TIDMBHP

RNS Number : 3594G

BHP Group PLC

24 November 2020

NEWS RELEASE

Release Time IMMEDIATE

Date 24 November 2020

Release Number 23/20

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO

ANY PERSON LOCATED OR RESIDENT IN OR AT ANY ADDRESS IN, ANY

JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE

THIS ANNOUNCEMENT (SEE "LEGAL NOTICES" BELOW).

Results of BHP's subordinated note repurchase plan

BHP announced today the results of its global multi-currency

subordinated note repurchase plan.

BHP Billiton Finance (USA) Limited ("BHPB Finance (USA)

Limited") and BHP Billiton Finance Limited ("BHPB Finance Limited"

and, together with BHPB Finance (USA) Limited, the "Companies" and

each a "Company") today announced the results of BHP's global

multi-currency subordinated note repurchase plan, announced on 13

November 2020, which includes:

(a) an invitation by BHPB Finance (USA) Limited to eligible

holders of its outstanding US$2,250,000,000 6.750 per cent.

Subordinated Non-Call 10 Fixed Rate Reset Notes due 2075 guaranteed

by BHP Group Limited and BHP Group Plc (the "Parent Companies")

(ISIN: US055451AX66 (Rule 144A) / USQ12441AB91 (Reg S)) (CUSIP:

055451AX6 / Q12441AB9), of which US$745,768,000 in principal amount

of such Notes was outstanding as at the Launch Date (the "US Dollar

Notes"); and

(b) an invitation by BHPB Finance Limited to eligible holders of

its outstanding EUR750,000,000 5.625 per cent. Subordinated

Non-Call 9 Fixed Rate Reset Notes due 2079 guaranteed by BHP Group

Limited and such Notes and such guarantee being guaranteed by BHP

Group Plc (ISIN: XS1309436910), of which EUR714,733,000 in

principal amount of such Notes was outstanding as at the Launch

Date (the "Euro Notes"; the Euro Notes and the US Dollar Notes each

being a "Series", and any notes within any such Series being the

"Notes", and the eligible holders of any Notes, the "Holders"),

to offer to tender any and all of their Notes for repurchase by

the relevant Company for cash (together, the "Offers"), on the

terms and conditions set out in a tender offer memorandum dated 13

November 2020 prepared by the Companies in connection with the

Offers (the "Tender Offer Memorandum") .

Capitalised terms not defined in this announcement have the

meanings given to them in the Tender Offer Memorandum.

Results of Offers

The Expiration Deadline for the Offers was 5:00 p.m., New York

City time, on 23 November 2020 (the "Expiration Deadline"). The

Withdrawal Deadline was 5:00 p.m., New York City time, on 23

November 2020. As a result, tendered Notes may no longer be

withdrawn.

The table below contains a summary of the principal amount of

Notes the Companies have accepted for purchase pursuant to the

Offers following the Expiration Deadline, being all Notes validly

tendered and not withdrawn by Holders by the Expiration

Deadline.

Notes ISIN / CUSIP Principal Final Acceptance Principal amount

amount outstanding as Amounts(1) outstanding after

at Launch Date Settlement Date(1)

US Dollar Notes US055451AX66 (Rule 144A) US$745,768,000 US$ 492,709,000 US$ 253,059,000

/ 055451AX6 (CUSIP)

USQ12441AB91 (Reg S) /

Q12441AB9 (CUSIP)

------------------------ ----------------------- ------------------------ -----------------------

Euro Notes XS1309436910 EUR714,733,000 EUR461,102,000 EUR253,631,000

------------------------ ----------------------- ------------------------ -----------------------

(1) Assuming that all Notes tendered pursuant to the Guaranteed

Delivery Procedures are validly delivered by the Guaranteed

Delivery Deadline. The aggregate principal amount of US Dollar

Notes tendered pursuant to the Guaranteed Delivery Procedures is

US$1,500,000. No amount of Euro Notes were tendered pursuant to the

Guaranteed Delivery Procedures.

Holders who tendered their Notes pursuant to the Guaranteed

Delivery Procedures set out in the Tender Offer Memorandum must

deliver such Notes no later than 5:00 p.m. (New York City time) on

the second Business Day after the Expiration Deadline, being 25

November 2020 (such applicable date and time, the "Guaranteed

Delivery Deadline").

