TIDMPEG

RNS Number : 9218Z

Petards Group PLC

24 September 2020

24 September 2020

Petards Group plc

("Petards", "the Group" or "the Company")

Interim results for the six months ended 30 June 2020

Petards Group plc (AIM: PEG), the AIM quoted developer of

advanced security and surveillance systems, is pleased to report

its interim results for the six months ended 30 June 2020.

Key Highlights:

-- Operational

o Order book at 30 June 2020 over GBP12 million (H1 2019: GBP15

million)

o First half 2020 eyeTrain revenues impacted by COVID-19 related

factors

o All other Group operational performances ahead of H1 2019

o QRO acquisition of NASBox ANPR technology rights for

GBP149,000

o Significant reduction in the Group's on-going cost base

-- Financial

o Revenue GBP7.1 million (H1 2019: GBP8.9 million)

o Gross margin 34.4% (H1 2019: 35.9%)

o Adjusted EBITDA GBP337,000 (H1 2019: GBP625,000)(1)

o Adjusted post-tax loss GBP164,000 (H1 2019 profit:

GBP65,000)(2)

o Post-tax loss GBP469,000 (H1 2019: profit GBP65,000)

o Cash generated from operating activities GBP1,802,000 (H1

2019: GBP584,000 cash used)

o Net funds at 30 June 2020 increased to GBP1.0 million (31 Dec

2019: net debt GBP0.5 million)

o Renewal of Group's banking facilities to June 2022

o Diluted EPS 0.82p loss (H1 2019: 0.11p earnings)

(1. Earnings before financial income and expenses, tax,

depreciation, amortisation, share based payment charges and

exceptional restructuring costs.)

(2. Adjusted for exceptional restructuring costs of

GBP305,000.)

Commenting on the current outlook, Raschid Abdullah, Chairman,

said:

"The Group's strong cash performance in the first half of 2020

has strengthened the balance sheet and its undrawn GBP0.75 million

revolving credit facility was renewed in June for a further two

years. The closing order book at 30 June 2020 of over GBP12 million

continues to provide a solid base to build upon, although given the

uncertain business environment the provision of forward guidance

remains extremely challenging."

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 and is

disclosed in accordance with the Company's obligations under

Article 17 of those Regulations.

Contacts:

Petards Group plc www.petards.com

Raschid Abdullah, Chairman Mb: 07768 905004

WH Ireland Limited, Nomad and www.whirelandcb .com

Joint Broker

Mike Coe, Chris Savidge Tel: 0207 220 1666

Hybridan LLP, Joint Broker www.hybridan.com

Claire Louise Noyce Tel: 020 3764 2341

claire.noyce@hybridan.com

Chairman's statement

Given the extremely challenging trading conditions I referred to

in my last statement, the Group made solid progress in the first

six months of 2020. While the results for the period were below our

expectations at the start of the year and have been affected by the

COVID-19 pandemic, they are much improved compared with those

reported for the second half of 2019.

Revenues for the six months to 30 June 2020 totalled GBP7.1

million and while down on the same period last year (H1 2019:

GBP8.9 million), they were ahead of those for the second half of

2019. More importantly the Group recorded adjusted earnings before

interest, tax, depreciation, amortisation, share based payment

charges and restructuring costs ("Adjusted EBITDA") of GBP337,000

and generated net cash from operations of GBP1.8 million, an

improvement over the results of the preceding six months (6 months

31 Dec 2019: EBITDA loss GBP906,000; net cash generated GBP0.7

million).

The Group closed the first half year with a strong cash

position, with cash balances of GBP2.2 million and net funds of

GBP1.0 million (31 Dec 2019: GBP0.8 million cash balances and

GBP0.5 million net debt).

Business overview

Petards' operations continue to be focused upon the development,

supply and maintenance of technologies used in advanced security,

surveillance and ruggedised electronic applications, the main

markets for which are:

-- Rail Technology - software driven video and other sensing

systems for on-train applications sold under the eyeTrain brand to

global train builders, integrators and rail operators, and

web-based real-time safety critical integrated software

applications supporting the UK rail network infrastructure sold

under the RTS brand;

-- Traffic Technology - Automatic Number Plate Recognition

(ANPR) systems for lane and speed enforcement and other

applications, and UK Home Office approved mobile speed enforcement

systems, sold under the QRO and ProVida brands to UK and overseas

law enforcement agencies and commercial customers; and

-- Defence Services - electronic countermeasure protection

systems, mobile radio systems and related engineering services sold

predominantly to the UK Ministry of Defence (MOD).

