TIDMWPHO

RNS Number : 5026F

Windar Photonics PLC

17 November 2020

17 November 2020

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Windar Photonics plc

("Windar", the "Company" or the "Group")

Unaudited interim report for the six months ended 30 June

2020

Windar Photonics plc (AIM:WPHO), the technology group that has

developed a cost efficient and innovative LiDAR wind sensor for use

on electricity generating wind turbines, announces its unaudited

interim results for the six months ended 30 June 2020.

Jørgen Korsgaard Jensen, CEO of Windar, commented:

"Firstly, I would like to personally apologize for the delays to

the publication of our Annual Report & Accounts for 2019 and

the release of our interims accounts for the six months to 30 June

2020.

This year has been an extraordinary and challenging year for our

Company. After having enjoyed a very positive start to the year

with the first ever larger scale orders from the OEM market

segment, the subsequent period has been impacted by delays,

postponement and other restrictions due to Covid-19 pandemic.

However, despite these challenges and the consequent reduction

in revenue during the first half compared to last year, I am very

pleased that the Company has, against that backdrop, managed to

reduce the EBITDA loss and substantially improve on operating cash

flow performance.

More importantly, our order intake in 2020 has now reached our

net revenue break-even level of c.EUR3 million. Whilst we expect to

be able to only execute approximately 40% of these orders in 2020

due to the ongoing Covid pandemic, the Board still expects to see

an improvement in our overall financial results for 2020 compared

to last year."

For further information, please contact:

Windar Photonics plc Tel: +45 21689476

Jørgen Korsgaard Jensen, CEO

Cenkos Securities plc (Nomad & Broker) Tel: 0131 220 6939

Neil McDonald / Pete Lynch

Notes to Editors:

Windar Photonics is a technology group that develops

cost-efficient and innovative Light Detection and Ranging ("LiDAR")

optimisation systems for use on electricity generating wind

turbines. LiDAR wind sensors in general are designed to remotely

measure wind speed and direction.

http://investor.windarphotonics.com

CHAIRMAN'S STATEMENT

The year 2020 started very positively for the Company, achieving

the first large volume orders from the OEM market. Moreover, we

received the first orders under our Vestas distribution agreement

and, in total, the Company received orders with a total value of

EUR1.9 million of which EUR1.2 million were planned for delivery in

the first half of 2020.

However, the Covid-19 pandemic has had a severe and negative

impact on the timing of execution and delivery of these orders and

consequently we were only able to realise revenue of EUR0.3

million, a decrease of 62% compared to the first six months of 2019

(H1 2019: EUR0.7 million).

The Company implemented various cost cutting initiatives in

response to the pandemic and, despite the revenue decrease, this

resulted in the EBITDA loss reducing slightly to EUR0.85 million

compared to the same period last year (H1 2019: EUR0.94 million).

Despite the gradual uptick in activity levels in the second half of

2020 due to the progressive lifting of the pandemic restrictions,

the cost cutting initiatives have been further intensified in the

second half of 2020.

However, it has been very encouraging that, after many years of

focus on the OEM wind turbine market, we have now started to

generate larger volume orders from OEM customers and have an

expanded pipeline of additional OEMs who are undertaking turbine

integration tests. Similarly, the Company is very pleased that,

after significant delays, it has managed to deliver the first test

installations to Vestas customers in Asia and North America. In

North America, there is particular focus on V82 and MN82 wind

turbines where initial test results are showing very encouraging

results.

Despite the various challenges the Company is facing, our

R&D activities remain an important part of our business and the

next generation of both the WindVision(TM) and WindEye(TM) products

are expected to be released at the end of 2020. In addition to many

new advanced functionalities, an important feature of the new

models is the reduction in unit costs by approximately 25% compared

to current systems.

Regarding the Covid-19 pandemic in general, one of our initial

reactions was to maintain our assembly line throughout the period

given the positive order situation. Seen retrospectively, and given

the prolonged effects of the pandemic, this decision has proven to

further challenge the cash flow constraints the Company has

experienced. As mentioned, the Company has seen an uptick in

activity levels in the second half of 2020 with revenue in the

third quarter surpassing the total revenue earned in the first half

of 2020, but it is of course reliant on punctual payments from

customers and other parties. Until now the Company has received

only limited financial help from the various Government Covid

support schemes. However, as stated in the recently released annual

accounts, the Company has received a long-term Covid-loan of EUR0.4

million from Vaekstfonden, the Danish Business Growth fund, and an

extension to repayment of instalments (totalling EUR0.15 million)

due in 2021 on the existing Vaekstfonden loan.

