TIDMIGE

RNS Number : 5119H

Image Scan Holdings PLC

04 December 2020

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

4 December 2020

Image Scan Holdings plc

("Image Scan", the "Company" or the "Group")

PRELIMINARY RESULTS FOR THE YEARED 30 SEPTEMBER 20 20

Image Scan (AIM: IGE), the specialist supplier of X-ray

screening systems to the security and industrial inspection

markets, today announces preliminary results for the year ended 30

September 2020.

HIGHLIGHTS

-- Sales increased 50% to GBP3.5m (2019: GBP2.4m)

-- Pre-tax trading profit of GBP113k (2019: Loss of GBP402k)

-- Aftersales revenues increased by 50%

-- Strong cash generation, yielding a year-end balance of GBP1.4m (2019: GBP640k)

-- Sales of portable X-ray systems doubled

-- A new cabinet X-ray system was launched

-- A partnership agreement was signed with a major security technology company

-- Strong cash flow due to excellent working capital management

Bill Mawer, Chairman and Chief Executive of Image Scan

commented: "It is gratifying to be able to report a profit in the

middle of such a difficult period for manufacturers around the

world. The COVID-19 pandemic has impacted our customers, our supply

chain and our staff. However, I am proud of the way the whole

Company has pulled together through this period to keep the

business operating and to be able to deliver a profit for the year

that exceeded our earlier estimates.

The recent launch of the Axis-CXi cabinet X-ray machine is an

exciting step forward for the Company and should bring new

customers and new sources of revenue. With our strong cash position

and our ambitious product development programme we look to emerge

from the pandemic well-placed for the future

--

For further information on the Company, please visit:

www.ish.co.uk and for further information on its

products, please visit: www.3dx-ray.com

Enquiries:

Image Scan Holdings plc Tel: +44 (0) 1509 817

William Mawer, Chairman and Chief Executive Officer 400

Sarah Atwell King, Finance Director and Company ir@ish.co.uk

Secretary

----------------------

W H Ireland - Nominated Adviser and Broker Tel: +44 (0) 117 945

Mike Coe/Chris Savidge (Corporate Finance) 3470

----------------------

About Image Scan Holdings plc

The core activity of the Group is the manufacture of portable

X-ray systems for security and counter terrorism applications. The

Group recently launched a cabinet X-ray machine and is replacing

its Axis range of checkpoint X-ray systems with new machines

developed with a partner. All these products are taken to market

across the world through a strong network of international

partners.

In addition, over the last fourteen years, Image Scan has

developed and manufactured industrial X-ray inspection systems, the

MDXi range. The primary market for these systems is in automotive

emissions control where they are used for quality control

inspection of catalytic converters and diesel particulate

filters.

For further information on the Company, please visit:

www.ish.co.uk - and for further information on its products, please

visit: www.3dx-ray.com

CHAIRMANS STATEMENT

OVERVIEW

I am pleased to announce that the Group is reporting a profit

after tax for its year ended 30 September 2020 of GBP137k compared

with a loss last year of GBP367k. This result reflects a strong

first half, building on a large portable X-ray order won at the end

of the previous year, and a lower level of activity in the second

half as COVID-19 led to a slowdown in new business. However, the

Group has continued to receive orders, run its manufacturing site,

and supported its customers throughout the pandemic. Additionally,

careful management of costs and stock made the business strongly

cash generative. Product development activity continued at near

normal levels and led to the launch of a new cabinet X-ray system,

while a partnership agreed with a security technology company will

lead to further product launches.

FINANCIAL RESULTS

New orders received in the year declined under the influence of

COVID-19 to GBP2.4m (2019: GBP3.9m), however, the strong order book

brought forward from the prior year allowed sales of GBP3.5m (2019:

GBP2.4m), a 50% increase year on year. Geographically the

destinations for these sales were highly diverse and included

customers in South America and Africa alongside more normal targets

in the Middle East and Asia. Aftersales revenues, which consist

primarily of service, spares and training, were up by nearly 50%,

supported by valuable spares contracts for a nuclear screening

system originally delivered in 2015.

Gross margins returned to more normal levels at 49% (2019: 54%)

reflecting the balance of product mix towards portable X-ray.

Overheads declined slightly to GBP1.6m, as the Company used the

Government's Coronavirus Job Retention Scheme to support salaries

during periods of reduced activity. The pre-tax trading profit for

the year was GBP113k (2019: loss of GBP402k).

The Company ended the period with an order book of GBP633k

(2019: GBP1.7m) and a healthy year-end cash balance of GBP1.4m

(2019: GBP640k). The strong bank balance represents cash generation

of GBP769k (2019: reduction GBP142k), achieved in part by carefully

trading out of the high stock holding reported at the end of the

previous period. Stock has been managed tightly, particularly in

the period of the pandemic, with a balance being struck between

control of working capital and the need to offer favourable

delivery times to customers. In the year, the Company took

advantage of the Government's Bounce Back loan for GBP50k which

will be repaid in FY2021.