Operating review

Against the backdrop of COVID-19, the first six months of 2020

included some aspects which adversely affected the performance of

the Group's business, primarily revenues and order intake relating

to eyeTrain systems. However, the period closed with increased

revenues and profits for all of the Group's other areas of

business, together with a record order intake at QRO and the

acquisition of a new product line.

The Group's eyeTrain revenues in the first half experienced

delays due to customer driven production re-scheduling, and reduced

spares volumes due to fewer train services running post lock down

and the dramatic reduction in passenger numbers. Following on from

the cost reductions commenced in 2019, and given the changed market

conditions in 2020, a further significant reduction in eyeTrain's

cost base has been undertaken at a cost of GBP305,000, to realign

it to the supply of our present product range. Productivity is a

key measurement and we continue to explore areas where this metric

can be further improved.

The Department for Transport (DfT) has recently announced the

end of the UK rail franchising system that has been in place for

almost a quarter of a century. Until a new system of operating is

put in place, train operators have been placed on transitional

contracts first initiated following the pandemic. Together with yet

to be published recommendations from the Williams' Review, this

lack of certainty for the industry is likely to affect the demand

and timing of orders for new trains. However, undoubtedly some

level of orders will continue to be placed and we were pleased to

finalise an initial two-year maintenance contract with Siemens

Mobility UK for the provision of technical and software support,

servicing and repairs for eyeTrain systems fitted to Siemens Desiro

City trains used on Thameslink and Moorgate services.

RTS's software business performed well in the period, with

revenues two-thirds higher than in the same period in 2019. It

benefits from a high level of recurring revenues and underpinned

these when in May it secured the renewal of an existing software

support services contract with one of its major rail infrastructure

customers. The renewed contract commenced in June 2020 and extends

support for a further four years to June 2024.

QRO had an exceptional first half year and has been growing its

Traffic Technology product portfolio through both technology

acquisitions and in-house development. Revenues from systems and

support services were up by 34% and its profit contribution to the

Group was up threefold on the same period in 2019. These increased

revenues came from both systems supply and from service and support

activities, primarily in support of UK Police Forces, and during

the period QRO expanded its facilities at its Northamptonshire site

to support this and future growth.

As was announced in May, QRO acquired the software and hardware

intellectual property rights to Nexus ANPR Smart Box ("NASBox") for

GBP149,000 cash plus an on-going royalty, with the first

post-acquisition sales being that month. The NASBox solution

creates a fully compliant and cost effective roadside ANPR system

when interfaced with commercial off-the-shelf cameras, such as

QRO's latest competitively priced ANPR camera offering. Orders and

sales to date have been pleasing and we consider NASBox to be a

valuable addition to the Group's portfolio that will provide

opportunities to continue the growth in Traffic Technology.

Defence Services also delivered higher revenues and profit

contribution in the period than in the first six months of 2019.

The Group's core engineering service contracts with the MOD

continue to provide the bedrock of Defence Services revenues, with

the growth having arisen in two areas. The first was the earlier

than scheduled delivery of just over half of the GBP1.1 million

contract for electronic countermeasures equipment for a MOD

programme to which I referred in the 2019 Annual Report. The second

related to higher levels of engineering services for a specific

mobile radio systems project.

The Group has been seeking to develop its Defence Services

offering and encouragingly the MOD recently confirmed that the

eyeCraft360 spherical video systems developed by Petards had

completed successful trials in partnership with the British Army's

Armoured Trials and Development Unit. It is hoped that the

successful completion of the trials will generate increased

interest in eyeCraft360 and that this leads to it becoming an

essential component in providing the best available protection for

military personnel in the UK and other approved markets.

Financial review

Operating performance

Revenues for the six months ended 30 June 2020 totalled GBP7.1

million (H1 2019: GBP8.9 million). As reported above, revenue

increases for Traffic Technology, Defence Services and Rail

infrastructure software were insufficient to offset the reduction

in deliveries of eyeTrain systems and spares.