Financial Overview

Overall, the Group realised revenues of EUR0.3 million (H1 2019:

EUR0.7 million) and a net loss of EUR1.0 million for the period (H1

2019: loss of EUR1.0 million) after depreciation, amortisation and

warrant costs of EUR0.18 million (H1 2019: EUR0.14 million).

Cash flow from operations produced a net outflow of EUR0.7

million for the period compared to a net outflow of EUR1.7 million

in H1 2019. The Company's current cash position, which has been

assisted by the receipt of the new long-term Covid loan from

Vaekstfonden and the receipt of certain outstanding customers

payments, was EUR0.43 million as at 13 November 2020.

Outlook

As at the date of this announcement, the total order inflow in

2020 has been encouraging, standing at EUR3.0 million contractually

to be delivered in 2020. However, due to the ongoing Covid-19

pandemic and the impact on timing of execution and delivery of

these orders, the Board expects to convert only approximately

EUR1.3 million of these orders into realised revenue in 2020 with

the remaining EUR1.7 million of the order back-log to be carried

into 2021. Despite the only marginally higher revenue expectation

compared to 2019 and the general Covid implications in 2020, the

Board expects the financial performance in 2020 to be substantially

improved compared to 2019.

Moving into 2021 the level of uncertainty is, of course, high

due to the Covid-19 pandemic. However, in view of the

recently-announced new distribution agreements in Asia, the launch

of our Lidar as a Service (LaaS) concept, which has already

attracted very positive feedback from the market, and our Vestas

distribution agreement, the Board believes the Group is

well-positioned to pursue additional revenue streams in 2021.

Further, the cost reductions implemented during the current year,

which have been focussed on both operational expenses and

manufacturing costs, have reduced the estimated revenue break-even

level in the Company to approximately EUR3 million.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE

INCOME

FOR THE SIX MONTHSED 30 JUNE 2020

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2019

2020 2019

(unaudited) (unaudited) (audited)

Note EUR EUR EUR

Revenue 274,752 730,597 1,177,897

Cost of goods sold (151,445) (371,218) (629,560)

Gross profit 123,307 359,379 548,337

Administrative expenses (1,172,592) (1,451,745) (3,680,990)

Other operating income 16,076 16,075 32,145

Loss from operations (1,033,209) (1,076,291) (3,100,508)

Finance expenses (47,465) (53,081) (190,889)

Loss before taxation (1,080,674) (1,129,372) (3,291,397)

Taxation 67,194 90,437 212,488

Loss for the period (1,013,480) (1,038,935) (3,078,909)

Other comprehensive income

Items that will or maybe reclassified

to profit or loss:

Exchange losses arising on

translation of foreign operations 14,932 5,094 3,085

Total comprehensive loss for

the period (998,548) (1,033,841) (3,075,824)

============ ============== =============

Loss per share for loss attributable

to the ordinary equity holders

of Windar Photonics plc

Basic and diluted, cents per

share 2 (2.1) (2.3) (6.7)

------------ -------------- -------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE

2020

As at As at As at

30 June 30 June 31 December

2020 2019 2019

(unaudited) (unaudited) (audited)

Notes EUR EUR EUR

Assets

Non-current assets

Intangible assets 1,223,825 976,133 1,192,607

Property, plant & equipment 41,236 89,692 61,800

Deposits 24,957 43,796 24,980

Total non-current assets 1,290,018 1,109,621 1,279,387

-------------------------------- ------ ------------- ------------- -------------

Current assets

Inventory 3 1,062,398 1,088,878 1,019,564

Trade receivables 4 160,284 787,696 111,703

Other receivables 4 101,863 167,339 84,305

Tax credit receivables 4 67,303 210,723 212,428

Prepayments 15,152 65,412 44,857

Restricted cash and cash - 368,000 -

equivalents

Cash and cash equivalents 268,174 268,581 763,024

Total current assets 1,675,174 2,956,629 2,235,881

-------------------------------- ------ ------------- ------------- -------------

