TIDMNET

RNS Number : 8502B

Netcall PLC

13 October 2020

13 October 2020

NETCALL PLC

("Netcall", the "Company", or the "Group")

Final Results for the Year Ended 30 June 2020

Double digit revenue growth

Netcall plc (AIM: NET), a leading provider of L ow-code,

customer engagement and contact center software, today announces

its audited results for the year ended 30 June 2020.

Financial Highlights

-- Revenue up 10% to GBP25.1m (FY19: GBP22.9m)

-- Total annual contract value(1) ('ACV') at 30 June 2020 up 7%

year over year to GBP16.8m (30 June 2019: GBP15.7m)

-- Cloud services ACV at 30 June 2020 up 25% year over year to GBP7.5m (30 June 2019: GBP6.0m)

-- Adjusted EBITDA(2) on an IFRS 16 basis up 29% to GBP4.41m

(FY19: GBP3.41m on an IAS 17 basis). Adjusted EBITDA on an IAS17

basis increased by 21% to GBP4.12m

-- Profit before tax of GBP0.50m (FY19: GBP0.75m)

-- Cash generated from operations of GBP9.39m (FY19: GBP6.84m)

including GBP2.21m of deferred VAT payments

-- Group cash at 30 June 2020 was GBP12.7m (FY19: GBP7.77m) more

than offsetting borrowings of GBP6.75m (FY19: GBP6.63m)

-- Final ordinary dividend of 0.25p proposed, an increase of 25% (FY19: 0.20p)

Operational Highlights

-- Solid trading in the financial year including strong demand

in the final quarter despite COVID-19

-- Continued high growth for cloud and Low-code solutions

-- Organisation remained intact during the pandemic without

requirement for furloughing, redundancies or pay-cuts

-- Launched several releases to the Liberty platform including

solutions catering for COVID-19 requirements

-- Several large customer implementations went live during the year

Henrik Bang, CEO of Netcall , commented:"Netcall performed

excellently in the year, delivering double-digit revenue and cloud

ACV growth. We experienced solid demand in our largest market

segments of healthcare, government and financial services, where

our cloud and Low-code business continued to grow

significantly.

"Following the outbreak of COVID-19, customer demand continued

to be strong and the organisation remained firmly intact without

furloughing, pay-cuts or redundancies. Throughout the challenging

period, the Netcall team has shown tremendous flexibility,

creativity and resilience, providing support to our customers,

especially those within the NHS, and I would like to thank

everybody for their contribution.

"The new financial year has begun well, with the Group trading

strongly and ahead of last year in the first three months.

Notwithstanding the positive start to the year and the Group's

significant recurring revenues, the Board is mindful of the current

economic uncertainty and the impact it may have on customers, which

we continue to monitor closely. The acceleration of organisations'

digital transformation initiatives represents a significant

long-term opportunity for Netcall and provides the Board with

confidence in the future prospects of the Group."

(1) ACV, as of a given date, is the total of the value of each

cloud and support contract divided by the total number of years of

the contract.

(2) Profit before interest, tax, depreciation and amortisation

adjusted to exclude the effects of share-based payments,

acquisition, impairment, profit or loss on disposals, contingent

consideration and non-recurring transaction costs.

For further enquiries, please contact:

Netcall plc Tel. +44 (0) 330

333 6100

Henrik Bang, CEO

Michael Jackson, Chairman

James Ormondroyd, Group Finance Director

Canaccord Genuity Limited (Nominated Adviser Tel. +44 (0) 20

and Broker) 7523 8000

Simon Bridges/ Andrew Potts

Alma PR Tel. +44 (0) 20

3405 0205

Caroline Forde / Helena Bogle / Robyn Fisher

About Netcall plc

Netcall's Liberty software platform with Low-code, customer

engagement and contact centre solutions helps organisations

transform their businesses faster and more efficiently, empowering

them to create leaner, more customer-centric organisations.

Netcall's customers span enterprise, healthcare and government

sectors. These include two-thirds of the NHS Acute Health Trusts

and leading corporates, such as Legal and General, Lloyds Banking

Group, ITV and Nationwide Building Society.

Prior to publication the information communicated in this

announcement was deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No 596/2014 ('MAR') With the publication of this announcement, this

information is now considered to be in the public domain.

Introduction

Netcall delivered an excellent trading performance in the year,

achieving double digit revenue and adjusted EBITDA growth, whilst

reacting to the disruption caused by the global pandemic. Our team

adapted fantastically to the changes and showed tremendous

flexibility, resilience and creativity, quickly delivering

innovative solutions to support our customers as they responded to

the lockdown measures introduced.

Digital transformation is rapidly advancing across our customer

base and key market segments. Solutions enabled by our Liberty

platform touch many aspects of our daily lives, whether it be

enabling house-buyers to apply for mortgages, to make insurance

claims, providing businesses with easy means to apply for COVID-19

business support or enabling hospitals to safely manage socially

distanced outpatient appointments. Our COVID-19 related apps and

solutions which with traditional software development might

previously have taken months, if not years, to be launched, were

live within weeks, helping our customers to support their patients,

customers and citizens. This demonstrates the power of our Liberty

platform and the ability of our team to combine technology

capabilities and business knowledge to create solutions which

enable organisations to implement more lean and automated

operations, delivering better experiences for their customers and

employees.

As a result of solid demand throughout the financial year, cloud

ACV grew by 25% to GBP7.5m (FY19: GBP6.0m) contributing to a 7%

growth in total ACV to GBP16.8m. The growth in ACV came through new

customer wins and cross-sales of our expanded product suite,

combined with high customer retention and renewal rates. Low-code

and cloud bookings continued to drive sales, while we also saw

positive trading performance from product sales.

