TIDMMERC

Mercia Asset Management PLC

18 September 2020

RNS REACH 18 September 2020

Mercia Asset Management PLC

("Mercia")

Life Sciences' Portfolio Update

Mercia Asset Management PLC (AIM: MERC), the proactive,

regionally focused, specialist asset manager, is pleased to provide

an update on the Life Sciences investments within both its balance

sheet and managed funds' portfolios.

Life Sciences investments accounted for seven out of the top 20

direct investments as at 31 March 2020 and their cumulative fair

value of GBP28.6million represented 32.7% of the total portfolio by

value.

All of Mercia's Life Sciences direct investments originated from

its third-party managed funds and in addition to these investments,

Mercia has a further c.40 Life Sciences investments across its

third-party managed funds.

In the current financial year to date GBP4.2million has been

invested into six Life Sciences direct investments, with a further

GBP1.6million invested by Mercia's managed funds.

Direct investments

Oxford Genetics Ltd ("OXGENE") - Third consecutive year of 100%+

revenue growth

-- 30.2% fully diluted direct investment stake as at 31 March

2020 with a further c.10% fully diluted stake held by Mercia's

managed funds

OXGENE, based in Oxford, is a biotechnology company specialising

in gene therapy, gene editing and antibody discovery that delivered

a third consecutive year of 100%+ revenue growth, more than

doubling revenues in its financial year ended 30 April 2020. This

continued growth has been fuelled by a combination of strategic

licensing agreements and service delivery projects, including a

strategic partnership with Fujifilm Diosynth Biotechnologies. The

company's continued growth has been recognised recently by The

Sunday Times' Fastest Growing Tech 100 at position 19.

Medherant Ltd ("Medherant") - Novel transdermal drug

delivery

-- 30.1% fully diluted direct investment stake as at 31 March

2020 with a further c.16% fully diluted stake held by Mercia's

managed funds

Warwickshire-based Medherant, which was spun out of the

University of Warwick, is a developer of transdermal

drug-in-adhesive patches using a novel adhesive. In May 2020 the

company announced that it had signed an agreement to develop and

commercialise multiple products using the TEPI Patch(R) technology

for the global commercial-stage pharmaceutical company Cycle

Pharmaceuticals Ltd ("Cycle"). Cycle focuses on rare diseases and

intends to utilise Medherant's technology to develop formulations

that will address the unmet needs of patients with conditions such

as dysphagia and dyskinesia. As interest continues in Medherant's

platform technology, the company has recently secured an additional

large pharma evaluation agreement. In parallel, Medherant is

developing an internal candidate patch which is expected to go into

clinical trials in 2021, addressing a market estimated at

c.$1billion per annum. In June 2020, the company completed on a

syndicated investment round of GBP2.8million of which Mercia made a

direct investment of GBP1.4million.

Locate Bio Ltd ("Locate") - Appointment of CEO and funding

-- 17.4% fully diluted direct investment stake as at 31 March

2020 with a further c.17% fully diluted stake held by Mercia's

managed funds

Locate, a spinout from the University of Nottingham and based at

MediCity in Nottinghamshire, is a regenerative medicine company

focused on orthobiologics. It received a GBP2.3million syndicated

investment in July 2020 and has recently appointed as CEO John von

Benecke who brings executive experience from ApaTech Ltd, a leading

UK orthobiologics success story, which was sold for c.$330million

to Baxter.

Locate's first product, at pre-clinical stage, will help

patients who require spinal fusion surgery to overcome low back

pain by using a type of bone protein to achieve the fusion. Its

second therapy will be for the biological renewal of the

intervertebral disc and will help those suffering from degenerative

disc disease, which affects c.33million people in the US and

EU.

In July 2020, Locate secured a syndicated investment of

GBP2.5million of which Mercia made a direct investment of

GBP0.8million.

MIP Diagnostics Ltd ("MIP") - GBP5.1million syndicated funding

round in July 2020 to accelerate global expansion.

-- 3.3% fully diluted direct investment stake currently with a

further c.30% fully diluted stake held by Mercia's managed

funds

MIP, which is a spinout from the University of Leicester and

located in Bedford, has developed a proprietary process to provide

Molecular Imprinted Polymers ("MIPS") to the vitro diagnostic,

bioprocessing and oil and gas industries. The company develops and

manufactures synthetic affinity reagents - polymers that are

designed to bind to specific target molecules for detection,

purification or extraction purposes. In July 2020, Mercia made its

first direct investment in a GBP5.1million syndicated funding round

to accelerate MIP's global expansion. The company recently

announced a partnership with Stream Bio to develop a rapid COVID-19

viral infection detection assay.

The Native Antigen Company Ltd ("NAC") - Evidence of Mercia's

model in action

-- Sale announced in July 2020, achieving an 8.4x return on original direct investment cost

In keeping with Mercia's model of providing a return to

third-party managed fund investors and looking to exit its direct

investments within a three to seven-year period, Mercia was pleased

to exit this investment fully in July 2020. NAC, a leading producer

of infectious disease reagents that include antigens for COVID-19

antibody test kits, was sold to global life sciences tools company

LGC in July 2020 for a total cash consideration of up to

GBP18.0million.

NAC was originally a divestiture from Hybrid Systems, a

University of Birmingham spinout of which Mercia was a founding

investor via its managed funds. The sale generated, on its original

direct investment cost, an 8.4x return and a 65% internal rate of

return ("IRR") and, on a blended third-party managed funds

investment cost, a 12.1x return a 31% funds IRR.

