By Karen Langley

Investors betting on a continued economic rebound are

increasingly looking beyond U.S. stocks.

Many money managers are focusing on emerging markets, which they

expect to outperform as the global economy accelerates in the wake

of the Covid-19 vaccine rollout. Some are also taking a look at

European markets, which lagged behind in 2020 but are dominated by

cyclical shares.

Investing in U.S. stocks, they say, has increasingly become a

concentrated bet on the technology sector, which contributed more

than half of the S&P 500's 18% total return last year. The

tech-laden Nasdaq Composite fared even better, rising 45% including

dividends. Those gains might be difficult to replicate in the new

year.

"We feel like the opportunity from here going forward is really

going to be in the international markets outside of the U.S.," said

Munish Malhotra, co-portfolio manager of global equity strategy at

Cambiar Investors. Potential easing of Washington's trade tensions

with China could reduce a headwind, while in the U.S., big

technology companies might face challenges trying to extend their

rapid growth, he said.

Cambiar recently added to positions in the German engineering

giant Siemens AG and the Macau casino operator Sands China Ltd.,

betting that both will benefit as the pandemic subsides.

Recent surveys have shown budding interest in overseas stocks.

The net percentage of respondents to Bank of America's December

global fund manager survey who said they were overweight on

emerging-markets stocks jumped to its highest level since November

2010, and the share favoring eurozone equities also increased. The

net share of investors who were overweight on U.S. equities, by

contrast, ticked lower from the prior month.

A December investor survey from RBC Capital Markets, meanwhile,

found that emerging-markets stocks, small-capitalization stocks and

cyclical stocks were among the top picks for trades expected to

outperform in the next six to 12 months.

The outlook for emerging markets is supported by the heavy

presence of China, where the economy is forecast to grow more

rapidly than in the U.S. or the eurozone in 2021.

"As the global economy starts to recover, you will see more

procyclical sectors come through," said Sinead Colton Grant, deputy

chief investment officer and head of equities at BNY Mellon Wealth

Management. "One of the ways that we think that will play out is

investors realizing that not only will they gain more

diversification through international exposure, but it also allows

them to have more procyclical exposure."

Ms. Colton Grant said she expects technology will continue to

outperform but anticipates industrial and materials stocks will

also do well.

The U.S. stock market is looking increasingly expensive, adding

to the appeal of international equities. The S&P 500 ended 2020

trading at 22.68 times its projected earnings over the next 12

months, above a five-year average of 17.78, according to FactSet.

The MSCI Emerging Markets index, by contrast, traded at 15.36 times

forward earnings, while the MSCI Europe index traded at 17.10 times

earnings, according to MSCI.

"A lot of emerging economies just have stronger secular growth

rates and yet their valuations are cheap relative to the U.S.,"

said David Donabedian, chief investment officer for CIBC Private

Wealth in the U.S.

The S&P 500 advanced 16% in 2020, in line with the MSCI

emerging-markets index's rally. Both gauges outpaced the MSCI

Europe index.

The heavy presence of growth stocks benefited the U.S. market.

The pandemic forced economic activity online, boosting the behemoth

technology and tech-related stocks that dominate the U.S. market.

Apple Inc. shares surged 81% for the year, Amazon.com Inc. rallied

76% and Microsoft Corp. advanced 41%. All three stocks have pulled

back slightly to start the new year.

But looking forward, some investors said they see an advantage

for overseas indexes because they are more evenly split between

shares of companies promising rapid growth and stocks thought to

trade at value prices.

"In the international markets, it's more evenly balanced," said

George Mateyo, chief investment officer at Key Private Bank. "It

still skews a little bit towards growth, but not nearly as much as

it does in the U.S. One of the reasons why we think the U.S.

markets might actually lag a little bit against their international

peers is for that reason."

The tech sector made up about 28% of the S&P 500 on Dec. 31,

with Apple and Microsoft alone accounting for about 12% of the

index's weight. By comparison, technology made up 20% of the MSCI

emerging-markets index and 7.6% of the MSCI Europe index at that

time.

The economically sensitive materials sector, by contrast,

accounts for about 8% of the Europe and emerging-markets benchmarks

but less than 3% of the S&P 500, meaning the U.S. benchmark is

less positioned to benefit if economic growth fuels demand for

chemicals, packaging and construction materials.

The S&P 500 also has relatively low exposure to bank stocks,

which could benefit during an economic recovery. Financials make up

18% of the MSCI emerging-markets index and nearly 16% of its Europe

gauge, compared with 10% of the U.S. benchmark.

"As consumers and businesses have more confidence that we will

return to some level of normalcy, European equities should do

really well relative to a lot of other parts of the world," said

Mr. Malhotra at Cambiar Investors. "A lot of European companies

tend to be very cyclical."

Write to Karen Langley at karen.langley@wsj.com

(END) Dow Jones Newswires

January 06, 2021 05:44 ET (10:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

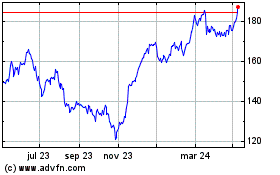

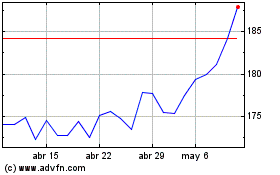

Siemens (TG:SIE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Siemens (TG:SIE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024