TIDMBHP

RNS Number : 2318G

BHP Group PLC

23 November 2020

NEWS RELEASE

Release Time IMMEDIATE

Date 23 November 2020

Release Number 22/20

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO

ANY PERSON LOCATED OR RESIDENT IN OR AT ANY ADDRESS IN, ANY

JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE

THIS ANNOUNCEMENT (SEE "LEGAL NOTICES" BELOW).

BHP's subordinated note repurchase plan - price

determination

BHP announced today the pricing of its global multi-currency

subordinated note repurchase plan.

BHP Billiton Finance (USA) Limited ("BHPB Finance (USA)

Limited") and BHP Billiton Finance Limited ("BHPB Finance Limited"

and, together with BHPB Finance (USA) Limited, the "Companies" and

each a "Company") today announced the pricing of BHP's global

multi-currency subordinated note repurchase plan, announced on 13

November 2020, which includes:

(a) an invitation by BHPB Finance (USA) Limited to eligible

holders of its outstanding US$2,250,000,000 6.750 per cent.

Subordinated Non-Call 10 Fixed Rate Reset Notes due 2075 guaranteed

by BHP Group Limited and BHP Group Plc (the "Parent Companies")

(ISIN: US055451AX66 (Rule 144A) / USQ12441AB91 (Reg S)) (CUSIP:

055451AX6 / Q12441AB9) , of which US$745,768,000 in principal

amount of such Notes was outstanding as at the Launch Date (the "US

Dollar Notes"); and

(b) an invitation by BHPB Finance Limited to eligible holders of

its outstanding EUR750,000,000 5.625 per cent. Subordinated

Non-Call 9 Fixed Rate Reset Notes due 2079 guaranteed by BHP Group

Limited and such Notes and such guarantee being guaranteed by BHP

Group Plc (ISIN: XS1309436910), of which EUR714,733,000 in

principal amount of such Notes was outstanding as at the Launch

Date (the "Euro Notes"; the Euro Notes and the US Dollar Notes each

being a "Series", and any notes within any such Series being the

"Notes", and the eligible holders of any Notes, the "Holders"),

to offer to tender any and all of their Notes for repurchase by

the relevant Company for cash (together, the "Offers"), on the

terms and conditions set out in a tender offer memorandum dated 13

November 2020 prepared by the Companies in connection with the

Offers (the "Tender Offer Memorandum") .

The Offers are subject to the offer restrictions set out below

and as more fully described in the Tender Offer Memorandum. For

detailed terms of, and information on the procedures for

participating in, the Offers, please refer to the Tender Offer

Memorandum, copies of which are (subject to the distribution

restrictions) available from the Tender and Information Agent as

set out below.

Notes purchased in the Offers are intended to be retired and

cancelled.

Capitalised terms not defined in this announcement have the

meanings given to them in the Tender Offer Memorandum.

Pricing determination

In accordance with the Tender Offer Memorandum, pricing of the

Offers took place at 10:00 a.m., New York time today, 23 November

2020. The table below sets out the Consideration for each

Series.

Notes ISIN / CUSIP Principal Reference Yield Fixed Spread Reference Consideration

amount Security or

outstanding as Reference

at Launch Date Interpolated

Rate

US Dollar Notes US055451AX66 US$745,768,000 0.388% 170 bps 0.25% US$1,215.93 per

(Rule 144A) / U.S. Treasury US$1,000

055451AX6 Security due

(CUSIP) October 31,

2025

USQ12441AB91

(Reg S) /

Q12441AB9

(CUSIP)

---------------- ---------------- --------------- ------------ --------------- ----------------

Interpolated

Euro Mid-Swap EUR1,182.11 per

Euro Notes XS1309436910 EUR714,733,000 -0.492% 135 bps Rate EUR1,000

---------------- ---------------- --------------- ------------ --------------- ----------------

The Companies shall also pay Accrued Interest (rounded to the

nearest cent, with half a cent rounded upwards) on all Notes

validly tendered and accepted for purchase pursuant to the relevant

Offer(s).

The Offers will expire at 5:00 p.m. (New York City time) today,

23 November 2020, unless extended, reopened, amended and/or

terminated by the relevant Company as provided in the Tender Offer

Memorandum (such applicable date and time, the "Expiration

Deadline").

Notes tendered may be withdrawn at any time prior to or at 5:00

p.m. (New York City time) today, 23 November 2020, unless extended

or otherwise amended in respect of any Offer by the relevant

Company in accordance with the Tender Offer Memorandum (such

applicable date and time, the "Withdrawal Deadline") but not

thereafter.

