TIDMNRR

RNS Number : 4446B

NewRiver REIT PLC

08 October 2020

NewRiver REIT plc

("NewRiver" or the "Company")

Trading Update

NewRiver is today hosting a virtual Capital Markets Event

focused on its community pub business, Hawthorn Leisure, and is

providing the following trading update.

The Company has continued to make strong progress in three key

areas: rent collection, cash and liquidity, and disposals.

Retail rent collection

Our rent collection for the first and second quarters continues

to improve, and in recent weeks we have signed key agreements with

a number of retailers which until now represented a significant

proportion of rent outstanding.

Rents in respect of the third quarter were due on 29 September,

and rent that has either been collected or had alternative payments

agreed for this period is already 72% ahead of where it was at the

same stage in the second quarter, at 66%. This reflects an overall

recovery in retail sales and the significant progress that has been

made in reaching payment agreements with the Company's

occupiers.

The table below shows the current status of rent collection for

the first two quarters of FY21, providing comparatives to the

figures provided in previous releases.

Q1 FY21 Q2 FY21

As at 8 Oct 2020 14 Aug 2020 18 June 2020 8 Oct 2020 14 Aug 2020

--------------- ---------------- ------------- --------------- ----------------

Collected 69% 64% 52% 71% 60%

--------------- ---------------- ------------- --------------- ----------------

Deferred 9% 10% 17% 6% 5%

--------------- ---------------- ------------- --------------- ----------------

Re-gear 7% 10% 6% 7% 15%

--------------- ---------------- ------------- --------------- ----------------

Total collected

or alternative

payments agreed 85% 84% 75% 84% 80%

--------------- ---------------- ------------- --------------- ----------------

Waived 4% 1% 4% 1% 1%

--------------- ---------------- ------------- --------------- ----------------

Rent outstanding 11% 15% 21% 15% 19%

--------------- ---------------- ------------- --------------- ----------------

Total (%) 100% 100% 100% 100% 100%

--------------- ---------------- ------------- --------------- ----------------

Disposal progress

As we enter the second half of FY21, the Company is ahead of its

strategy to dispose of GBP80 million to GBP100 million of assets

this financial year, with GBP65.7 million of disposals either

completed, exchanged or currently under offer. In aggregate these

disposals represent a modest 3% discount to March 2020

valuations.

Completed disposals total GBP50.9 million, including the

disposal announced last week of 90% of our interest in Sprucefield

Retail Park, Lisburn, to our joint venture partner BRAVO Strategies

III LLC ("BRAVO").

Notwithstanding that the retail real estate capital markets were

significantly impacted by COVID-19, particularly in the first

quarter, the progress we have made with disposals to date reflects

the liquidity and locational qualities of the Company's portfolio.

Active discussions relating to a number of further disposals are

progressing, which we expect to complete in the second half of

FY21.

Cash and liquidity

We begin the second half with GBP140 million of cash reserves,

which is 71% higher than the position as at 31 March 2020, driven

by the progress with disposals and rent collection. Both the retail

and pub businesses have remained cash positive throughout lockdown

and beyond. Including our GBP45 million of undrawn revolving credit

facilities and our eligibility for GBP50 million of financing under

the Covid Corporate Finance Facility ('CCFF'), which the Company

currently has no need or intention to draw, the Company has total

available liquidity of GBP235 million.

Retail portfolio

Across our retail portfolio, 94% of occupiers by gross income

are now open and trading.

We have continued to progress leasing activity in recent months.

This includes the signing of two new leases with B&M at our

retail parks in Beverley and Blackburn, and new leases with Burger

King and Costa on two drive thru units that we developed at

Waterfront Retail Park, Barry. Last month, we completed a portfolio

deal with the value card and gift retailer Cardzone, which saw it

take an additional six stores across our portfolio, more than

doubling our rental income from this growing retailer.

Footfall has remained relatively robust across our community

shopping centre portfolio. In the week prior to this announcement,

commencing 28 September 2020, footfall was 131% higher than the

week commencing 8 June 2020, the last week before non-essential

stores were allowed to reopen, and 31% below the same week in 2019.

This year-on-year performance is a 10% outperformance of the UK

benchmark.

