TIDMNWT

RNS Number : 3983Y

Newmark Security PLC

09 September 2020

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR).

Newmark Security plc

("Newmark", the "Company" or the "Group")

Final Results

Newmark Security plc (AIM: NWT), a leading provider of

electronic and physical security systems, is pleased to announce

its audited results for the year ended 30 April 2020.

Highlights

Financial highlights:

-- Revenue was marginally behind last year as communicated in

the interim report at GBP18.77 million (2019: GBP19.58 million), a

decrease of 4%

-- Gross profit increased to 39.7% (2019: 39.3%)

-- Operating Profit before exceptional items was GBP604,000 (2019: GBP638,000)

-- Operating Profit after exceptional items was GBP305,000 (2019: GBP286,000)

-- Tax credit of GBP896,000 (2019: charge GBP25,000)

-- Profit after tax for the year of GBP1,127,000 (2019: GBP189,000)

-- Earnings per share of 0.24 pence (2019: 0.04 pence)

-- Cash generated from operations before exceptional items was GBP1,267,000 (2019: GBP518,000)

-- Investment in development increased to GBP886,000 (2019: GBP333,000)

-- Net Assets of GBP8,302,000 (2019: GBP7,114,000)

Operational highlights:

-- People and Data Management division (Grosvenor Technology)

o Revenues from Human Capital Management (HCM) increased by 32%

to reach GBP9,142,000 (2019: GBP6,908,000)

-- New US HCM contracts signed following the year end are good

signs for the future

o Access Control revenues grew by 4% to GBP4,215,000 (2019:

GBP4,071,000)

-- Existing Access Control Legacy Janus product revenue

increased by 27% whilst Sateon revenue decreased by 19%

-- The new platform Janus C4 was released at the end of the

previous year. The Integrated Security Management and Access

Control product provides a single-platform, multi discipline

solution and reached GBP383,000 of revenue (2019: GBP35,000).

-- Physical Security Solutions division (Safetell)

o Revenue decreased by 37% to GBP5,410,000 (2019: 8,604,000)

from the expected reduction on the Post Office Network

Transformation project combined with the continued decrease in

demand from high street banks and building societies.

o Following the main restructuring in the Physical Security

Solutions division in the prior year a number of strategic reviews

were carried out which have resulted in an improved product

portfolio where we have seen some green shoots of future profitable

growth

Commenting on the results, Maurice Dwek, Chairman of Newmark

Security, said "Whilst the current year results will be adversely

affected by COVID-19, I remain confident that there will be medium

to long-term growth in both our divisions' core markets. In the

People and Data Management division, we continue to build a greater

proportion of recurring revenues, in line with our long-term

strategy. In particular, the provision of Software-as-a-Service

(SaaS) in the HCM sector is likely to increase further, as the

value we can add in enhancing data protection is recognised by new

and existing partners. Our Physical Security Solutions division

continues to benefit from last year's restructure, as we increase

the range of products we offer, through new product development and

certification. With increasing crime rates and the continued threat

of terrorism, our leadership team has also identified new markets

and customers that will firmly position Safetell for future growth.

"

For further information:

Newmark Security plc

Marie-Claire Dwek, Chief Executive Tel: +44 (0) 20 7355

Officer 0070

Graham Feltham, Group Finance www.newmarksecurity.com

Director

Allenby Capital Limited Tel: +44 (0) 20 3328

(Nominated Adviser and Broker) 5656

James Reeve / Liz Kirchner

(Corporate Finance)

Amrit Nahal (Sales & Broking)

CHAIRMAN'S STATEMENT

Overview

It has been a year of real progress for Newmark Security, in

which we have refocused the strategic direction of the Company,

rebranded our US operation, and positioned ourselves for future

growth.

Continued progress and profitability

I am pleased to report a period of continued profitability for

the Group this year, which has been helped by good growth in our

sales in North America. The US represents a lucrative market for

our People and Data Management division, and our US business,

Grosvenor Technology LLC, has been rebranded as 'GT Clocks',

allowing us to market the business and trade under a name that is

more relevant for the US market. It puts a renewed focus on the

provision of timeclocks, alongside the relevant services we can

provide to both manage and maintain the devices remotely and,

importantly, ensure the secure management of our clients' data.

Following a business reorganisation of our Physical Security

Solutions division, Safetell, at the end of the 2019 financial

year, we have seen the division delivering improved gross margins

that have added to the profitability of the Group this year,

despite lower revenue.

Performance in line with management's expectations

Overall performance across the Group during the year has been in

line with expectations, with revenue for the year from operations

slightly down at GBP18,767,000 (2019: GBP19,583,000), despite

COVID-19 impacting trading in the last two months of the financial

year. Profit from operations was GBP305,000 (2019: GBP286,000).

Revenue in the People and Data Management division (Grosvenor)

increased by 22% from GBP10,979,000 to GBP13,357,000, while revenue

in the Physical Security Solutions division (Safetell) decreased by

37% from GBP8,604,000 to GBP5,410,000. A full Financial Review of

our results is included below.

Our people and the response to COVID-19

Although it only affected the latter part of our financial year,

the COVID-19 pandemic had a major impact on our people and the

business, both operationally and financially, particularly in the

final month before year-end. The Board has been extremely pleased

with the rapid response from our management team, and the way they

have acted to keep our people and communities safe, protect and

maintain jobs and protect the business.

I would like to take this opportunity to express the Board's

appreciation to all colleagues for their tremendous efforts during

the year, especially in the light of recent challenges. We have a

strong leadership team, and this has made a real difference as we

continue to prove ourselves as an established leader in markets of

increasing importance in the areas of data and physical

security.

Board and governance

The Board and its Committees maintain a robust governance

framework, using individuals' experience to provide independent

challenge and ensure that good governance is promoted across the

Group. We follow the Quoted Companies Alliance Corporate Governance

Code ("QCA Code"), and details on how the Company applies the

principles of the QCA Code are set out in our Corporate Governance

section of the annual report.

As reported at half-year, our Group Finance Director, Brian

Beecraft, retired during the year. Following a short handover with

Brian, Graham Feltham became Group Finance Director in October

2019.

I was also pleased to welcome Terence Yap as a new Independent

Non-Executive Director in May 2020. He has more than 25 years'

experience in various industries, including Telecommunications,

Security and Smart Cities Development, and is the Chairman of

Guardforce AI, a group focusing on delivering technologically

innovative security solutions within the Asia Pacific region.

Terence further enhances the balance of Directors and the skill

sets available to the Board, and we will benefit greatly from his

strategic advice as we plan the next phase of Newmark's growth.

