TIDMVOD

RNS Number : 4446J

Vodafone Group Plc

22 December 2020

22 December 2020

Vodafone announces Tender Offer for Kabel Deutschland minority

holdings

Vodafone Group Plc ("Vodafone Group") and its wholly-owned

subsidiary Vodafone Vierte Verwaltungs AG ("Vodafone KDG")

(together, "Vodafone") announce today a tender offer to all other

shareholders of Kabel Deutschland Holding AG ("KDG").

Vodafone will offer the KDG shareholders cash consideration of

EUR103 for each outstanding KDG share (the "Offer"). Vodafone has

received irrevocable undertakings from entities advised by the D.

E. Shaw group, by Elliott Advisers (UK) Limited ("Elliott") and by

UBS O'Connor LLC (together the "Accepting Shareholders") to accept

the Offer for all of their KDG shares, representing approximately

17.1% of the share capital of KDG. Following completion of the

Offer, Vodafone will own at least 93.8% of the outstanding share

capital of KDG.

The consideration for the shares of the Accepting Shareholders

in KDG who have given irrevocable undertakings is EUR1,557 million.

If all KDG minorities tender their shares, the consideration will

increase to EUR2,119 million. The cash consideration will be funded

from Vodafone's existing cash resources.

The Offer is beneficial to Vodafone and will:

-- be immediately accretive for both adjusted earnings per share and free cash flow per share;

-- be neutral to Vodafone Group's credit ratings; and

-- reduce Vodafone's exposure to ongoing legal proceedings related to the KDG acquisition.

The Offer compares to the current 30 day VWAP of EUR108 per

share.

Background to the Offer

Vodafone announced its intention to acquire KDG in June 2013 via

a voluntary public takeover offer. The offer settled and completed

in October 2013, with Vodafone owning 76.8% of KDG. Subsequently,

Vodafone entered into a domination and profit and loss transfer

agreement (the "DPLTA") in December 2013, taking effect on 1 April

2014, which allowed the integration of Vodafone Germany and

KDG.

Pursuant to the DPLTA, Vodafone undertook to pay to the minority

shareholders of KDG an annually recurring net compensation of

EUR3.17 per KDG share in cash. Vodafone also agreed, upon demand,

to purchase such minority shareholders' KDG shares for EUR84.53 per

share in cash (the 'Put Option'). In accordance with German law,

the Put Option price increases every year based on a formula of:

German base rate plus 5% less dividends paid. Consequently, the

current effective cost of funding for Vodafone is 4.12%, which is

significantly higher than its borrowing cost. The Put Option Price

as at 30 September 2020 was EUR92 per KDG share.

At the instigation of the KDG minority shareholders, the Munich

District Court (LG München 1) considered the adequacy of the

mandatory cash offer made to minority shareholders in Vodafone's

takeover of KDG. In November 2019, the Munich District Court (LG

München 1) ruled that the compensation Vodafone paid was "adequate"

given KDG's earnings potential based on an outlook set out by the

Board of KDG in November 2013. A number of KDG minority

shareholders appealed this decision, triggering an appeals process

which has now commenced and is expected to take several years to

complete.

Other relevant aspects in relation to the Offer

-- In considering the value of the Offer, Vodafone anticipated

the likely future guaranteed compensation payments to be made to

the minority shareholders in KDG, as well as the Put Option value

of the shares once the court process concludes and the risks and

expenses related to the legal proceedings. In accepting the Offer,

KDG shareholders will agree to waive their rights to any proceeds

resulting from the ongoing court process.

-- The acquisition of KDG shares from the Accepting Shareholders

who have provided irrevocable undertakings will increase Vodafone's

reported net debt as at 30 September 2020 from EUR44.0 billion to

EUR45.5 billion, increasing to EUR46.1 billion if all KDG

minorities tender their shares. The full minority shareholding in

KDG is already reflected as a liability in the rating agencies'

adjusted credit metrics, so the Offer is not expected to impact

Vodafone's current ratings.

-- For the purposes of the UK Listing Rules, Elliott is

considered to be a related party of Vodafone by virtue of its

shareholding in KDG exceeding 10%. As a result, Elliott's

irrevocable commitment to tender its KDG shares constitutes a

smaller related party transaction under LR 11.1.10 R.

-- As a result of the agreement to tender their shares in KDG to

Vodafone, the Accepting Shareholders will withdraw their appeal

from the court of appeal in Munich (Oberlandesgericht München).

Elliott has also agreed to certain confidentiality and other

restrictions, including commitments not to take further legal

action against Vodafone.

-- The Offer will be conditional on clearance under German foreign investment legislation.

-- The acceptance period will begin on 28 December 2020 and be

open until 1 February 2021. There will be no additional acceptance

period.

-- The German offer document will together with an English

convenience translation be published on the following website:

https://investors.vodafone.com/individual-shareholders/KDG-offer

- ends -

For more information, please contact:

Investor Relations Media Relations

Investors.vodafone.com Vodafone.com/media/contact

ir@vodafone.co.uk GroupMedia@vodafone.com

Registered Office: Vodafone House, The Connection, Newbury,

Berkshire RG14 2FN, England. Registered in England No. 1833679

About Vodafone Group

Vodafone is a leading telecommunications company in Europe and

Africa. Our purpose is to "connect for a better future" and our

expertise and scale gives us a unique opportunity to drive positive

change for society. Our networks keep family, friends, businesses

and governments connected and - as COVID-19 has clearly

demonstrated - we play a vital role in keeping economies running

and the functioning of critical sectors like education and

healthcare.

Vodafone is the largest mobile and fixed network operator in

Europe and a leading global IoT connectivity provider. Our M-Pesa

technology platform in Africa enables over 45m people to benefit

from access to mobile payments and financial services. We operate

mobile and fixed networks in 21 countries and partner with mobile

networks in 48 more. As of 30 September 2020, we had over 300m

mobile customers, more than 27m fixed broadband customers, over 22m

TV customers and we connected more than 112m IoT devices.

We support diversity and inclusion through our maternity and

parental leave policies, empowering women through connectivity and

improving access to education and digital skills for women, girls,

and society at large. We are respectful of all individuals,

irrespective of race, ethnicity, disability, age, sexual

orientation, gender identity, belief, culture or religion.

Vodafone is also taking significant steps to reduce our impact

on our planet by reducing our greenhouse gas emissions by 50% by

2025 and becoming net zero by 2040, purchasing 100% of our

electricity from renewable sources by 2025, and reusing, reselling

or recycling 100% of our redundant network equipment.

For more information, please visit www.vodafone.com , follow us

on Twitter at @VodafoneGroup or connect with us on LinkedIn at

www.linkedin.com/company/vodafone .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENLFLLLBLLLFBF

(END) Dow Jones Newswires

December 22, 2020 02:15 ET (07:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

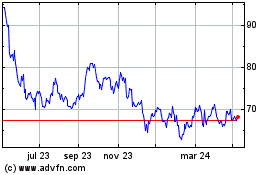

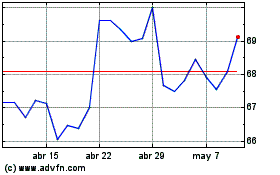

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024