The relevant deadlines set by any intermediary or Clearing

System will be earlier than these deadlines. Tender Instructions

(or, if applicable, Notices of Guaranteed Delivery) must be

submitted in respect of a minimum principal amount of Notes of the

relevant Series of no less than the Minimum Denomination for such

Series, and may be submitted in integral multiples of US$1,000 or

EUR1,000, as applicable. There is no separate letter of transmittal

in connection with the Tender Offer Memorandum.

The Offers are subject to the satisfaction of certain

conditions, as set forth in the Tender Offer Memorandum.

The Companies have an option to redeem remaining Notes of a

Series at par plus any accrued but unpaid interest following the

purchase of at least 80 per cent. of the aggregate principal amount

of Notes of such Series issued on the "Issue Date" for such

Series

The terms and conditions of each Series allow the relevant

Company (subject to applicable laws) to redeem the Notes in that

Series early (in whole but not in part), at their outstanding

principal amount plus any accrued but unpaid interest, if a

"Substantial Repurchase Event" occurs, meaning at least 80 per

cent. of the aggregate principal amount of the Notes of such Series

issued on the "Issue Date" for such Series has been purchased by or

on behalf of the relevant Company and certain related parties of

the relevant issuing Company. Such redemption will be subject to

giving not less than 30 days' irrevocable notice.

It is the current intention of each Company to redeem the

remaining Notes of each Series at their outstanding principal

amount plus any accrued but unpaid interest, in accordance with the

Series' terms and conditions, if a "Substantial Repurchase Event"

is triggered in respect of such Series by the purchase of any Notes

pursuant to the relevant Offer(s). However, no Company is under any

obligation to make any such redemption and each Company's intention

to do so may change at any time and for any reason.

Further, each Company may, if the "Substantial Repurchase Event"

is not triggered by the purchase of Notes pursuant to the Offer

made by that Company, acquire outstanding Notes of the relevant

Series by way of open market purchases or otherwise and may, as a

consequence, trigger a "Substantial Repurchase Event". However, no

Company is under any obligation to make any such acquisition. Any

future purchases by either Company or its affiliates will depend on

various factors existing at that time.

Guaranteed Delivery Procedures

A Holder who desires to tender its Notes but either cannot

comply with the applicable procedures for book-entry transfer or

time will not permit such Notes to be tendered on or before the

Expiration Deadline, may effect a Tender pursuant to the Guaranteed

Delivery Procedures set out in the Tender Offer Memorandum.

The delivery of Notes tendered by the Guaranteed Delivery

Procedures must be made no later than 5:00 p.m. (New York City

time) on the second Business Day after the Expiration Deadline,

expected to be 25 November 2020 (such applicable date and time, the

"Guaranteed Delivery Deadline").

Summary Timetable

The following table sets out the expected dates and times of the

remaining key events relating to each Offer. All references to

dates and times are to New York City dates and times unless

indicated otherwise. The times and dates below are indicative only

and subject to change at the discretion of the relevant Company. In

particular, the below times and dates are subject to the right of

each Company to extend, re-open, amend, and/or terminate the Offer

made by that Company (subject to applicable law and as provided in

the Tender Offer Memorandum).

Holders are advised to check with any bank, securities broker or

other intermediary through which they hold Notes when such

intermediary would need to receive instructions from a Holder in

order for that Holder to be able to participate in, or withdraw

their instruction to participate in, the Offers by the deadlines

specified in the Tender Offer Memorandum. The deadlines set by any

such intermediary and each Clearing System for the submission and

withdrawal of a Tender (including, where applicable, by way of the

Guaranteed Delivery Procedures) will be earlier than the relevant

deadlines specified in the Tender Offer Memorandum.

