Witan Investment Trust PLC New global manager appointments (0047Y)

04 Septiembre 2020 - 1:00AM

UK Regulatory

TIDMWTAN

RNS Number : 0047Y

Witan Investment Trust PLC

04 September 2020

Witan Investment Trust plc

4 September 2020

Witan Investment Trust - appointment of two Global Growth

managers

Witan's appointment of WCM Investment Management ("WCM") and

Jennison Associates ("Jennison") as new investment managers has now

been completed, with the portfolio transition taking effect during

the latter part of August.

Both US-based managers specialise in high quality and faster

growing companies as well as being signatories to the UNPRI (in

common with Witan and its other managers).

WCM has been allocated $200m to manage (8% of Witan's assets).

Based in Laguna Beach, California, WCM is an independent asset

management firm that runs focused portfolios, comprised of

high-quality businesses with growing economic moats, aligned with

strong, adaptable corporate cultures, and supported by durable

global tailwinds. The portfolio is concentrated in 30 - 40 high

conviction investments with the objective of securing long-term

excess return and downside protection. As an active manager, WCM

believes that their investee companies have meaningful structural

advantages which, when allied with a 'buy and manage' low turnover

approach, will allow long-term outperformance of the relevant

benchmark. As of June 30, 2020, WCM's 62 employees managed $59

billion in client assets.

Jennison has been allocated $100m to manage (4% of Witan's

assets). Mark Baribeau, Head of Global Equities at Jennison

Associates, seeks to invest in a portfolio of market-leading

companies with innovative business models, positively inflecting

growth rates, and long-term competitive advantages. Mark, along

with co-portfolio manager Tom Davis and a team of global sector

analysts, employs a high conviction, concentrated approach that is

sector-, region-, and country-agnostic. The team invests in a

select group of companies with innovative and disruptive businesses

that are driving structural shifts in their respective industries.

They also look for companies with defensible business models and

attractive product offerings, supported by secular demand trends.

The portfolio typically has between 35 and 45 holdings and

securities must meet stringent standards in order to remain or earn

a place in the portfolio.

The portfolios were mainly funded from the sale of a US equity

exchange traded fund (ETF) which had been used as a temporary means

of maintaining market exposure following earlier portfolio changes.

The balance was funded by the sale of a GBP54m UK equity portfolio

managed by Heronbridge Investment Management LLP ("Heronbridge").

Heronbridge has managed part of Witan's portfolio since June 2013,

achieving a total return of 36% (to the end of July 2020), ahead of

the 27% return from the UK equity market over the same period.

Andrew Bell, CEO of Witan Investment Trust said:

"We are delighted to add WCM and Jennison this month to our list

of managers. They specialise in high-conviction investments in

rapidly growing companies and those with increasing competitive

advantages that should enable them to win market share and achieve

superior business results. At the same time, I must thank

Heronbridge for their stewardship of our assets over the past seven

years and the outperformance they have delivered for our

shareholders.

The new global asset allocation that Witan introduced from

January incorporates greater exposure than before to faster growing

parts of the world and economic sectors. These appointments

represent an important further stage in implementing that policy,

providing a degree of specialism that complements the approaches of

our other managers.

Witan's performance had a disappointing start to 2020, when the

Covid-19 lockdown measures affected the portfolio adversely, as

reported on in detail in our interim results last month. Since May,

modest outperformance has resumed, although this is subject to the

usual uncertainties and caveats and neither good nor bad

performance should be extrapolated.

We believe that our equity portfolio offers a balance across

sectors and regions that will reward existing and new investors for

their patience, both in terms of net asset value returns and a

narrowing discount."

Further information on WCM and Jennison is available on the

Company's website at

www.witan.com/about-witan/meet-the-managers/.

- ENDS -

For further information please contact:

Andrew Bell, Chief Executive Officer

Witan Investment Trust plc

Tel: 020 7227 9770

Andrew.Bell@witan.co.uk

James Hart, Investment Director

Witan Investment Trust plc

Tel: 020 7227 9770

James.Hart@witan.co.uk

Alexis Barling, Director of Marketing

Witan Investment Trust plc

Tel: 020 7227 9770

Alexis.Barling@witan.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRUPUBGBUPUGQW

(END) Dow Jones Newswires

September 04, 2020 02:00 ET (06:00 GMT)

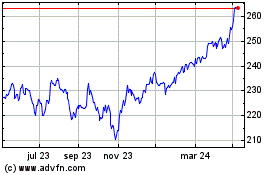

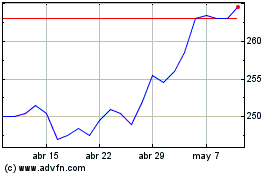

Witan Investment (LSE:WTAN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Witan Investment (LSE:WTAN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024