Going concern

The Board continues to have a reasonable expectation that the

Company and the Group have adequate resources to continue in

operational existence for the foreseeable future. There will be an

impact on the business due to the COVID-19 crisis, as described

above and elsewhere in this report. However, we have worked closely

with our bank (HSBC) and secured financing via a CBILS

government-backed loan to the value of GBP2million, with

opportunities to extend invoice financing and overdraft facilities

if required. Overall, the business has performed better than our

own forecasting had suggested during the COVID-19 period and we are

optimistic that this trend will continue in these uncertain times.

With the post year end securing of two significant customer

agreements, with more in the pipeline, this puts us in a good

position for the next twelve months.

Dividend

The Board is not recommending the payment of a dividend for the

year ended 30 April 2020 (2019: GBPNil).

Outlook

Whilst the current year results will be adversely affected by

COVID-19, I remain confident that there will be medium to long-term

growth in both our divisions' core markets. In the People and Data

Management division, we continue to build a greater proportion of

recurring revenues, in line with our long-term strategy. In

particular, the provision of Software-as-a-Service (SaaS) in the

HCM sector is likely to increase further, as the value we can add

in enhancing data protection is recognised by new and existing

partners.

Our Physical Security Solutions division continues to benefit

from last year's restructure, as we increase the range of products

we offer, through new product development and certification. With

increasing crime rates and the continued threat of terrorism, our

leadership team has also identified new markets and customers that

will firmly position Safetell for future growth.

Maurice Dwek

Chairman

8 September 2020

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

We strengthened our presence in high-growth, specialist markets

in data and security during the 12 months to 30 April 2020.

Following the impact of the COVID-19 pandemic, we are also

developing 'new workplace' solutions that are helping organisations

to re-think the way they work.

Building a sustainable business

Our products have become the industry standard in people and

data security and Newmark Security benefits from long-term

relationships with many blue-chip customers and is generating a

greater proportion of its revenues from recurring services. That is

reflected in a good set of results for the year, and is helping us

to build a business that has long-term stability and sustainability

at its core.

We were pleased with our performance in the year, despite the

impact of COVID-19 at the end of the financial year. We saw a

continued increase in revenue within the People and Data Management

division of 22% to GBP13,357,000 (2019: GBP10,979,000). This

included revenue from Human Capital Management (HCM), which was up

32% to GBP9,142,000 (2019: GBP6,908,000), and revenue from Access

Control, which increased by 4% to GBP4,215,000 (2019:

GBP4,071,000). Revenue in the Physical Security Solutions division

decreased by 37% to GBP5,410,000 (2019: GBP8,604,000), following

the changes we made at Safetell last year. Improved margins and

cost efficiencies meant that Group operating profit before

exceptional items was consistent at GBP604,000 (2019: GBP638,000)

and which resulted in an operating profit after exceptional items

of GBP305,000 (2019: 286,000).

Grosvenor Technology performed very well this year while the

restructure and strategic turnaround at Safetell in the UK has

positioned that business for growth. We are introducing new

products that will help us increase our reach to more customers in

new markets, and I believe we have excellent growth potential

across all our businesses.

The impact of COVID-19

The COVID-19 virus has had an enormous impact on economic and

personal life around the world. It affected Newmark in the last few

months of our financial year, contributing to the modest drop in

revenue compared to last year. While we have seen slowdowns in some

sectors, such as retail and hospitality, other sectors have

remained steady, or even buoyant.

Despite incredibly challenging conditions, the Group continued

to trade in all divisions. Like most businesses, we had to take

very quick action, and I'm immensely proud of the way our people

worked extremely hard to handle different kinds of pressures. They

adapted brilliantly to new ways of working, while we also took the

difficult decision to furlough up to 30% of our colleagues at the

height of the crisis. By employing technology to ensure our

remaining colleagues were able to work seamlessly from home, we

maintained productivity levels throughout and supported the opening

of 40 new accounts.

As the world changed, we knew we had to change too. Safetell,

who have years of experience in supplying screens and products for

banking and the Post Office, created a product line of hygiene

screens and security hatches, which were sold to organisations such

as Amazon and Travis Perkins. We also developed new security

portals with temperature and touchless sensors. Grosvenor

Technology has received enquiries from clients globally looking for

new ways to interact with access control door readers and

traditional timeclocks. As a consequence, we are now marketing a

range of existing and new touchless solutions, such as proximity

cards and facial recognition.

Additional details on the impact of COVID-19 on our business and

people is contained in the annual report.

Overview of Divisional performance

People and Data Management division - continued good

performance

Following its significant growth trend over the last few years,

Grosvenor Technology continued to perform well this year and is the

focus of our investment strategy in the development of new products

and services.

Human Capital Management (HCM) - US operations driving

growth

Our HCM sales in North America delivered the most significant

growth this year. This growth was in line with our expectations, as

our major US clients continued the roll out of Grosvenor

Technology's 'next generation' hardware.

During the year, we rebranded our US business as 'GT Clocks',

which has enabled us to create marketing that is more specific and

relevant for our US customers.

Grosvenor's UK-based HCM business, which serves the rest of the

world outside of North America, also saw a growth in sales, due to

a general uplift across a number of mostly European customers, as

opposed to significant growth from any single client.

We are supporting the growth of the division with increased

investment in new products and services, developing our HCM

software platforms with a Cloud and API (Application Programming

Interface) first approach. A Cloud and API first approach

prioritises utilising a Cloud infrastructure along with APIs to

provide seamless connectivity between back-end and front-end

systems for customers. This development is focused on providing

added services on a Software as a Service (SaaS) basis, which

enables us to create additional value from our hardware

post-deployment. This also allows for a business model where

Software, Services and Terminals are bundled as a 'Clock as a

Service' (ClaaS) offering, generating long-term recurring revenue

potential.

Access Control - move toward an integrated platform

Overall, we delivered revenue growth in Access Control this

year, in part due to price increases in the market. We launched our

new Security Management System (SMS), Janus C4, which was developed

in conjunction with our software development partner based in

Slovakia.

The market is moving away from stand-alone Access Control

solutions, towards integrated Access Control, Intruder, CCTV, Fire

and Building Management, all provided within a single platform. I

believe Janus C4 represents an excellent opportunity for growth,

and the solution has been well received by both existing and

prospective customers. As with all new Access Control sales there

is an inevitable lag between pipeline generation and an upturn in

revenue and to help decrease this lag and to further support

clients adopting the Janus C4 platform, we have invested in

additional training resource.

