------------------------------- -------------------- ----------------------- ------------------------

Decrease in net cash and cash

equivalents

in cash flow (15.0) (215.3) (204.2)

Cash and cash equivalents at

beginning

of period 843.9 1,048.1 1,048.1

--------------------------------------------- -------------------- ----------------------- ------------------------

Cash and cash equivalents at end

of period 828.9 832.8 843.9

Lease liabilities (9.3) (9.1) (8.9)

--------------------------------------------- -------------------- ----------------------- ------------------------

Net cash at end of period 819.6 823.7 835.0

--------------------------------------------- -------------------- ----------------------- ------------------------

Net cash is defined as cash and cash equivalents, bank

overdrafts, lease obligations and interest bearing borrowings.

11. Retirement benefit assets

The amounts recognised in the consolidated statement of

comprehensive income are as follows:

Six months Six months Year to

to 30 to 30 June 31 December

June 2020 2019 2019

GBPm GBPm GBPm

--------------------------------------------- -------------------- ----------------------- ------------------------

Current service cost 1.0 0.9 1.7

Administrative expense 0.2 0.5 0.9

--------------------------------------------- -------------------- ----------------------- ------------------------

Pension cost recognised as

operating

expense 1.2 1.4 2.6

--------------------------------------------- -------------------- ----------------------- ------------------------

Interest income on net defined

benefit

asset (0.7) (1.3) (2.7)

--------------------------------------------- -------------------- ----------------------- ------------------------

Pension cost recognised as a net

finance

credit (0.7) (1.3) (2.7)

--------------------------------------------- -------------------- ----------------------- ------------------------

Total defined benefit pension

cost recognised

in profit or loss 0.5 0.1 (0.1)

Remeasurement losses recognised

in other

comprehensive expense 54.9 3.6 27.0

--------------------------------------------- -------------------- ----------------------- ------------------------

Total defined benefit scheme loss

recognised 55.4 3.7 26.9

--------------------------------------------- -------------------- ----------------------- ------------------------

The amounts included in the balance sheet arising from the

Group's obligations in respect of the Pension Scheme are as

follows:

30 June 30 June 31 December

2020 2019 2019

GBPm GBPm GBPm