Overall net assets at the year-end increased to GBP1.4m (2019:

1.3m) and with year- end cash balances of GBP1.4m this leaves the

Group in a strong financial position to both weather the pandemic

and continue its investment in its products and markets.

BUSINESS REVIEW

The business started the year with a strong order book of

GBP1.7m, which included a large order valued at over GBP800k for

portable X-ray systems from a European government customer. That

order was manufactured in the first quarter and delivered in the

second quarter through our local partner. The production team was

also kept busy by a succession of smaller portable X-ray orders

from customers in a wide range of geographies, contributing to a

strong and profitable first half. The rate of portable X-ray sales

in the second half declined, but the figures for the full year were

pleasing, showing a doubling of unit sales numbers over FY2019.

The sales process for portable X-ray systems typically incudes

trade shows, customer demonstrations and live trials, often

conducted with our overseas partners. COVID-19 has significantly

impacted this activity, but our team has successfully migrated to

online campaigning. This is a multi-platform effort, and includes

the creation of new video material, the ability to conduct online

demonstrations where the customer is able to control the equipment

remotely, and our first attendance at an online security trade

show. We are creating a permanent exhibition area in our facility

to support both visits and online demonstrations.

The R&D team continued to add features to our portable X-ray

products and expand the range of peripheral options available. An

example of this, released in the period, is a hand-held trigger

which allows our portable X-ray generators to be used with X-ray

film, without the need to set up a detector panel or laptop, an

important option for some bomb scenarios. Our US based sales

consultant, an experienced former bomb technician, has created

detailed instruction videos to support this and other new

developments. Bomb technician training courses were carried out in

the US under the 3DX-Ray name for the first time.

The new Axis-CXi cabinet X-ray system, launched at an online

trade show just after the year end, presents a level of

sophistication in image capture and processing not previously

available in this type of screening system. Use of many components

and software modules from the portable X-ray systems made this an

efficient development process and will help in manufacturing and

customer support. The team has also made good progress on a new

conveyor X-ray system based on technology from our technology

partner. Both project teams have included Bluefrog Design, an

award-winning industrial design company based in Leicester, who

have helped create an impactful external design for machines.

New measurement techniques for the MDXi range of industrial

scanners were taken to market during the year and, shortly after

the year end, this activity led to a software contract to finalise

the development of the techniques and implement them on deployed

MDXi inspection systems. This demonstrates the close working

relationships we maintain with our key industrial customers,

important for our continued success in this profitable niche.

ADAPTING THE OPERATION OF THE BUSINESS

While the focus of operational improvement efforts in the prior

year had been on-time delivery and quality, in FY2020 the emphasis

has been on adapting to the challenging demands of the COVID-19

pandemic. The manufacturing space has been reorganised to create

social distancing, new controls have been introduced and access to

software tools for remote product development has been improved.

Sales and administration functions have worked almost entirely from

home. Our customer support staff have had to re-think how they

operate, increasing remote access to deployed systems and, in some

cases, finding and training local support partners.

We have worked hard to maintain the atmosphere of co-operative

teamwork that existed when the whole team was working in one place.

The business will continue to adapt and improve in this new and

challenging environment.

OUR STRATEGY

The Group's short-term strategy is to pursue organic growth

through expansion of the product range, selling these products in a

wider range of market segments and filling in gaps in its

geographic reach. The Group seeks to play in profitable niche

security segments for which it can create highly differentiated

products that it can take to market at good margins. The Group

recognises that as a relatively small business it can only support

a limited range of technologies and it is therefore creating an

underlying toolkit as the core of a broad range of its products.

The new Axis-CXi is a good example of this approach, using

detectors and software from the portable X-ray range.

Where it is not cost-effective to entirely develop a product

ourselves, we will look to partner with other companies, just as we

have done in this year. This allows us to further expand the

product range, while keeping our own R&D investment at

affordable levels.

The Group's core security segment is the "bomb squad" market to

whom it sells its portable X-ray systems. We will continue to

invest in this sector, broadening and strengthening our offer to

customers. The new cabinet X-ray system and planned conveyor X-ray

systems create new opportunities in building security, mail

screening, prisons and sports stadia. X-ray equipment in these

markets must, by law, be serviced regularly allowing the Group to

increase its recurring service and support revenue as new systems

are deployed.

In industrial screening, we will look for customer investment to

enhance the MDXi product range and recently won a contract to

develop sophisticated new measurement methods for inspection of

catalytic converters. We will continue to look for new customers in

this sector, while selectively investigating opportunities in the

broader industrial X-ray market.