To rapidly adapt to COVID-19 working environments, we launched

several training courses as online webinars, a move that has been

very popular with installation engineers. While the majority of our

Janus C4 customers and prospects have been new clients, many of our

traditional customers have begun to consider Janus C4 as a natural

next step and some Sateon clients began to migrate to Janus C4

during the period, a trend we expect to continue at additional pace

in future years.

The development of Sateon software is now limited to critical

bug fixes and maintenance, although Sateon product family sales

continue to be bolstered by sales of the OEM variant, used as a

component within our customers offering, of the Sateon Advance.

This allows third parties to use the hardware in a non-proprietary

way on their own access control platforms. We added a second OEM

customer during the year and continue to explore further options

with global third-party access control providers.

Physical Security Solutions division - progress following

strategic review

While Safetell generated considerably lower revenue than last

year, the business achieved increased margins and performed in line

with internal expectations. This slowdown resulted from the

expected reduction in the volume of work as the Post Office Network

Transformation programme came to an end, as well as lower demand

from high street banks and buildings societies and less project

work coming into Safetell's service division.

Safetell has been dominant for many years in the rising screen

market, but we have long recognised the need to diversify its

customer base and product range. That is why we carried out a

full-scale review of the division and, last year, we implemented

significant changes, combining the product and service divisions

and aligning divisional resources into central teams to create a

much leaner organisation that offers real value to our

customers.

During the year, the reorganisation started to bear fruit, and

this is reflected in our improved performance, delivering improved

gross margins that have added to the profitability of the Group.

With increases in crime rates and the continued threat of

terrorism, I am confident the division is well placed to make the

most of opportunities for growth over the next few years and to

gain market share.

People

I would like to convey my personal thanks to all of our

colleagues for playing their part in what has overall been a

successful year for Newmark Security. The changes at Safetell saw

Anton Pieterse, the division's Managing Director, leave the Group

in November 2019. I would like to thank Anton for his long period

of service, and I warmly welcome Paul Lovell to the role. Paul

joined the Group in 1991 working in various capacities and, as an

accountant who qualified with KPMG, he has a wealth of experience

that will benefit and support Safetell as it enters a new period of

growth.

Looking ahead

With lockdown only now beginning to ease, the year has started

slowly. Some clients are understandably taking longer to commit to

activities, or postponing them for an indefinite period. However,

we have many projects ongoing and there are many more we hope to

win again when the time is right. I believe we have adapted well,

both in terms of being able to continue to trade and proactively

implement strategies that have led to Safetell and Grosvenor

Technology receiving new enquiries to cater for the new workplaces

being created by many businesses.

Both divisions are well positioned for a post COVID-19 world,

with existing strategies becoming more relevant than ever before.

Providing safe and secure workplaces will remain a key objective

globally for organisations of every shape and size and we will

continue to invest to meet this need. It remains difficult to say

exactly how the market will develop over the next 12 months, but

we've done what was needed - we've reduced cost in the business,

we've protected our workforce, and we have continued to adapt to

the needs of our customers. The year ahead will be challenging

owing to the COVID-19 impact, but I am sure we have the right

strategy, the best people, and the resources we need to build a

solid platform for future sustainable growth.

Marie-Claire Dwek

Chief Executive Officer

8 September 2020

OUR DIVISIONS - People and Data Management (previously

Electronic Division)

Increase/ Percentage

Divisional revenue 2020 2019 (decrease) change

GBP'000 GBP'000 GBP'000 %

People and Data Management

division

Legacy Janus 1,549 1,218 331 27%

Sateon Advance 2,283 2,818 (535) (19%)

Janus C4 383 35 348 994%

Total Access control 4,215 4,071 144 4%

-------- -------- ------------ -----------

HCM Rest of world 3,238 2,393 845 35%

HCM US 5,904 4,515 1,389 31%

Total HCM 9,142 6,908 2,234 32%

-------- -------- ------------ -----------

Division total 13,357 10,979 2,378 22%

-------- -------- ------------ -----------

Grosvenor Technology enjoyed another year of growth across both

its lines of business and regions, but primarily driven by our

Human Capital Management (HCM) business in North America. In this

region, where we rebranded as 'GT Clocks,' we continued to see

strong performance as the relevance of our specialist offering

gained traction in the sector. The growth trend we have enjoyed in

recent years in this region means our US based business generated

44% of our total revenues for this division.

We have received new enquiries from new and existing HCM vendors

looking not just for hardware, but for an organisation that can

facilitate people-data security solutions. As US state-by-state

legislature pertaining particularly to biometric data evolves, we

are well positioned to take advantage of this growing demand for

data security and management. First and foremost, however, we have

built a reputation for highly reliable and performant hardware and

during this period we opened or continued negotiations with several

'Tier 1' HCM solutions providers considering their next generation

'timeclocks' decisions. We have successfully concluded one

negotiation with a new 'Tier 1' vendor and, with our support, one

of our HCM solution partners also closed another agreement to

supply a major international retailer through an existing partner

in the first half of FY2020/21 potentially worth up to $3.8m over

the next two to three years. The news of the merger between

Ultimate Software and Kronos, which we expect will result in a

transfer of orders away from us over time to the Kronos clock, is

disappointing, however we have benefited from this relationship and

will continue to work with Ultimate into the foreseeable future. As

in previous reports, we still feel the HCM business in the Americas

is our area of greatest opportunity and during the period we

increased our Business Development resource to leverage this.

In our Rest of World HCM business, we also experienced

significant growth, increasing revenues by 35% as we have continued

to grow the strong partnerships with our existing HCM clients, many

of which have increased their spend with us. Although this growth

has largely come from hardware sales, we again have seen increased

enquiries for our subscription 'data management' services, a trend

we expect to see continue in 2020/21.

To cater for, and drive this growing need, we intend to continue

to invest in developing our offering from a Cloud first, to an

eventual cloud only methodology. We remain fully committed to

offering a suite of services to ensure people-data of all types is

completely secure, whether at rest or in transit and we expect this

to be a major recurring revenue generator for years to come.

The period also saw us launch a new mid-tier device (GT4), which

we expect to replace sales of its predecessor timeclock in this

market sector, as well as creating sales from new clients globally.

Following the year end we have received our first major contract

for the GT4, from a US client committed to purchasing a minimum of

3,000 devices and some allied services in the next three years

valued in excess of $1million.

We have also shown positive movement in Access Control (AC)

revenues achieving growth of 4% across our three product

families.

As reported last year, the Sateon platform is considered mature

and complete, with development efforts limited to essential bug

fixes and maintenance. The last iteration of this platform however,

Sateon Advance, is still purchased by many AC installers and

integrators and many of these still install this product into new

projects. This helped limit the decline in sales to 19% and the

line played an important role in sustaining overall AC revenues as

we gain traction in our new product line Janus C4. Our legacy AC

range, Janus, continues to maintain its sales.