Date Calendar Date and Time

Withdrawal Deadline 5:00 p.m., New York City time, on 23 November

2020

-------------------------------------------------

Expiration Deadline 5:00 p.m., New York City time, on 23 November

2020

-------------------------------------------------

Results Announcement As soon as practicable after the Expiration

Time Deadline, expected to be 24 November 2020

-------------------------------------------------

Guaranteed Delivery 5:00 p.m., New York City time, on the second

Deadline Business Day after the Expiration Deadline,

expected to be 25 November 2020

-------------------------------------------------

Settlement Date Expected to be 27 November 2020, the third

Business Day after the Expiration Deadline,

or as soon as reasonably practicable thereafter

-------------------------------------------------

Unless stated otherwise in the Tender Offer Memorandum, all

announcements in connection with the Offers will be made in

accordance with applicable law: (i) by publication through RNS;

(ii) by the delivery of notices to the Clearing Systems for

communication to Direct Participants; (iii) on the relevant Reuters

Insider Screen; (iv) by the issue of a press release to a Notifying

News Service or on the BHP Group website; (v) on the Offer Website;

and/or (vi) obtainable from the Tender and Information Agent, the

contact details for which are below. Significant delays may be

experienced where notices are delivered to the Clearing Systems and

Holders are urged to contact the Tender and Information Agent for

the relevant announcements during the course of the Offers. In

addition, Holders may contact the Lead Dealer Managers for

information regarding the Offers using the contact details set out

below.

Further Information

Holders may contact the Lead Dealer Managers or the Tender and

Information Agent using the contact details below:

LEAD DEALER MANAGERS

Deutsche Bank AG, London Branch Merrill Lynch International

Winchester House 2 King Edward Street

1 Great Winchester Street London, EC1A 1HQ

London EC2N 2DB United Kingdom

United Kingdom Telephone (London): +44 20 7996

Telephone (London): +44 (0) 20 5420

7545 8011 Telephone (U.S. Toll Free): +1

Telephone (US Toll Free): +1 (866) (888) 292 0070

627 0391 Telephone (U.S.): +1 (980) 387

Telephone (US): +1 (212) 250 2955 3907

Attention: Liability Management Attention: Liability Management

Group Group

Email: DG.LM-EMEA@bofa.com

In respect of the Offer for Euro In respect of the Offer for US

Notes: Dollar Notes:

UBS AG London Branch UBS Securities LLC

5 Broadgate 1285 Avenue of the Americas

London EC2M 2QS New York, New York 10019

United States of America

Telephone: +44 20 7568 1121 U.S. Toll Free: +1 (888) 719-4210

Attention: Liability Management Collect: +1 (203) 719-4210

Group In Europe: +44 20 7568 1121

Email: ol-liabilitymanagement-eu@ubs.com Attention: Liability Management

Group

Email: ol-liabilitymanagement-eu@ubs.com

TER AND INFORMATION AGENT

D.F. King

Offer Website: www.dfking.com/bhp

Email: bhp@dfking.com

In New York: In London:

48 Wall Street 65 Gresham Street

New York, NY 10005 London EC2V 7NQ

Fax: +1 (212) 709-3328 United Kingdom

Banks and Brokers Call: +1 (212) Tel: +44 20 7920 9700

269-5550

All Others Call: +1 (866) 829-0135

Legal notices

This announcement must be read in conjunction with the Tender

Offer Memorandum. The Tender Offer Memorandum contains important

information which must be read carefully before any decision is

made with respect to the Offers described in this announcement. If

any Holder is in any doubt about any aspect of the Offers and/or

the action it should take, it is recommended to seek its own legal,

tax and financial advice from its stockbroker, bank manager,

counsel, accountant or other independent adviser. Any Holder whose

Notes are held on its behalf by a bank, securities broker or other

intermediary must contact such entity if it wishes to offer to

tender such Notes pursuant to the Offers. The Dealer Managers are

acting exclusively for the Companies and no one else in connection

with the arrangements described in this announcement and the Tender

Offer Memorandum and will not be responsible to any Holder for

providing the protections which would be afforded to customers of

the Dealer Managers or for advising any other person in connection

with the Offers.

This announcement is for informational purposes only and is

neither an offer to purchase nor the solicitation of an offer to

sell any of the securities described herein, and neither this

announcement nor the Tender Offer Memorandum constitutes an offer

or invitation to participate in the Offers in any jurisdiction in

which, or to any person to or from whom, it is unlawful to make

such offer or invitation or for there to be such participation

under applicable laws. The distribution of this announcement and

the Tender Offer Memorandum, and the transactions contemplated by

the Offers, may be restricted in certain jurisdictions by law.

Persons into whose possession the Tender Offer Memorandum comes are

required by BHPB Finance Limited, BHPB Finance (USA) Limited, the

Parent Companies, the Dealer Managers and the Tender and

Information Agent to inform themselves about and to observe any

such restrictions. The materials relating to the Offers, including

this announcement, do not constitute, and may not be used in

connection with, an offer or solicitation in any place where, or

from any person to or whom, offers or solicitations are not

permitted by law.

