TIDMWYN

RNS Number : 9813M

Wynnstay Group PLC

27 January 2021

AIM: WYN

Wynnstay Group Plc

("Wynnstay" or the "Group" or the "Company")

Final Results

For the year ended 31 October 2020

Resilient results in an unprecedented year of challenges

Key points

Financial

-- Resilient results in a year of unprecedented challenges for

the sector

- historically poor 2019 autumn planting season and 2020

UK harvest at 20 year low

- subdued farmer confidence and investment, reflecting weaker

farmgate prices in H1 and Brexit uncertainty

- coronavirus pandemic

-- Revenue of GBP431.40m (2019: GBP490.60m), affected by commodity

deflation and reduced volumes in certain traded commodities,

in particular grain

-- Increase in underlying pre-tax profit*, up 4% to GBP8.37m (2019:

GBP8.01m)/ Reported PBT of GBP6.98m (2019: GBP7.55m)

-- Basic earnings per share, including non-recurring items, of

27.73p (2019: 30.95p)

-- Net cash at year end increased to GBP8.42m; GBP14.71m before

IFRS 16 implementation (31 October 2019: GBP3.84m before IFRS

16 implementation )

-- Net assets increased to GBP98.18m/GBP4.92 per share at year

end (31 October 2019: GBP94.95m/GBP4.79 per share)

-- Proposed final dividend of 10.00p (2019: 9.40p), taking total

for the year to 14.60p (2019: 14.00p), a 4.3% rise

Operational

-- Agriculture Division - revenue of GBP302.58m (2019: GBP358.69m),

profit of GBP2.88m (2019: GBP2.95m)

- feed activity performed very well - improved gross margin,

with manufactured volumes in line with last year

- arable activity was affected by lower demand for arable

inputs and reduced volumes of grain available for trading,

reflecting very poor autumn planting and harvest

- Glasson activity delivered a solid performance

-- Specialist Agricultural Merchanting Division - revenue of GBP128.81m

(2019: GBP131.84m), profit increased 10% to GBP5.78m (2019:

GBP5.24m)

- like-for-like sales were just 1% lower, helped by a stronger

H2

- margins enhanced by ongoing efficiency programme, and network

optimisation continued

-- Continued focus on strengthening specialist advisory teams

across all our sectors

-- Reorganisation of management structure in H2; new roles and

reporting lines to support growth plans

-- Significant investment programme started in FY2021 to increase

feed manufacturing capacity and improve productivity

Outlook

-- Farmer confidence significantly improved with EU trade deal

and stronger farmgate prices

-- UK Agriculture Bill creates significant opportunities with

farmers now incentivised for efficiency and environment initiatives

-- Trading in the new financial year is in line with management

expectations

* Underlying pre-tax profit is a non-GAAP (generally accepted

accounting principles) measure and is not intended as a substitute

for GAAP measures and may not be calculated in the same way as

those used by other companies. Refer to Note 14 for an explanation

on how this measure has been calculated and the reasons for its

use.

Gareth Davies, Chief Executive of Wynnstay, commented:

"Wynnstay's strengths have been clearly demonstrated in what was

an exceptionally difficult year for both the agricultural sector

and wider society. Our resilient results reflect well on our

balanced business model, strong financial management and recent

growth initiatives.

"The new financial year has started well, and Wynnstay's

performance is in line with management expectations. We remain

focused on developing our channels to market, investing to build

capacity and capability, particularly advisory, and implementing

efficiencies.

"Stronger farmgate prices, the EU settlement and UK Agricultural

Bill continue to buoy sentiment across the farming sector. We

believe that Wynnstay is in an excellent position to help farmers

adapt to new priorities set by the Agricultural Bill, and look to

the future with confidence".

Enquiries:

Wynnstay Group Plc Gareth Davies, Chief T: 020 3178 6378 (today)

Executive T: 01691 827 142

Paul Roberts, Finance

Director

KTZ Communications Katie Tzouliadis / Dan T: 020 3178 6378

Mahoney

Shore Capital (Nomad Stephane Auton / Patrick T: 020 7408 4090

and Broker) Castle / John More

CHAIRMAN'S REPORT

Overview

The Group has delivered a very resilient trading performance in

an unprecedented year of challenges. Underlying pre-tax profit*

increased by 4% to GBP8.37m (2019: GBP8.01m) on revenues of

GBP431.40m (2019: GBP490.60m). This pleasing result, which is ahead

of original market expectations, was helped by a strong close to

the year, particularly for feed sales, which benefited both the

Agricultural Division and Specialist Agricultural Merchanting

Division. It also reflects well on the Group's strategy, which is

focused on further developing existing products and services,

strengthening channels to market, and improving efficiency and

productivity. Our balanced business model, which spans both arable

and livestock sectors, also provided a strong natural hedge to the

sector variations experienced in the year.

The challenges over the financial year were significant even

without the coronavirus crisis. We started the financial year with

subdued farmer confidence, arising from lower farmgate prices and

continuing Brexit uncertainty. The abnormally wet 2019 autumn

severely disrupted planting, resulting in one of the worst seasons

on record and consequently low demand for arable inputs and a

historically poor autumn harvest and reduced grain trading. The

onset of the coronavirus pandemic created further difficulties.

However, our teams responded magnificently and, as an essential

service provider, we worked hard to rapidly adopt new safety

practices so that we could continue to operate all our sites while

ensuring the welfare of our colleagues, customers, suppliers and

communities. Other than for a short period when a handful of depots

were closed, we have kept all our depots, manufacturing and

processing facilities open and operating in line with government

restrictions.

Despite the additional demands of responding to the pandemic, we

made good progress with strategic growth initiatives. We continued

with our outlet optimisation programme, closing two sites, and have

further strengthened our specialist advisory teams, particularly in

youngstock, animal health, dairy and free range egg production, all

of which are growth areas for the Group. We have also introduced a

sales trading desk to support our on-farm specialists, and will be

continuing to focus on developing our channels to market, including

digital. With the expiry of our lease on our Selby seed plant in

Yorkshire, we closed this site in December and are exploring

options for a new site. We are also planning to invest in our seed

processing plant at Astley in Shrewsbury to increase capacity and

efficiency.

Towards the end of the financial year, we put into effect a

reorganisation of the Group's management structure. These changes

encompassed the creation of new management roles with new

designated areas of responsibility and reporting lines. The new

management structure will better support our growth plans for the

business and strengthen our operational effectiveness. We expect to

conclude this significant major initiative over the coming

months.

