TIDMWTE

RNS Number : 8714T

Westmount Energy Limited

30 March 2021

30(th) March 2021

WESTMOUNT ENERGY LIMITED

("Westmount" or the "Company")

Interim Results

Westmount Energy Limited (UK AIM: WTE.L, USA OTCQB: WMELF), the

AIM-quoted oil and gas investing company focussed on the

Guyana-Suriname Basin is please to announce its unaudited Interim

Results for the six months ended 31 December 2020.

Copies of the Company's interim results are avaiable on the

Company's website, www.westmountenergy.com , and wil be posted to

shareholders shortly.

2020 Highlights

-- High quality reservoirs and hydrocarbons identified in first

wells on Kaieteur and Canje blocks - confirming extension of the

Cretaceous petroleum system outboard of the Liza trend

-- Tanager-1 Discovery contains gross 65.3 MMbbls (42.7 MMbbls

Net to Kaieteur Block) contingent resources (2C, unrisked)(1) in

high quality Maastrichtian reservoir - but is non-commercial as a

standalone development

-- Detailed analysis of the data collected at the recently

completed Bulletwood-1 well, the first well on the Canje Block, is

ongoing

-- Initial Drilling activities have commenced at Jabillo-1, an

independent circa 1bn bbl prospect(2) , and the second of three

wells scheduled for drilling on the Canje Block in 2021

-- Investment portfolio rebalancing to reflect changing risk

profile and optimise exposure to 2021 drilling activity

-- Shares commenced cross trading on the US OTCQB market under the ticker symbol "WMELF"

-- Cash balance of GBP2.2M at period end

Chairman's Review

Five years on since the world-class Liza-1 discovery, the

Guyana-Suriname Basin continues to manifest the hallmarks of a

prolific emerging hydrocarbon province. With more than 50 wells

drilled in the basin since 2015, in excess of 10 billion oil

equivalent barrels discovered between Stabroek and Block 58 (with

estimated 70% oil or liquids)(3) and a total basin potential now

estimated to be more than twice the discovered resource(4) , the

basin continues to be an outlier in terms of global exploration

performance and investment growth. Further testimony to the

accelerating activity levels is provided by the current deployment

of seven drillships and one semi-submersible rig across the basin

by three operators.

Nevertheless, the backdrop to the oil and gas exploration sector

for much of 2020 was dominated by the global pandemic, an oil price

crash and a sharpening focus on accelerating the energy transition.

After the economic shocks and oil price collapse observed in the

first half of 2020 the second half of the year has witnessed a

period of steady improvement in demand and price recovery -

notwithstanding persistent concerns of the potential for slow

vaccine rollout and the still spreading Covid-19, with new

variants, to delay global economic and oil demand recovery. Oil

prices have shown a continued upward trend from circa $40/bbl Brent

in early November 2020 to above $65/bbl Brent in mid-March 2021.

This move has been supported by a reduction in global inventories

due to OPEC+ production curbs, US cold weather events, a weakening

US Dollar, optimism about Covid-19 vaccinations, a US$1.9tn

coronavirus relief package in the US and growing economic activity

in Europe - all pointing towards a tighter oil market. Near term

price outlook is likely to be determined by the rate of re-opening

of OECD economies, the rate of loosening of production supply

constraints by OPEC+, increasing US rig count and geopolitical

considerations including whether or not sanctions on Iran are

lifted.

Notwithstanding the challenging macro environment, in the second

half of the year, Guyana continued its transformation towards a

significant oil producing nation - with Liza Phase 1 reaching its

plateau production rate of 120,000 BOPD, Liza Phase 2 development

is on track to achieve first oil in early 2022, with a capacity of

220,000 BOPD and with a third field development, Payara, also with

220,000 BOPD capacity, now sanctioned and targeting first oil in

2024. In addition, it is anticipated that the Stabroek consortium

will submit to the Guyanese government a 4th development plan, for

the Yellowtail discoveries, by the end of 2021.

Also, during this period estimates of gross discovered resources

to date on the Stabroek Block were revised upwards to 9 billion

barrels of oil equivalent with exploration drilling continuing

apace. New discoveries were reported at Redtail-1 and Yellowtail-2

bringing the total number of reported discoveries to date on the

Stabroek Block to eighteen. In addition, circa 15m of oil bearing,

Santonian, sandstone was recently reported in the Hassa-1 well,

which is located proximal to the Canje block boundary.

At the south-eastern end of the basin two additional stacked pay

discoveries were announced by the Total/Apache consortium in Block

58, during this period - Kwaskwasi-1 and East Keskesi-1 - bringing

the number of reported discoveries on the block to four. These

discoveries reported light oil and gas-condensate pay in the

shallower Campanian reservoirs overlying light oil pay in deeper

Santonian reservoirs. Appraisal of these discoveries has now

commenced, with Total as operator, targeting FID for the first

development in early 2022 and first oil by the end of 2025. In

addition, in December, Petronas announced a discovery at the

Sloanea-1 exploration well on Block 52, where several

hydrocarbon-bearing sandstone packages with good reservoir

qualities were encountered in the Campanian.

