TIDMPPS

RNS Number : 8448D

Proton Motor Power Systems PLC

02 November 2020

2 November 2020

Proton Motor Power Systems plc

("Proton" or the "Company")

Improved terms for existing loans agreed

Proton Motor Power Systems plc (AIM: PPS), the designer,

developer and producer of fuel cells and fuel cell electric hybrid

systems with a zero-carbon footprint, announces that it has agreed

with SFN CleanTech Investment Ltd ("SFN") and Mr Falih Nahab to

amend certain terms of the existing loans and financing facilities

on terms more favourable to the Company.

The Company currently has loans outstanding of EUR29.0 million

from SFN and EUR53.7 million from Mr Falih Nahab, including

principal and interest. As announced on 23 June 2020, these are

part of financing facilities provided by SFN and Mr Falih Nahab,

which expire on 31 December 2021. Interest on these loans is

charged at 10% and the interest, but not the principal, is

convertible at the option of SFN and Mr Falih Nahab into ordinary

shares of the Company ("Ordinary Shares"). At 30 June 2020,

GBP18.12 million of accrued interest was convertible at 2p per

Ordinary Share. As interest from 1 July 2020, as announced below,

will no longer be convertible, there will be no interest

convertible to shares at 48p, as announced on 23 June 2020.

Under the amended terms agreed between the Company, SFN and Mr

Falih Nahab, interest payable on the existing and future loans

will, from 1 January 2021, be charged at a reduced rate of 3% over

LIBOR and new interest accrued as from 1 July 2020 will no longer

be convertible into Ordinary Shares, so that the maximum number of

shares which might be issued as a result of conversion of the

interest on the loans has been fixed at 30 June 2020.

In addition, the existing facilities, amounting to EUR64.9

million (excluding interest), and the date when the loans become

repayable have now been extended from 31 December 2021 to 31

December 2025. The right to convert the interest outstanding at 30

June 2020 has been extended to 31 December 2031. As stated

previously, the undrawn portions of the loan facilities are

expected to allow the Company to satisfy its working capital needs

until at least June 2021.

Mr Falih Nahab has also agreed that, unless otherwise requested

by the Company or as a result of institutional demand for the

Ordinary Shares, he will limit the annual conversion of interest

accrued up to 30 June 2020 into Ordinary Shares, so that no more

than 42 million Ordinary Shares per calendar year will be issued as

a result of the conversion of the loans. Proceeds from any sale of

Ordinary Shares by SFN and Mr Falih Nahab will continue to be used

to provide further financing for the Company as previously

announced.

The Company's board of directors recognises that the long term

preparedness of Mr. Falih Nahab and SFN to provide financing for

the Company's operations and development programme has contributed

vitally to the high level of focus in advancing its hydrogen

related technology to its current stage and that the above

mentioned measures serve to further alleviate the Company's cost

structure and to improve the balance sheet situation.

The change to the interest rate payable on the loans will serve

to substantially lower Proton's interest charge burden. The

Company's board of directors believes that the extension of the

existing facilities to the end of 2025 will allow the Company to

pursue with confidence the many opportunities that the Company has

in addition to those which the board believes will become available

as a result of the German Government's National Hydrogen Strategy,

including EUR7.0 billion to be allocated to the German hydrogen

sector as contained in the German economic stimulus package passed

in June 2020, the UK Government's forthcoming energy white paper

and also EU initiatives such as the European Alliance for Green

Hydrogen.

Related party transaction

Mr. Falih Nahab is indirectly, via SFN, a substantial

shareholder (as defined in the AIM Rules) of the Company and

therefore both Mr. Falih Nahab and SFN, which is a substantial

shareholder, are related parties to the Company. The amendments to

the terms of the existing loan facilities are therefore classified

as transactions with related parties for the purposes of the AIM

Rules. In accordance, therefore, with the AIM Rules, the directors

of the Company, with the exclusion of Dr. Faiz Nahab, who is the

brother of Mr. Falih Nahab and a shareholder in SFN, having

consulted with the Company's nominated adviser, Shore Capital,

consider that the amendments to the terms of the existing loan

facilities are fair and reasonable insofar as the Company's

shareholders are concerned.

For further information:

Proton Motor Power Systems plc

Dr Faiz Nahab, CEO

Helmut Gierse, Chairman

Sebastian Goldner, COO/CTO

Roman Kotlarzewski, CFO Tel: +49 (0) 173 189

Manfred Limbrunner, Director Sales 0923

and Marketing www.protonpowersystems.com

Shore Capital

Nominated adviser and broker

Antonio Bossi / David Coaten Tel: +44 (0) 20 7408

4050

www.shorecap.co.uk

About Proton Motor Fuel Cell GmbH

Proton Motor has more than 20 years of experience in Power

Solutions using CleanTech technologies such as hydrogen fuel cells,

fuel cell and hybrid systems with a zero carbon footprint. Based in

Puchheim near Munich, Proton Motor offers complete fuel cell and

hybrid systems from a single source - from the development and

production through the implementation of customized solutions. The

focus of Proton Motor is on back-to-base, for example, for mobile,

marine and stationary solutions applications. The product portfolio

consists of base-fuel cell systems, standard complete systems, as

well as customized systems.

Proton Motor serves IT, Telecoms, public infrastructure and

healthcare customers in Germany, Europe and Middle East with power

supply solutions for DC and AC power demand. In addition to power

supply, SPower also offers solutions for Solar Systems as well as a

new product line for Solar Energy Storage.

Proton Motor Fuel Cells GmbH is a wholly owned subsidiary of

Proton Motor Power Systems plc. The Company has been quoted on the

AIM market of the London Stock Exchange since October 2006 (code:

PPS).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAFEFDLPEFFA

(END) Dow Jones Newswires

November 02, 2020 02:00 ET (07:00 GMT)

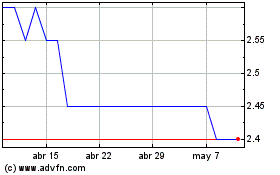

Proton Motor Power Systems (LSE:PPS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Proton Motor Power Systems (LSE:PPS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024