The majority of our sales, marketing and training activities

have been linked to promotion of our new product line, Janus C4,

and as a consequence we have seen the burgeoning sales begin to

gain traction. Janus C4 isn't 'just another' AC product. Developed

in collaboration with a Slovakian Security Management System (SMS)

software business it utilises the same class-leading hardware as

our popular Sateon Advance product, but has been designed to take

advantage of the market trend towards the integration of

traditionally disparate offerings such as CCTV, Fire Safety,

Intrusion Detection and Energy Management, to create a completely

seamless, single platform solution that protects buildings and the

people within them, at the same time as reducing energy consumption

and carbon emissions.

OUR DIVISIONS - Physical Security Solutions division (previously

Asset Protection division)

Increase/ Percentage

Divisional revenue 2020 2019 (decrease) change

GBP'000 GBP'000 GBP'000 %

Physical Security Solutions

division

Products 2,695 4,810 (2,115) (44%)

Service 2,715 3,794 (1,079) (28%)

Division total 5,410 8,604 (3,194) (37%)

-------- -------- ------------ -----------

At Safetell, we create safe and secure workplaces for our

customers - designing, installing and maintaining a diverse range

of physical security solutions to a wide range of sectors.

Our security products and services are used in many environments,

including:

* NHS * Education and Local Authorities * Stadia, Leisure and * Government, Police and Pri

Hospitality sons

* Finance, Safety Deposit Centres * Corporate Buildings

and Jewellers * Retail, ATM and Petr * Data Centres and Utilities

ol Forecourts

-------------------------------------- --------------------------- ---------------------------------

A transitional year for our Physical Security Solutions

division

While Safetell is best known for supplying and installing fast

rising screens in the banking sector, our team of industry experts

are here to provide a professional service and a personal response

to all our customers' needs. We carried out a full-scale review and

reorganisation of the division last year and are making good

progress in expanding our product range and widening our customer

base.

However, Safetell remains a business in transition, having

generated significantly lower revenue this year - largely due to

the end of the Post Office Network Transformation programme, and

lower volumes in our traditional client base of banks and building

societies. During the reorganisation, we combined our product and

service divisions, and aligned our divisional resources into

central teams, to create a much leaner organisation that offers

even better value to our customers. This has helped us to improve

our gross margins and maintain performance in line with

expectations prior to the impact of COVID-19.

A simplified, more agile and responsive organisation

Transforming our Safetell business has dramatically reduced

overheads, while simplifying reporting lines and management

structures. This has allowed for quicker and better decision

making, and we are building a much more agile and responsive

operation, which has already been tested during the COVID-19

crisis. Many of our clients operate from critical locations, such

as hospitals, retail sites, financial hubs, and major buildings

(e.g. the Shard in London). Within a week of lockdown in March, we

were designing and supplying new screens and products to meet their

urgent needs during the pandemic.

We are building long-term relationships that our customers

can trust by offering:

Bespoke design Professional Specialist installation Aftersales support

capability to and experienced teams dedicated and extended

help select the project management to working in lifetime warranties

most appropriate teams with specialist disciplined and to maintain our

solutions to knowledge of challenging environments products to the

meet various demanding site highest standards

business needs conditions and

high-risk locations

----------------------- -------------------------- ---------------------

The growth opportunity - what makes Safetell different

The continuing threats of crime and terrorism have made physical

security a priority for businesses in most sectors, while

additional concerns around COVID-19 have increased demand for new

and innovative solutions, as we have all been forced to adapt to

new ways of working together. While we do not foresee a significant

overall growth in the market for physical security products and

services, we are ideally placed to make the most of the growth

opportunities ahead and to gain market share.

As Safetell emerges as a leaner but more energetic and flexible

organisation, we believe we are one of the few businesses of our

type to offer a one-stop shop approach in a fragmented market. Our

new website puts a firm focus on our expanding product range, and

the wide range of bespoke services that gives us a competitive

advantage in the market.

We know that most customers will come to us with a requirement

for a single product, rather than a 'solution', but that can

quickly become an opportunity to upsell. We have extensive

expertise in every product we sell, with highly qualified and

experienced technical engineers who can create the bespoke designed

solutions that will ultimately save our customers money and make

them safer.

This is how we build long-standing client relationships. Unlike

most of our direct competitors, our people are multi-skilled, and

we build ongoing revenue streams through our follow-up services,

which include locksmiths, pneumatic experts, CCTV/speech systems

and much more. We are even able to install third party products

where necessary and support them via a service contract.

While the expansion of the business may not initially come

directly from our service business, we believe that as our product

sales increase, this will drive the integrated service business.

Most of the products we are installing now will generate service

work for Safetell, particularly those products with mechanical

aspects, rather than traditional static elements like screens. This

service offering will help us build recurring revenue streams and

deepen our relationships with customers.

Our fully accredited product portfolio is designed to meet

the changing needs of our customers:

BUILDING SECURITY ASSET PROTECTION ENTRANCE CONTROL OTHER PRODUCTS

------------------------------------------------------------ ---------------------------------------------------------- -------------------------------------------------------

* Manual attack and ballistic resistant cash counters, * Customised cash and asset storage and protection * Certified Secure Portals and Revolving Doors * Counter terror and target hardening solutions

windows and moving security screens

* Cash and speech transfer units * Integrated Speed Gates to control the flow of staff * Range of 'touchless' security solutions

* Bullet resistant doors and partitions and visitors to buildings

* Storage functions to reduce risk of harm or damage to * Other standard and bespoke physical products and

* Interlocking door airlocks a secure environment * Door automation and remote locking solutions services

------------------------------------------------------------ ---------------------------------------------------------- -------------------------------------------------------

FINANCIAL REVIEW

Revenue

Group revenue reduced by (4%) to GBP18.77million (2019:

GBP19.58million). The revenue performance has arrived as expected

at a marginal reduction to last year which, given the impact to the

Group in April 2020 from COVID-19 and the year of transition for

our Physical Security Solutions division, has been a strong

performance. Further commentary and discussion can be found in the

divisional sections.

