Pound Falls On No-deal Brexit Fears

06 Septiembre 2020 - 10:54PM

RTTF2

The pound depreciated against its major counterparts in the

Asian session on Monday, as concerns over a no-deal Brexit

intensified after UK Prime Minister Boris Johnson has confirmed a

deadline of October 15 for a free trade deal with the European

Union.

"If London and Brussels don't reach a deal by October, the UK

will be ready to accept this and move on," Johnson said on

Sunday.

The negotiations will resume in London on Tuesday. The talks

have stalled because of deadlock over fishing rights and fair

competition rules.

U.K. chief negotiator David Frost told the Mail on Sunday

newspaper that Britain was "not going to compromise on the

fundamentals of having control over our own laws."

The Financial Times reported that the UK government is set to

announce a legislation that will undermine prospects of a trade

deal.

The so-called internal market bill, expected to be published

Wednesday, would "eliminate the legal force of parts of the

withdrawal agreement" in issues relating to state aid and Northern

Ireland customs union, the report added.

The pound dropped to 1.3198 against the greenback, from a high

of 1.3266 hit at 5:00 pm ET. The next possible support for the

pound is seen around the 1.28 level.

After rising to 140.99 at 8:45 pm ET, the pound edged down to

140.23 against the yen. Should the pound slides further, it may

find support around the 138.00 level.

The GBP/CHF pair hit 1.2061. This followed a gain to 1.2115 at

5:30 pm ET. The pound is seen locating support near the 1.18

mark.

The pound weakened to a 1-week low of 0.8962 versus the euro,

down from a high of 0.8925 seen at 5:30 pm ET. The currency is

poised to challenge support around the 0.92 mark.

U.S. markets are closed for Labor Day holiday.

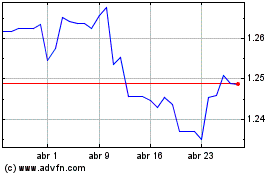

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024