Financial Results

Group revenue decreased by 12% to GBP431.40m (2019: GBP490.60m),

which mainly reflected commodity price deflation and significantly

reduced volumes in certain categories, notably grain trading. The

impact was felt most by the Agriculture Division, where revenue was

down by 16% to GBP302.58m (2019: GBP358.69m). Revenue in the

Specialist Agricultural Merchanting Division was 2% lower at

GBP128.81m (2019: GBP131.84m). This mainly reflected the impact of

restricted trading protocols, introduced at the start of the

coronavirus crisis. Like-for-like sales for this Division reduced

by 1%.

Underlying pre-tax* profit, the Board's preferred alternative

performance measure, which includes the gross share of results from

joint ventures and excludes share-based payments and non-recurring

items, increased by 4% to GBP8.37m (2019: GBP8.01m). The

Agriculture Division contributed GBP2.88m (2019: GBP2.95m) to this

result, which included contributions from joint ventures, and the

Specialist Agricultural Merchanting Division contributed GBP5.78m

(2019: GBP5.24m). Other activities generated a small loss of

GBP0.12m (2019: loss of GBP0.05m). On an IFRS basis, reported

profit before taxation was GBP6.98m (2019: GBP7.55m).

The Group incurred a number of additional charges in the year,

mainly relating to its strategic reorganisation, but also including

site closure charges and goodwill impairments charges. Together

these amounted to GBP1.19m (2019: GBP0.3m).

The Group adopted the new accounting standard, IFRS 16, relating

to leases, which replaces rental expense with right-of-use asset

amortisation and interest. As a result, reported net finance costs

increased by GBP0.09m to GBP0.27m (2019: GBP0.18m excluding IFRS

16).

Profit after taxation was GBP5.53m (2019: GBP6.13m), and basic

earnings per share was 27.73p (2019: 30.95p).

Cash flows and balance sheet

Continued strong cash generation, together with tight control of

working capital, left the business with net cash, before lease

obligations, at the financial year-end of GBP18.41m (31 October

2019: GBP7.57m). After deducting total lease obligations of

GBP9.99m (2019: GBP3.72m excluding IFRS 16), total net cash at 31

October 2020 amounted to GBP8.42m (2019: GBP3.84m).

The Group's balance sheet remains strong with net assets 3%

higher at GBP98.18m (2019: GBP94.95m) at the financial year-end.

This equates to GBP4.92 (2019: GBP4.79) per share, and the return

on net assets was 8.6% (2019: 8.5%).

Dividend

The Board is pleased to propose the payment of a final dividend

of 10.00p per share. Together with the interim dividend of 4.60p

per share, paid on 31 October 2020, this takes the total dividend

for the year to 14.60p, an increase of 4.3% on last year (2019:

14.00p).

The final dividend will be paid on 30 April 2021 to shareholders

on the register on 6 April 2021, subject to shareholder approval at

the AGM. A scrip dividend alternative will continue to be available

as in previous years. The last date for election for the scrip

dividend will be 16 April 2021.

The Board and Colleagues

On behalf of the Board, I would like to thank all our colleagues

for their professionalism and dedication in a very difficult year.

The drive to ensure that the business was able to adapt swiftly to

the new conditions created by the coronavirus pandemic and to

maintain operations, while ensuring the safety of colleagues,

customers and suppliers, was outstanding.

Following our reorganisation of operations, Andrew Evans stood

down from the Board on 1 December 2020. Nonetheless, he remains a

key member of the Senior Executive Team in his new role of Group

Operations and Feeds Director. On behalf of my fellow Directors, I

would like both to formally acknowledge Andrew's contribution as a

member of the Board since 2008, and to welcome his ongoing

significant contribution as member of the Senior Executive

Team.

Outlook

Now that a non-tariff trade agreement has been concluded with

the EU, the picture for UK agriculture is significantly clearer as

we start 2021, and a major uncertainty has been removed. We expect

to see investment recommence and the sector move forward, with UK

food producers also having the ability to seek new markets for

agricultural products. The UK Agriculture Bill will change the way

that farmers are supported by the Government, and we anticipate

that a more resilient agricultural sector will result. We also

expect opportunities for Wynnstay to provide support as farmers

focus on environmental investment and efficiencies. We therefore

view medium and long-term prospects for our industry

positively.

Agricultural commodity prices have generally improved over the

past 12 months and the short-term outlook remains strong. Winter

cereal plantings are significantly greater than a year ago, in line

with a more normal sowing season. This will drive demand for arable

inputs and yield a larger crop to trade post-harvest.

While the coronavirus and associated restrictions remain a

concern, the onset of the national vaccination programme should

help to underpin social and economic recovery. We have clear

targets for the business over the next few years. These include

continuing investment to improve productivity and support growth,

and a focus on ensuring that we are best placed to support UK

farmers as they pivot to new priorities, including environmental

initiatives and the adoption of new farming practices. We see a

significant role for Wynnstay in supporting farmers with products

and services to help drive sustainability and greater efficiency as

well as to reduce carbon emissions, including the management of

farm waste.

Our ongoing investment in widening the Group's knowledge base

and advisory teams, and the importance we place on innovative

products and services by working with our valued suppliers, is

integral to positioning Wynnstay as a leading UK agricultural

supplier. The reorganisation that we have substantially completed

is also part of this strategy, and should support greater

innovation and flexibility as we look to develop and grow our

channels to market.

The new financial year has started well, and the Board remains

confident that the Group is well-placed to progress with its

strategic objectives. We will also continue to assess acquisition

opportunities that align with our growth strategy, and look to the

future with confidence.

Jim McCarthy

Chairman

* Underlying pre-tax profit is a non-GAAP (generally accepted

accounting principles) measure and is not intended as a substitute

for GAAP measures and may not be calculated in the same way as

those used by other companies. Refer to Note 14 for an explanation

on how this measure has been calculated and the reasons for its

use.

CHIEF EXECUTIVE OFFICER'S REPORT

INTRODUCTION

Wynnstay's strengths have been clearly demonstrated in what was

an exceptionally difficult year for both the agricultural sector

and wider society. Farmer confidence at the start of the financial

year was low because of weaker farmgate prices and ongoing

Brexit-related uncertainties. The highly disrupted autumn planting

season in 2019 and the dry, late spring created further

difficulties for arable farmers while, from March 2020, the

coronavirus pandemic and government sanctions to control virus

spread affected farmers across all sectors. Farmgate prices for red

meat and milk were especially hit by the initial national lockdown,

although they recovered during the year.