Key Performance Indicators

Increase/ Percentage

Revenue 2020 2019 (decrease) change

GBP'000 GBP'000 GBP'000 %

People and Data Management

division

Access control 4,215 4,071 144 3.5%

HCM 9,142 6,908 2,234 32.3%

13,357 10,979 2,378 21.7%

Physical Security Solutions

division

Products 2,695 4,810 (2,115) (44.0%)

Service 2,715 3,794 (1,079) (28.4%)

5,410 8,604 (3,194) (37.1%)

Group revenue 18,767 19,583 (816) (4.2%)

-------- -------- ------------ -----------

Gross profit margins have remained consistent at 39.7% (2019:

39.3%). Physical Security Solutions division obtained a gross

profit of 44.4% (2019: 39.6%) and Data and People Management

division reaching 37.8% (2019: 31.2%) the combined weighting of

margins and product mix has resulted in the margins remaining

consistent with last year.

Increase/ Percentage

2020 2019 (decrease) change

GBP'000 GBP'000 GBP'000 %

Gross profit before exceptional

items 7,449 7,765 (316) (4.1%)

Gross Profit before exceptional

items percentage 39.7% 39.7%

Gross profit 7,449 7,705 (256) (3.3%)

Gross profit percentage 39.7% 39.3%

Operating expenses & average employees

Operating expenses before exceptional items have fallen by 4.1%

to GBP6.85million (2019: GBP7.13million). This has mainly been the

result of the restructuring exercise in the Physical Security

Solutions division carried out in the previous year resulting in a

fall in average employees by 27% to 53 (2019: 73) countered by the

growth in the People and Data Management division mainly in

development with further roles in sales, customer services and

marketing resulting in an increase of 13% to 59 employees (2019:

52). Overall average employees have fallen 10% to reach 115 (2019:

128) with a resulting 12% reduction in wages and salaries of

GBP952,000 to GBP6,979,000 (2019: GBP7,931,000).

Exceptional costs

During the year exceptional costs of GBP299,000 (2019:

GBP352,000) were incurred with GBP167,000 (2019: GBP352,000) from a

continuation of streamlining and realignment of positions mainly in

Safetell. Other exceptional costs of GBP132,000 (2019: nil) were

incurred with GBP82,000 of asset impairment as Safetell vacated one

of the division's leased properties. A further GBP50,000 incurred

on a Group rationalisation project which commenced during the year

with an objective of making the Group fit for purpose and

efficient. The overarching objective is to reduce the number of

companies from 17 to 4 unless management identifies a requirement

to keep any of the companies that are currently dormant.

Profitability

Profit before tax grew by GBP17,000 to GBP231,000 (2019:

GBP214,000). At the interim an improved level of profitability was

expected compared to last year, which has been realised. COVID -19

reduced April revenues by an estimated GBP400,000 which resulted in

an estimated fall in gross profit of GBP200,000. Without the impact

of COVID-19 the performance of the Group would have been

significantly improved and exceeded the expectations set at the

time of announcement of our half year results.

Taxation

A tax credit of GBP896,000 (2019: charge GBP25,000) was

recognised in the year. This resulted from a current tax credit of

GBP583,000 (2019: charge GBP45,000) which was recognised following

the review of the Research and Development claim process in the

second half of the year. This resulted in a tax credit of

GBP612,000 being a current year claim of GBP176,000 and revised

claims for prior years of GBP436,000. An additional element of the

claim related to RDEC (Research and Development Expenditure Claim)

which resulted in a GBP75,000 credit shown within operating profit.

A deferred tax credit of GBP313,000 (2019: GBP20,000) was driven by

the recognition of a deferred tax asset relating to losses of

GBP450,000 countered by other movements of (GBP137,000).

Earnings per share

Earnings per share increased by 0.20p to 0.24p (2019: 0.04p).

The increase in earnings per share is mainly attributed to the

current tax credit and the recognition of deferred tax assets

supported by a consistent year on year profit before tax.

Balance sheet

Net assets have increased by GBP1,188,000 to GBP8,302,000 (2019:

GBP7,114,000). This is mainly derived from an increased investment

in development of GBP553,000 and an increase in current and

deferred tax assets of GBP1,000,000. Other working capital

movements contributed by a reduction in debtors of GBP269,000 and a

reduction in trade and other payables of GBP741,000 of which

GBP239,000 of the reduction related to a payment of prior year

restructuring at Safetell and the remainder is due to a reduction

in trading activities around the year end somewhat impacted by

COVID-19. Invoice discounting was utilised by an additional

GBP212,000 to GBP905,000 (2019: 693,000) with the Group's cash

position falling by GBP421,000. The introduction of IFRS 16 Leases

created additional assets of GBP766,000 and an associated

additional liability related to leases previously classified as

operating of GBP848,000 at the end of the year.

Research & Development

The Group has increased its investment by GBP540,000 to

GBP873,000 (2019: GBP333,000) in the People and Data Management

division. The investment has been focused on the cloud development

of GT Connect, our SaaS platform. Clock development continued with

enhancements to our existing GT10 offering and we are excited to

have started development work on our next generation device. We

have continued to work with our software partner on our new Janus

C4 access control product. With the onset of COVID-19 we have

reviewed the extent of our development work and prioritised to

safeguard our cash expenditure.

Cashflow

During the year we have reduced our cash levels by GBP421,000 to

GBP620,000 (2019: GBP1,041,000). Cash generated from operations

before exceptional items increased by GBP749,000, however this

excludes payments of GBP415,000 of lease liability payments now

classified in financing activities following the adoption of IFRS

16. Adjusting for this movement, the like for like increase year on

year is GBP334,000. Exceptional cash payments were made in regard

to both prior and current year employment termination costs of

GBP362,000 (2019: GBP113,000). With other minor variances and the

additional investment in R&D of GBP553,000 the group had a

resulting decrease in cash of GBP421,000.

Post Balance Sheet events

Following a detailed review of the potential impact of COVID-19

on the business Newmark Security PLC entered into a Coronavirus

Business Interruption Loan Agreement with HSBC for a Loan facility

of GBP2,000,000 at a fixed rate of 4.69% for a period of six years

with the first year being interest free under the Business

Interruption Payment Scheme.