The Group gross profit margin was slightly lower at 34.4% (H1

2019: 35.9%). Of the two eyeTrain projects on which cost provisions

were taken at the 2019 year-end, one was fully installed within the

revised cost budget, and the other is on target to be similarly

completed. However, the much lower than usual margin on these

projects affected the overall gross profit margin in the first

half.

Before exceptional restructuring costs of GBP0.3 million,

administrative expenses were down 15% to GBP2.6 million (H1 2019:

GBP3.1 million) reflecting the measures taken to date to reduce

eyeTrain headcount. At 30 June 2020 GBP170,000 of the restructuring

costs had been settled in cash with the balance being paid in the

second half of the year.

Adjusted EBITDA for the period was GBP337,000 (H1 2019:

GBP625,000), and with amortisation and depreciation charges at

similar levels to the prior year, the Group incurred an operating

loss of GBP468,000 after exceptional restructuring charges (H1

2019: GBP114,000 profit). Net financial expenses, which

predominantly relate to the Group's term loan and lease

liabilities, totalled GBP38,000 (H1 2019: GBP49,000).

After a net tax credit of GBP37,000 (H1 2019: GBPnil), the

Group's loss after tax was GBP469,000 (H1 2019: GBP65,000 profit).

The tax credit related to the recognition of the Group's net

deferred tax assets at the newly enacted rate of 19% effective from

April 2020, and differences in the rate at which recognised tax

losses were surrendered for R&D credits during 2020. The basic

and diluted loss per share was 0.82p (H1 2019: earnings of

0.11p).

Cash, cash flow and net debt

The Group generated net cash from operating activities in the

period of GBP1.8 million (H1 2019: GBP0.6 million cash used) after

the payment of restructuring costs. This positive cash performance

reflected a reduction in working capital of GBP0.7 million and the

benefit of R&D tax credit receipts of GBP1.0 million.

The overall increase in cash for the period was GBP1.3 million

(H1 2019: GBP1.3 million decrease) and as anticipated, cash

outflows from investing activities were much lower than the first

half of 2019. Investment in development expenditure totalled GBP0.1

million (H1 2019: GBP0.5 million) and the initial GBP0.1 million

instalment was paid in respect of the acquisition of the NASBox

intellectual property rights.

After repayments of debt and interest of GBP0.2 million (H1

2019: GBP0.2 million), cash balances increased to GBP2.2 million at

30 June 2020 (31 Dec 2019: GBP0.8 million).

Net funds at 30 June 2020, after deducting the Group's term loan

and lease liabilities, had also much improved and totalled GBP1.0

million (December 2019: GBP0.5 million net debt).

Outlook

While to date 2020 has certainly proved to be an extremely

challenging period as being experienced by many other companies, I

am pleased that progress is being made by the Group. Other than the

impact of the pandemic and delays on its eyeTrain business, the

Group's operations returned a good performance in the first half of

2020. Further action was taken to reduce the cost base of the

eyeTrain business in the first half, the benefits of which are

expected to filter through in the final quarter of the year.

The strong order performance in Traffic Technology from the

Police sector seen in the first half year is expected to continue

in the coming months. Bid levels within Defence Services have

improved, and there remain some potential business opportunities

for eyeTrain.

The Group's strong cash performance in the first half of 2020

has strengthened the balance sheet and its undrawn GBP0.75 million

revolving credit facility was renewed in June for a further two

years. The closing order book at 30 June 2020 of over GBP12 million

continues to provide a solid base to build upon, although given the

uncertain business environment the provision of forward guidance

remains extremely challenging.

Raschid Abdullah

24 September 2020

Condensed Consolidated Income Statement

for the six months ended 30 June 2020

Unaudited Unaudited

6 months 6 months Audited

ended 30 ended 30 Year ended

June June 31 December

Note 2020 2019 2019

GBP000 GBP000 GBP000

Restated*

Revenue 7,092 8,851 15,706

Cost of sales (4,655) (5,677) (10,863)

Gross profit 2,437 3,174 4,843

Administrative expenses (2,905) (3,060) (6,130)

---------- --------- ------------

Adjusted EBITDA** 337 625 (281)

Amortisation of intangibles (315) (336) (639)

Depreciation of property,

plant and equipment (107) (109) (204)

Amortisation of right of

use assets (67) (51) (133)

Share based payment charges (11) (15) (30)