Wynnstay's results for the full year are significantly better

than our expectations at the time of the interim results following

a stronger than anticipated second half of the year. Reduced

revenue of GBP431.40m (2019: GBP490.60m) principally reflected

commodity deflation and decreased volumes of traded commodities,

especially grain, feed raw materials and fertiliser. Underlying

pre-tax profit at GBP8.37m was 4% ahead of last year (2019:

GBP8.01m), itself a difficult year for the sector, and we are

pleased with this outcome given the circumstances.

The results were underpinned by our robust balance sheet and

balanced business model, with its broad spread of products and

services, which ensure that we are not unduly exposed to any

particular sector. While a weaker performance from arable

activities materialised as expected, feed sales performed very

well, benefiting both our Divisions. The second half was especially

strong for manufactured feed (bulk and bagged) in terms of both

volume and gross margins, and we secured new business particularly

in the dairy and free range egg sectors. Glasson Grain generated a

solid performance, although below last year's record level.

The Specialist Agricultural Merchanting Division delivered a 10%

improvement in profit contribution, although sales of some product

lines were adversely affected by initial lockdown restrictions.

This was helped by the efficiency programme introduced during the

last financial year, and which remains under way.

We continued to invest across the Group, and have now started a

major three year investment programme at our Carmarthen feed mill.

This will significantly increase our manufacturing capacity and

improve productivity. We are also considering options for a new

seed processing facility. This would replace our former plant at

Selby, and in the meantime, we will be investing in our seed

processing plant at Astley, in Shropshire to increase capacity and

productivity.

Increasingly we are focusing on accelerating our environmental

and sustainability agenda, addressing raw materials and products

sourcing and carbon impact. We have made progress with utilising

bio-diesel for our commercial delivery fleet, and will make further

improvements across the business to reduce carbon emissions. In

addition, we envisage playing a significant role in supporting our

customers with environmental initiatives, which are a key focus of

the new UK Agriculture Bill.

In the second half of the year, we substantially completed a

significant reorganisation of our operational management, further

information on which is provided below.

REORGANISATION

We completed a review of the Group's core organisational

structure and implemented a number of changes that will better

support the Board's plans for the Group's future growth and

development, including our investment programmes.

At the heart of the changes has been a reorganisation of the

management of Wynnstay (Agricultural Supplies) Limited, where we

have created new senior management roles. These cover Group

Operations and Feeds, Arable including GrainLink, and Sales and

Marketing. Reporting lines have been reorganised accordingly. We

believe this new structure provides for enhanced effectiveness and

sales agility. It also supports our multi-channel and environmental

and sustainability strategies. I would like to thank Andrew Evans,

who is now heading Group Operations and Feeds, for leading this

important reorganisation.

REVIEW OF ACTIVITIES

AGRICULTURAL DIVISION

The Agriculture Division manufactures and processes a wide range

of agricultural inputs, including feeds, fertiliser and seeds, as

well as providing grain-marketing services. Over recent years, the

Division has focused on enhancing its offering through specialist

advisory teams and this remains a focus.

Divisional revenue was 16% lower at GBP302.58m (2019:

GBP358.69m), mainly reflecting lower commodity prices and the very

poor winter planting season and dry spring, which reduced activity

across certain product categories, especially grain, feed raw

materials and merchanted fertiliser. The Division's profit

contribution reduced by 2% year-on-year to GBP2.88m (2019:

GBP2.95m).

Feed

We manufacture both ruminant and monogastric products in

compounded, blended and meal form. This wide range provides

protection against fluctuations in demand. All our manufactured

feed is sold under the Wynnstay brand, and in addition to bulk

deliveries to farm, a growing percentage of our feed is sold in

20kg or 500kg bagged form, predominantly via our depot network.

Total feed volumes were in line with last year, and gross

margins improved, helped by our strong positions in raw materials

and production efficiencies.

Compound dairy feed volumes strengthened in the second half of

the financial year after a weaker first half and matched last

year's level. This reflected the recovery in milk prices after

lower demand in the early part of the financial year as a result of

good on-farm forage stocks, the mild winter and a drop in demand

for liquid milk from the hospitality sector during the coronavirus

lockdown. We have also gained new customers following a successful

campaign led by our dairy technical team.

Poultry feed sales for the free range egg market continued to

grow, and we have further strengthened our specialist poultry team

of advisors to drive expansion. Demand from the sheep feed market

recovered from the previous year both for breeding sheep feed and

lamb finishing rations as farmers chose to market their lambs

earlier, in order both to take advantage of higher market prices

and before a potential "no-deal" Brexit.

We have continued to focus on the technical knowledge within our

teams, and as well as strengthening our poultry team, we have

strengthened our specialist teams in dairy, youngstock, beef and

sheep. This will support our growth plans in these areas.

We started a significant expansion programme at our Carmarthen

feed mill, although its commencement was delayed by the coronavirus

pandemic. This major investment will be completed over the next

three years. It will significantly increase our feed manufacturing

capacity, improve efficiency and support better environmental

practices.

Arable Products

It has been a challenging year for our arable activities. This

was caused by the exceptionally wet autumn of 2019, which

drastically reduced farmers' ability to sow winter cereal crops,

and the dry spring that followed, which had a detrimental impact on

yields. As a result, demand for fertiliser and other inputs

reduced, traded grain volumes contracted, and there was decreased

demand for seed in autumn 2020, given the significant carry-over of

unsown seed from the prior year. Margins were also squeezed as

suppliers chased reduced volumes.

The UK wheat harvest in 2020 was 37.5% lower than the 2019

harvest, the lowest production seen since 1981. While this,

together with the reduced oilseed rape crop, dramatically impacted

trading volumes for GrainLink, our specialist combinable crop

marketing business, the business still made a profitable

contribution to the Division's performance. GrainLink is currently

considering alternative protein crops to contract with growers. We

have also moved grain traders to remote working and closed the

Grantham trading office, so reducing costs. With a more normal

autumn planting season in 2020, we expect a significantly improved

performance from GrainLink in 2021.

Spring cereal seed sales were boosted by farmers turning to

spring sowing after the exceptionally poor winter cereals seed

planting season, and sales were up 40% on the previous year. With

an estimated carry-over of 30% of the 2019 purchased winter cereal

seed, as expected, winter 2020 sales were down year-on-year.

Margins were also affected by the necessity to purchase seed from

third parties because yields of contracted seed were low. Grass

seed sales performed above the previous year.