CONSOLIDATED INCOME STATEMENT FOR THE YEAR 30 APRIL 2020

2020 2019

Notes GBP'000 GBP'000

Revenue 18,767 19,583

Cost of sales (2019 includes GBP60,000 exceptional

redundancy costs) (11,318) (11,878)

Gross profit 7,449 7,705

Administrative expenses (includes exceptional

costs of GBP299,000 (2019:GBP292,000)) (7,144) (7,419)

Profit from operations before exceptional

items 604 638

Exceptional redundancy costs (167) (352)

Other exceptional costs (132) -

---------------------------------------------------- ------ --------- ---------

Profit from operations 305 286

Finance costs (74) (72)

Profit before tax 231 214

Tax credit/(charge) 3 896 (25)

Profit for the year 1,127 189

--------- ---------

Attributable to:

- Equity holders of the parent 1,127 189

--------- ---------

Earnings per share

- Basic (pence) 0.24 0.04

- Diluted (pence) 0.24 0.04

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

2020 2019

GBP'000 GBP'000

Profit for the year 1,127 189

Foreign exchange on the retranslation of overseas

operation 26 1

Total comprehensive income for the year 1,153 190

-------- --------

Attributable to:

- Equity holders of the parent 1,153 190

-------- --------

The notes in the annual report and accounts form part of these

financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AT 30 APRIL

2020

2020 2019

Note GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 1,262 491

Intangible assets 5,234 4,753

Deferred tax 329 16

Total non-current assets 6,825 5,260

-------- --------

Current assets

Inventory 2,544 2,599

Trade and other receivables 3,664 3,246

Cash and cash equivalents 620 1,041

Total current assets 6,828 6,886

-------- --------

Total assets 13,653 12,146

-------- --------

LIABILITIES

Current liabilities

Trade and other payables 3,246 3,987

Other short-term borrowings 1,351 796

Total current liabilities 4,597 4,783

-------- --------

Non-current liabilities

Long term borrowings 654 149

Provisions 100 100

Total non-current liabilities 754 249

-------- --------

Total liabilities 5,351 5,032

-------- --------

TOTAL NET ASSETS 8,302 7,114

-------- --------

Capital and reserves attributable to equity

holders of the company

Share capital 4,687 4,687

Share premium reserve 553 553

Merger reserve 801 801

Foreign exchange difference reserve (106) (132)

Retained earnings 2,327 1,165

Total attributed to equity holders 8,262 7,074

Non-controlling interest 40 40

TOTAL EQUITY 8,302 7,114

-------- --------

The financial statements were approved by the Board of Directors

and authorised for issue on 8 September 2020.

MC DWEK

Director

The notes set out in the annual report and accounts form part of

these financial statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 30 April 2020

2020 2019

Notes GBP'000 GBP'000

Cash flow from operating activities before

exceptional items

Net profit after tax from ordinary activities 1,127 189

Adjustments for: Depreciation, amortisation

and impairment 1,022 619

Exceptional items* 299 352

Interest expense 74 72

Gain on sale of property, plant and equipment (58) (32)

Share based payment 13 -

Income tax (credit)/expense 3 (896) 25

Operating profit before changes in working

capital and provisions 1,581 1,225

Decrease/(Increase) in trade and other receivables 290 (414)

Decrease/(Increase) in inventories 71 (991)

(Decrease)/increase in trade and other payables (675) 698

Cash generated from operations before exceptional

items 1,267 518

Exceptional items (362) (113)

Cash generated from operations after exceptional

items 905 405

Income taxes paid - (45)

Cash flows from operating activities 905 360

Cash flow from investing activities

Acquisition of property, plant and equipment (150) (196)

Sale of property, plant and equipment 43 53

Research and development expenditure (886) (333)

(993) (476)

-------- --------

Cash flow from financing activities

Principal paid on lease liabilities (2019:

Finance lease payments) (475) (87)

Proceeds from invoice discounting 212 246

Interest paid on lease liabilities (44) (17)

Interest paid (30) (55)

(337) 87

-------- --------

Decrease in cash and cash equivalents (425) (29)

Cash and cash equivalents at beginning of

year 1,041 1,069

Exchange differences on cash and cash equivalents 4 1

Cash and cash equivalents at end of year 620 1,041

-------- --------

*Exceptional items for 2019 have been represented to show cash

paid during the year and allocated from the movement in trade and

other payables. Trade and other payables increase of GBP698,000 was

previously stated at GBP937,000 with GBP239,000 being the unpaid

exceptional items.

The notes set out in the annual report and accounts form part of

these financial statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Amounts

attributable

Foreign to owners

Share Share Merger exchange Retained of the Non-controlling Total

capital premium reserve reserve earnings parent interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 April

2019 4,687 553 801 (132) 1,165 7,074 40 7,114

Impact of IFRS

16 Lease

transition - - - - 22 22 - 22

At 1 May 2019

as restated 4,687 553 801 (132) 1,187 7,096 40 7,136

Profit for the

year - - - - 1,127 1,127 - 1,127

Other

comprehensive

income - - - 26 - 26 - 26

Total

comprehensive

income for

the year - - - 26 1,127 1,153 - 1,153

-------- -------- -------- --------- --------- ------------- ---------------- --------

Transactions

with owners

Share based

payment - - - - 13 13 - 13

As at 30 April

2020 4,687 553 801 (106) 2,327 8,262 40 8,302

-------- -------- -------- --------- --------- ------------- ---------------- --------

At 1 May 2018 4,687 553 801 (133) 976 6,884 40 6,924

Profit for the

year - - - - 189 189 - 189

Other

comprehensive

income - - - 1 - 1 - 1

Total

comprehensive

income for

the year - - - 1 189 190 - 190

-------- -------- -------- --------- --------- ------------- ---------------- --------

As at 30 April

2019 4,687 553 801 (132) 1,165 7,074 40 7,114

-------- -------- -------- --------- --------- ------------- ---------------- --------

The notes set out in the annual report and accounts form part of

these financial statements.

1. Accounting policies

Newmark Security PLC (the "Company") is a public limited company

registered in England & Wales. The consolidated financial

statements of the Company for the year ended 30 April 2020 comprise

the Company and its subsidiaries (together referred to as the

"Group").

Basis of preparation

The financial information has been abridged from the audited

financial information for the year ended 30 April 2020.

The financial information set out above does not constitute the

Company's consolidated statutory accounts for the years ended 30

April 2020 or 2019, but is derived from those accounts. Statutory

accounts for 2019 have been delivered to the Registrar of Companies

and those for 2020 will be delivered following the Company's Annual

General Meeting. The Auditors have reported on those accounts;

their reports were unqualified, did not draw attention to any

matters by way of emphasis without qualifying their reports and did

not contain statements under s498(2) or (3) Companies Act 2006 or

equivalent preceding legislation.

Accounting policies have been consistently applied consistently

with those set out in the 2019 financial statements, as amended

when relevant to reflect the adoption of new standards, amendments

and interpretations which became effective in the year. The only

new standard which had a significant impact on these financial

statements is the adoption of IFRS 16 Leases as set out below.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards ('IFRS'), this announcement does not itself contain

sufficient financial information to comply with IFRS. The Group

will be publishing full financial statements that comply with IFRS

in September 2020.