None of the Companies, the Parent Companies, the Dealer Managers

or the Tender and Information Agent or any of their respective

directors, employees or affiliates make any representation or

recommendation whatsoever regarding this announcement, the Tender

Offer Memorandum or the Offers or whether any Holder should submit

Tenders or refrain from doing so, and no one has been authorised by

any of them to make any such recommendation. None of the Companies,

the Parent Companies, the Dealer Managers or the Tender and

Information Agent (or any of their respective directors, officers,

employees, agents or affiliates) is providing Holders with any

legal, business, tax or other advice in this announcement and/or

the Tender Offer Memorandum. Each Holder must make its own decision

as to whether to submit Tenders or refrain from doing so and, if it

wishes to submit a Tender, the principal amount of Notes to

tender.

NEITHER THIS ANNOUNCEMENT NOR THE TER OFFER MEMORANDUM HAS BEEN

REVIEWED BY ANY STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY

IN THE UNITED STATES, THE UNITED KINGDOM OR THE EUROPEAN ECONOMIC

AREA, NOR HAS THE U.S. SECURITIES AND EXCHANGE COMMISSION OR ANY

SUCH COMMISSION OR AUTHORITY PASSED UPON THE ACCURACY OR ADEQUACY

OF THIS ANNOUNCEMENT NOR THE TER OFFER MEMORANDUM. ANY

REPRESENTATION TO THE CONTRARY IS UNLAWFUL AND MAY BE A CRIMINAL

OFFENCE.

United Kingdom

The communication of this announcement, the Tender Offer

Memorandum and any other documents or materials relating to the

Offers is not being made, and such documents and/or materials have

not been approved, by an authorised person for the purposes of

Section 21 of the Financial Services and Markets Act 2000 (as

amended). Accordingly, such documents and/or materials are not

being distributed to, and must not be passed on to, the general

public in the United Kingdom, and are only for circulation to

persons to whom they can lawfully be circulated outside the United

Kingdom or to persons within the United Kingdom falling within the

definition of investment professionals (as defined in Article 19(5)

of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the "Order")), or within Article 43(2) of

the Order, or within Article 49(2)(a) to (d) of the Order, or to

other persons to whom it may lawfully be communicated in accordance

with the Order (such persons together being the "Relevant

Persons"). Each of this announcement and the Tender Offer

Memorandum is only available to Relevant Persons and the

transaction contemplated therein will be available only to, or

engaged in only with, Relevant Persons, and no person other than

Relevant Persons should act on or rely on this

announcement, the Tender Offer Memorandum or any of its

contents.

Australia

No prospectus or other disclosure document (as defined in the

Corporations Act 2001 (Cth) ("Corporations Act")) in relation to

the Offers has been or will be lodged with the Australian

Securities and Investments Commission ("ASIC") or any other

regulatory authority in Australia and the Tender Offer Memorandum

does not comply with Division 5A of Part 7.9 of the Corporations

Act.

No offers or applications will be made or invited for the

purchase of any or all Notes in Australia (including an offer or

invitation which is received by a person in Australia).

This announcement, the Tender Offer Memorandum and any other

offering material or advertisement relating to any or all Notes

will not be distributed or published in Australia, unless: (i) such

action complies with all applicable laws, directives and

regulations (including, without limitation, the licensing

requirements set out in Chapter 7 of the Corporations Act); (ii)

such action does not require any document to be lodged with ASIC or

any other regulatory authority in Australia; and (iii) the offer or

invitation is made in circumstances specified in Corporations

Regulation 7.9.97.

If you are a resident of Australia, you have been sent the

Tender Offer Memorandum on the basis that you are a wholesale

client for the purposes of Section 761G of the Corporations Act or

otherwise a person to whom disclosure is not required under Part

6D.2 or Chapter 7 of the Corporations Act.

Italy

None of the Offers, this announcement, the Tender Offer

Memorandum or any other documents or materials relating to the

Offers has been or will be submitted to the clearance procedures of

the Commissione Nazionale per le Società e la Borsa ("CONSOB")

pursuant to Italian laws and regulations.