The Board's longer-term ambition to increase the critical mass

of the business through carefully selected acquisitions remains.

However, we recognise that the opportunities will be limited by the

current low share price and market capitalisation.

COVID-19 AND THE OUTLOOK FOR IMAGE SCAN

The Covid-19 pandemic has impacted the Group's customers, its

supply chain and its staff. However, the Group created a

Covid-secure working environment at its facility and continued

manufacturing operations onsite. R&D has continued, with staff

working both onsite and from home, and sales and administrative

staff have mainly worked from home. Provided our staff remain

healthy, this method of operation will continue for as long as

Government guidance recommends it.

As our international government customers have tended to focus

effort and budget on healthcare, some larger government

procurements of security systems have been delayed. Nevertheless,

we have continued to receive a steady stream of smaller orders and

are optimistic that this will continue. By continuing to invest in

the portable X-ray product range we expect to be well positioned

when procurement returns to a more normal level. We aim to make the

first sales of our new cabinet X-ray systems in the current

financial period and expect growth beyond that. Accessing broader

groups of customers with this and other new products will add new

revenue streams that make us less dependent on the highly

competitive portable X-ray market.

It is hard to anticipate when spending on security systems might

return to more normal levels, but we are confident that our

expanded product range and wide market access puts us in a good

position to benefit when that happens.

The Group's industrial sales in FY2020 were consistent with

previous years, but the wider automotive sector, which includes our

industrial customers, has been severely hit by the pandemic, as

sales across that sector are estimated to be 20% down in 2020

(Source IHS Markit). Our customers are reducing activity in key

plants and we expect a low level of new system acquisitions over

the next 12 months. It is anticipated that recovery in the car

market will be strongest in China, where growth was particularly

impressive before the pandemic, and we would expect to benefit as

manufacturing capacity is further increased there.

The impact of Brexit on the business is hard to estimate with

any accuracy but we have considered both direct and indirect

effects. A relatively small part of our turnover comes from EU

customers so, even if there is a tendency by those customers to

procure from within the EU, the impact should be small. Our only

significant EU supplier has already been replaced by an alternative

source within the UK. The most likely indirect impact is a general

slow-down of customs processes for incoming parts and outgoing

finished goods, but we anticipate that this will be manageable. The

Board reviews potential impacts of Brexit on the business every

month.

In summary, we have entered the new financial year with

continuing economic and political uncertainties. Without the

benefit of exceptionally strong order book going into last year and

the current delays in the placing of large orders, we therefore

expect a challenging year ahead. However, our strong cash balance

gives us confidence that we can weather these uncertainties and our

expanded product range a wide market access means we are

well-placed to benefit as and when activity levels return to more

normal levels.

In the longer term, the Board continues to believe that a blend

of organic and acquisition growth is the best way to deliver

shareholder value, the greater scale will provide both protection

from market shocks and stronger amortisation of the relatively high

fixed costs associated with a stock market listing.

STAFF

Our staff have worked exceptionally hard to maintain the

performance of the business through this difficult period and the

Board is grateful for their efforts.

William Mawer

CHAIRMAN

3 December 2020

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

2020 2019

GBP GBP

REVENUE 3,484,410 2,365,202

Cost of sales (1,760,242) (1,086,595)

Gross profit 1,724,168 1,278,607

Operating expenses (1,312,562) (1,272,779)

Research and development

expenses (299,804) (408,531)

Total administrative expenses (1,612,366) (1,681,310)

OPERATING PROFIT/ (LOSS) 111,802 (402,703)

Finance income 993 892

PROFIT / (LOSS) BEFORE TAXATION 112,795 (401,811)

Taxation 25,160 33,939

PROFIT/(LOSS) AND TOTAL COMPREHENSIVE

INCOME FOR THE YEAR FROM

CONTINUING OPERATIONS ATTRIBUTABLE

TO THE EQUITY OWNERS OF THE

PARENT COMPANY 137,955 (367,872)

Pence Pence

Earnings per share

Basic 0.10 (0.27)

Diluted 0.10 (0.27)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

2020 2019

GBP GBP

NON-CURRENT ASSETS

Intangible Assets 17,839 25,334

Property, plant and equipment 7,197 11,575

Right of Use Asset 39,664 -

Deferred Tax Asset - 7,150

64,700 44,059

CURRENT ASSETS

Inventories 450,574 783,089

Trade and other receivables 314,525 663,959

Cash and cash equivalents 1,409,494 640,489

2,174,593 2,087,537

TOTAL ASSETS 2,239,293 2,131,596

CURRENT LIABILITIES

Trade and other payables 707,630 848,037

Lease Liability 38,522 -

Warranty provision 33,750 16,000

Bank Loan 3,147 -

783,049 864,037

NON-CURRENT LIABILITIES

Bank Loan 46,853 -

46,853 -

NET ASSETS 1,409,391 1,267,559

EQUITY

Share capital 1,363,546 1,363,546

Share premium account 8,327,910 8,327,910

Retained earnings (8,282,065) (8,423,897)