Payment for the Notes validly tendered and accepted for purchase

(and, in the case of Notes tendered pursuant to the Guaranteed

Delivery Procedures, validly delivered by the Guaranteed Delivery

Deadline) will be made on the Settlement Date, expected to be 27

November 2020, the third Business Day after the Expiration

Deadline.

The Companies have an option to redeem remaining Notes of a

Series at par plus any accrued but unpaid interest following the

purchase of at least 80 per cent. of the aggregate principal amount

of Notes of such Series issued on the "Issue Date" for such

Series

As detailed further in the Tender Offer Memorandum, the terms

and conditions of each Series allow the relevant Company (subject

to applicable laws) to redeem the Notes in that Series early (in

whole but not in part), at their outstanding principal amount plus

any accrued but unpaid interest, if a "Substantial Repurchase

Event" occurs, meaning at least 80 per cent. of the aggregate

principal amount of the Notes of such Series issued on the "Issue

Date" for such Series has been purchased by or on behalf of the

relevant Company and certain related parties of the relevant

issuing Company.

Following settlement :

(a) 88.75 per cent. of the total aggregate principal amount of

the US Dollar Notes issued on the "Issue Date" for such Series will

have been purchased by BHPB Finance (USA) Limited assuming that all

US Dollar Notes tendered pursuant to the Guaranteed Delivery

Procedures are validly delivered by the Guaranteed Delivery

Deadline or 88.69 per cent. of the total aggregate principal amount

of the US Dollar Notes issued on the "Issue Date" excluding any US

Dollar Notes tendered pursuant to the Guaranteed Delivery

Procedures ; and

(b) 66.18 per cent. of the total aggregate principal amount of

the Euro Notes issued on the "Issue Date" for such Series will have

been purchased by BHPB Finance Limited.

Accordingly, at such time, a "Substantial Repurchase Event" will

have been triggered in respect of the US Dollar Notes and it is the

current intention of BHPB Finance (USA) Limited to redeem the

remaining US Dollar Notes at their outstanding principal amount

plus any accrued but unpaid interest, in accordance with the US

Dollar Notes' terms and conditions, following settlement of the

Offer for US Dollar Notes. However, BHPB Finance (USA) Limited is

not under any obligation to make any such redemption and BHPB

Finance (USA) Limited's intention to do so may change at any time

and for any reason.

BHPB Finance Limited may choose to acquire outstanding Euro

Notes by way of open market purchases from time to time, but is

under no obligation to make any such open market purchases. In

addition, if such open market purchases are made and a "Substantial

Repurchase Event" is triggered in respect of the Euro Notes, BHPB

Finance Limited is not under any obligation to make any redemption

pursuant to the terms and conditions of the Euro Notes.

Further Information

Holders may contact the Lead Dealer Managers or the Tender and

Information Agent using the contact details below:

LEAD DEALER MANAGERS

Deutsche Bank AG, London Branch Merrill Lynch International

Winchester House 2 King Edward Street

1 Great Winchester Street London, EC1A 1HQ

London EC2N 2DB United Kingdom

United Kingdom Telephone (London): +44 20 7996

Telephone (London): +44 (0) 20 5420

7545 8011 Telephone (U.S. Toll Free): +1

Telephone (US Toll Free): +1 (866) (888) 292 0070

627 0391 Telephone (U.S.): +1 (980) 387

Telephone (US): +1 (212) 250 2955 3907

Attention: Liability Management Attention: Liability Management

Group Group

Email: DG.LM-EMEA@bofa.com

In respect of the Offer for Euro In respect of the Offer for US

Notes: Dollar Notes:

UBS AG London Branch UBS Securities LLC

5 Broadgate 1285 Avenue of the Americas

London EC2M 2QS New York, New York 10019

United States of America

Telephone: +44 20 7568 1121 U.S. Toll Free: +1 (888) 719-4210

Attention: Liability Management Collect: +1 (203) 719-4210

Group In Europe: +44 20 7568 1121

Email: ol-liabilitymanagement-eu@ubs.com Attention: Liability Management

Group

Email: ol-liabilitymanagement-eu@ubs.com

TER AND INFORMATION AGENT

D.F. King

Offer Website: www.dfking.com/bhp

Email: bhp@dfking.com

In New York: In London:

48 Wall Street 65 Gresham Street

New York, NY 10005 London EC2V 7NQ

Fax: +1 (212) 709-3328 United Kingdom

Banks and Brokers Call: +1 (212) Tel: +44 20 7920 9700

269-5550

All Others Call: +1 (866) 829-0135

Legal notices

This announcement must be read in conjunction with the Tender

Offer Memorandum. No offer or invitation to acquire or sell any

securities is being made pursuant to this announcement.