Exceptional restructuring

costs 6 (305) - -

Operating (loss)/profit (468) 114 (1,287)

Financial income 4 - 1

Financial expenses (42) (49) (176)

(Loss)/profit before tax (506) 65 (1,462)

Income tax 7 37 - 1,269

(Loss)/profit for the period

attributable to equity shareholders

of the company (469) 65 (193)

Other comprehensive income - - -

Total comprehensive (expense)/income

for the period (469) 65 (193)

---------- --------- ------------

(Loss)/earnings per ordinary

share (pence)

Basic 11 (0.82) 0.11 (0.34)

Diluted 11 (0.82) 0.11 (0.34)

---------- --------- ------------

* Details of the prior year restatement are provided at Note 5

.

** Earnings before financial income and expenses, tax,

depreciation, amortisation, share based payment charges and

exceptional restructuring costs .

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 June 2020

Share Share Equity Retained Total

capital premium reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2019 (audited) 575 1,617 14 5,885 8,091

Prior year adjustment, net

of tax* - - - (450) (450)

Adjusted balance at 1 January

2019 (audited) 575 1,617 14 5,435 7,641

Profit for the period as previously

stated - - - 206 206

Prior year adjustment, net

of tax* - - - (141) (141)

Total comprehensive income

for the period as restated - - - 65 65

Equity settled share based

payments - - - 15 15

At 30 June 2019 as restated

(unaudited) 575 1,617 14 5,515 7,721

-------- -------- -------- --------- -------

At 1 January 2019 (audited) 575 1,617 14 5,435 7,641

Loss for the year - - - (193) (193)

Total comprehensive expense

for the year - - - (193) (193)

Equity settled share based

payments - - - 30 30

At 31 December 2019 (audited) 575 1,617 14 5,272 7,478

-------- -------- -------- --------- -------

At 1 January 2019 (audited) 575 1,617 14 5,272 7,478

Loss for the period - - - (469) (469)

Total comprehensive expense

for the period - - - (469) (469)

Exercise of share options - 7 - - 7

Equity settled share based

payments - - - 11 11

At 30 June 2020 (unaudited) 575 1,624 14 4,814 7,027

-------- -------- -------- --------- -------

* Details of the prior year restatement are provided at Note 5

.

Condensed Consolidated Statement of Financial Position

at 30 June 2020

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

Restated*

ASSETS

Non-current assets

Property, plant and equipment 894 906 973

Right of use assets 397 460 466

Intangible assets 4,699 4,797 4,733

Deferred tax assets 469 390 528

--------- --------- ------------

6,459 6,553 6,700

--------- --------- ------------

Current assets

Inventories 2,420 2,941 2,430

Trade and other receivables 8 3,580 4,139 3,798

Cash and cash equivalents 2,174 815 827

--------- --------- ------------

8,174 7,895 7,055

--------- --------- ------------

Total assets 14,633 14,448 13,755

========= ========= ============

EQUITY AND LIABILITIES

Equity attributable to equity

holders

of the parent

Share capital 575 575 575

Share premium 1,624 1,617 1,617

Equity reserve 14 14 14

Retained earnings 4,814 5,515 5,272

Total equity 7,027 7,721 7,478

--------- --------- ------------

Non-current liabilities

Interest-bearing loans and

borrowings 10 784 1,140 338

--------- --------- ------------

784 1,140 338

--------- --------- ------------

Current liabilities

Interest-bearing loans and

borrowings 10 364 375 1,014

Trade and other payables 9 6,458 5,212 4,925

--------- --------- ------------

6,822 5,587 5,939

--------- --------- ------------

Total liabilities 7,606 6,727 6,277

--------- --------- ------------

Total equity and liabilities 14,633 14,448 13,755

========= ========= ============

* Details of the prior year restatement are provided at Note 5

.