As a result, revenues increased by 10% to GBP25.1m which lifted

the Group's adjusted EBITDA by 29% to GBP4.41m. Low-code

subscription revenue grew 29% contributing to an overall growth in

Low-code revenue of 17% to GBP8.99m (FY19: GBP7.66m), now

representing 36% of Group revenues (FY19: 33%).

The business model is underpinned by our highly profitable and

cash generative contact centre and communication revenue streams,

which grew 9% in the year. The profits and cash generated from this

business sector provide the means to invest in our Low-code and

cloud operations, as we continue to capitalise on the rapidly

expanding digital automation market opportunity.

Cash collection was particularly strong, resulting in cash

generated from operations of GBP9.39m and Group cash at 30 June

2020 of GBP12.7m, (FY19: GBP7.77m) of which GBP2.21m was deferred

VAT payments, resulting in a normalised cash position of GBP10.5m

which exceeds borrowings of GBP6.75m (FY19: GBP6.63m).

Response to COVID-19

During February and March 2020, we tested our contingency plans

to ensure the organisation was ready when we started working from

home in March. The team adapted quickly to the changes which

resulted in minimal disruption to the business, with no negative

impact on productivity or ability to support and market to

customers.

Due to the pandemic's impact on some of our customers, we

adjusted our roadmap priorities to focus on the rapid development

of new applications to support them, harnessing the tremendous

speed and power of our Low-code platform. This included areas such

as enabling home working for customers' employees, assisting

hospitals in managing changes to outpatient processes and COVID-19

responses, as well as supporting councils in providing enhanced

citizen and local business support. Today, we have multiple new

solutions available, including in our AppShare, and more are in

development.

These activities helped underpin continued good demand from our

customers in the final quarter with the healthcare sector in

particular performing strongly, where we had an increased uptake of

Liberty Converse and Connect, both on premise and for the first

time in the cloud, as well as our Low-code platform Liberty Create,

through our Patient Hub. The strong performance in healthcare,

public sector and financial services offset limited delays and

cancellations in some smaller segments of our customer base, such

as travel and transportation, where customers faced unprecedented

challenges and we worked with them to help them though the initial

stage of the crisis. This caused our exit ACV figure to be dampened

slightly, but had minimal impact on reported revenue.

As a result of the overall good trading performance, the Group

has not been required to introduce pay-cuts, furlough staff or make

redundancies, although increased cash management measures,

including the deferral of VAT, have been implemented and the

Company retained its strong focus on operational efficiency.

Moving forward, the changes in society brought about by the

pandemic, including the workplace, will continue to accelerate

organisations' digital transformation initiatives, as they look for

ways to better serve their customers, employees and citizens. These

changes support long-term significant growth drivers for

Netcall.

Current trading and outlook

The new financial year has begun well, with the Group trading

strongly and ahead of the last fiscal period in the first three

months. Notwithstanding the strong start to the current year and

significant recurring revenues, the Board is mindful of the current

economic disruptions and the impact it may have on customers, which

we continue to monitor closely. The acceleration of organisations'

digital transformation initiatives presents a significant long-term

opportunity for Netcall and provides the Board with confidence in

the future prospects of the Group.

Business Review

Netcall helps organisations transform their customer engagement

activities and enables digital transformation faster and more

efficiently, empowering them to improve customer experiences and

operational efficiencies. We achieve this by delivering a

market-leading software platform, Liberty, that addresses

best-in-class customer experience and digital process

automation.

The Liberty platform is today used by more than 600

organisations, across all sectors including financial services,

local government and healthcare, making life easier for the people

they serve.

The platform includes three core solutions; Liberty Create - a

cloud based Low-code platform for digital process automation,

Liberty Connect - a cloud based conversational messaging and

chatbot platform and Liberty Converse - a complete omnichannel

contact centre platform.

In harmony, these solutions empower business users and IT

developers, at a wide-range of organisations including the likes of

Hampshire Trust Bank and Dreams, to collaboratively deliver

solutions that support leaner and more customer-centric

organisations .

The Group's organic growth strategy for this large and growing

market focuses on four core pillars:

-- expansion of our customer base;

-- growth through a land and expand model;

-- continued innovation and enhancement of our platform; and

-- growing our partner base.

In addition to the Group's focused organic strategies, the Board

continues to look for selective acquisitions with complementary

proprietary software and/or additional customers in our target

markets.

Expansion of our customer base

We primarily target organisations with large numbers of

customers and/ or employees and, in many cases, are subject to a

high level of regulation. This mainly includes the financial

services, healthcare and government sectors where we currently have

a significant market presence, and which generated 84% of Group

revenues in 2020. This has provided the Group with resilience

during the COVID-19 pandemic, with limited exposure to those

sectors more impacted by the lockdown.

Our marketing activities include the recent release of

'LaunchPads', which are groups of applications targeted for

particular industry verticals, such as the water industry, which

provide prospective customers with an easy entry point to Liberty

Create.

New customer implementations include:

-- A FTSE-100 financial services company used Liberty to

streamline a number of complex insurance claims processes and

manage the high volume of claims, as well as improving

communication with customers while their claim was being processed.

Through Liberty Create the financial services company has now

automated processes and customer communications for various

insurance products, replacing a legacy implementation.

-- A global broadcaster has adopted Liberty to automate and

streamline advert bookings across multiple products improving

efficiency, management and reporting. The Liberty platform has

replaced a legacy solution involving significant manual

intervention.

