TIDMGLEN

RNS Number : 6676D

Glencore PLC

30 October 2020

NEWS RELEASE

Baar, 30 October 2020

Third Quarter 2020 Production Report

Glencore Chief Executive Officer, Ivan Glasenberg:

"Glencore has delivered a solid third quarter operating

performance, including the continued successful ramp-up of Katanga,

which remains on track to achieve design capacity by year end. Our

teams have adapted well to the numerous challenges presented by

Covid-19.

"We maintain our 2020 full year production guidance, except

coal, which was adjusted for the extended strike at Cerrejon. We

will provide a detailed business update, including progress on

climate change initiatives at our Investor Update on 4

December."

Production from own sources - Total(1)

Change

YTD 2020 YTD 2019 %

--------------------------------- ------------ ----------- ----------- ----------------

Copper kt 934.7 1,015.8 (8)

Cobalt kt 21.6 34.4 (37)

Zinc kt 860.1 809.2 6

Lead kt 194.3 219.8 (12)

Nickel kt 81.8 89.4 (9)

Gold koz 611 622 (2)

Silver koz 23,220 23,733 (2)

Ferrochrome kt 651 1,030 (37)

Coal - coking mt 5.6 6.1 (8)

Coal - semi-soft mt 3.6 5.1 (29)

Coal - thermal mt 74.3 92.8 (20)

--------------------------------- ------------ ----------- ----------- ----------------

Coal mt 83.5 104.0 (20)

Oil (entitlement interest basis) kbbl 3,360 3,638 (8)

1 Controlled industrial assets and joint ventures only.

Production is on a 100% basis, except as stated.

Production guidance

-- Changes in guidance reflect the tightening of most ranges and

coal down 5mt (4%), accounting for the current extended industrial

strike at Cerrejón JV (Colombia).

Actual Current Previous

Q1 Q2 Q3 YTD ROY guidance guidance

2020 2020 2020 2020 2020 2020 2020

------------ ------- ----- -------- -------- -------- -------- --------- --- ---------

1,255 1,255

Copper kt 293 295 347 935 320 +/- 25 +/- 35

------------ -------- ----- -------- -------- -------- -------- --------- --- ---------

28 +/- 28 +/-

Cobalt kt 6 8 8 22 6 1 2

------------ -------- ----- -------- -------- -------- -------- --------- --- ---------

1,160 1,160

Zinc kt 296 255 310 860 300 +/- 25 (1) +/- 30

------------ -------- ----- -------- -------- -------- -------- --------- --- ---------

114 +/- 114 +/-

Nickel kt 28 27 27 82 32 3 4

------------ -------- ----- -------- -------- -------- -------- --------- --- ---------

1,000 1,000

Ferrochrome kt 388 78 185 651 349 +/- 25 +/- 25

------------ -------- ----- -------- -------- -------- -------- --------- --- ---------

109 +/- 114 +/-

Coal mt 32 26 26 84 25 3 3

1 Excludes Volcan

Highlights

-- The generally strong sequential quarterly production

performance noted in the table above, in large part, reflects

reversal of the various short-term Covid-19 related shutdowns in

Q2, as mandated by several national/local governments.

-- Own sourced copper production of 934,700 tonnes was 81,100

tonnes (8%) lower than the comparable prior period, reflecting

Mutanda being on care and maintenance in the current period and the

temporary suspension of operations at Antamina in Q2, partly offset

by a continued strong milling performance at Collahuasi and

Katanga's ramp-up.

-- Own sourced cobalt production of 21,600 tonnes was 12,800

tonnes (37%) lower than the comparable prior period, mainly

reflecting Mutanda on care and maintenance, partly offset by

Katanga's ramp-up.

-- Own source zinc production of 860,100 tonnes was 50,900

tonnes (6%) higher than the comparable prior period, mainly

reflecting: (i) higher zinc grades from Antamina notwithstanding

the temporary Covid-related suspension (21,800 tonnes); (ii)

improved throughput at Mount Isa (14,900 tonnes); and (iii) the net

positive effect of 13,800 tonnes from Other South America owing to

re-opening the short-life Iscaycruz mine in Peru, offset by

Covid-related slowdowns and suspensions.

-- Own sourced nickel production of 81,800 tonnes was 7,600

tonnes (9%) lower than the comparable prior period, mainly

reflecting Koniambo running as a single-line operation for most of

Q2/Q3, with Covid-related restrictions on mobility affecting timing

of maintenance.

-- Attributable ferrochrome production of 651,000 tonnes was

379,000 tonnes (37%) lower than the comparable prior period,

primarily reflecting the Q2 South African lockdown measures. As of

1 September, four of the five smelters were running. The

competitive environment across the South African ferrochrome

industry continues to be challenging, in particular due to high

input costs including electricity.

-- Coal production of 83.5 million tonnes was 20.5 million

tonnes (20%) lower than the comparable prior period, reflecting

Prodeco being on care and maintenance for most of 2020, disruptions

at Cerrejón (initially Covid-related, and lately due to industrial

action), and targeted H2 volume reductions across the Australian

portfolio, during a time of weak market conditions.

-- Entitlement interest oil production of 3.4 million barrels

was 0.3 million barrels (8%) lower than the comparable prior

period, reflecting the temporary suspension of Chad operations

since April 2020, partly offset by new wells drilled in Equatorial

Guinea and Cameroon.