The following principal accounting policies have been applied

consistently in the preparation of these financial statements:

New standards, interpretations and amendments effective from 1

May 2019

New standards impacting the Group that have been adopted in the

Group annual financial statements for the year ended 30 April 2020,

and which have given rise to changes in the Company's accounting

policies are:

-- IFRS 16 Leases issued January 2016 and effective for annual

periods beginning on or after 1 January 2019 see note 4

No new standards that are not yet effective have been early

adopted or are expected to have a material impact on the Group's

profit or loss.

Going concern

Based on the Group's latest trading, future expectations and

associated cash flow forecasts, the Directors have considered the

Group cash requirements and are confident that the Company and the

Group will be able to continue trading for a period of at least

twelve months following approval of these financial statements.

In August 2021, the Group secured a GBP2million financing

facility from its bankers, HSBC, via the Coronavirus Business

Interruption Loan Scheme ("CBILS"). This loan is for a term of 6

years, with the first year being interest, repayment and covenant

free under the Business Interruption Payment scheme The covenant

requires the Group to deliver a pre-debt service cashflow of 1.2

times the level of debt service commencing for the year end 30

April 2022. Along with existing cash of circa GBP1.25million as at

31 July 2020 and existing overdraft facility of GBP200,000 this

loan financing provides the Group with a healthy cash plus

overdraft position of circa GBP3.45million which the Directors'

believe is more than adequate to continue trading. Other sources of

financing were reviewed with HSBC such as extending the UK invoice

discounting from 85% to 100% coverage, commencing invoice

discounting within the US, as s well as increasing the current

overdraft facility from GBP200,000 to GBP400,000. The Group is

currently operating ahead of expectations, with the first quarter

coming in ahead of budget and a number of new wins secured,

expected to provide further headroom, and therefore have been able

to recommence on-hold development projects without to the need to

pursue these additional financing options further, however they

remain available to the Group subject to the standard approval

processes. The forecasts assumed a short term reduction in trading

due to the UK lockdown earlier in the year, along with remedial

actions implemented to support the Group's cash position. Remedial

actions undertaken relate to staff furlough, staff pay cuts, rent

reductions, re-prioritisation of development expenditure, deferral

of payments to HMRC and reduced overhead expenditure.

Further scenario testing and sensitivity analysis was completed

to model various severe but possible COVID-19 scenarios,

specifically additional lockdowns and prolonged periods of customer

uncertainty. Directors have assessed that the most likely impact on

the Group of these scenarios would be a reduction in revenue

receipts. It was assessed that the Group could absorb the impact of

approximately a prolonged 20% reduction in forecast receipts and

associated materials cost outflows over the next 12 months to

September 2021 without any implementing any cost cutting measures.

This percentage increases to up to 30% when the cost saving impact

of previously utilised remedial actions are taken resulting in a

10-15% saving of cash outflows. Finally Directors modelled the

impact of a second, more severe lockdown period, noting that the

Group could sustain shorter periods of revenue and material cost

reductions of up to 80%.

Owing to the Group's effectiveness in reacting to the first

lockdown and in the, hopefully unlikely, event of a second national

lockdown we are extremely confident that the Group would be able to

respond quickly and effectively with remote working and detailed

review of resourcing requirements. Accordingly, the Directors

consider it appropriate to prepare the financial statements on a

going concern basis.

Leases

IFRS 16 was adopted 1 May 2019 without restatement of

comparative figures. For an explanation of the transitional

requirements that were applied see Note 4.

The following policies apply subsequent to the date of initial

application, 1 May 2019. Lease liabilities are measured at the

present value of the contractual payments due to the lessor over

the lease term, with the discount rate determined by reference to

the rate inherent in the lease unless (as is typically the case)

this is not readily determinable, in which case the group's

incremental borrowing rate on commencement of the lease is used.

Variable lease payments are only included in the measurement of the

lease liability if they depend on an index or rate. In such cases,

the initial measurement of the lease liability assumes the variable

element will remain unchanged throughout the lease term. Other

variable lease payments are expensed in the period to which they

relate.

On initial recognition, the carrying value of the lease

liability also includes:

-- amounts expected to be payable under any residual value guarantee;

-- the exercise price of any purchase option granted in favour

of the Group if it is reasonable certain to assess that option;

-- any penalties payable for terminating the lease, if the term

of the lease has been estimated on the basis of termination option

being exercised.

Right of use assets are initially measured at the amount of the

lease liability, reduced for any lease incentives received, and

increased for:

-- lease payments made at or before commencement of the lease;

-- initial direct costs incurred; and

-- the amount of any provision recognised where the group is

contractually required to dismantle, remove or restore the leased

asset (typically leasehold dilapidations)

Subsequent to initial measurement lease liabilities increase as

a result of interest charged at a constant rate on the balance

outstanding and are reduced for lease payments made. Right-of-use

assets are amortised on a straight-line basis over the remaining

term of the lease or over the remaining economic life of the asset

if, rarely, this is judged to be shorter than the lease term. When

the Group revises its estimate of the term of any lease (because,

for example, it re-assesses the probability of a lessee extension

or termination option being exercised), it adjusts the carrying

amount of the lease liability to reflect the payments to make over

the revised term, which are discounted using a revised discount

rate. The carrying value of lease liabilities is similarly revised

when the variable element of future lease payments dependent on a

rate or index is revised, except the discount rate remains

unchanged. In both cases an equivalent adjustment is made to the

carrying value of the right-of-use asset, with the revised carrying

amount being amortised over the remaining (revised) lease term. If

the carrying amount of the right-of-use asset is adjusted to zero,

any further reduction is recognised in profit or loss.

All leases are accounted for by recognising a right-of-use asset

and a lease liability except for:

-- Leases of low value assets; and

-- Leases with a duration of 12 months or less.

2. Segment information

Description of the types of products and services from which

each reportable segment derives its revenues

The Group has two main reportable segments:

-- People and Data Management division (previously called the

Electronic division) - This division is involved in the design,

manufacture and distribution of access-control systems (hardware

and software) and the design, manufacture and distribution of HCM

hardware only, for time-and-attendance, shop-floor data collection,

and access control systems. This division contributed

71.2 per cent. (2019: 56.1 per cent.) of the Group's

revenue.

-- Physical Security Solutions division (previously called the

Asset Protection division) - This division is involved in the

design, manufacture, installation and maintenance of fixed and

reactive security screens, reception counters, cash management

systems and associated security equipment. This division

contributed 28.8 per cent. (2019: 43.9 per cent.) of the Group's

revenue.

Factors that management used to identify the Group's reportable

segments

The Group's reportable segments are strategic business units

that offer different products and services. The two divisions are

managed separately as each involves different technology, and sales

and marketing strategies. Operating segments are reported in a

manner consistent with the internal reporting provided to the chief

operating decision maker.