Growth through Land and Expand

Many of our customers initially purchase an entry level solution

with the objective of rolling out further applications over time

and deploying the systems more widely to support their future

customer engagement and digital transformation initiatives. This

combined with continuous enhancements to our product portfolio and

tighter integration between the various solutions, provides

substantial cross and up-sale opportunities in three areas:

-- Low-code solutions, which represent the largest opportunity

as our existing customers digitise and modernise their operations

enabling them to further leverage their existing Liberty estate.

The ACV of a Low-code cross-sales is a significant uplift on the

average customer spend which emphasises the potential value of

Low-code sales into the existing customer base;

-- evolution of transitioning our premise-based customers to

cloud solutions. This opportunity is in its infancy where we see

growing number of customers transitioning their Liberty estate to a

cloud model; and

-- on-going upgrades and addition of modules to the Liberty

platform as customers expand the use of the platform and we release

new features and modules.

To stimulate cross-sales and fast-track implementations we are

also providing several pre-built accelerators and modules via our

AppShare which supplement the existing Liberty applications. The

number of accelerators and modules have now increased to well over

100, several of which have been designed and uploaded by our

customers and partners. From launch in September 2019, there are

today more than 300 different organisations participating in the

community with developers and business users benefiting from the

apps, best practice sharing and previews of new functionality among

other things.

This includes the module Citizen Hub, for local authorities,

which is a suite of pre-built business processes and citizen

portals that can be downloaded for Liberty Create and integrated

with our customer engagement solutions. We have a number of live

customers for Citizen Hub and an extensive roadmap of additional

applications to be added.

For example, Croydon Council used Liberty Create to build and

launch a business rates claim solution in just nine days following

the outbreak of COVID-19. The solution included a business register

which allowed applicants to follow their claim progress right the

way through, enabling the office team to check and process the

grants that the business owners desperately needed.

Continued innovation and enhancement of our platform

We continue to invest in the technical enhancement of our

Liberty platform and innovations over the financial year

included:

-- The incorporation of Google Cloud's Artificial Intelligence

services within our Low-code, Liberty Create solution, enabling the

quick creation of intelligent enterprise applications. We also

completed the development of our Low-code Monitor Studio which

enables an organisation to automate the entirety of the software

development lifecycle within the Liberty Create platform; deploying

apps through the Controller; developing using Build/Code Studios;

testing using test Studio and now monitoring using Monitor Studio;

all on a single platform through a unified interface.

-- Within our Contact Centre, Liberty Converse solution, the

development of integrated workforce management which allows

managers to plan shifts and monitor adherence in real-time,

ensuring that Contact Centres are staffed correctly in order to

meet customer demand. An integrated softphone for agents that

allows calls to be handled directly within the app, means there is

no need for separate handsets. Furthermore, we added the ability to

queue back-office tasks (such as order processing, expenses, and HR

activities) into appropriately skilled agents and thereby

automatically distributing all kinds of work while providing

visibility of workload and employee performance. This insight can

help improve throughput, achieve SLAs and deliver an enhanced

customer experience.

-- Within our conversational messaging and bot platform, Liberty

Connect, the launch of Web Messaging introduced a new

communications channel, enabling consumers to engage in both

inbound and proactive outbound messaging on customer websites. This

is complemented by a natural language enabled bot designer for

creating tailored conversation flows and intelligent FAQ answers

that work seamlessly across web, social, and SMS channels.

Moreover, customers can further increase their self-service and

automation capabilities by integrating their back-end systems into

their bots with the introduction of Connect's app developer

framework.

COVID-19 related innovation

A number of innovations on our road-map have been fast-tracked

as a result of the COVID-19 pandemic. The increased adoption of

Microsoft Teams within our core customer base drove the development

of an integration being made available for both Liberty Create and

Liberty Converse. Native video was also added to Liberty Create to

support virtual appointments within apps built on the Low-code

platform. Patient Hub, our digital appointment management service

built using Liberty Create, can now deliver COVID-19 results to

patients, ask patients to confirm they do not have symptoms before

attending appointments, and help hospitals manage patients waiting

outside rather than in a waiting room using our 'I've Arrived'

app.

Internally, we have also used our Liberty platform to drive

digital transformation. This includes our new Liberty Create based

CRM system, "Hive", our new support portal, "Nest", and our new

help portal, "Docs", on our Liberty Create platform, just like our

"Community" app is managed and driven by Liberty Create. In

addition, we are using the latest version of our Liberty Converse,

deployed in the Amazon cloud, AWS, to support customer

enquiries.

Growing our partner base

Partners are an important additional route to market, providing

the scope to access new markets and scale our business opportunity

faster. The aim is to grow revenue via partners significantly by

assisting them in creating new offerings and revenue streams from

their customers. We are building an eco-system of partners with

industry knowledge and delivery and support capabilities, focusing

on large organisations with global footprints.

The year saw the launch of a new Managed Service Partner

programme, building on the initial success of our partner programme

last year. We now offer various packages, each including a mix of

sales enablement, marketing support and technical training. The

first partners have now signed up to the programme and initial

customer wins have been secured. We will continue to grow this part

of the business in the year ahead.

New partners include:

-- CGI Group, among the largest independent IT and business

consulting services firms' in the world, with approximately 77,500

consultants and professionals across the globe. CGI Group has

developed its own solutions based on Liberty Create.

-- Gobeyond, a leading provider of consulting, training,

innovative technology and next generation managed services through

whom we won an initial contract supplying Liberty Create to a

financial services customer.

Financial Review

The Group's revenue comprises the following components:

-- Cloud services: revenue subscription and usage fees for cloud-based offerings.

