TIDMIHG

RNS Number : 3029I

InterContinental Hotels Group PLC

11 December 2020

11 December 2020

InterContinental Hotels Group PLC

Financing and reporting update

InterContinental Hotels Group ("IHG") [LON:IHG, NYSE:IHG (ADRs)]

provides a financing update including a further waiver and

relaxation of existing banking covenants, alongside an update on

changes to System Fund income recognition.

Financing update

As IHG announced in April, we amended our existing $1.35bn

syndicated and bilateral revolving credit facilities (RCF) to

include a waiver of existing covenants at 30 June 2020, 31 December

2020 and 30 June 2021(1) . The interest cover and leverage ratio

covenants were replaced by a $400m minimum liquidity covenant(2) .

The maturity of the RCF was extended by 18 months to September

2023.

IHG has now reached agreement for further amendments to the RCF.

This includes an additional waiver of the covenants at 31 December

2021, together with a relaxation to the covenants at 30 June 2022

and 31 December 2022. The leverage ratio covenant has been amended

to require Net Debt to EBITDA of less than 7.5:1 at 30 June 2022

and less than 6.5:1 at 31 December 2022. The interest cover

covenant has been amended to require a ratio of above 1.5:1 at 30

June 2022 and above 2.0:1 at 31 December 2022. The covenant

relaxations have been based on a theoretical severe downside

scenario. The minimum liquidity covenant of $400m will continue

whilst the amendments are in place and will be tested at 31

December 2021, 30 June 2022 and 31 December 2022.

Changes to System Fund income recognition

Ahead of reporting its results for the 2020 financial year, IHG

is today providing an outline of changes in income recognised in

the System Fund and in its results from reportable segments(3) as

follows:

-- Recognising revenue arising from the licensing of

intellectual property under co-brand credit card agreements in

IHG's reportable segments within Central Revenue rather than in the

System Fund. As only the proportion of revenue associated with

IHG's intellectual property will move, the vast majority of revenue

associated with the cobrand portfolio will continue to be

recognised in the System Fund.

-- Recognising the revenue, costs and profit of running the

Ambassador programme (the InterContinental Hotel & Resorts

paid-for loyalty programme) in the System Fund, rather than IHG's

reportable segments.

These changes are effective from 1 January 2020 with amounts

recognised in prior years unchanged. The net effect of the changes,

if these had been effective in 2019, would have been an increase in

IHG's revenue and operating profit from reportable segments of $18m

and $22m respectively, with a corresponding reduction in System

Fund revenue and increase in the System Fund in-year deficit. A

broadly similar impact is anticipated for the 2020 financial

year.

-Ends-

For further information, please contact:

Investor Relations (Stuart Ford; Rakesh +44 (0)1895 512 +44 (0)7527 419

Patel; Kavita Tatla) 176 431

Media Relations (Yasmin Diamond; Mark +44 (0)1895 512 +44 (0)7527 424

Debenham) 097 046

----------------------------------------- ---------------- ----------------

Notes and definitions

(1) The RCF has customary covenants in respect of interest cover

and leverage ratio, tested at half year and full year on a trailing

twelve-month basis. The interest cover covenant requires a ratio of

EBITDA to net interest payable above 3.5:1 and the leverage ratio

requires Net Debt:EBITDA of below 3.5:1 on a 'frozen GAAP' basis

pre-IFRS 16.

(2) Defined as unrestricted cash and undrawn facilities with a

remaining term of 6 months, tested on 30 June and 31 December.

(3) IHG's results from reportable segments excludes System Fund

results, hotel cost reimbursements and exceptional items. Revenue

and operating profit from reportable segments therefore comprises

the Group's fee business and owned, leased and managed lease

hotels.

Notes to Editors

IHG (R) (InterContinental Hotels Group) [LON:IHG, NYSE:IHG

(ADRs)] is a global organisation with a broad portfolio of hotel

brands, including Six Senses Hotels Resorts Spas , Regent Hotels

& Resorts , InterContinental (R) Hotels & Resorts , Kimpton

(R) Hotels & Restaurants , Hotel Indigo (R) , EVEN (R) Hotels ,

HUALUXE (R) Hotels and Resorts , Crowne Plaza (R) Hotels &

Resorts , voco(TM) , Holiday Inn (R) Hotels & Resorts , Holiday

Inn Express (R) , Holiday Inn Club Vacations (R) , avid(TM) hotels

, Staybridge Suites (R) , Atwell Suites(TM) , and Candlewood Suites

(R) .

IHG franchises, leases, manages or owns nearly 6,000 hotels and

890,000 guest rooms in more than 100 countries, with approximately

1,900 hotels in its development pipeline. IHG also manages IHG (R)

Rewards Club , our global loyalty programme, which has more than

100 million enrolled members.

InterContinental Hotels Group PLC is the Group's holding company

and is incorporated in Great Britain and registered in England and

Wales. Approximately 400,000 people work across IHG's hotels and

corporate offices globally.

Visit www.ihg.com for hotel information and reservations and

www.ihgrewardsclub.com for more on IHG Rewards Club. For our latest

news, visit: https://www.ihgplc.com/en/news-and-media and follow us

on social media at: https://twitter.com/ihgcorporate ,

www.facebook.com/ihgcorporate and

www.linkedin.com/company/intercontinental-hotels-group .

Cautionary note regarding forward-looking statements

This announcement contains certain forward-looking statements as

defined under United States law (Section 21E of the Securities

Exchange Act of 1934) and otherwise. These forward-looking

statements can be identified by the fact that they do not relate

only to historical or current facts. Forward-looking statements

often use words such as 'anticipate', 'target', 'expect',

'estimate', 'intend', 'plan', 'goal', 'believe' or other words of

similar meaning. These statements are based on assumptions and

assessments made by InterContinental Hotels Group PLC's management

in light of their experience and their perception of historical

trends, current conditions, expected future developments and other

factors they believe to be appropriate. By their nature,

forward-looking statements are inherently predictive, speculative

and involve risk and uncertainty. There are a number of factors

that could cause actual results and developments to differ

materially from those expressed in or implied by, such

forward-looking statements. The main factors that could affect the

business and the financial results are described in the 'Risk

Factors' section in the current InterContinental Hotels Group PLC's

Annual report and Form 20-F filed with the United States Securities

and Exchange Commission.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEANAEFFAEFFA

(END) Dow Jones Newswires

December 11, 2020 02:00 ET (07:00 GMT)

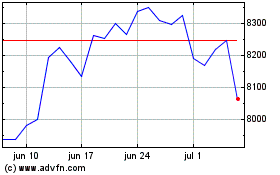

Intercontinental Hotels (LSE:IHG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

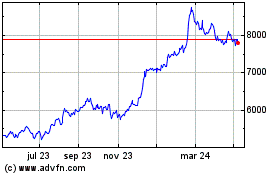

Intercontinental Hotels (LSE:IHG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024