We decommissioned our seed plant in Selby when its lease came up

for renewal in December 2020, and are now in the process of

identifying a suitable site for a modern, new plant. We will

continue to invest at our Astley seed processing plant and will be

utilising facilities with collaborative partners in 2021.

National fertiliser usage contracted by approximately 10%, and

our own merchanted sales was similarly affected. We have continued

to focus on improving our market position, with our suitably

qualified FACTS advisors offering expert advice covering all

aspects of fertiliser usage. We have also launched a sales trading

desk that will offer an additional route to market, complementing

our specialist team at Astley.

Looking forward, strong market prices and the large acreage of

autumn plantings give us confidence for a significantly improved

arable performance in 2021.

Glasson Grain Limited

The Glasson Grain business, which is based at Glasson Dock near

Lancaster, comprises three core activities, the supply of feed raw

materials, the production and distribution of fertilisers, and the

manufacture of added value animal feed products.

Glasson generated a solid performance, in line with management

expectations although below last year's outstanding

performance.

The fertiliser blending operation manufactured record volumes,

with all three sites contributing to this result. Margins came

under some pressure as competitors reacted to lower demand,

reflected in the 10% reduction in national usage. However, prices

recovered in the second half and Glasson remains the second largest

blended-fertiliser manufacturer in the UK. Feed raw material

volumes were lower than last year, because of both the mild winter

and an abundance of grass in the summer period. Our added value

animal feed products performed well and although the coronavirus

impacted sales to the wild bird market, we secured some additional

markets.

The business is well placed for the current financial year.

SPECIALIST AGRICULTURAL MERCHANTING DIVISION

The Specialist Agricultural Merchanting Division trades

predominantly through a network of 54 depots but also via

additional channels-to-market, including specialist catalogues for

the dairy, poultry, beef and sheep sectors, and online. Youngs

Animal Feeds is accounted for within this Division. It manufactures

and distributes a wide range of equine products, which are sold in

Wales and the Midlands through three dedicated outlets and a number

of Wynnstay depots.

Divisional revenue was 2% lower at GBP128.81m (2019:

GBP131.84m), although like-for-like revenue was just 1% down, with

the year-on-year reductions mainly reflected the constrictions to

trading at the onset of the first national coronavirus-related

lockdown. The Division's profit contribution increased by 10% to

GBP5.78m (2019 GBP5.24m), helped by stronger sales in the second

half and previous efficiency initiatives.

Wynnstay Depots and Youngs Animal Feeds

We are pleased with the performance of the depots during a year

in which the challenges to normal operations were severe, and

included temporary depot closures to the public, a switch over to

an "order and collect" only service, and the establishment of a

coronavirus-secure environment following Government guidelines to

ensure the safety to our employees and customers. Many customers

have continued to operate on an "order and collect" basis.

While the wet and mild winter period in the first half impacted

sales of certain product categories, such as hardware materials and

feed blocks, sales in the second half of the financial year closed

strongly. Wynnstay-branded bagged feed sales were very good, helped

by a vigorous marketing campaign in our trading area, as were sales

of animal health products, milk replacers and fencing products.

Sales and profits at Youngs Animal Feeds were lower

year-on-year, affected by the cancellation of horse events due to

the coronavirus. However the popularity of our feed range remains

high and the business retains a loyal customer base.

We continued with our network optimisation and efficiency

programmes. In July, we closed the Wynnstay depot at Salisbury in

Wiltshire, taking depot numbers to 54, and, in October, closed the

Youngs Animal Feed outlet in Huyton in Merseyside, when its lease

came up for renewal. Nonetheless, we were able to retain the

majority of both customer bases.

ENVIRONMENTAL INITIATIVES

We continue to push forward with sustainable sourcing and to

evaluate the origin of all of our feed raw materials. We are

pleased to report that soya within Wynnstay feed rations has moved

entirely to sustainable sources.

As part of our strategy to reduce carbon emissions, the majority

of our commercial delivery fleet now utilises fuel product with

bio-diesel, and we are looking at adaptations to decrease fuel

usage. We have also continued with the conversion of the

composition of Wynnstay feed bags, which now include a minimum of

30% recyclable plastic. Our feed formulation specialists have

introduced lower protein rations and are trialling methane

inhibitors to reduce carbon emissions.

Llansantffraid Feed Mill has recently undergone its third annual

'Green Dragon' audit, after first gaining this accreditation in

November 2018. We completed the audit and maintained our Level 3

accreditation, with no non-conformances. The accreditation is

awarded to organisations that are taking action to understand,

monitor and control their impacts on the environment.

JOINT VENTURE AND ASSOCIATE COMPANIES

Wynnstay has three joint venture companies, Bibby Agriculture

Limited, Wyro Developments Limited and Total Angling Ltd and one

associate company, Celtic Pride Limited. The three JVs performed

well during the year and the combined profit contribution from the

four businesses was higher year-on-year.

COLLEAGUES

The past year has been exceptionally challenging for all our

colleagues and I am extremely proud of their outstanding response

during this time, and their commitment to the business. It has

meant that we were able to maintain all our operations and provide

customers with a continued high level of service. Colleagues have

also shown great care regarding the health and welfare of fellow

colleagues, customers and suppliers. I look forward to a successful

year ahead.

OUTLOOK

The UK's trade deal with the EU has introduced clarity and

stability for UK farming and removed an obstacle that has been

inhibiting farmer confidence and investment spending. The new UK

Agricultural Bill maps out the support that the Government will

provide to farmers post-Brexit, and 2021 marks the start of a seven

year transition period that will see direct payments reduce and

farmers incentivised for efficiency and environmental projects. The

continued social and economic impacts of the coronavirus pandemic

mean that uncertainties remain. However, we anticipate that farmers

will adjust to the new world and invest in their businesses to

improve efficiency and productivity while also addressing

environmental issues.

Our commitment to the environment and sustainability, both

through carbon footprint reduction and steps to source sustainable

products and promote precision farming, will help support our

customers. It will also ensure that we are playing our part to

benefit both the local communities in which we live and work, and

society more widely.

A major investment programme in our manufacturing facilities is

now under way and will help advance our environmental goals as well

as enhancing productivity and efficiency.

The operational reorganisation that we are in the process of

completing supports our growth ambitions and in particular has

created more focused sales channels. Progress with the development

of our digital offering continues.

The new financial year has started well. Stronger farmgate

prices towards the end of 2020, along with the EU settlement and UK

Agricultural Bill, have helped to buoy sentiment across the farming

sector. Wynnstay's performance to date is in line with management

expectations, and we believe that our strong financial position and

balanced business model puts us in an excellent position to make

good progress over the coming year and beyond.