Segment assets and liabilities exclude group company

balances.

People Physical

and Data Security

Management Solutions

division division Total

2020 2020 2020

GBP'000 GBP'000 GBP'000

Revenue from external customers 13,357 5,410 18,767

------------ ----------- --------

Finance cost 50 24 74

Depreciation 324 280 604

Amortisation 405 - 405

Segment profit before income tax 1,623 (12) 1,611

------------ ----------- --------

Additions to non-current assets 999 132 1,131

Disposal of non-current assets - 159 159

Reportable segment assets 10,250 2,961 13,211

Reportable segments liabilities 3,022 1,782 4,804

People Physical

and Data Security

Management Solutions

division division Total

2019 2019 2019

GBP'000 GBP'000 GBP'000

Revenue from external customers 10,979 8,604 19,583

------------ ----------- --------

Finance cost 50 10 60

Depreciation 87 194 281

Amortisation 314 - 314

Segment profit before income tax 1,035 321 1,356

------------ ----------- --------

Additions to non-current assets 454 310 764

Disposal of non-current assets - 21 21

Reportable segment assets 9,216 3,113 12,329

Reportable segments liabilities 2,499 1,984 4,483

Reconciliation of reportable segment revenues, profit or loss,

assets and liabilities to the Group's corresponding amounts:

2020 2019

GBP'000 GBP'000

Revenue

Total revenue for reportable segments 18,767 19,583

Profit or loss before income tax expense

Total profit or loss for reportable

segments 1,611 1,356

Parent company salaries and related

costs (755) (596)

Other parent company costs (625) (540)

Profit before income tax expense 231 220

Corporation taxes 896 (25)

Profit after income tax expense 1,127 195

-------- --------

Assets

Total assets for reportable segments 13,211 12,329

Parent company assets * 442 (183)

Group's assets 13,653 12,146

-------- --------

Liabilities

Total liabilities for reportable segments 4,804 4,483

Parent company liabilities 547 549

Group's liabilities 5,351 5,032

-------- --------

*PLC bank overdraft is set off against other group cash balances

and has therefore been included within the asset line owing to an

offsetting arrangement that is in place with HSBC.

There was one customer that accounted for more than 10% of Group

revenue at GBP3.5million (2019: no customer had greater than 10% of

revenue).

Geographical information:

Non-current assets

by location of assets

2020 2019

GBP'000 GBP'000

UK 6,456 5,243

USA 40 1

6,496 5,244

------------ -----------

Reportable Reportable

segment Group segment Group

totals PLC Totals totals PLC Totals

2020 2020 2020 2019 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Other material items

Additions to non-current

assets 1,131 43 1,174 764 7 771

Disposals non-current

assets 159 66 225 21 - 21

Depreciation and amortisation 1,009 14 1,023 595 24 619

3. Tax

2020 2019

GBP'000 GBP'000

Current tax expense

UK corporation tax on profit for the

year (176) 42

Overseas corporation tax 29 3

Adjustment to provision in prior periods (436) -

(583) 45

-------- --------

Deferred tax expense

Origination and reversal of temporary

differences 137 (20)

Recognition of previously unrecognised

deferred tax assets (450) -

(313) (20)

-------- --------

Total tax (credit) / charge (896) 25

-------- --------

The reasons for the differences between the actual tax credit

for the year and the standard rate of corporation tax in the UK

applied to profits for the year are as follows:

2020 2019

GBP'000 GBP'000

Profit for the year 1,127 189

Income tax charge/(credit) for the year (896) 25

Profit before income tax 231 214

-------- --------

Expected tax credit based on the standard

rate of corporation tax in the UK of 19.0

per cent. (2019: 19.0 per cent) 44 41

Research and development allowances (176) (82)

Effects on profits on items not taxable or

deductible for tax purposes 23 (3)

Recognition of previously unrecognised deferred

tax assets (450) -

Utilisation of unrecognised deferred tax 61 -

Temporary differences on deferred tax liabilities 35 25

Different tax rates applied in overseas

jurisdictions 3 41

Adjustments for tax credit relating to previous

periods (436) 3

Total tax (credit)/charge (896) 25

-------- --------

The Group has the following tax losses, subject to agreement by

HMRC Inspector of Taxes, available for offset against future

trading profits as appropriate:

2020 2019

GBP'000 GBP'000

Management expenses 185 199

Trading losses 4,678 5,178

4,863 5,377

-------- --------

2020 2019

A deferred tax asset has not been recognised

for the following GBP'000 GBP'000

Management expenses - 34

Trading losses 338 744

338 778

-------- --------

4. Lease transition

The group mainly enters into leases for properties, vehicles and

office equipment such as photocopiers. In the assessment of the

right of use asset valuation management consider available

extension and termination options and apply the most likely

contract end date that will be utilised.

On implementation of IFRS 16 Leases the modified retrospective

approach was adopted, where leases were measured from lease

commencement using the discount rate applicable at the date of

transition on 1 May 2019. Practical expedients were taken for short

term leases that had less than 1 year remaining and low value

leases. The group recognised the following adjustments through

reserves. The weighted average discount rate was 3.2%.

Property,

plant

and Lease

equipment liabilities Reserves

As at 30 April 2019 491 (252) 1,165

Right of use asset recognised 1,202 (1,180) 22

As at 1 May 2019 1,693 (1,432) 1,187

----------- ------------- ---------

Total

GBP'000

Minimum operating lease commitment at 30 April

2019 1,382

Short term lease not included in IFRS 16 transition (30)

Less effect of discounting using the incremental

borrowing rate as at 1 May 2019 (172)

Lease liability for leases classified as operating

under IAS 17 1,180

Leases previously classified as finance under

IAS 17 252

1,432

--------

5. Subsequent events

Following a detailed review of the potential impact of COVID-19

on the business Newmark Security PLC entered into a Coronavirus

Business Interruption Loan Agreement with HSBC for a Loan facility

of GBP2,000,000 at a fixed rate of 4.69% for a period of six years

with the first year being interest free under the Business

Interruption Payment Scheme.

6. Dividends

The Directors are not proposing a final dividend (2019: nil

pence).

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SSMFUAESSEEU

(END) Dow Jones Newswires

September 09, 2020 02:00 ET (06:00 GMT)

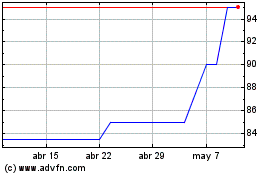

Newmark Security (LSE:NWT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Newmark Security (LSE:NWT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024