-- Product support contracts: provision of software updates,

system monitoring and technical support services for our

products.

-- Communications services: fees for telephony and messaging services.

-- Product revenues: software license sales with supporting hardware.

-- Professional services: consultancy, implementation and training services.

The Group continues its transition to a digital cloud business,

having reached an inflection point last year, with new Cloud

services bookings continuing to exceed new Product and Product

support contract sales.

Group revenue increased 10% to GBP25.1m (FY19: GBP22.9m) of

which Low-code solutions now represent GBP8.99m (FY19: GBP7.66m) of

Group revenues, increasing 17% in the year.

As a result of the change in sales mix towards recurring revenue

models, total ACV at 30 June 2020 increased by 7% year over year to

GBP16.8m, with Cloud services ACV up 25% year over year to GBP5.4m.

ACV, as at a given date, is the total of the value of each cloud

and support contract divided by the total number of years of the

contract. The table below sets out ACV at the end of the last three

financial years:

GBP'm ACV FY20 FY19 FY18

------------------ ----- ----- -----

Low-code 5.4 4.5 3.3

Liberty cloud 2.1 1.5 1.5

------------------ ----- ----- -----

Total cloud 7.5 6.0 4.8

Support contract 9.3 9.7 9.4

Total 16.8 15.7 14.2

================== ===== ===== =====

The table below sets out revenue by component for the last three

financial years:

GBP'm Revenue FY20 FY19 FY18

-------------------------------------------------- ----- ----- -----

Cloud services 6.6 5.7 4.3

Product support contracts 9.6 9.3 8.9

-------------------------------------------------- ----- ----- -----

Total Cloud services & Product support contracts 16.1 15.0 13.2

Communication services 1.9 1.8 2.3

Product 3.1 2.3 3.1

Professional services 4.0 3.8 3.3

Total 25.1 22.9 21.9

================================================== ===== ===== =====

Revenue from Cloud services increased by 14% to GBP6.55m (FY19:

GBP5.74m) reflecting the higher year over year Cloud service ACV.

The comparative period figure included a one-off termination fee of

GBP0.5m which excluding this gives an underlying growth rate of

25%.

Product support contract revenue increased by 3% to GBP9.56m

(FY19: GBP9.26m) as a result of the contribution of new product

sales and price rises.

Cloud service and product support contract revenues, which are

recurring in nature, total GBP16.1m (FY19: GBP15.0m) are 64% of

overall revenues (FY19: 66%).

Communication services revenue increased by 7% to GBP1.93m

(FY19: GBP1.81m) due to higher application driven messaging volumes

and call-back usage.

Product revenue increased by 34% to GBP3.07m (FY19: GBP2.29m)

due to higher sales to NHS and Public Sector organisations.

Professional services revenue increased 5% to GBP4.01m (FY19:

GBP3.81m) due to demand for implementation services for Cloud

service and Product solutions. The overall demand for our

professional services is dependent on:

-- the mix of direct and indirect sales of our solutions, in the

latter case our partners provide the related services directly for

the end customer; and

-- whether a customer requires the support of a full application

development service or support to enable their own development

teams.

Gross profit margin was 88% (FY19: 90%) mainly due to an

increase in outsourced and insourced consultants from partners to

supplement our in-house teams in delivering professional

services.

Administrative expenses, before depreciation, amortisation,

impairment, share-based payments and acquisition related items

increased to GBP17.8m (FY19: GBP17.1m) reflecting an underlying

increase of 5%, a result of the previously announced investment

programme into our business, offset by a reduction of GBP0.30m in

operating lease payments following the Group's adoption of IFRS 16

'Leases' (see note 8 for further information).

Consequently, Group adjusted EBITDA on an IFRS 16 basis

increased by 29% to GBP4.41m (FY19: GBP3.41m), a margin of 18% of

revenue (FY19: 15%). Adjusted EBITDA on an IAS17 basis increased by

21% to GBP4.12m (see note 8 for further information).

Profit before tax was GBP0.50m (FY19: GBP0.75m) after accounting

for acquisition related items and interest on borrowings taken out

to fund the acquisition of MatsSoft in August 2017 and higher

depreciation and amortisation of capitalised development.

The Group tax charge of GBP0.01m (FY19: GBP0.14m) represents an

effective rate of tax of 1% (FY19: 10%) on adjusted profit before

tax. The underlying effective rate of tax is lower than the

headline rate of corporation tax principally due to deductions for

R&D expenditure.

Basic earnings per share was 0.34 pence (FY19: 0.43 pence) and

increased by 27% to 1.01 pence on an adjusted basis (FY19: 0.80

pence). Diluted earnings per share was 0.33 pence (FY19: 0.41

pence) and increased 28% to 0.97 pence on an adjusted basis (FY19:

0.76 pence).

Cash generated from operations increased by 37% to GBP9.39m

(FY19: GBP6.84m), a conversion of 213% (FY19: 202%) of adjusted

EBITDA. The normalised cash conversion rate was 163% when adjusted

for GBP2.21m of VAT payments that were deferred due to COVID-19

until March 2021. In addition, the comparative including GBP0.30m

of rental payments under IAS 17 Leases which are now accounted as

lease liabilities under IFRS 16 Leases (see note 8).

Spending on research and development, including capitalised

software development, was GBP3.59m (FY19: GBP3.21m) of which

capitalised software expenditure was GBP1.71m (FY19: GBP1.53m).

Total capital expenditure was GBP1.86m (FY19: GBP2.96m); the

balance after capitalised development, being GBP0.16m (FY19:

GBP1.43m) was significantly lower as the comparative period

included new office fit-out.

