Unilever to Give Investors Advisory Vote on Climate-Change Plan

14 Diciembre 2020 - 1:13PM

Noticias Dow Jones

By Saabira Chaudhuri

Unilever PLC said it would become the first major company to

voluntarily give shareholders a vote on its efforts to reduce

carbon emissions, seeking greater engagement with investors on

climate issues.

The owner of Dove soap and Ben & Jerry's ice cream said

Monday it would seek approval from investors every three years on

its plan to mitigate its carbon impact and the risks of climate

change on its business. However, the vote would be only advisory

and doesn't require Unilever to make changes.

Major investors say they are putting more emphasis on addressing

the threats posed by climate change, with shareholder resolutions

on the issue becoming more common. By proposing its own climate

resolutions for shareholders to vote on -- which take into account

the challenges and realities of achieving them -- Unilever is in

the driving seat, said one big investor.

BlackRock Inc., one of Unilever's largest investors, said

earlier this year that it would be increasingly likely to vote

against management and boards if companies don't disclose

climate-change risks and plans in line with key industry

standards.

Climate Action 100+, a group of large investors including

BlackRock that is pressuring companies to act on climate change,

welcomed Unilever's announcement as meaningful.

"Despite only being an advisory vote, it will allow investors to

provide a clear statement of intent to the company about the

importance of sticking to its plans for a transition to net-zero

emissions," said Piers Hugh Smith, the investor group's point

person for Unilever.

A Unilever spokeswoman said investor interest in managing the

transition to net zero was growing and that the company wanted to

send a signal that it was serious about meeting these targets.

The consumer-goods giant is among the growing number of

companies setting public targets for cutting carbon emissions over

the next few years. London-based Unilever has promised to eliminate

emissions from its own operations by 2030 and to do the same from

sourcing to point of sale by 2039. It also plans to halve the

footprint of its products in the next decade, which involves the

more difficult process of cutting emissions from consumers using

its products.

To achieve those goals, Unilever said it would need to rethink

the raw materials it sources, use more renewable energy and

eliminate deforestation from its supply chain, among other

measures. The company said it would rely on carbon credits to

balance residual emissions.

Nestle SA said earlier this month that it would invest the

equivalent of about $3.6 billion over the next five years in

cutting carbon emissions as the Nescafe coffee owner works toward

hitting its own targets. Other consumer-goods giants such as

Colgate-Palmolive Co., Procter & Gamble Co. and Kimberly Clark

Corp. have made similar pledges.

Unilever said it would share more details about its climate

strategy in the first quarter and plans to report on its annual

progress in 2022.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

December 14, 2020 13:58 ET (18:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

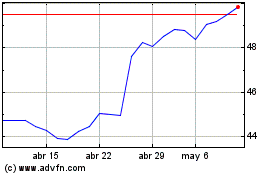

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

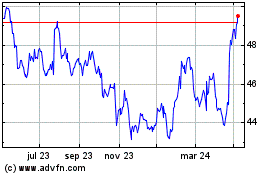

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024