Total assets 2,965,192 4,066,250 3,515,268

-------------------------------- ------ ------------- ------------- -------------

Equity

Share capital 5 622,375 560,859 608,689

Share premium 14,016,576 12,558,434 13,692,119

Merger reserve 2,910,866 2,910,866 2,910,866

Foreign currency reserve (3,698) (16,621) (18,630)

Accumulated loss (17,352,276) (14,296,692) (16,338,796)

Total equity 208,843 1,716,846 854,248

-------------------------------- ------ ------------- ------------- -------------

Non-current liabilities

Warranty provisions 61,310 78,461 61,170

Loans 6 1,164,431 1,193,867 5,174

-------------------------------- ------ ------------- ------------- -------------

Total non-current liabilities 1,225,741 1,272,328 66,344

-------------------------------- ------ ------------- ------------- -------------

Current liabilities

Trade payables 7 950,015 523,745 1,045,792

Other payables and accruals 7 188,906 376,930 211,879

Invoice discounting 7 42,372 143,532 1,992

Contract liabilities 7 220,274 27,473 69,954

Loans 7 129,041 5,396 1,265,059

-------------------------------- ------ ------------- ------------- -------------

Total current liabilities 1,530,608 1,077,076 2,594,676

-------------------------------- ------ ------------- ------------- -------------

Total liabilities 2,756,349 2,349,404 2,661,020

-------------------------------- ------ ------------- ------------- -------------

Total equity and liabilities 2,965,192 4,066,250 3,515,268

-------------------------------- ------ ------------- ------------- -------------

CONSOLIDATED CASH FLOW STATEMENT FOR THE SIX MONTHSED

30 JUNE 2020

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2020 2019 2019

(unaudited) (unaudited) (audited)

EUR EUR EUR

Loss for the period before

tax (1,080,674) (1,129,372) (3,291,397)

Adjustments for:

Finance expenses 47,465 53,081 190,889

Amortisation 143,254 89,417 267,317

Depreciation 20,640 21,164 52,411

Received tax credit 212,570 - 120,186

Foreign exchange difference 14,932 5,094 3,085

Warrants expense 15,000 30,000 27,868

--------------------------------------- ------------ ------------ -------------

(626,813) (930,616) (2,629,641)

Movements in working capital

Changes in inventory (42,834) (361,880) (292,565)

Changes in receivables (66,139) (150,633) 144,164

Changes in prepayments 29,706 - 38,905

Changes in deposits 23 - 21,305

Changes in trade payables (95,780) 30,376 552,426

Changes in contract liabilities 150,320 (55,696) (13,214)

Changes in warranty provision 140 39 (17,252)

Changes in other payables

and provision 266 (190,529) 447,972

Cash flow (used in) operations (651,111) (1,658,939) (1,747,900)

--------------------------------------- ------------ ------------ -------------

Investing activities

Payments for intangible assets (245,743) (79,497) (528,278)

Grants received 74,055 - 50,824

Payments for tangible assets - - (3,427)

Cash flow (used in) investing

activities (171,688) (79,497) (480,881)

--------------------------------------- ------------ ------------ -------------

Financing activities

Proceeds from issue of share

capital 375,714 - 1,315,342

Costs associated with the

issue of share capital (37,571) - (133,827)

(Reduction) / proceeds from

invoice discounting 40,380 (2,158) (8,743)

(Decrease)/ increase restricted

cash balances - 282,935 158,138

Repayment of loans - (2,732) (5,240)

Interest (paid)/received (47,465) 7,200 (55,878)

Cash flow from financing activities 331,058 285,245 1,269,792

--------------------------------------- ------------ ------------ -------------

Net (decrease)/increase in

cash and cash equivalents (491,741) (1,453,191) (958,989)

Exchange differences (3,109) (31) 210

Cash and cash equivalents at

the beginning of the period 763,024 1,721,803 1,721,803

Cash and cash equivalents at

the end of the period 268,174 268,581 763,024

--------------------------------------- ------------ ------------ -------------

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX

MONTHS

ED 30 JUNE 2020

Share Share Merger Foreign Accumulated Total

Capital Premium reserve currency Losses

reserve

EUR EUR EUR EUR EUR EUR

--------------------- --------- ----------- ---------- ---------- ------------- ------------

