International Personal Finance Plc October 2020 Trading Update (6410F)

18 Noviembre 2020 - 1:00AM

UK Regulatory

TIDMIPF

RNS Number : 6410F

International Personal Finance Plc

18 November 2020

18 November 2020

International Personal Finance plc

October 2020 Trading Update

International Personal Finance plc (IPF) specialises in

providing unsecured consumer credit to around 1.7 million customers

across 10 markets. We operate the world's largest home credit

business and a leading fintech business, IPF Digital .

As part of our ongoing strategy to regularly inform and update

investors on key operational performance metrics during the

Covid-19 pandemic, IPF is publishing the following information for

October 2020.

-- Highlights

Ø Continued improvements in trading performance

Ø Collections effectiveness increased 2 ppts to 97% of pre-Covid

expectations

Ø Further increase in credit issued to 60% of pre-Covid

expectations

Ø Net cashflow of GBP7 million reflecting the progressive shift

towards growth

Ø Successful bond exchange and refinancing of the Group

Gerard Ryan, CEO at IPF, commented: "I'm very pleased to report

a further improvement in our collections performance and that we

are carefully increasing lending to our highest quality customers.

We are well-prepared for operating during the second wave of the

Covid pandemic, with our priority being the health and safety of

our colleagues and customers. Successfully completing the

refinancing of the business provides the financial foundation on

which we will continue to provide credit responsibly to

under-served consumers and deliver long-term growth and value to

all our stakeholders."

-- Continued improvements in trading performance

We continued to deliver progressive improvements in our

operational performance in October with a further increase in

credit issued and a good collections performance. The second wave

of the pandemic has resulted in rising Covid cases in all our

European markets. Various restrictions have been introduced by

governments, but our agents continue to serve their customers

effectively. Whilst freedom of movement restrictions are beginning

to result in a slight reduction in demand, the expected negative

impact on collections for which we had planned has not arisen. In

Mexico, reported Covid cases are stable and various state-by-state

restrictions remain in place. Safeguarding our people and customers

remains our priority and, applying the lessons learned in the first

wave of the pandemic, we are well-prepared, providing safety

guidance and PPE for all of our field-based colleagues and agents,

and alternative repayment options for affected customers.

-- Strong collections effectiveness

We continued to deliver a strong level of collections

effectiveness, rising to 97% of pre-Covid expectations in October.

All of our businesses (excluding Hungary where an opt-out

moratorium is in place) delivered a good performance. As reported

in our Q3 2020 statement, we continue to expect a modest reduction

in collections effectiveness during the winter period,

notwithstanding the fact we have seen improvements in the month of

October.

-- Good credit issued

The robust collections effectiveness delivered since the half

year has enabled a progressive relaxation of credit settings in

order to increase lending and reduce the rate of contraction of our

receivables portfolio. This strategy has driven an increase in

credit issued to 60% of pre-Covid expectations, primarily in our

home credit operations in Europe and Mexico. Our plan remains to

continue increasing credit issued during the remainder of the year

while maintaining a clear focus on portfolio quality and the

macroeconomic effects of Covid.

-- Net cashflow generation

Net cashflow generation in October was GBP7 million. This more

modest level of cash generation compared to recent months was

expected and reflects our strategic decision to increase lending

cautiously to rebuild the portfolio, together with tax payments

falling due in a number of our jurisdictions in the month.

-- Successful refinancing of the business

As previously reported, a new 5-year bond issue and amended

covenant package across all the Group's bonds has been successfully

completed. This, together with the Group's bank facilities, totals

GBP560 million of funding with amended covenants that is available

to support future growth of the business. This compares to

borrowings net of non-operational cash balances of GBP401 million

at the end of October.

Investor relations and media contact:

International Personal Finance Rachel Moran

+44 (0)7760 167637 / +44 (0)113

285 6798

A copy of this statement can be found on our website -

www.ipfin.co.uk

Legal Entity Identifier: 213800II1O44IRKUZB59

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDDLFFBFLXFBD

(END) Dow Jones Newswires

November 18, 2020 02:00 ET (07:00 GMT)

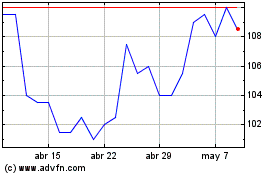

International Personal F... (LSE:IPF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

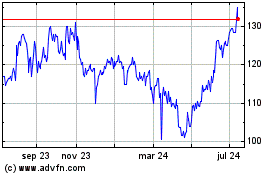

International Personal F... (LSE:IPF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024