Condensed Consolidated Statement of Cash Flows

for the six months ended 30 June 2020

Unaudited Unaudited Audited

6 months 6 months Year ended

ended 30 June ended 30 June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

Cash flows from operating activities

(Loss)/profit for the period (469) 65 (193)

Adjustments for:

Depreciation of property, plant

and equipment 116 105 204

Amortisation of right of use

assets 58 55 133

Amortisation of intangible assets 315 336 639

Exceptional restructuring costs 305 - -

Financial income (4) - (1)

Financial expenses 42 49 176

Equity settled share-based payment

expenses 11 15 30

Income tax (credit)/charge (37) - (1,269)

Operating cash flows before

movement in

working capital 337 625 (281)

Change in inventories 10 607 1,118

Change in trade and other receivables (632) (1,674) (379)

Change in trade and other payables 1,291 (250) (425)

Cash generated from operations 1,006 (692) 33

Tax received 966 108 109

Payments in respect of exceptional

restructuring costs (170) - -

Net cash from operating activities 1,802 (584) 142

Cash flows from investing activities

Acquisition of property, plant

and equipment (23) (27) (263)

Acquisition of right of use

assets - - (5)

Acquisition of intellectual

property rights (80) - -

Capitalised development expenditure (131) (457) (696)

Interest received 4 - 1

Net cash outflow from investing

activities (230) (484) (963)

Cash flows from financing activities

Bank loan repaid (125) (125) (250)

Interest paid on lease liabilities (11) (12) (25)

Interest paid on loans and borrowings (20) (37) (53)

Principal paid on lease liabilities (65) (60) (117)

Other interest and foreign exchange (11) - (24)

Proceeds from exercise of share

options 7 - -

Net cash outflow from financing

activities (225) (234) (469)

Net increase/(decrease) in cash

and cash equivalents 1,347 (1,302) (1,290)

Total movement in cash and cash

equivalents

in the period 1,347 (1,302) (1,290)

Cash and cash equivalents at

1 January 827 2,117 2,117

Cash and cash equivalents 2,174 815 827

Notes to the financial statements

1. Reporting entity

Petards Group plc (the 'Company') is incorporated and domiciled

in England and its shares are publicly traded on the Alternative

Investment Market ('AIM') of the London Stock Exchange. These

condensed consolidated interim financial statements ('interim

financial statements') as at and for the six months ended 30 June

2020 comprise the Company and its subsidiaries (together referred

to as the 'Group').

Copies of these interim financial statements will be available

on the Company's website (www.petards.com) and from the Company's

registered office at Parallel House, 32 London Road, Guildford, GU1

2AB.

2. Basis of preparation

As permitted, these interim financial statements have been

prepared in accordance with AIM Rules for Companies and are not

required to comply with IAS 34 'Interim Financial Reporting' to

maintain compliance with IFRS. They should be read in conjunction

with the Group's last annual consolidated financial statements as

at and for the financial year ended 31 December 2019 ('last annual

financial statements'). They do not include all of the financial

information required for a complete set of IFRS financial

statements, however selected explanatory notes are included to

explain events and transactions that are significant to the

understanding of the changes in the Group's financial position and

performance since the last annual financial statements. This

financial information does not constitute statutory accounts as

defined in Section 435 of the Companies Act 2006.

The comparative figures for the financial year ended 31 December

2019 set out in these interim statements are not the Group's

statutory accounts for that financial year. Those accounts have

been reported on by the Company's auditors and delivered to the

Registrar of Companies. The report of the auditors was (i)

unqualified, (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without

qualifying their report, and (iii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

Impact of accounting standards to be applied in future

periods

There are a number of standards and interpretations which have

been issued by the International Accounting Standards Board that

are effective for periods beginning subsequent to 31 December 2020

(the date on which the Company's next annual financial statements

will be prepared up to) that the Group has decided not to adopt

early. The Group does not believe these standards and

interpretations will have a material impact on the financial

statements once adopted.

3. Use of judgements and estimates

In preparing these interim financial statements, management has

made judgements and estimates that affect the application of

accounting policies and the reported amounts of assets,

liabilities, income and expense. Actual amounts may differ from

these estimates.

The significant judgements made by management in applying the

Group's accounting policies and the key sources of estimation

uncertainty were the same as those described in the last annual

financial statements.

The Board has reviewed the continuing effect of Covid-19 on the

Group's business and has concluded that there is no material effect

on areas requiring significant judgements and estimates.

4. Amendments to IFRS 16: Covid-19-Related Rent Concessions

Effective 1 June 2020, IFRS 16 was amended to provide a

practical expedient for lessees accounting for rent concessions

that arise as a direct consequence of the COVID-19 pandemic and

satisfy certain criteria. No rent concessions have been provided in

respect of any of the Group's leases and therefore this amendment

has no impact on the results for the period.