The Company acquired MatsSoft Limited in August 2017. The

purchase agreement provided for potential further cash and shares

to be paid dependent on achieving specified performance targets

over various periods from completion of the acquisition. In October

2019, the fair value of the remaining contingent consideration was

re-estimated at GBP1.76m resulting in GBP0.04m being debited to the

income statement as a change in estimate of fair value. During the

period the Company paid GBP1.76m comprising GBP1.68m in cash and

GBP0.08m in shares under this arrangement, bringing the total

consideration paid to GBP15.6m. No further payments are expected

under this agreement.

To support the acquisition, the Company issued a GBP7m Loan

Note. Interest payments under the Loan Note in the period totalled

GBP0.48m (FY19: GBP0.59m). The Loan Note is unsecured and is

repayable in six instalments from 30 September 2022 to 31 March

2025. See note 7 for further information.

The Group applied IFRS 16 Leases for the first time, whereby it

recognised lease liabilities in relation to leases which had

previously been classified as 'operating leases' under the

principles of IAS 17 'Leases'. IFRS 16 was adopted using the

modified retrospective approach and lease liabilities of GBP0.90m

and a right-of-use asset GBP0.82m were recognised on 1 July 2019.

See note 8 for further information.

As a result of these factors, net funds were GBP4.82m at 30 June

2020 (30 June 2019: GBP1.14m). See note 7 for further

information.

Dividend

In line with the Company's dividend policy to pay-out 25% of

adjusted earnings per share, the Board is proposing a final

dividend for this financial year of 0.25p (FY19: 0.20p). If

approved, the final dividend will be paid on 9 February 2021 to

shareholders on the register at the close of business on 29

December 2020.

Audited consolidated income statement for the year ended 30 June

2020

2020 2019

GBP'000 GBP'000

-------------------------------------------------- --------- ---------

Revenue 25,114 22,903

Cost of sales (2,930) (2,329)

Gross profit 22,184 20,574

Administrative expenses (20,926) (19,058)

Other losses - net (24) (11)

--------------------------------------------------- --------- ---------

Adjusted EBITDA 4,413 3,411

Depreciation (657) (310)

Net loss on disposal of property, plant

and equipment - (2)

Amortisation of acquired intangible

assets (483) (512)

Amortisation of other intangible assets (1,344) (1,120)

Change in fair value of contingent consideration

(see note 4) (37) 865

Post-completion services (see note 4) (33) (244)

Share-based payments (625) (583)

--------------------------------------------------- --------- ---------

Operating profit 1,234 1,505

Finance income 38 41

Finance costs (775) (794)

--------------------------------------------------- --------- ---------

Finance costs - net (737) (753)

Profit before tax 497 752

Tax charge (10) (142)

--------------------------------------------------- --------- ---------

Profit for the year 487 610

=================================================== ========= =========

Earnings per share - pence

Basic 0.34 0.43

Diluted 0.33 0.41

=================================================== ========= =========

All activities of the Group in the current and prior periods are

classed as continuing. All of the profit for the period is

attributable to the shareholders of Netcall plc.

Audited consolidated statement of comprehensive income for the

year ended 30 June 2020

2020 2019

GBP'000 GBP'000

------------------------------------------------- -------- --------

Profit for the year 487 610

Other comprehensive income

Items that may be reclassified to profit

or loss

Exchange differences arising on translation

of foreign operations (14) (17)

Total other comprehensive income for the

year (14) (17)

-------------------------------------------------- -------- --------

Total comprehensive income for the year 473 593

================================================== ======== ========

All of the comprehensive income for the year is attributable to

the shareholders of Netcall plc.

Audited consolidated balance sheet at 30 June 2020

2020 2019

GBP'000 GBP'000

------------------------------------------- --- -------- --------

Assets

Non-current assets

Property, plant and equipment 960 1,210

Right-of-use assets 970 -

Intangible assets 29,078 29,188

Deferred tax asset 482 501

Financial assets at fair value through

other comprehensive income 72 72

Total non-current assets 31,562 30,971

------------------------------------------- --- -------- --------

Current assets

Inventories 139 165

Other current assets 1,392 1,314

Contract assets 585 1,178

Trade receivables 3,957 3,864

Other financial assets at amortised cost 4 100

Cash and cash equivalents 12,710 7,769

------------------------------------------- --- -------- --------

Total current assets 18,787 14,390

------------------------------------------- --- -------- --------

Total assets 50,349 45,361

------------------------------------------- --- -------- --------

Liabilities

Non-current liabilities

Contract liabilities 104 207

Borrowings 6,745 6,632

Lease liabilities 902 -

Deferred tax liabilities 842 851

Provisions - 77

------------------------------------------- --- -------- --------

Total non-current liabilities 8,593 7,767

------------------------------------------- --- -------- --------

Current liabilities

Trade and other payables 6,907 5,265

Contract liabilities 11,724 10,395

Lease liabilities 248 -

Total current liabilities 18,879 15,660

------------------------------------------------ -------- --------

Total liabilities 27,472 23,427

------------------------------------------------ -------- --------

Net assets 22,877 21,934

=========================================== === ======== ========

Equity attributable to owners of Netcall

plc

Share capital 7,312 7,259

Share premium 3,015 3,015

Other equity 4,900 4,832

Other reserves 3,996 4,440

Retained earnings 3,654 2,388

------------------------------------------- --- -------- --------

Total equity 22,877 21,934

=========================================== === ======== ========

Audited consolidated statement of cash flows for the year ended

30 June 2020

2020 2019

GBP'000 GBP'000

----------------------------------------------- -------- --------

Cash flows from operating activities

Profit before income tax 497 752

Adjustments for:

Depreciation and amortisation 2,484 1,942

Loss on disposal of property, plant

and equipment - 2

Share-based payments 625 583

Net finance costs 737 753

Other non-cash expenses 1 -

Changes in operating assets and liabilities,

net of effects from purchasing of subsidiary

undertaking:

Decrease in inventories 26 51

(Increase)/ decrease in trade receivables (92) 2,216

Decrease in contract assets 589 252

Decrease in other financial assets at

amortised cost 100 24

Increase in other current assets (107) (257)

Increase/ (decrease) in trade and other

payables 3,334 (242)

Increase in contract liabilities 1,223 862

Decrease in provisions (29) (95)

------------------------------------------------ -------- --------

Cash flows from operations 9,388 6,843

------------------------------------------------ -------- --------

Interest received 38 41

Interest paid (6) (4)

Net cash inflow from operating activities 9,420 6,880

------------------------------------------------ -------- --------

Cash flows from investing activities

Payment for acquisition of subsidiary,

net of cash acquired (1,679) (591)

Payment for property, plant and equipment (146) (1,078)

Payment of software development costs (1,708) (1,532)

Payment for other intangible assets (9) (350)

Proceeds from sale of property, plant

and equipment - 1

Net cash outflow from investing activities (3,542) (3,550)

------------------------------------------------ -------- --------

Cash flows from financing activities

Proceeds from issues of ordinary shares 39 16

Interest paid on Loan Notes (478) (590)

Principle element of lease payments (199) -

Dividends paid to Company's shareholders (287) (758)

------------------------------------------------ -------- --------

Net cash outflow from financing activities (925) (1,332)

------------------------------------------------ -------- --------

Net increase in cash and cash equivalents 4,953 1,998

Cash and cash equivalents at beginning

of the financial year 7,769 5,779

Effects of exchange rate on cash and

cash equivalents (12) (8)

================================================ ======== ========

Cash and cash equivalents at end of

financial year 12,710 7,769

================================================ ======== ========

Audited consolidated statement of changes in equity at 30 June

2020

Share Share Other Other Retained

capital premium equity reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- -------- ---------- ---------- --------

Balance at

30 June 2018 7,242 3,015 4,832 3,917 2,482 21,488

-------------------------------- --------- --------- -------- ---------- ---------- --------

Proceeds from share issue 16 - - - - 16

Increase in equity reserve

in relation to options

issued - - - 633 - 633

Tax debit relating to

share options - - - (38) - (38)

Reclassification following

exercise or lapse of options 1 - - (55) 54 -

Dividends paid - - - - (758) (758)

-------------------------------- --------- --------- -------- ---------- ---------- --------

Transactions with owners 17 - - 540 (704) (147)

-------------------------------- --------- --------- -------- ---------- ---------- --------

Profit for the year - - - - 610 610

Other comprehensive income

for the year - - - (17) - (17)

-------------------------------- --------- --------- -------- ---------- ---------- --------

Profit and total comprehensive

income for the year - - - (17) 610 593

-------------------------------- --------- --------- -------- ---------- ---------- --------

Balance at

30 June 2019 as original

presented 7,259 3,015 4,832 4,440 2,388 21,934

-------------------------------- --------- --------- -------- ---------- ---------- --------

Change in accounting policy

(note 8) - - - - 14 14

Restated balance at

30 June 2019 7,259 3,015 4,832 4,440 2,402 21,948

Issue of ordinary shares

as consideration for an

acquisition in a business

combination 14 - 68 - - 82

Proceeds from share issue 39 - - - - 39

Increase in equity reserve

in relation to options

issued - - - 622 - 622

Reclassification following

exercise or lapse of options - - - (1,052) 1,052 -

Dividends paid - - - - (287) (287)

-------------------------------- --------- --------- -------- ---------- ---------- --------

Transactions with owners 53 - 68 (430) 765 456

-------------------------------- --------- --------- -------- ---------- ---------- --------

Profit for the year - - - - 487 487

Other comprehensive income

for the year - - - (14) - (14)

-------------------------------- --------- --------- -------- ---------- ---------- --------

Profit and total comprehensive

income for the year - - - (14) 487 473

-------------------------------- --------- --------- -------- ---------- ---------- --------

Balance at

30 June 2020 7,312 3,015 4,900 3,996 3,654 22,877

-------------------------------- --------- --------- -------- ---------- ---------- --------

Notes to the financial information for the year ended 30 June

2020

1. General information

Netcall plc (AIM: "NET", "Netcall", or the "Company"), is a

leading provider of customer engagement software, is a limited

liability company and is quoted on AIM (a market of the London

Stock Exchange). The Company's registered address is 1st Floor,

Building 2, Peoplebuilding Estate, Maylands Avenue, Hemel

Hempstead, Hertfordshire, HP2 4NW and the Company's registered

number is 01812912.

2. Basis of preparation

The Group financial statements consolidate those of the Company

and its subsidiaries (together referred to as the 'Group').

The financial information set out in these preliminary results

has been prepared in accordance with International Financial

Reporting Standards ('IFRSs') as adopted by the European Union. The

accounting policies adopted in this results announcement have been

consistently applied to all the years presented and are consistent

with the policies used in the preparation of the statutory accounts

for the period ended 30 June 2020 as updated for new standards and

interpretations effective from 1 July 2019. The Group has adopted

IFRS 16 'Leases' from 1 July 2019, replacing IAS 17 'Leases', see

note 8 for details. No other significant changes to accounting

policies are expected for the year ending 30 June 2020.