At 1 January 2019 560,859 12,558,434 2,910,866 (21,715) (13,287,757) 2,720,687

Share option and

warrant costs - - - - 30,000 30,000

--------- ----------- ---------- ---------- ------------- ------------

Transaction with

owners - - - - 30,000 30,000

--------- ----------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (1,038,935) (1,038,935)

Other comprehensive

loss - - - 5,094 - 5,094

Total comprehensive

income - - - 5,094 (1,038,935) (1,033,841)

At 30 June 2019 560,859 12,558,434 2,910,866 (16,621) (14,296,692) 1,716,846

New shares issued 47,830 1,267,512 - - - 1,315,342

Costs associated

with capital raise - (133,827) - - - (133,827)

Share option and

warrant costs - - - - (2,130) (2,130)

--------- ----------- ---------- ---------- ------------- ------------

Transaction with

owners 47,830 1,133,685 - - (2,130) 1,179,385

--------- ----------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (2,039,974) (2,039,974)

Other comprehensive

income - - - (2,009) - (2,009)

Total comprehensive

income - - - (2,009) (2,039,974) (2,041,983)

At 31 December 2019 608,689 13,692,119 2,910,866 (18,630) (16,338,796) 854,248

New shares issued 13,686 324,457 - - - 338,143

Share option and

warrant costs - - - - 15,000 15,000

--------- ----------- ---------- ---------- ------------- ------------

Transaction with

owners 13,686 324,457 - - 15,000 353,143

--------- ----------- ---------- ---------- ------------- ------------

Comprehensive loss

for the period - - - - (1,013,480) (1,013,480)

Other comprehensive

Income - - - 14,932 - 14,932

Total comprehensive

income - - - 14,932 (1,013,480) (998,548)

At 30 June 2020 622,375 14,016,576 2,910,866 (3,698) (17,352,276) 208,843

--------------------- --------- ----------- ---------- ---------- ------------- ------------

1. BASIS OF PREPARATION

The financial information for the six months ended 30 June 2020

and 30 June 2019 does not constitute the Groups statutory financial

statements for those periods with the meaning of Section 434(3) of

the Companies Act 2006 and has neither been audited or reviewed

pursuant to guidance issued by the Auditing Practices Board. The

annual financial statements of Windar Photonics plc are prepared in

accordance with International Financial Reporting Standards as

endorsed by the European Union ("IFRS"). The principal accounting

policies used in preparing the Interim financial statements are

those that the Group expects to apply in its financial statements

for the year ended 31 December 2020 and are unchanged from those

disclosed in the Group's Annual Report for the year ended 31

December 2019. The comparative financial information for the year

ended 31 December 2019 included within this report does not

constitute the full statutory accounts for that period. The

statutory Annual Report and Financial Statements for 2019 have been

filed with the Registrar of Companies. The Independent Auditor's

Report on the Annual Report and Financial Statements for 2019 was

unqualified, but included a reference to the material uncertainty

related to going concern in respect of the timing of future

revenues without qualifying their report and did not contain a

statement under section 498(2)-498(3) of the Companies Act 2006.

After making enquiries, the directors have a reasonable expectation

that the Group has adequate resources to continue operating for the

next 12 months. Accordingly, they continue to adopt the going

concern basis in preparing the half yearly condensed consolidated

financial statements. This interim report was approved by the

directors.

2. Loss per share

The loss and weighted average number of ordinary shares used in

the calculation of basic loss per share are as follows:

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2019

2020 2019

EUR EUR EUR

Loss for the period (1,013,480) (1,038,935) (3,078,909)

------------ ------------- -------------

Weighted average number of ordinary

shares for the purpose of basic

earnings per share 49,167,898 44,508,369 45,639,729

Basic loss and diluted, cents per

share (2.1) (2.3) (6.7)

------------ ------------- -------------

There is no dilutive effect of the warrants as the dilution

would reduce the loss per share.