TOTAL EQUITY ATTRIBUTABLE

TO SHAREHOLDERS 1,409,391 1,267,559

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share capital Share premium Retained Total

GBP GBP earnings GBP

GBP

As at 1 October 2018 1,363,546 8,327,910 (8,061,389) 1,630,067

Loss for the year and total

comprehensive income/(expenditure)

for the year - - (367,872) (367,872)

Transactions with owners:

Share-based transactions - - 5,364 5,364

As at 30 September 2019 1,363,546 8,327,910 (8,423,897) 1,267,559

Profit for the year and total

comprehensive income/(expenditure)

for the year - - 137,955 137,955

Transactions with owners:

Share-based transactions - - 3,877 3,877

As at 30 September 2020 1,363,546 8,327,910 (8,282,065) 1,409,391

CONSOLIDATED CASH FLOW STATEMENT

2020 2019

GBP GBP

Cash flows from operating activities

Operating profit before research

and development expenditure and exceptional

costs 411,606 5,828

Research and development expenditure (299,804) (408,531)

Operating profit/(loss) 111,802 (402,703)

Adjustments for:

Depreciation 9,414 13,482

Amortisation of intangible assets 12,049 10,458

Amortisation of lease 39,269 -

Impairment of inventories 26,263 13,297

Decrease in inventories 306,252 142,253

Decrease in trade and other receivables 349,434 119,511

Decrease in trade and other payables (140,407) (61,929)

Increase/(decrease) in warranty provisions 17,750 (18,999)

Share-based payments 3,877 5,364

Cash generated by/(used in) operating

activities 735,703 (179,266)

Corporation tax 32,310 64,133

Net cash flows generated by/(used

in) operating activities 768,013 (115,133)

Cash flows from investing activities

Interest received 993 892

Purchase of intangibles (4,555) (16,915)

Purchase of property, plant and

equipment (5,035) (9,990)

Net cash used in investing activities (8,597) (26,013)

CASH FLOWS FROM FINANCING ACTIVITIES

Bank loan 50,000 -

Lease payment (40,411) -

Net cash generated from financing 9,589 -

activities

Net INCREASE/(DECREASE) in cash and cash equivalents 769,005 (141,146)

Cash and cash equivalents at beginning

of year 640,489 781,635

Cash and cash equivalents at end

of year 1,409,494 640,489

Notes to the preliminary statement

1. Basis of preparation

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 30 September 2020

and 30 September 2019 but is derived from those accounts. Statutory

accounts for 2019 have been delivered to the Registrar of

Companies, and those for 2020 will be delivered following the

Company's Annual General Meeting. The auditors have reported on

those accounts; their reports were unqualified and did not contain

statements under Section 498 of the Companies Act 2006.

2. IFRS 2 'Share-based payments'

Operating expenses includes a charge of GBP3,877 (2019:

GBP5,364) after valuation of the Group's employee share options

schemes in accordance with IFRS 2 'Share-based payments. Under this

standard, the fair value of the options at the grant date is spread

over the vesting period. These items have been added back in the

statement of changes in equity.

3. Earnings per share

Diluted profit per share is calculated by adjusting the weighted

average number of ordinary shares in issue on the assumption of

conversion of dilutive potential ordinary shares. The Company's

dilutive potential ordinary shares are shares issued under the

Company's Enterprise Management Incentive (EMI) scheme and options

issued under the Company's Unapproved scheme.

2020 2019

GBP GBP

Profit/(loss) for the year 137,955 (367,872)

Weighted average number of ordinary

shares in issue 136,354,577 136,354,577

Number of diluted shares 136,463,866 136,354,577

Basic loss per share 0.10p (0.27p)

Diluted loss per share 0.10p (0.27p)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR KKNBDABDDCBK

(END) Dow Jones Newswires

December 04, 2020 02:00 ET (07:00 GMT)

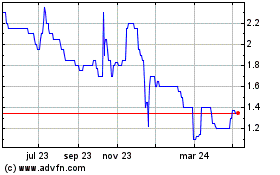

Image Scan (LSE:IGE)

Gráfica de Acción Histórica

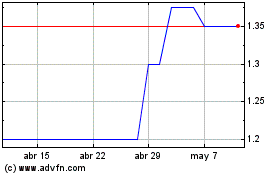

De Mar 2024 a Abr 2024

Image Scan (LSE:IGE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024