We look to the future with confidence.

Gareth Davies

Chief Executive Officer

WYNNSTAY GROUP PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 October 2020

2020 2019

Note GBP000 GBP000 GBP000 GBP000

------- ---------- ------- ----------

Revenue 2 431,398 490,602

Cost of sales (370,630) (428,621)

Gross profit 60,768 61,981

Manufacturing, distribution

and selling costs (46,033) (48,177)

Administrative expenses (6,945) (6,434)

Other operating income 351 385

Adjusted(1) operating profit 8,141 7,755

Amortisation of acquired intangible

assets and share-based payment

expense 4 (132) (77)

Non-recurring items 4 (1,194) (301)

------------------------------------- ----- ------- ---------- ------- ----------

Group operating profit 6,815 7,377

Interest income 164 164

Interest expense (436) (348)

------- ---------- ------- ----------

3 (272) (184)

Share of profits in joint ventures

and associates accounted for

using the equity method 538 463

Share of tax incurred by joint

ventures and associates (100) (103)

------- ---------- ------- ----------

6 438 360

Profit before taxation 6,981 7,553

Taxation 7 (1,448) (1,421)

------- ---------- ------- ----------

Profit for the year and other

comprehensive income attributable

to the equity holders 5,533 6,132

Basic earnings per ordinary

share (pence) 27.73 30.95

Diluted earnings per ordinary

share (pence) 27.57 30.95

WYNNSTAY GROUP PLC

CONSOLIDATED BALANCE SHEET

As at 31 October 2020

2020 2019

Note GBP000 GBP000

--------- ---------

ASSETS

NON-CURRENT ASSETS

Goodwill 14,367 14,968

Investment property 2,372 2,372

Property, plant and equipment 17,545 23,225

Right-of-use assets 11,240 -

Investments accounted for

using equity method 3,611 3,175

Intangibles 225 261

49,360 44,001

--------- ---------

CURRENT ASSETS

Inventories 34,190 42,239

Trade and other receivables 55,850 63,887

Financial assets

* loan to joint venture 3,889 4,413

Cash and cash equivalents 11 19,980 10,608

113,909 121,147

--------- ---------

TOTAL ASSETS 163,269 165,148

--------- ---------

LIABILITIES

CURRENT LIABILITIES

Financial liabilities -

borrowings 11 (1,572) (3,686)

Lease liabilities 11 (3,483) -

Trade and other payables (52,326) (62,113)

Current tax liabilities (784) (894)

(58,165) (66,693)

--------- ---------

NET CURRENT ASSETS 55,744 54,454

--------- ---------

NON-CURRENT LIABILITIES

Financial liabilities -

borrowings 11 - (3,078)

Lease liabilities 11 (6,509) -

Trade and other payables (141) (201)

Deferred tax liabilities (276) (228)

(6,926) (3,507)

--------- ---------

TOTAL LIABILITIES (65,091) (70,200)

--------- ---------

NET ASSETS 98,178 94,948

--------- ---------

EQUITY

Share capital 10 5,013 4,974

Share premium 30,637 30,284

Other reserves 3,525 3,429

Retained earnings 59,003 56,261

TOTAL EQUITY 98,178 94,948

--------- ---------

WYNNSTAY GROUP PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

As at 31 October 2020

Share

Share premium Other Retained

capital account reserves earnings Total

Group GBP000 GBP000 GBP000 GBP000 GBP000

---------- --------- ---------- ----------- --------

At 1 November 2018 4,943 29,941 3,377 52,812 91,073

Profit for the year - - - 6,132 6,132

Total comprehensive

profit for the year - - - 6,132 6,132

---------- --------- ---------- ----------- --------

Transactions with owners

of the Company, recognised

directly in equity:

Shares issued during

the year 31 343 - - 374

Own shares disposed

of by ESOP trust - - 3 - 3

Dividends - - - (2,683) (2,683)

Equity settled share-based

payment transactions - - 49 - 49

Total contributions

by and distributions

to owners of the Company 31 343 52 (2,683) (2,257)

---------- --------- ---------- ----------- --------

At 31 October 2019 4,974 30,284 3,429 56,261 94,948

---------- --------- ---------- ----------- --------

Profit for the year - - - 5,533 5,533

Total comprehensive

income for the year - - - 5,533 5,533

---------- --------- ---------- ----------- --------

Transactions with owners

of the Company, recognised

directly in equity

Shares issued during

the year 39 353 - - 392

Dividends - - - (2,791) (2,791)

Equity settled share-based

payment transactions - - 96 - 96

Total contributions

by and distributions

to owners of the Company 39 353 96 (2,791) (2,303)

---------- --------- ---------- ----------- --------

At 31 October 2020 5,013 30,637 3,525 59,003 98,178

---------- --------- ---------- ----------- --------

There was no other comprehensive income during the current and

prior years and all amounts are derived from continuing

operations.

WYNNSTAY GROUP PLC

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 October 2020

2020 2019

Note GBP000 GBP000

-------- --------

Cash flows from operating activities

Cash generated from operations 12 20,372 14,756

Interest received 164 164

Interest paid (436) (348)

Tax paid (1,510) (1,680)

Net cash generated from operating activities 18,590 12,892

-------- --------

Cash flows from investing activities

Proceeds from sale of property, plant

and equipment 194 288

Purchase of property, plant and equipment (1,058) (2,412)

Acquisition of subsidiaries, net of

cash acquired (125) (893)

Own shares disposed of by ESOP trust - 3

Dividends received from joint ventures

and associates 2 132

Net cash used by investing activities (987) (2,882)

-------- --------

Cash flows from financing activities

Net proceeds from the issue of ordinary

share capital 392 374

Lease repayments (4,362) (1,798)

Repayment of borrowings (1,470) (1,971)

Dividends paid to shareholders 8 (2,791) (2,683)

Net cash used by financing activities (8,231) (6,078)

-------- --------

Net increase in cash and cash equivalents 9,372 3,932

Cash and cash equivalents at the beginning

of the period 10,608 6,676

Cash and cash equivalents at the end

of the period 11 19,980 10,608

======== ========

WYNNSTAY GROUP PLC

NOTES TO THE ACCOUNTS

1. GENERAL INFORMATION AND SIGNIFICANT ACCOUNTING POLICIES

The Company is taking advantage of the exemption in s408 of the

Companies Act 2006 not to present its individual income statement

and related notes that form part of these approved financial

statements.

