China Manufacturing Sector Expands For Fourth Month

31 Agosto 2020 - 10:42PM

RTTF2

China's manufacturing activity expanded for the fourth straight

month in August suggesting that the sector continued to recover

from the impact of the coronavirus pandemic, survey data from IHS

Markit showed Tuesday.

The Caixin manufacturing Purchasing Managers' Index rose to 53.1

in August from 52.8 in July. The reading signaled a solid overall

improvement in the health of the sector, and one that was the most

marked since January 2011.

According to official survey, the manufacturing PMI fell

marginally to 51.0 in August from 51.1, while the non-manufacturing

PMI advanced to 55.2 from 54.2 a month ago.

IHS Markit survey revealed that manufacturing new orders

expanded at the sharpest rate since the start of 2011 amid reports

of firmer client demand as the domestic and global economy

continued to recover from the pandemic. Notably, manufacturers

registered the first increase in new export sales since December

2019.

Driven by higher new business, production expanded further. The

rate of growth was the most marked since January 2011. At the same

time, staff numbers fell at a fractional pace that was the slowest

in the year to date.

Chinese manufacturers faced a further increase in average input

costs in August. The rate of inflation remained solid overall amid

reports of greater raw material costs. Consequently, companies

partially passed on their higher operating expenses to clients in

the form of higher selling prices.

Although firms generally expect output to rise over the next

year, the degree of optimism edged down to a three-month low in

August.

The survey data suggest that manufacturing growth has continued

to pick up in recent weeks, despite having already returned to its

pre-virus level at the end of the second quarter, Julian

Evans-Pritchard and Sheana Yue, economists at Capital Economics,

said.

In the near-term, continued policy stimulus is set to keep

industrial growth strong, the economists added.

Macroeconomic policy supports are essential, especially when

there are still many uncertainties in domestic and overseas

economies, Wang Zhe, senior economist at Caixin Insight Group said.

Relevant policies should not be significantly tightened.

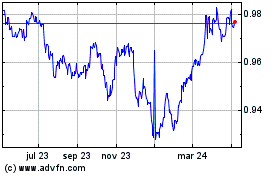

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

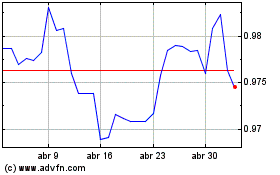

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024