Mercia Asset Management PLC Successful exit of Clear Review (3993C)

19 Octubre 2020 - 1:00AM

UK Regulatory

TIDMMERC

RNS Number : 3993C

Mercia Asset Management PLC

19 October 2020

RNS 19 October 2020

Mercia Asset Management PLC

("Mercia" the "Company" or the "Group")

Successful exit of Clear Review delivering a 72% IRR

Mercia Asset Management PLC (AIM: MERC), the proactive

regionally focused specialist asset manager with c.GBP800 million

of assets under management, is pleased to announce the profitable

sale of Clear Review Limited ("Clear Review") for a total cash

consideration of up to GBP26.0million.

Mercia held a 4.0% fully diluted direct holding in Clear Review

at the date of sale and will receive cash proceeds of GBP1.0million

representing a 2x return on its investment and a 72% IRR. In

addition to this direct investment return, the sale will also

generate an 8x return on Mercia's EIS managed fund investment cost

and a 122% fund IRR.

The company, which was first backed by Mercia's managed funds in

2018 and became a direct investment in June 2019, has been sold to

Advanced Business Software and Solutions Limited ("Advanced"), the

third largest British software and services company in the UK.

Clear Review, which was founded by Stuart Hearn, former HR

director at Sony, is a software as a service ("SaaS") tool

providing organisations with data and systems to improve

performance management. Under Stuart's leadership the company

quickly met its commercial milestones, passing GBP2.0million in

annual recurring revenue in December 2019, up 100% from the

previous year. Mercia portfolio director Nigel Owens was a

non-executive director from December 2019 until the sale.

Stuart Hearn, CEO of Clear Review, said "We're extremely proud

of the success of our Clear Review platform and its role in

improving business performance and developing talent around the

world. The acquisition will enable us to accelerate Clear Review's

growth as well as integrate with Advanced's HR solutions, helping

organisations retain their best talent and increase

performance."

Dr Mark Payton, CEO of Mercia Asset Management, said: "Clear

Review is now our fifth full cash exit from the direct investment

portfolio, coming just three months after we announced the sale of

The Native Antigen Company. We have been consistent in our stated

objective to both source and exit deals well, and I am pleased that

we have been able to again demonstrate our execution of this

strategy through another successful exit.

"The team at Clear Review has achieved great things in a

relatively short period of time and I am confident that under their

new custodian they will continue to disrupt the HR SaaS sector.

"This sale process has been handled entirely virtually, which is

testament to our team's effectiveness in transacting deals even

during these complex times."

-Ends-

For further information, please contact:

Mercia Asset Management PLC

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial Officer +44 (0)330 223

www.mercia.co.uk 1430

Canaccord Genuity Limited (NOMAD and Joint +44 (0)20 7523

Broker) 8000

Simon Bridges, Emma Gabriel, Richard Andrews

N+1 Singer (Joint Broker)

+44 (0)20 7496

Harry Gooden, James Moat 3000

+44 (0)20 3727

FTI Consulting 1051

Tom Blackwell, Louisa Feltes, Shiv Talwar

mercia@fticonsulting.com

About Mercia Asset Management PLC:

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of balance

sheet, venture, private equity and debt capital: the Group's

'Complete Connected Capital'. The Group initially nurtures

businesses via its third-party funds under management, then over

time Mercia can provide further funding to the most promising

companies, by deploying direct investment follow-on capital from

its own balance sheet.

The Group has a strong UK footprint through its regional

offices, 19 university partnerships and extensive personal

networks, providing it with access to high-quality deal flow.

Mercia currently has c.GBP800million of assets under management

and, since its IPO in December 2014, has invested over GBP96million

into its direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the EPIC

"MERC".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKKFBQDBDDDKD

(END) Dow Jones Newswires

October 19, 2020 02:00 ET (06:00 GMT)

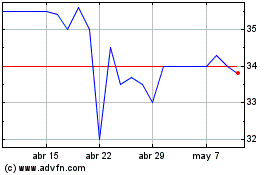

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024