Changes in accounting policies

New standards impacting the Group that will be adopted in the

annual financial statements for the year ended 31 October 2020, and

which have given rise to changes in the Group's accounting policies

are:

-- IFRS 16 Leases (IFRS 16); and

-- IFRIC 23 Uncertainty over Income Tax Treatments (IFRIC

23)

Details of the impact of IFRS 16 have had are given in note 13

below. The adoption of IFRIC 23 has not had a material impact.

Other new and amended standards and Interpretations issued by the

IASB that will apply for the first time in the next annual

financial statements are not expected to impact the Group as they

are either not relevant to the Group's activities or require

accounting which is consistent with the Group's current accounting

policies.

New Standards, interpretations and amendments not yet

effective

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the group has decided

not to adopt early.

The following amendments are effective for the period beginning

1 January 2020:

-- IAS 1 Presentation of Financial Statements and IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors

(Amendment - Definition of Material)

-- IFRS 3 Business Combinations (Amendment - Definition of

Business)

-- Revised Conceptual Framework for Financial Reporting

In January 2020, the IASB issued amendments to IAS 1, which

clarify the criteria used to determine whether liabilities are

classified as current or non-current. These amendments clarify that

current or non-current classification is based on whether an entity

has a right at the end of the reporting period to defer settlement

of the liability for at least twelve months after the reporting

period. The amendments also clarify that 'settlement' includes the

transfer of cash, goods, services, or equity instruments unless the

obligation to transfer equity instruments arises from a conversion

feature classified as an equity instrument separately from the

liability component of a compound financial instrument. The

amendments are effective for annual reporting periods beginning on

or after 1 January 2022.

Wynnstay Group Plc is currently assessing the impact of these

new accounting standards and amendments. The Group does not believe

that the amendments to IAS 1 will have a significant impact on the

classification of its liabilities.

2. SEGMENTAL REPORTING

IFRS 8 requires operating segments to be identified on the basis

of internal financial information about the components of the Group

that are regularly reviewed by the chief operating decision maker

("CODM") to allocate resources to the segments and to assess their

performance.

The chief operating decision maker has been identified as the

Board of Directors ("the Board"). The Board reviews the Group's

internal reporting in order to assess performance and allocate

resources. The Board has determined that the operating segments,

based on these reports are Agriculture, Specialist Agricultural

Merchanting and Other.

The Board considers the business from a product/service

perspective. In the Board's opinion, all of the Group's operations

are carried out in the same geographical segment, namely the United

Kingdom.

Agriculture - manufacturing and supply of animal feeds,

fertiliser, seeds and associated agricultural products.

Specialist Agricultural Merchanting - supplies of a wide range

of specialist products to farmers, smallholders, and pet

owners.

Other - miscellaneous operations not classified as Agriculture

or Specialist Agricultural Merchanting.

The Board assesses the performance of the operating segments

based on a measure of operating profit. Non-recurring costs and

finance income and costs are not included in the segment result

that is assessed by the Board. Other information provided to the

Board is measured in a manner consistent with that in the financial

statements. No segment is individually reliant on any one

customer.

The segment results for the year ended 31 October 2020 are as

follows:

Specialist

Agricultural

Year ended 31 October Agriculture Merchanting Other Total

2020 GBP000 GBP000 GBP000 GBP000

------------ -------------- -------- --------

Revenue from external

customers 302,580 128,807 11 431,398

------------ -------------- -------- --------

Segment result

Group operating profit

before non-recurring

items 2,411 5,728 (130) 8,009

Share of results of

joint ventures before

tax 471 53 14 538

2,882 5,781 (116) 8,547

------------ -------------- -------- --------

Non-recurring items (1,194)

Interest income 164

Interest expense (436)

--------

Profit before tax from

operations 7,081

Income taxes (includes

tax of joint ventures

and associates) (1,548)

--------

Profit for the year

attributable to equity

shareholders from operations 5,533

========

Segment net assets 44,867 37,623 7,272 89,762

Corporate net cash (note

11) 8,416

--------

Net assets after corporate

net cash 98,178

========

The segment results for the year ended 31 October 2019 are as

follows:

Specialist

Agriculture Agricultural Other Total

Merchanting

Year ended 31 October 2019 GBP000 GBP000 GBP000 GBP000

-------------- -------------- -------- --------

Revenue from external customers 358,687 131,843 72 490,602

-------------- -------------- -------- --------

Segment result

Group operating profit before

non-recurring items 2,417 5,240 21 7,678

Share of results of associate

and joint ventures before

tax 534 4 (75) 463

-------------- -------------- -------- --------

2,951 5,244 (54) 8,141

Non-recurring items (301)

Interest income 164

Interest expense (348)

--------

Profit before tax 7,656

Income taxes (includes tax

of associate and joint ventures) (1,524)

--------

Profit for the year attributable

to equity shareholders 6,132

========

Segment net assets 47,213 36,097 7,794 91,104

Corporate net debt (note

11) 3,844

--------

Net assets after corporate

net cash 94,948

========

3. FINANCE COSTS

2020 2019

GBP000 GBP000

Interest expense:

Interest payable on borrowings (141) (191)

Interest payable on finance leases (295) (157)

Interest and similar charges payable (436) (348)

------- -------

Interest income 164 164

Interest receivable 164 164

------- -------

Finance costs (272) (184)

======= =======

4. AMORTISATION OF ACQUIRED INTANGIBLE ASSETS, SHARE-BASED PAYMENTS AND NON-RECURRING ITEMS

2020 2019

GBP000 GBP000

------- -------

Amortisation of acquired intangible assets

and share-based payments

Amortisation of intangibles 36 28

Cost of share-based reward 96 49

132 77

------- -------

Non-recurring items

Business re-organisation costs 185 297

Business combination expenses - 4

Goodwill and Investment impairment 601 -

Huyton store closure costs 256 -

Decommissioning of Selby seed plant 152 -

------- -------

1,194 301

======= =======

Business re-organisation costs relate to the redundancy related

expenses of colleagues leaving the business as a result of

re-organising operations and was completed during the year.

The goodwill impairment relates to the GrainLink cash generating

unit.

Huyton depot store closure costs comprise redundancy costs and

costs associated with exiting the leased premises.

Decommissioning of Selby seed plant relates to the costs of

vacating a leased property and transferring the plant and machinery

to a new location.