We continue to have limited exposure to the structurally

challenged retail sub-sectors that have been particularly impacted

by COVID-19 and recent restrictions, with no department stores in

our portfolio, and minimal exposure to mid-market fashion and

casual dining operators.

Residential development

We have continued to progress residential conversion

opportunities across our retail and community pub portfolio. In

September 2020, Mid Sussex District Council approved our revised

plans for the regeneration of Burgess Hill town centre, increasing

the residential provision of the scheme from 142 to 172 units, and

reducing the space designated for retail. We are also now under

offer to sell to a housing association the 10 residential units at

our combined c-store and residential development at the former site

of the Sea View Inn in Poole, which reached practical completion at

the end of July 2020.

Hawthorn Leisure

Almost all of our community pubs in England, Scotland and Wales

are now open and trading.

Our pub portfolio has outperformed the wider market since the

easing of lockdown restrictions. For the 12 week period since 5

July 2020, the day pubs were allowed to open in England,

like-for-like volumes in our Leased & Tenanted pubs were down

only 8% compared to the same period in 2019, and like-for-like

sales in our Operator Managed pubs were down 16% compared to the

same period in 2019. Our trading performance compares favourably to

the wider market over the same period, with data from the Coffer

Peach Business Tracker reporting that pub like-for-like sales are

down 18% compared to the same period last year.

Hawthorn returned to profitability within eight weeks of

reopening. For the month of September 2020, Hawthorn Group EBITDA

was GBP1.9 million, which is 90% of the Hawthorn Group EBITDA in

September 2019.

The liquidity and alternative use value of pubs is evidenced by

the fact that, since 1 April 2020, we have sold 19 pubs, generating

GBP5.1 million in proceeds, and two convenience stores, generating

GBP2.1 million.

Capital Markets Event 2020

NewRiver will be hosting a virtual Capital Markets Event at 2pm

until 5pm today, focused on its community pub business, Hawthorn

Leisure. Details on how to register for the event and view the

webcast live can be found at the following link:

https://kvgo.com/IJLO/NewRiver_Capital_Markets_Event_2020

There will be an opportunity for investors to submit written

questions during the presentation. Materials from the event can be

found on our website shortly after its conclusion.

For further information

NewRiver REIT plc +44 (0)20 3328 5800

Allan Lockhart (Chief Executive)

Mark Davies (Chief Financial Officer)

Tom Loughran (Head of Investor

Relations)

Finsbury +44 (0)20 7251 3801

Gordon Simpson

James Thompson

This announcement contains inside information as defined in

Article 7 of the EU Market Abuse Regulation No 596/2014 and has

been announced in accordance with the Company's obligations under

Article 17 of that Regulation. This announcement has been

authorised for release by the Board of Directors.

About NewRiver

NewRiver REIT plc ('NewRiver') is a leading Real Estate

Investment Trust specialising in buying, managing and developing

essential retail and leisure assets throughout the UK.

Our GBP1.2 billion portfolio covers 9 million sq ft and

comprises 33 community shopping centres, 25 conveniently

located

retail parks and over 700 community pubs. We hand-picked our

assets to deliberately focus on occupiers providing

essential goods and services, and avoid structurally challenged

sub-sectors such as department stores, mid-market

fashion and casual dining. This focus, combined with our

affordable rents and desirable locations, delivers sustainable and

growing returns for our shareholders, while our active approach to

asset management and inbuilt 2.5 million sq ft

development pipeline provide further opportunities to extract

value from our portfolio.

NewRiver has a Premium Listing on the Main Market of the London

Stock Exchange (ticker: NRR). Visit www.nrr.co.uk for further

information.

LEI Number: 2138004GX1VAUMH66L31

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUBSURRAURRUA

(END) Dow Jones Newswires

October 08, 2020 02:00 ET (06:00 GMT)

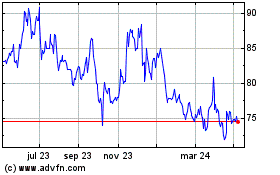

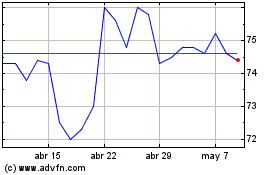

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024