To view the full report please click:

https://www.glencore.com/dam/jcr:3b5ec265-1700-4269-8f66-1a1fded7bc87/GLEN_2020-Q3_ProductionReport.pdf

For further information please contact:

Investors

Martin Fewings t: +41 41 709 m: +41 79 737 martin.fewings@glencore.com

2880 5642

Maartje Collignon t: +41 41 709 m: +41 79 197 maartje.collignon@glencore.com

32 69 42 02

Media

Charles Watenphul t: +41 41 709 m: +41 79 904 charles.watenphul@glencore.com

2462 3320

www.glencore.com

Glencore LEI: 2138002658CPO9NBH955

Notes for Editors

Glencore is one of the world's largest global diversified

natural resource companies and a major producer and marketer of

more than 60 commodities. The Group's operations comprise around

150 mining and metallurgical sites and oil production assets.

With a strong footprint in both established and emerging regions

for natural resources, Glencore's industrial and marketing

activities are supported by a global network of offices located in

over 35 countries.

Glencore's customers are industrial consumers, such as those in

the automotive, steel, power generation, battery manufacturing and

oil sectors. We also provide financing, logistics and other

services to producers and consumers of commodities. Glencore's

companies employ around 158,000 people, including contractors.

Glencore is proud to be a member of the Voluntary Principles on

Security and Human Rights and the International Council on Mining

and Metals. We are an active participant in the Extractive

Industries Transparency Initiative.

Important notice concerning this document including forward

looking statements

This document contains statements that are, or may be deemed to

be, "forward looking statements" which are prospective in nature.

These forward looking statements may be identified by the use of

forward looking terminology, or the negative thereof such as

"outlook", "plans", "expects" or "does not expect", "is expected",

"continues", "assumes", "is subject to", "budget", "scheduled",

"estimates", "aims", "forecasts", "risks", "intends", "positioned",

"predicts", "anticipates" or "does not anticipate", or "believes",

or variations of such words or comparable terminology and phrases

or statements that certain actions, events or results "may",

"could", "should", "shall", "would", "might" or "will" be taken,

occur or be achieved. Forward-looking statements are not based on

historical facts, but rather on current predictions, expectations,

beliefs, opinions, plans, objectives, goals, intentions and

projections about future events, results of operations, prospects,

financial condition and discussions of strategy.

By their nature, forward-looking statements involve known and

unknown risks and uncertainties, many of which are beyond

Glencore's control. Forward looking statements are not guarantees

of future performance and may and often do differ materially from

actual results. Important factors that could cause these

uncertainties include, but are not limited to, those disclosed in

the last published annual report and half-year report, both of

which are freely available on Glencore's website.

For example, our future revenues from our assets, projects or

mines will be based, in part, on the market price of the commodity

products produced, which may vary significantly from current

levels. These may materially affect the timing and feasibility of

particular developments. Other factors include (without limitation)

the ability to produce and transport products profitably, demand

for our products, changes to the assumptions regarding the

recoverable value of our tangible and intangible assets, the effect

of foreign currency exchange rates on market prices and operating

costs, and actions by governmental authorities, such as changes in

taxation or regulation, and political uncertainty.

Neither Glencore nor any of its associates or directors,

officers or advisers, provides any representation, assurance or

guarantee that the occurrence of the events expressed or implied in

any forward-looking statements in this document will actually

occur. You are cautioned not to place undue reliance on these

forward-looking statements which only speak as of the date of this

document.

Except as required by applicable regulations or by law, Glencore

is not under any obligation and Glencore and its affiliates

expressly disclaim any intention, obligation or undertaking, to

update or revise any forward looking statements, whether as a

result of new information, future events or otherwise. This

document shall not, under any circumstances, create any implication

that there has been no change in the business or affairs of

Glencore since the date of this document or that the information

contained herein is correct as at any time subsequent to its

date.

No statement in this document is intended as a profit forecast

or a profit estimate and past performance cannot be relied on as a

guide to future performance. This document does not constitute or

form part of any offer or invitation to sell or issue, or any

solicitation of any offer to purchase or subscribe for any

securities.

The companies in which Glencore plc directly and indirectly has

an interest are separate and distinct legal entities. In this

document, "Glencore", "Glencore group" and "Group" are used for

convenience only where references are made to Glencore plc and its

subsidiaries in general. These collective expressions are used for

ease of reference only and do not imply any other relationship

between the companies. Likewise, the words "we", "us" and "our" are

also used to refer collectively to members of the Group or to those

who work for them. These expressions are also used where no useful

purpose is served by identifying the particular company or

companies.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLEASENALEEFFA

(END) Dow Jones Newswires

October 30, 2020 03:00 ET (07:00 GMT)

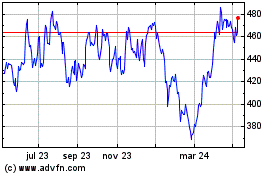

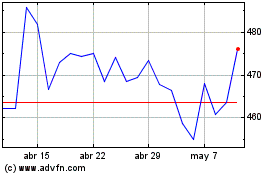

Glencore (LSE:GLEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Glencore (LSE:GLEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024