5. GROUP OPERATING PROFIT

The following items have been included in arriving at operating

profit:

2020 2019

GBP000 GBP000

Staff costs 30,031 30,143

Cost of inventories recognised as an expense 315,785 347,239

Depreciation of property plant and equipment:

- owned assets 2,290 3,323

Amortisation of right-of-use assets (2019:

depreciation of assets held under finance

leases) 3,888 290

Amortisation of intangibles 36 28

(Profit) on disposal of fixed assets (142) (170)

Loss on disposal of right-of-use asset 25 -

Other operating lease rentals payable 244 3,221

Services provided by the Group's auditor

During the year the Group obtained the following services from

the Group's auditor:

2020 2019

GBP000 GBP000

Audit services - statutory audit 99 93

6. SHARE OF POST-TAX PROFITS OF JOINT VENTURES AND ASSOCIATES

2020 2019

GBP000 GBP000

------- -------

Share of post-tax profits in joint

ventures 438 360

------- -------

Total share of post-tax profits of

joint ventures and associates 438 360

======= =======

7. TAXATION

2020 2019

Analysis of tax charge in year GBP000 GBP000

------- -------

Current tax

- Operating activities 1,496 1,502

- Adjustments in respect of prior years (73) (50)

------- -------

Total current tax 1,423 1,452

------- -------

Deferred tax

- Accelerated capital allowances 165 (31)

- other temporary and deductible differences (140) -

------- -------

Total deferred tax 25 (31)

------- -------

Tax on profit on ordinary activities 1,448 1,421

======= =======

8. DIVIDS

2020 2019

GBP000 GBP000

------- -------

Final dividend paid for prior year 1,870 1,770

Interim dividend paid for current

year 921 913

2,791 2,683

======= =======

Subsequent to the year end it has been recommended that a final

dividend of 10.0p net per ordinary share (2019: 9.40p) be paid on

30 April 2021. Together with the interim dividend already paid on

31 October 2020 of 4.60p net per ordinary share (2019: 4.60p) this

will result in a total dividend for the financial year of 14.60p

net per ordinary share (2019: 14.00p).

9. EARNINGS PER SHARE

Basic earnings Diluted earnings

per share per share

2020 2019 2020 2019

-------- ------- --------- ---------

Earnings attributable to shareholders

(GBP000) 5,533 6,132 5,533 6,132

Weighted average number of shares

in issue during the year (number

'000) 19,952 19,812 20,070 19,812

Earnings per ordinary 25p share

(pence) 27.73 30.95 27.57 30.95

Basic earnings per 25p ordinary share is calculated by dividing

profit for the year from continuing operations attributable to

ordinary shareholders by the weighted average number of ordinary

shares in issue during the year.

For diluted earnings per share, the weighted average number of

ordinary shares is adjusted to assume conversion of all dilutive

potential ordinary shares (share options) taking into account their

exercise price in comparison with the actual average share price

during the year.

10. SHARE CAPITAL

2020 2019

----------------- ------------------

No. of GBP000 No. of GBP 000

shares shares

000 000

-------- ------- -------- --------

Authorised

Ordinary shares of 25p

each 40,000 10,000 40,000 10,000

-------- ------- -------- --------

Allotted, called up and

fully paid

Ordinary shares of 25p

each 20,051 5,013 19,896 4,974

======== ======= ======== ========

During the year 155,035 shares (2019: 124,212) were issued with

an aggregate nominal value of GBP38,759 (2019: GBP31,053) and were

fully paid up for equivalent cash of GBP392,135 (2019: GBP373,457)

to shareholders exercising their right to receive dividends under

the Company's Scrip dividend scheme.

No other shares were issued (2019: nil).

11. CASH AND CASH EQUIVALENTS, BORROWINGS AND LEASE

LIABILITIES

2020 2019

GBP000 GBP000

Current

Cash and cash equivalents per balance

sheet and cash flow 19,980 10,608

Bank loans and overdrafts due within

one year or on demand:

Secured loans (897) (1,457)

Loanstock (unsecured) (675) (683)

Net obligations under finance leases - (1,546)

Financial liabilities - borrowings (1,572) (3,686)

Non-property leases (1,473) -

Property leases (2,010) -

-------- ----------

Lease liabilities (3,483) -

Total current net cash and lease liabilities 14,925 6,922

Non-current

Bank loans:

Secured loans - (902)

Net obligations under finance leases - (2,176)

-------- ----------

Financial liabilities - borrowings - (3,078)

Non-property leases (2,228) -

Property leases (4,281) -

-------- ----------

Lease liabilities (6,509) -

Total non-current net debt and lease

liabilities (6,509) (3,078)

Total net cash and lease liabilities 8,416 3,844

-------- ----------

Memo: total net cash and lease liabilities

excluding property leases 14,707 3,844

======== ==========

All amounts are denominated in GBP and are at book and fair

value. The Loanstock is redeemable at par at the option of the

Company. Interest of 0.5% (2019: 1.5%) per annum is payable to the

holders.

-- Cash and cash equivalents

Cash and cash equivalents are all cash at bank and held with

HSBC Bank Plc, except for GBP311,000 (2019: GBP148,000) which is

held at INTL FC Stones for futures trading. HSBC Bank Plc's credit

rating per Moody's is A2 (2019: Aa3).

-- Bank borrowings

Bank loans and overdrafts are secured by an unlimited composite

guarantee of all of the trading entities within the Group. One

company within the Group had an overdraft of GBP253,000 (2019:

GBP230,000). The outstanding loan will be repaid within 1 year, the

rate of interest on this loan is 0.85% over base per annum.

12 . C ASH GENERATED FROM OPERATIONS

2020 2019

GBP000 GBP000

-------- ---------

Profits for the year from operations 5,533 6,132

Adjustments for:

Tax 1,448 1,421

Investment and goodwill impairment 601 -

Depreciation of tangible fixed assets 2,290 3,579

Amortisation of right-of-use assets 3,888 -

Amortisation of other intangible fixed

assets 36 28

Profit on disposal of property, plant

and equipment (142) (170)

Loss on disposal of right-of-use asset 25 -

Profit from distribution from associate - (84)

Interest income (164) (164)

Interest expense 436 348

Share of results of joint ventures

and associate (438) (360)

Share-based payments 96 49

Changes in working capital (excluding

effects of acquisitions and disposals

of subsidiaries):

Decrease/(increase) in short term loan

to joint ventures 524 (1,601)

Decrease in inventories 8,049 10,171

Decrease in trade and other receivables 8,055 7,426

(Decrease)in payables (9,865) (12,019)

Cash generated from operations 20,372 14,756

======== =========

13. IMPACT OF IFRS 16

The Group adopted IFRS 16 Leases with a transition date of 1

November 2019. The Group has chosen not to restate comparatives on

adoption of IFRS 16, and therefore, the revised requirements are

not reflected in the prior year financial statements. Rather, these

changes have been processed at the date of initial application

(i.e. 1 November 2019) and recognised in the opening equity

balances.