The consolidated financial information is presented in sterling

(GBP), which is the company's functional and the Group's

presentation currency.

The financial information set out in these results does not

constitute the company's statutory accounts for 2020 or 2019.

Statutory accounts for the years ended 30 June 2020 and 30 June

2019 have been reported on by the Independent Auditors; their

report was (i) unqualified; (ii) did not draw attention to any

matters by way of emphasis; and (iii) did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006.

Statutory accounts for the year ended 30 June 2019 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 30 June 2020 will be delivered to the Registrar in

due course. Copies of the Annual Report 2020 will be posted to

shareholders on or about 17 November 2020. Further copies of this

announcement can be downloaded from the website www.netcall.com

.

3. Segmental analysis

Management consider that there is one operating business segment

being the design, development, sale and support of software

products and services, which is consistent with the information

reviewed by the Board when making strategic decisions. Resources

are reviewed on the basis of the whole of the business

performance.

The key segmental measure is adjusted EBITDA which is profit

before interest, tax, depreciation, amortisation, share-based

payments, non-recurring transaction costs, which is set out on the

consolidated income statement.

4. Material profit or loss items

The Group identified a number of items which are material due to

the significance of their nature and/or their amount. These are

listed separately here to provide a better understanding of the

financial performance of the Group.

2020 2019

GBP'000 GBP'000

----------------------------------------------------- -------- --------

Change in fair value of contingent consideration(1) (37) 865

Post completion services expense(2) (33) (244)

(80) 621

----------------------------------------------------- -------- --------

(1) The purchase agreement of MatsSoft Ltd provided for

potential further cash and shares to be paid dependent on achieving

specified performance targets over various periods from completion

of the acquisition. In October 2019, the fair value of the

remaining contingent consideration was re-estimated at GBP1.76m

resulting in GBP0.04m being debited to the income statement as a

change in estimate of fair value. During the period the Company

paid GBP1.76m comprising GBP1.68m in cash and GBP0.08m in shares

under this arrangement, bringing the total consideration paid to

GBP15.6m. No further payments are expected under this

agreement.

(2) A number of former owners of MatsSoft Ltd continued to work

in the business following its acquisition and in accordance with

IFRS 3 a proportion of the contingent consideration arrangement is

treated as remuneration and expensed in the income statement.

5. Earnings per share

The basic earnings per share is calculated by dividing the net

profit attributable to equity holders of the Company by the

weighted average number of ordinary shares in issue during the

year, excluding those held in treasury.

30 June 30 June

2020 2019

---------------------------------------------------- -------- --------

Net earnings attributable to ordinary shareholders

(GBP'000) 487 610

Weighted average number of ordinary shares

in issue (thousands) 143,588 143,038

---------------------------------------------------- -------- --------

Basic earnings per share (pence) 0.34 0.43

---------------------------------------------------- -------- --------

The diluted earnings per share has been calculated by dividing

the net profit attributable to ordinary shareholders by the

weighted average number of shares in issue during the year,

adjusted for potentially dilutive shares that are not

anti-dilutive.

30 June 30 June

2020 2019

----------------------------------------------- -------- --------

Weighted average number of ordinary shares

in issue (thousands) 143,588 143,038

Adjustments for share options 5,839 6,085

Weighted average number of potential ordinary

shares in issue (thousands) 149,427 149,123

----------------------------------------------- -------- --------

Diluted earnings per share (pence) 0.33 0.41

----------------------------------------------- -------- --------

Adjusted earnings per share have been calculated to exclude the

effect of acquisition, contingent consideration and reorganisation

costs, share-based payment charges, amortisation of acquired

intangible assets and with a normalised rate of tax. The Board

believes this gives a better view of on-going maintainable

earnings. The table below sets out a reconciliation of the earnings

used for the calculation of earnings per share to that used in the

calculation of adjusted earnings per share:

GBP'000 30 June 2020 30 June 2019

--------------------------------------------------------------- ------------- -------------

Profit used for calculation of basic and diluted EPS 487 610

Change in fair value of contingent consideration (see note 4) 37 (865)

Share-based payments 625 583

Post completion services (see note 4) 33 244

Amortisation of acquired intangible assets 483 512

Unwinding of discount - contingent consideration & borrowings 123 181

Tax effect of adjustments (332) (125)

Profit used for calculation of adjusted basic and diluted EPS 1,456 1,140

--------------------------------------------------------------- ------------- -------------

30 June 30 June

2020 2019

--------------------------------------------- -------- --------

Adjusted basic earnings per share (pence) 1.01 0.80

Adjusted diluted earnings per share (pence) 0.97 0.76

--------------------------------------------- -------- --------

6. Dividends

Statement of changes June 2020 balance

Cash flow statement in equity sheet

Year to June 2020 Paid Pence per share (GBP'000) (GBP'000) (GBP'000)

---------------------- -------- ---------------- -------------------- --------------------- ---------------------

Final ordinary

dividend for the

year to June 2019 5/2/20 0.20p 287 287 -

---------------------- -------- ---------------- -------------------- --------------------- ---------------------

287 287 -

------------------------------- ---------------- -------------------- --------------------- ---------------------

Statement of changes June 2019 balance

Cash flow statement in equity sheet

Year to June 2019 Paid Pence per share (GBP'000) (GBP'000) (GBP'000)

---------------------- -------- ---------------- -------------------- --------------------- ---------------------

Final ordinary

dividend for the

year to June 2018 6/2/19 0.53p 758 758 -

758 758 -

------------------------------- ---------------- -------------------- --------------------- ---------------------

It is proposed that this year's final ordinary dividend of 0.25

pence per share will be paid to shareholders on 9 February 2021.