The distribution of this announcement and the Tender Offer

Memorandum, and the transactions contemplated by the Offers, may be

restricted in certain jurisdictions by law. Persons into whose

possession the Tender Offer Memorandum comes are required by BHPB

Finance Limited, BHPB Finance (USA) Limited, the Parent Companies,

the Dealer Managers and the Tender and Information Agent to inform

themselves about and to observe any such restrictions. The

materials relating to the Offers, including this announcement, do

not constitute, and may not be used in connection with, an offer or

solicitation in any place where, or from any person to or whom,

offers or solicitations are not permitted by law.

None of the Companies, the Parent Companies, the Dealer Managers

or the Tender and Information Agent (or any of their respective

directors, officers, employees, agents or affiliates) is providing

Holders with any legal, business, tax or other advice in this

announcement and/or the Tender Offer Memorandum.

NEITHER THIS ANNOUNCEMENT NOR THE TENDER OFFER MEMORANDUM HAS

BEEN REVIEWED BY ANY STATE SECURITIES COMMISSION OR REGULATORY

AUTHORITY IN THE UNITED STATES, THE UNITED KINGDOM OR THE EUROPEAN

ECONOMIC AREA, NOR HAS THE U.S. SECURITIES AND EXCHANGE COMMISSION

OR ANY SUCH COMMISSION OR AUTHORITY PASSED UPON THE ACCURACY OR

ADEQUACY OF THIS ANNOUNCEMENT NOR THE TENDER OFFER MEMORANDUM. ANY

REPRESENTATION TO THE CONTRARY IS UNLAWFUL AND MAY BE A CRIMINAL

OFFENCE.

Further information on BHP can be found at: bhp.com

Authorised for lodgement by:

Caroline Cox

Group General Counsel & Company

Secretary

Media Relations Investor Relations

Email: media.relations@bhp.com Email: investor.relations@bhp.com

Australia and Asia Australia and Asia

Gabrielle Notley Tara Dines

Tel: +61 3 9609 3830 Mobile: Tel: +61 3 9609 2222 Mobile:

+61 411 071 715 + 61 499 249 005

Europe, Middle East and Africa Europe, Middle East and Africa

Neil Burrows James Bell

Tel: +44 20 7802 7484 Mobile: Tel: +44 20 7802 7144 Mobile:

+44 7786 661 683 +44 79 61 636 432

Americas Americas

Judy Dane Brian Massey

Tel: +1 713 961 8283 Mobile: Tel: +1 713 296 7919 Mobile:

+1 713 299 5342 +1 832 870 7677

BHP Group Limited ABN 49 004 BHP Group plc Registration

028 077 number 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in Australia Registered in England and Wales

Registered Office: Level 18, Registered Office: Nova South,

171 Collins Street 160 Victoria Street

Melbourne Victoria 3000 Australia London SW1E 5LB United Kingdom

Tel +61 1300 55 4757 Fax +61 Tel +44 20 7802 4000 Fax +44

3 9609 3015 20 7802 4111

Members of the BHP Group which is

headquartered in Australia

Follow us on social media

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBIBJTMTMTBRM

(END) Dow Jones Newswires

November 24, 2020 08:09 ET (13:09 GMT)

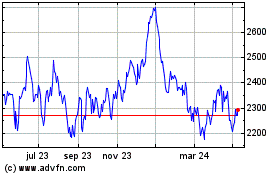

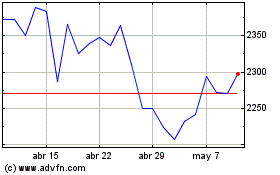

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024