Therefore, the Offers may only be carried out in the Republic of

Italy pursuant to an exemption under article 101-bis, paragraph

3-bis of the Legislative Decree No. 58 of 24 February 1998, as

amended (the "Financial Services Act") and article 35-bis,

paragraph 4 of CONSOB Regulation No. 11971 of 14 May 1999, as

amended. Holders of each Series of Notes that are resident and/or

located in the Republic of Italy may tender their Notes through

authorised persons (such as investment firms, banks or financial

intermediaries permitted to conduct such activities in the Republic

of Italy in accordance with the Financial Services Act, CONSOB

Regulation No. 20307 of 15 February 2018, as amended from time to

time, and Legislative Decree No. 385 of September 1, 1993, as

amended) and in compliance with applicable laws and regulations or

with requirements imposed by CONSOB or any other Italian

authority.

Each intermediary must comply with the applicable laws and

regulations concerning information duties vis-à-vis its clients in

connection with the Notes and the Offers.

France

The Offers are not being made, directly or indirectly, to the

public in the Republic of France. This announcement and the Tender

Offer Memorandum and any other document or material relating to the

Offers have only been and shall only be distributed in France to

qualified investors as defined in Article 2(e) of Regulation (EU)

2017/1129. Neither this announcement nor the Tender Offer

Memorandum has been nor will be submitted for clearance to nor

approved by the Autorité des Marchés Financiers.

General

Neither this announcement, the Tender Offer Memorandum nor any

other materials relating to the Offers constitutes an offer to buy

or the solicitation of an offer to sell Notes (and Tenders will not

be accepted from Holders) in any circumstances in which such offer

or solicitation is unlawful. If a jurisdiction requires that the

Offers be made by a licensed broker or dealer and any of the Dealer

Managers or any of their respective affiliates is a licensed broker

or dealer in that jurisdiction, the Offers shall be deemed to be

made by such Dealer Manager or affiliate, as the case may be, on

behalf of the Companies in that jurisdiction .

Each Holder wishing to submit a Tender will be deemed to give

certain agreements, acknowledgements, representations, warranties

and undertakings in respect of the jurisdictions referred to above

and generally as set out in the Tender Offer Memorandum. Any Tender

from a Holder that is unable to make these agreements,

acknowledgements, representations, warranties and undertakings will

not be accepted. Each of BHPB Finance Limited, BHPB Finance (USA)

Limited, the Parent Companies, the Dealer Managers and the Tender

and Information Agent reserves the right, in its absolute

discretion, to investigate, in relation to any Tender, whether any

such representation and warranty given by a Holder is correct and,

if such investigation is undertaken and as a result the Companies

determine (for any reason) that such representation is not correct,

such tender shall not be accepted. None of BHPB Finance Limited,

BHPB Finance (USA) Limited, the Parent Companies, the Dealer

Managers and the Tender and Information Agent is under any

obligation to make such an investigation.

Further information on BHP can be found at: bhp.com

Authorised for lodgement by:

Caroline Cox

Group General Counsel & Company

Secretary

Media Relations Investor Relations

Email: media.relations@bhp.com Email: investor.relations@bhp.com

Australia and Asia Australia and Asia

Gabrielle Notley Tara Dines

Tel: +61 3 9609 3830 Mobile: Tel: +61 3 9609 2222 Mobile:

+61 411 071 715 + 61 499 249 005

Europe, Middle East and Africa Europe, Middle East and Africa

Neil Burrows James Bell

Tel: +44 20 7802 7484 Mobile: Tel: +44 20 7802 7144 Mobile:

+44 7786 661 683 +44 79 61 636 432

Americas Americas

Judy Dane Brian Massey

Tel: +1 713 961 8283 Mobile: Tel: +1 713 296 7919 Mobile:

+1 713 299 5342 +1 832 870 7677

BHP Group Limited ABN 49 004 BHP Group plc Registration

028 077 number 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in Australia Registered in England and Wales

Registered Office: Level 18, Registered Office: Nova South,

171 Collins Street 160 Victoria Street

Melbourne Victoria 3000 Australia London SW1E 5LB United Kingdom

Tel +61 1300 55 4757 Fax +61 Tel +44 20 7802 4000 Fax +44

3 9609 3015 20 7802 4111

Members of the BHP Group which is

headquartered in Australia

Follow us on social media

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUOSNRRNUAUAA

(END) Dow Jones Newswires

November 23, 2020 11:49 ET (16:49 GMT)

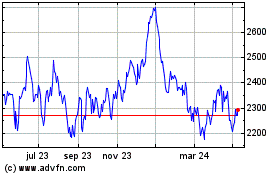

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

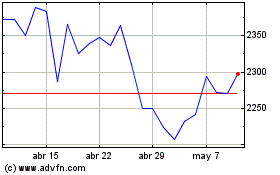

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024