Third-party managed funds investments

The following is a selection of promising businesses within

Mercia's third-party managed funds, which represent potential

future candidates for Mercia's direct investment portfolio.

Abingdon Health Ltd ("Abingdon") - Leading the UK Rapid Test

Consortium ("UK-RTC")

-- Mercia's managed funds hold fully diluted stakes totalling c.23%

This York-based medical device manufacturer that is leading the

UK-RTC has recently received its CE mark for the SARS-CoV-2 virus

("COVID-19") rapid antibody tests which it developed. The

AbC-19(TM) Rapid Test for detection of IgG antibodies to COVID-19

is now available for distribution for professional use. Abingdon

reached design freeze for the AbC-19(TM) lateral flow test for IgG

antibodies to COVID-19 in June 2020 after which it fast-tracked

development and secured European CE Mark approval in just 14 weeks.

This process would normally take 10 months or more to complete. The

company is targeting to produce 0.5million COVID-19 antibody tests

per month from October 2020 and 1.0million tests per month from

January 2021.

Sense Biodetection Ltd ("Sense") - Accelerated programme to

launch the first instrument-free, point-of-care, molecular

diagnostic test for COVID-19

-- Mercia's managed funds hold fully diluted stakes totalling c.15%

With operations in the UK (in Oxford and Cambridge) and the US

(in Boston), Sense is focused on the development of instrument-free

molecular diagnostics delivering true point-of-care molecular

testing. Just under 12 months ago Sense raised GBP10.5million in

Series A investments and concurrently secured a grant of

GBP1.8million from Innovate UK. In March 2020 Sense announced an

accelerated programme to launch the world's first instrument-free,

point-of-care molecular diagnostic test for COVID-19, partnering

with Phillips-Medisize (a leading global medical device innovator,

developer and manufacturer, owned by Molex) to scale up production

of its testing to meet the growing demand for rapid

diagnostics.

Medovate Ltd ("Medovate") - Named as one of 2020's 'Leading

Innovators in Medical Device Development' in Global Health &

Pharma's ("GHP") 2020 Global Excellence Awards

-- Mercia's managed funds hold fully diluted stakes totalling c.30%

Based in Cambridge, Medovate is a medical device company focused

on the development, manufacture and commercialisation of innovative

medical technologies created within the National Health Service

("NHS"). The company, which received GBP4.5milion of investment

from Mercia's Northern VCT Funds in 2017, is making considerable

commercial progress. Since April 2020, it concluded agreements with

four US-based companies to act as the exclusive distributors for

its FDA-approved Safer Injection for Regional Anaesthesia

("SAFIRA") innovation across the US. In September 2020, the company

secured European CE Mark approval for SAFIRA and a further

agreement was concluded with Brisbane-based LTR Medial, which will

provide exclusivity in Australia and New Zealand.

Mark Payton, Chief Executive Officer at Mercia, commented:

"The Life Sciences sector represents a significant growth area

in the UK's regions and is well positioned to benefit from current

trends. We are excited by the progress we are seeing in both our

direct investments and managed funds, and the potential of our

portfolio demonstrates the value and innovation in th e UK

healthcare sector. Today's update is an important indicator that

the life sciences community is predominantly located outside of

London and that not only is it resilient, but it is fast

growing.

"Mercia has demonstrated its ability to identify investment

opportunities to which others do not have access. By continuing to

invest and nurture early-stage regional Life Sciences businesses,

we make it possible for the UK's technology industry to have a real

impact in tackling global issues, build regional employment and

create demonstrable shareholder value."

-Ends-

For further information, please contact:

Mercia Asset Management PLC

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial Officer +44 (0)330 223

www.mercia.co.uk 1430

Canaccord Genuity Limited (NOMAD and Joint +44 (0)20 7523

Broker) 8000

Simon Bridges, Emma Gabriel, Richard Andrews

N+1 Singer (Joint Broker)

+44 (0)20 7496

Harry Gooden, James Moat 3000

+44 (0)20 3727

FTI Consulting 1051

Tom Blackwell, Louisa Feltes, Shiv Talwar

mercia@fticonsulting.com

About Mercia Asset Management PLC:

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of balance

sheet, venture, private equity and debt capital: the Group's

'Complete Connected Capital'. The Group initially nurtures

businesses via its third-party funds under management, then over

time Mercia can provide further funding to the most promising

companies, by deploying direct investment follow-on capital from

its own balance sheet.

The Group has a strong UK footprint through its regional

offices, 19 university partnerships and extensive personal

networks, providing it with access to high-quality deal flow.

Mercia currently has c.GBP800million of assets under management

and, since its IPO in December 2014, has invested over GBP96million

into its direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the epic

"MERC".

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Private

Policy.

END

NRAUBUKRRNUKAAR

(END) Dow Jones Newswires

September 18, 2020 02:00 ET (06:00 GMT)

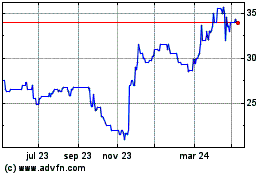

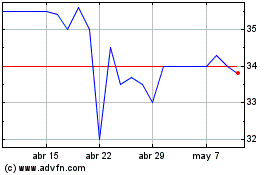

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024