Dollar Mixed After ADP Private Sector Employment Data

02 Diciembre 2020 - 3:46AM

RTTF2

The U.S. dollar showed mixed performance against its major

counterparts in the European session on Wednesday, after a data

showed that U.S. private sector employment rose less than expected

in November.

Data from payroll processor ADP showed that private sector

employment rose by 307,000 jobs in November after climbing by an

upwardly revised 404,000 jobs in October.

Economists had expected employment to increase by 410,000 jobs

compared to the addition of 365,000 jobs originally reported for

the previous month.

Early in the session, the currency was underpinned by concerns

over a no-deal Brexit following remarks from EU chief negotiator

Michel Barnier that there may be a no-deal outcome.

As British and European Union officials race to strike a

post-Brexit trade deal before the start of next week, Barnier told

EU ambassadors that a deal hangs in the balance and a no-deal

Brexit cannot be ruled out.

U.S. President-elect Joe Biden told the New York Times he'd

leave the phase-one trade deal with China in place while he

conducts a full review of the policy toward China in consultation

with traditional allies in Asia and Europe.

The greenback dropped in the Asian session as renewed prospects

of additional US fiscal stimulus and continued optimism over

potential coronavirus vaccines lifted risk sentiment.

The greenback appreciated to 1.2040 against the euro, after

touching 1.2088, which was its lowest level since April 2018. On

the upside, 1.18 is possibly seen as its next resistance level.

Data from Destatis showed that German retail sales grew more

than expected in October.

Retail sales increased 2.6 percent on a monthly basis, reversing

a 1.9 percent drop in September. Sales were expected to climb only

1.2 percent.

The U.S. currency strengthened to 1.3304 against the pound, from

a low of 1.3441 set at 2:45 pm ET. The greenback is seen finding

resistance around the 1.30 region.

The greenback approached an 8-day high of 104.75 against the

yen, reversing from a low of 104.23 hit at 7:00 pm ET. Next key

resistance for the greenback is seen around the 108.00 area.

Data from the Cabinet Office showed that Japan's consumer

confidence improved marginally to an 11-month high in October.

On a seasonally adjusted basis, the consumer confidence index

increased to 33.7 in November from 33.6 in October.

In contrast, the greenback dipped to 0.8959 against the franc, a

level not seen since January 2015. The greenback may find support

around the 0.87 level.

Data from the Federal Statistical Office showed that

Switzerland's consumer prices continued to decline in November.

The consumer price index decreased 0.7 percent year-on-year in

November, following a 0.6 percent fall in October. Economists had

expected a 0.5 percent fall.

Federal Reserve Chair Jerome Powell testifies on the CARES Act

before the House Financial Services Committee in Washington DC at

10:00 am ET.

The Federal Reserve's Beige book report will be released in the

New York session.

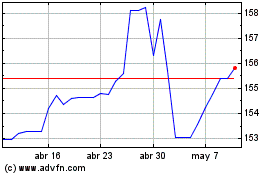

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024