Effective 1 November 2019, IFRS 16 has replaced IAS 17 Leases

and IFRIC 4 Determining whether an Arrangement Contains a Lease.

IFRS 16 provides a single lessee accounting model, requiring the

recognition of assets and liabilities for all leases, together with

options to exclude leases where the lease term is 12 months or

less, or there the underlying asset is of low value. IFRS 16

substantially carried for the lessor account in IAS 17, with the

distinction between operating leases and finance leases being

retained. The Group does not have significant leasing activities

acting as a lessor.

Full details of the transition method and practical expedients

utilised will be contained within the 2020 Annual Report and

Accounts.

The following table presents the impact of adopting IFRS 16 on

the statement of financial position as at 1 November 2019.

As originally IFRS 16 1 November

presented adjustments 2019

at 31 October GBP000 GBP000

2019

GBP000

-------------------------- --- --------------- ------------- -----------

NON CURRENT ASSETS

Property, plant and

equipment a 23,225 (4,521) 18,704

Right-of-use assets b - 12,322 12,322

LIABILITIES

Borrowings c (3,686) 1,546 (2,140)

Lease Liabilities - (3,937) (3,937)

NON CURRENT LIABILITES

Borrowings c (3,078) 2,176 (902)

Lease Liabilities - (7,586) (7,586)

Equity

Retained Earnings d 56,261 - 56,261

-------------------------- --- --------------- ------------- -----------

a. Property, plant and equipment was adjusted to reclassify

leases previously classified as finance type to right-of-use

assets. The adjustment reduced the cost of property, plant and

equipment by GBP6.5m and accumulated amortisation by GBP2.0m for a

net adjustment of GBP4.5m.

b. The adjustment to Right-of-use assets is comprised of GBP4.5m

finance type leases and GBP7.8m operating type leases, resulting in

a total adjustment of GBP12.3m.

c. Loans and borrowings were adjusted to reclassify leases

previously classified as finance type leases to lease

liabilities.

d. Retained earnings were not impacted as a result of adopting IFRS 16

14. ALTERNATIVE PERFORMANCE MEASURE

Using the Board's preferred alternative performance measured

referred to as Underlying pre-tax profit, which includes the gross

share of results from joint ventures and associates but excludes

share-based payments and non-recurring items, the Group achieved

GBP8.37m (2019: GBP8.01m). A reconciliation with the reported

income statements and this measure, together with the reasons for

its use is given below:

2020 2019

GBP000 GBP000

------- -------

Profit before tax 6,981 7,553

Share of tax incurred by joint ventures

and associates 100 103

Share-based payments 96 49

Non-recurring items 1,194 301

------- -------

Underlying pre-tax profit 8,371 8,006

======= =======

The Board provides this alternative performance measure as it

believes it provides a view of the underlying commercial

performance of the current trading activities, providing investors

and other users of the accounts with an improved view of likely

future performance by making the following adjustments to the IFRS

results for the following reasons:

-- The add back of tax incurred by joint ventures and

associates. The Board believes the incorporation of

the gross result of these entities provides a fuller

understanding of their combined contribution to the

Group performance.

-- The add back of share-based payments. This charge

is a calculated using a standard valuation model,

with the assessed non-cash cost each year varying

depending on new scheme invitations and the number

of leavers from live schemes. These variables can

create a volatile non-cash charge to the income statement,

which is not directly connected to the trading performance

of the business.

-- Non-recurring items. The Group's accounting policies

include the separate identification of non-recurring

material items on the face of the income statement,

which the Board believes could cause a misinterpretation

of trading performance if not disclosed. See note

4.

15. RESPONSIBILTY STATEMENT

The Directors below confirm to the best of their knowledge:

-- the financial statements, prepared in accordance with

the applicable set of accounting standards, give a

true and fair view of the assets, liabilities, financial

position and profit or loss of the Company and the

undertakings included in the consolidation taken as

a whole; and

-- the management report includes a fair review of the

development and performance of the business and the

position of the issuer and the undertakings included

in the consolidation taken as a whole, together with

a description of the principal risks and uncertainties

that they face.

J J McCarthy

P M Kirkham

B P Roberts

G W Davies

D A T Evans (resigned 1 December 2020)

H J Richards

S J Ellwood

16. CONTENT OF THIS REPORT

The financial information set out above does not constitute the

Group's statutory accounts for the years ended 31 October 2020 or

31 October 2019 but is derived from those accounts.

Statutory accounts for 2019 have been delivered to the Registrar

of Companies. The auditor, BDO LLP, has reported on the 2019

accounts; the report (i) was unqualified, (ii) did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying their report, and (iii) did not

contain a statement under section 498(2) or (3) of the Companies

Act 2006.

The statutory accounts for 2020 will be delivered to the

Registrar of Companies following the Annual General Meeting. The

auditor, BDO LLP, has reported on these accounts; their report is

unqualified, does not include a reference to any matters to which

the auditor drew attention by way of emphasis without qualifying

their report, and; does not include a statement under either

section 498(2) or (3) of the Companies Act 2006.

The Annual Report and full Financial Statements will be

available to shareholders prior to the AGM. Further copies will be

available to the public, free of charge, from the Company's

Registered Office at Eagle House, Llansantffraid, Powys, SY22 6AQ

or on the Company's website www.wynnstayplc.co.uk .

17. ANNUAL GENERAL MEETING

The Annual General Meeting of the Company will be held virtually

from the Wynnstay Group plc registered office at Eagle House,

Llansantffraid, Powys on Tuesday 23 March 2021 at 11.45am. Further

details will be published on the Company's website

www.wynnstayplc.co.uk .

(1) Adjusted operating profit is after adding back amortisation

of acquired intangible assets, share-based payment expense and

non-recurring items

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UNORRASUAUUR

(END) Dow Jones Newswires

January 27, 2021 02:00 ET (07:00 GMT)

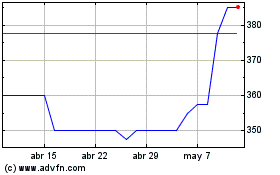

Wynnstay (LSE:WYN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Wynnstay (LSE:WYN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024