Exploration drilling results continue to support the presence of

multiple plays, quality reservoirs and the potential for

stacked-pay drilling opportunities within the basin. Although the

Upper Cretaceous Maastrichtian-Campanian Liza play dominates in

terms of number of discoveries and discovered volumes to date the

deeper Santonian pools on Block 58, in conjunction with the deeper

hydrocarbons reported at Liza-3, Tripletail-1, Yellowtail-2 and

Hassa-1 on the Stabroek Block, suggest an extensive emerging deeper

play fairway within the basin.

It is against this backdrop that the first 'large step-out play

extension wells' have been drilled on the Kaieteur and Canje blocks

during the last 7 months. High quality reservoirs and hydrocarbons

have been reported from both the Tanager-1 and Bulletwood-1 wells -

confirming the extension of the Cretaceous petroleum system

outboard of the Liza trend.

Kaieteur Block

The first well on the Kaieteur block, Tanager-1, is the deepest

well drilled in the Guyana-Suriname Basin to date. It was spudded

on the 11 August 2020, using the Stena Carron drillship. The well

was drilled in a water depth of 2,900 metres and reached a total

depth of 7,633 metres circa mid-November 2021. Evaluation of LWD,

wireline logging and sampling data confirmed 16 metres of net oil

pay (20(o) API oil) in high-quality sandstone reservoirs of

Maastrichtian age. Although high quality reservoirs were also

encountered at the deeper Santonian and Turonian intervals, initial

interpretation of the reservoir fluids was reported to be

equivocal, requiring further analysis - results of which have yet

to be disclosed. Post well analysis and integration of the data

collected continues with a view to highgrading the next drilling

target on the Kaieteur block.

A post-well Netherland, Sewell & Associates Inc. ("NSAI")

published CPR (14 February 2021) indicates that the Tanager-1

Maastrichtian discovery contains a 'Best Estimate' Unrisked Gross

(2C) Contingent Oil Resource of 65.3 MMBBLs (Low to High Estimates

17.7 MMBBLs to 131 MMBBLs) - with a 'Best Estimate' Unrisked Net

(2C) Contingent Oil Resource attributable to the Kaieteur Block of

42.7 MMBBLs (Low to High Estimates 11.3 MMBBLs to 86 MMBBLs).

However, this discovery is currently considered to be

non-commercial as a standalone development.

The Kaieteur Block is currently operated by an ExxonMobil

subsidiary, Esso Production & Exploration Guyana Limited (35%),

with Cataleya Energy Limited ("CEL") (25%), Ratio Guyana Limited

("RGL") (25%) and a subsidiary of Hess Corporation (15%) as

partners. Westmount retains a holding of approximately 5.3% of the

issued share capital of Cataleya Energy Corporation the parent

company of CEL and after recent portfolio rebalancing circa 0.04%

of the issued share capital of Ratio Petroleum Energy Limited

Partnership ("Ratio Petroleum") the ultimate holding entity with

respect to RGL.

Canje Block

The first well on the Canje block, Bulletwood-1, was spudded on

the 31 December 2020 using the Stena Carron drillship and was

completed in early March. The well was safely drilled in a water

depth of 2,846 metres to its planned target depth of 6,690 meters.

The primary target in the well was a Campanian age confined channel

complex. The well encountered quality reservoirs but non-commercial

hydrocarbons. There has been limited disclosure of the well results

to date as detailed analysis of the data collected is ongoing.

However, the initial results confirm the presence of the

Guyana-Suriname petroleum system and the potential prospectivity of

the Canje Block.

Initial drilling operations at the second well on the Canje

block, Jabillo-1, commenced on the 14 March 2021 using the Stena

Carron drillship. After interruption for a brief period of

maintenance work on the drillship it is anticipated that drilling

operations at Jabillo-1 will recommence in mid-late May 2021.

Previously published information indicated that Jabillo-1 is a

circa 1,000 MMbbl oil prospect targeting a Late Cretaceous,

Liza-age equivalent, basin floor fan(2) .

The third well on the Canje block, Sapote-1, will evaluate a

large independent prospect in the south east of the block and is

currently scheduled for drilling, using the Stena DrillMax

drillship, in Q3 2021.

Westmount holds an indirect interest in the Canje Block as a

result of its circa 7.7% interest in the issued share capital of

JHI Associates Inc. ("JHI"). Following a 2018 farm-out to Total,

JHI is carried for the drilling of the Bulletwood-1 and Jabillo-1

wells and is funded for the drilling of additional wells. The Canje

Block is currently operated by an ExxonMobil subsidiary, Esso

Exploration & Production Guyana Limited (35%), with Total

(35%), JHI (17.5%) and Mid-Atlantic Oil & Gas Inc. (12.5%) as

partners.