Netcall plc shares will trade ex-dividend from 24 December 2020 and

the record date will be 29 December 2020. The estimated amount

payable is GBP0.36m. The proposed final dividend is subject to

approval by shareholders at the Annual General Meeting and has not

been included as a liability in these financial statements.

7. Net funds reconciliation

30 June 30 June

GBP'000 2020 2019

------------------------------------------- -------- --------

Cash and cash equivalents 12,710 7,769

Borrowings - fixed interest and repayable

after one year (1) (6,745) (6,632)

Lease liabilities (1,150) -

------------------------------------------- -------- --------

Net funds 4,815 1,137

------------------------------------------- -------- --------

(1) To support the acquisition of MatsSoft Limited in August

2017, the Company issued a GBP7m Loan Note with options over 4.8m

new ordinary shares of 5p each priced at 58p. The Loan Note is

unsecured, has an annual interest rate of 8.5% payable quarterly in

arrears and is repayable in six instalments from 30 September 2022

to 31 March 2025. The Loan Note was initially allocated a fair

value of GBP6.42m and the share option a fair value of GBP0.58m.

The discount on the carrying value of the Loan Note is being

amortised via the profit and loss account over the expected option

life of five years.

8. IFRS 16 'Leases'

The Group has adopted IFRS 16 'Lease's retrospectively from 1

July 2019, but has not restated comparatives for the 30 June 2019

reporting period, as permitted under the specific transition

provisions in the standard. The reclassifications and the

adjustments arising from the new leasing rules are therefore not

recognised in the opening balance sheet on 1 July 2019.

On adoption of IFRS 16, the Group recognised lease liabilities

in relation to leases which had previously been classified as

'operating leases' under the principles of IAS 17 Leases. These

liabilities were measured at the present value of the remaining

lease payments, discounted using an incremental borrowing rate as

of 1 July 2019. The weighted average incremental borrowing rate

applied to the lease liabilities on 1 July 2019 was 3.25%.

In applying IFRS 16 for the first time, the Group has used the

following practical expedients permitted by the standard:

-- applying a single discount rate to a portfolio of leases with

reasonably similar characteristics;

-- relying on previous assessments on whether leases are onerous

as an alternative to performing an impairment review - there were

no onerous contracts as at 1 July 2019;

-- excluding initial direct costs for the measurement of the

right-of-use asset at the date of initial application; and,

-- using hindsight in determining the lease where the contract

contains options to extend or terminate the lease.

The Group has also elected not to reassess whether a contract

is, or contains a lease at the date of initial application.

Instead, for contracts entered into before the transition date the

group relied on its assessment made applying IAS 17 and

Interpretation 4 Determining whether an Arrangement contains a

Lease.

Measurement of lease liabilities

GBP'000

------------------------------------------------------------------- -----

Operating lease commitments at 30 June 2019 770

Add property lease dilapidations 227

Discounted using the incremental cost of borrowing at 1 July 2019 (93)

Lease liability recognised at 1 July 2019 904

------------------------------------------------------------------- -----

Of which are:

Current lease liabilities 179

Non-current lease liabilities 725

------------------------------------------------------------------- -----

904

------------------------------------------------------------------- -----

Measurement of right-of-use assets

The associated right-of-use assets were measured at the amount

equal to the lease liability, adjusted by the amount of any prepaid

or accrued lease payments relating to that lease recognised in the

balance sheet as at 30 June 2019.

Adjustments recognised in the balance sheet on 1 July 2019

The change in accounting policy affected the following items in

the balance sheet on 1 July 2019.

GBP'000

------------------------------------------- ------

Right-of-use assets 819

Prepayments (15)

Accruals 37

Lease liabilities (904)

Provisions - property lease dilapidations 77

Net impact on retained earnings 14

------------------------------------------- ------

Impact of change on income statement

In order to show the impact of IFRS 16 and to facilitate a

comparison of results with the prior year, a reconciliation is

presented below for the year ended 30 June 2020 as reported on an

IFRS 16 basis with the former IAS17 basis.

30 June 2020

GBP'000 (IFRS 16 basis) IFRS 16 impact 30 June 2020 (IAS 17 basis)

-------------------------------------------------- ------------------ --------------- ----------------------------

Adjusted EBITDA 4,413 (297)(1) 4,116

Depreciation (657) 261(2) (396)

Amortisation of acquired intangible assets (483) - (483)

Amortisation of other intangible assets (1,344) - (1,344)

Change in fair value of contingent consideration (37) - (37)

Post-completion services (33) - (33)

Share-based payments (625) - (625)

Finance costs - net (737) 32(3) (705)

Profit before tax 497 (4) 493

================================================== ================== =============== ============================

(1) reduced lease rental charge on IFRS 16 basis

(2) additional depreciation on right-of-use asset recognised

under IFRS 16

(3) additional interest cost on leases recognised under IFRS

16

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFEDITLFLII

(END) Dow Jones Newswires

October 13, 2020 02:00 ET (06:00 GMT)

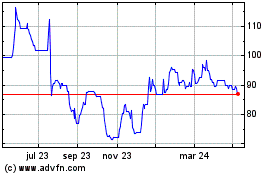

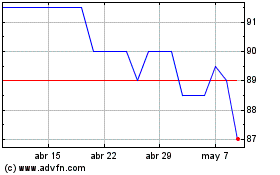

Netcall (LSE:NET)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Netcall (LSE:NET)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024