3. Inventory

As at

As at As at 31 December

30 June 30 June 2019

2020 2019

EUR EUR EUR

Raw materials 358,827 544,439 417,481

Work in progress 337,247 446,440 392,374

Finished goods 366,324 97,999 209,709

------------------ ---------- ---------- -------------

Inventory 1,062,398 1,088,878 1,019,564

------------------ ---------- ---------- -------------

4. Trade and other receivables

As at

As at As at 31 December

30 June 30 June 2019

2020 2019

EUR EUR EUR

--------------------------------------- ---------- ---------- -------------

Trade receivables 672,039 835,2606 623,458

Less; provision for impairment

of trade receivables (511,755) (47,564) (511,755)

--------------------------------------- ---------- ---------- -------------

Trade receivables - net 160,284 787,696 111,703

Total financial assets other than

cash and cash equivalents classified

at amortised costs 160,284 787,696 111,703

--------------------------------------- ---------- ---------- -------------

Tax receivables 67,303 210,723 212,428

Other receivables 101,863 167,339 84,305

Total other receivables 169,166 378,062 296,733

Total trade and other receivables 329,450 1,165,758 408,436

--------------------------------------- ---------- ---------- -------------

Classified as follows:

Current Portion 329,450 1,165,758 408,436

--------------------------------------- ---------- ---------- -------------

5. Share capital

Number

of shares EUR

Shares as 30 June 2019 44,508,369 560,859

Issue of shares for cash 4,076,348 47,830

Shares at 31 December 2019 48,584,717 608,689

Issue of shares for cash 1,166,361 13,686

Shares at 30 June 2020 49,751,078 622,375

------------------------------- ----------- --------

At 30 June 2020, the share capital comprises 49,751,078 shares

of 1 pence each.

6. Borrowings

The carrying value and fair value of Group's borrowings are as

follows:

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2019

2020 2019

EUR EUR EUR

Growth Fund (including accrued

interest) 1,285,457 1,185,764 1,259,499

Nordea Ejendomme 8,015 8,103 10,734

Total financial assets other than

cash and cash equivalents classified

as loans and receivables 1,293,472 1,193,867 1,270,233

--------------------------------------- ----------- ----------- -------------

The Growth Fund borrowing from the Danish public institution,

Vækstfonden, initially bore interest at a fixed annual rate of 12

per cent with a full bullet repayment in June 2020. Terms for the

borrowing were amended in June 2020, and November 2020, pursuant to

which the interest rate was reduced to 7 percent p.a. and the loan

is to be repaid in equal quarterly instalments over the period from

1 January 2022 until 1 January 2026. In November 2020 the Company

has received an offer on an additional Covid loan of EUR400,000 at

an annual interest rate of Cibor + 5% to be repaid over a 5 year

period starting from January 2022 The cash proceeds has been

received post reporting period..

The loan from Nordea Ejendomme is in respect of amounts included

in the fitting out of the offices in Denmark. The loan is repayable

over the 6 years and matures in November 2021 and carries a fixed

interest rate of 6 per cent.

Both loans are denominated in Danish Kroner.

7. Trade and other payables

As at As at

As at 30 June 31 December

30 June 2020 2019 2019

EUR EUR EUR

Invoice discounting 42,372 143,532 1,992

Trade payables 950,015 523,746 1,045,792

Other payables and accruals 188,906 376,930 211,879

Current portion of loans 129,041 5,396 1,265,059

Total financial liabilities,

excluding 'non-current'

loans and borrowings classified

as financial liabilities

measured at amortised cost 1,310,334 1,049,604 2,524,722

---------------------------------- --------------- ------------ -------------

Contract liabilities 220,274 27,473 69,954

---------------------------------- --------------- ------------ -------------

Total trade and other payables 1,530,608 1,077,076 2,594,676

---------------------------------- --------------- ------------ -------------

Classified as follows:

Current Portion 1,530,608 1,077,076 2,594,676

---------------------------------- --------------- ------------ -------------

There is no material difference between the net book value and

the fair values of current trade and other payables due to their

short-term nature.

8. Availability of Interim Report

Copies of the Interim Report will not be sent to shareholders

but will be available from the Group's website

www.investor.windarphotonics.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBBDBCXBDGGL

(END) Dow Jones Newswires

November 17, 2020 02:00 ET (07:00 GMT)

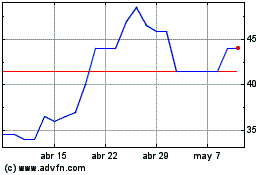

Windar Photonics (LSE:WPHO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Windar Photonics (LSE:WPHO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024