5. Prior year adjustment

The Group's 2019 annual consolidated financial statements

included a prior year adjustment concerning a costing error

identified in respect of the installation element of a project that

had been on-going since the latter part of 2016. This error led to

the profits taken at 31 December 2018 and 30 June 2019 to be

overstated. The impact was to reduce the previously reported profit

after tax for the year ended 31 December 2018 by GBP450,000 and

that for the six months ended 30 June 2019 by GBP141,000, and

reduced equity by the same amounts. The June 2019 adjustment

reduced gross profit by GBP141,000 with a corresponding reduction

in work in progress and there was no tax effect arising.

6. Exceptional restructuring costs

During the six-month period to 30 June 2020 the Group

restructured the cost base of certain parts of the business. The

cost of this exercise was GBP305,000 of which GBP170,000 was

settled before 30 June 2020.

7. Taxation

A tax credit of GBP37,000 (H1 2019: GBPnil) has been recognised

in the Condensed Consolidated Income Statement for the six months

to 30 June 2020 based on the estimated tax provision required for

the year ending 31 December 2020. This comprised a GBP62,000 credit

arising from recognising the Group's net deferred tax assets at

19%, the corporation tax rate enacted in March 2020, rather than

the previously enacted rate of 17% that was to apply from 1 April

2020, and a charge of GBP25,000 relating to tax losses surrendered

for R&D credits in 2020.

8. Trade and other receivables

Unaudited Unaudited

6 months 6 months Audited

ended 30 ended 30 Year ended

June June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

Trade receivables 3,076 3,872 2,592

Corporation tax recoverable 96 - 942

Other receivables and prepayments 408 267 264

3,580 4,139 3,798

========== ========== =============

9. Trade and other payables

Unaudited

Unaudited 6 months Audited

6 months ended 30 Year ended

ended 30 June June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

Trade payables 1,471 2,241 2,251

Contract liabilities 2,580 1,401 1,320

Non-trade payables and accrued

expenses 2,407 1,570 1,354

6,458 5,212 4,925

=============== ========== =============

10. Interest-bearing loans and borrowings

Current liabilities

Unaudited Unaudited

6 months 6 months Audited

ended 30 ended 30 Year ended

June June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

Bank loan 250 250 881

Lease liabilities 114 125 133

---------- ---------- -------------

364 375 1,014

========== ========== =============

Non-current liabilities

Unaudited Unaudited

6 months 6 months Audited

ended 30 ended 30 Year ended

June June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

Bank loan 500 750 -

Lease liabilities 284 390 338

---------- ---------- -------------

784 1,140 338

========== ========== =============

11. Earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to the shareholders by the weighted

average number of shares in issue.

Unaudited Unaudited

6 months 6 months Audited

ended 30 ended 30 Year ended

June June 31 December

2020 2019 2019

Earnings

(Loss)/profit for the period

(GBP000) (469) 65 (193)

========= ========= ============

Number of shares

Weighted average number of ordinary

shares ('000) 57,524 57,468 57,468

========= ========= ============

Diluted earnings per share

Diluted earnings per share assumes conversion of all potentially

dilutive ordinary shares, which arise from share options that would

decrease earnings per share or increase loss per share from

continuing operations, and is calculated by dividing the adjusted

profit for the year attributable to the shareholders by the assumed

weighted average number of shares in issue. Due to the loss for the

period, share options in issue in 2020 had an anti-dilutive

effect.

Unaudited Unaudited

6 months 6 months Audited

ended 30 ended 30 Year ended

June June 31 December

2020 2019 2019

Earnings

(Loss)/profit for the period

(GBP000) (469) 65 (193)

========= ========= ============

Number of shares

Weighted average number of ordinary

shares ('000) 57,524 59,695 57,468

========= ========= ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KKNBNPBKDACB

(END) Dow Jones Newswires

September 24, 2020 02:00 ET (06:00 GMT)

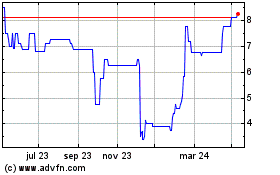

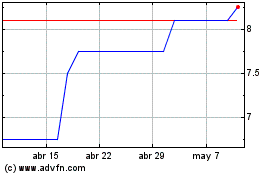

Petards (LSE:PEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Petards (LSE:PEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024