Pound Weakens As Brexit Fears Mount

08 Septiembre 2020 - 1:40AM

RTTF2

The pound fell sharply against its major counterparts in the

European session on Tuesday, amid fears that the UK would leave the

European Union without a trade deal.

The UK and EU negotiators began the latest round of Brexit

negotiations in London today. The talks have stalled because of

deadlock over fishing rights and fair competition rules.

News that the UK is drawing up legislation to override key

elements of the withdrawal agreement further irked the EU. The bill

is due for publication on Wednesday,

The EU warned of a no-trade deal if the U.K. tried to alter the

divorce deal.

Prime Minister Boris Johnson announced October 15 as the

deadline to reach the deal with the EU. His rhetoric raised no-deal

Brexit fears, weighing on the currency.

The pound dropped to 1.3053 against the greenback, its lowest

level since August 14. Next immediate support for the pound is seen

around the 1.28 level.

The GBP/CHF pair reached 1.1995, marking nearly a 2-week low.

The pound is seen finding support around the 1.17 region.

The pound dipped to a 2-week low of 138.75 against the yen from

Monday's closing value of 139.80. The next likely support for the

pound is seen around the 135.00 level.

Second estimate from the Cabinet Office showed that Japan's

economy contracted more than initially estimated in the second

quarter, largely due to a sharp downward revision in capital

investment.

Due to the restrictions imposed to contain the coronavirus

spread, gross domestic product shrank by a record 7.9 percent

sequentially instead of the 7.8 percent fall estimated

initially.

The pound depreciated to a new 2-week low of 0.9040 against the

euro, compared to yesterday's closing quote of 0.8967. On the

downside, 0.92 is possibly seen as its next support level.

Data from Eurostat showed that the euro area economy contracted

less than initially estimated in the second quarter but the pace of

decline was the most since the records began in 1995 due to the

coronavirus containment measures adopted by the member

countries.

Gross domestic product fell by a record 11.8 percent

sequentially but this was revised down from -12.1 percent estimated

initially. GDP had contracted 3.7 percent in the first quarter.

Looking ahead, U.S. consumer credit for July will be featured in

the New York session.

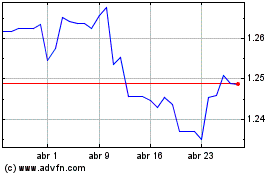

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024