Schneider Electric Upgrades 2020 Guidance

22 Octubre 2020 - 1:19AM

Noticias Dow Jones

By Giulia Petroni

Schneider Electric SE said Thursday that it was raising its

full-year guidance following a positive third-quarter

performance.

The French energy-management company said quarterly revenue came

in at 6.46 billion euros ($7.66 billion), down 2.8% from the

previous-year period. On an organic basis, revenue rose 1.3%.

The energy-management division registered organic growth of 2.5%

on year, while the industrial automation business posted a 2.5%

organic decline.

"We saw a progressive recovery across the business throughout

the quarter, which was boosted, in part, by pent-up demand from

past orders and re-stocking in our distribution channels," Chief

Executive Jean-Pascal Tricoire said.

The company said uncertainties persist around fourth-quarter

results due to a rise in coronavirus cases across geographies.

Schneider Electric raised its guidance for the full year, saying

it now expects a revenue decline of between 5% to 7% organically

from a previously forecast decline of 7% to 10%. The adjusted

earnings before interest, taxes and amortization margin is expected

to be around 15.1% and 15.4%.

The company reiterated its 2022 adjusted Ebita margin target of

around 17%.

It also said it remains committed to its portfolio optimization

program, but expects the timeline to be delayed by around one year

due to the Covid-19 crisis.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

October 22, 2020 02:04 ET (06:04 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

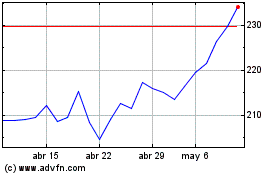

Schneider Electric (EU:SU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

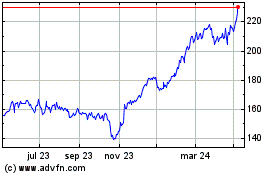

Schneider Electric (EU:SU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024