By Sarah McFarlane

BP PLC has unveiled the most aggressive plans yet by a major oil

company to pivot toward cleaner energy. But the revamp has so far

failed to ignite enthusiasm among investors despite growing

interest in renewables.

The British energy giant's strategy -- the biggest overhaul in

its 111-year history -- calls for a 40% reduction in oil-and-gas

production over the coming decade, greater investment in low-carbon

energy and a ramp-up in wind and solar power. No other major oil

company has targeted such a steep decline in their main source of

profit.

"Our new strategy is going to transform BP into a very different

company, not overnight...but fast," new Chief Executive Bernard

Looney told investors this month at an event detailing the plans.

He acknowledged there were "a few concerns, some skepticism and

even a few myths" about the overhaul.

The 50-year-old BP lifer, who took the helm in February, said

the company would see its income from oil, gas and refining decline

after 2025, but that the reduction would be more than offset by

growth from gas stations, charging points and retail sites.

His comments came as BP issued a bleak outlook for oil, saying

demand could have already peaked and that it would potentially

never recover to pre-pandemic levels. Meanwhile, BP forecast

booming growth for renewable power.

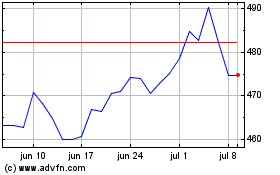

The new strategy has so far failed to lift BP's shares out of an

industrywide slump exacerbated by the pandemic. The company's

shares remain stuck near a 25-year-low and have performed worse in

the past three months -- down 26% -- than those of peers Royal

Dutch Shell PLC and Exxon Mobil Corp.

BP investors say that while they are keen on renewables, they

are also concerned about the company's ability to execute its plans

without hurting profit. That's partly because of a lack of detail

as to how new operations will compensate for its shrinking oil

business, which is expected to remain its main source of profits

for years.

Analysts have also questioned how BP will perform in new fields

where it lacks experience and competition is rising. Moreover,

returns from renewables typically aren't as lucrative as fossil

fuels.

BP also faces the extra burden of a heavier debt load than most

of its peers at a time when the pandemic has sapped demand for oil,

hitting profit. That's prompted the company to slash its dividend,

write down the value of its assets and cut staff.

"Investors are arguably taking on more risk, and receiving less

reward," said Biraj Borkhataria, an analyst at RBC Capital

Markets.

BP gave a glimpse of what its future could look like earlier

this month when it agreed to pay $1.1 billion to Equinor ASA for

stakes in two U.S. offshore wind farms. It also launched a

partnership with the Norwegian energy company to pursue other

similar opportunities.

The deal is part of BP's plan to increase its investment in

low-carbon energy 10-fold to $5 billion a year by 2030, taking its

renewable-energy capacity to 50 gigawatts, from 2.5 GW in 2019.

Analysts say more deals will be needed to hit the target, like its

investment in solar business Lightsource.

BP also this month entered a partnership with Microsoft Corp.

under which it will supply renewable energy to the software maker

and work on initiatives to help cities reduce emissions. It hopes

to make money from selling such services and has already entered

arrangements with Houston and Scotland's Aberdeen.

Analysts say it isn't clear how significant these new businesses

will be to BP's earnings.

BP plans for 20% of its investments to focus on what it calls

transition businesses by 2025. That is up from about 3% last year

and more than its rivals.

The company acknowledges that its profit will continue to be

driven by fossil fuels in the coming years. It aims to achieve

returns of 8% to 10% from its low-carbon energy business, compared

with industry targets of around 15% for oil-and-gas.

"Oil prices are still the most significant driver of BP's

results and will be for the years to come," said RBC's Mr.

Borkhataria.

BP's strategy commits to returning 60% of any surplus cash to

investors via share buybacks, once it has reduced its debt to $35

billion from around $41 billion at June 30.

The company also plans to sell $25 billion of assets by 2025,

which it is around halfway to achieving, having recently sold its

petrochemical business to Ineos Ltd. for $5 billion.

"Getting their house in order through deleveraging is going to

be the most important priority ahead of executing strategy," said

Christyan Malek, an analyst at JPMorgan.

BP is one of the most indebted oil major oil companies, with

gearing -- the ratio of net debt to the total of net debt and

equity -- just below 38% including leases as at June 30, above its

targeted 20% to 30%.

Mr. Looney said BP hoped its revamp would appeal to a range of

investors, who are taking a greater interest in carbon reduction.

Oil stocks have fallen out of favor in recent years, while

companies focused on renewable energy have performed better.

This isn't the first time BP has tried to pivot away from oil

and gas. More than a decade ago, it rebranded as "Beyond Petroleum"

and committed to generating more renewable energy. After struggling

to make a profit, it sold or shut some operations and temporarily

stopped investing in alternative energy.

"The energy transition is a huge threat and opportunity for the

oil majors, but the odds are against them being successful," said

Cameron Hepburn, director of the Smith School of Enterprise and the

Environment, University of Oxford. "Most incumbent businesses

facing existential threats don't manage to successfully pivot."

Write to Sarah McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

September 29, 2020 14:13 ET (18:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

Bp (LSE:BP.)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bp (LSE:BP.)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024