Orinduik Block

Westmount continues to hold an indirect interest in the Orinduik

Block as a result of its circa 0.8% interest in the issued share

capital of Eco (Atlantic) Oil and Gas Ltd. ("EOG"). Exploration

drilling did not occur on the Orinduik Block during 2020 but EOG

remains fully funded for its 15% working interest share of the next

two well drilling campaign on the block, which is expected to

target substantial Cretaceous prospects. The Orinduik Block is

currently operated by Tullow Guyana B.V. (60%), with TOQAP Guyana

B.V. (25%) and EOG (15%) as partners. TOQAP Guyana B.V. is jointly

owned by Total E&P Guyana B.V. (60%) and Qatar Petroleum

(40%).

Block 47, Suriname

Westmount retains a minor indirect interest in Block 47,

Suriname, via its circa 0.04% holding in Ratio Petroleum. The first

well on Block 47, the Goliathberg-Voltzberg North-1 ("GVN-1") well

was spudded circa 25 January 2021, using the Stena Forth Drillship

and was reported by the operator Tullow Oil to have reached total

depth on 18 March 2021. The well was drilled to a total depth of

5,060 metres in a water depth of 1,856 metres and was targeting

Turonian-Cenomanian stacked reservoirs. The well is reported to

have encountered good quality reservoir with minor oil shows and is

being plugged and abandoned. Block 47 is operated Tullow Suriname

B.V. (50%), with Petroandina Resources Corporation N.V (30%) and

Ratio Suriname Ltd. (20%) as partners.

Portfolio Effect

The period under review has provided the first exposure of

Westmount's investment strategy to a portfolio of drilling outcomes

on the Kaieteur and Canje blocks, offshore Guyana. While the

initial results at Tanager-1 and Bulletwood-1 have yielded

non-commercial hydrocarbons, we are encouraged by the data

collected in these 'large step-out' wells which confirms the

presence of high-quality reservoirs and the Cretaceous petroleum

system in the southern Kaieteur and north Canje areas. We remain

hopeful that the portfolio effect provided by drilling a sequence

of prospects in this prolific basin will win out over individual

prospect risks and we look forwards to the drilling results from

the large independent prospects, Jabillo-1 and Sapote-1, during

2021. Current guidance from the various deepwater operators

offshore Guyana indicates that Westmount remains the only US OTCQB

and London listed junior player offering exposure to drilling

offshore Guyana in 2021.

Investment portfolio rebalancing and optimisation of exposure to

2021 drilling activity

During the period under review your Company executed a number of

transactions with a view to rebalancing the investment portfolio

and optimising exposure to the more immediate and material drilling

activity - the three well campaign scheduled for the Canje Block in

2021.

On 10 September the Company announced that it had purchased

1,550,000 common shares in JHI by way of the issue of 18,290,000

new ordinary shares of no par value in Westmount ("New Ordinary

Shares"), representing approximately 12.7% of Westmount's enlarged

issued share capital. This share exchange transaction was agreed

with the counterparties on the basis of a share swap metric of 11.8

new ordinary shares in Westmount for each common share in JHI -

with Westmount shares being valued at 14.745p per share and JHI

shares being valued at CAD$3 per share.

Two additional 'cash only' JHI share purchase transactions were

also entered into by Westmount during and immediately post the

period under review. On 22 December 2020 the Company announced that

it had purchased 250,000 common shares in JHI at an aggregate cost

of USD$400,000. On 18 January 2021 the Company further announced

that it had purchased 287,500 common shares at an aggregate cost of

CAD$718,750. Following these purchases, Westmount holds a total of

5,651,270 shares in JHI, representing approximately 7.7% of the

issued common shares in JHI as of 13 November 2019.

On 17 November 2020 Westmount sold 1,200,000 shares in Ratio

Petroleum for an aggregate consideration of ILS 1,514,681

(GBPGBP338,480 after costs). On the same date the Company sold

300,000 WL2 Warrants for an aggregate consideration of ILS 69,251

(GBPGBP15,282 after costs). A residual holding of 89,653 WL2

warrants were exercised on 14 January 2021 for an aggregate

consideration of ILS 116,280 (GBPGBP27,378). After rebalancing and

the WL2 warrants exercise, Westmount continues to hold 89,653

shares in Ratio Petroleum representing approximately 0.04% of the

issued share capital.

Westmount continues to hold a total of 567,185 common shares in

CEC, representing approximately 5.3% of the issued share capital of

CEC as of 10 August 2020.

Westmount continues to hold 1,500,000 shares in EOG,

representing approximately 0.8% of the common shares in issue as of

31 December 2020.

The reported financial loss for the period is primarily made up

of a non-cash loss on financial assets held at fair value through

the profit and loss, the majority of which is as a result of

foreign exchange movements on the portfolio Investments when valued

at the period end.

US OTCQB Cross Trading Facility

On 1 December 2020 we announced that the Company's ordinary

shares of no par value each ("Ordinary Shares") commenced

cross-trading on the "OTCQB Market" in New York, U.S., under the

ticker symbol "WMELF".

The cross-trading facility on the OTCQB Market will allow

Westmount's Ordinary Shares to be traded in US Dollars by

broker-dealers in the United States. Westmount's Ordinary Shares

continue to trade on the AIM market of the London Stock Exchange

with the ticker symbol "WTE".

Summary/Outlook

After a bumpy ride in the first half of 2020, increasing

economic activity and oil demand, combined with OPEC+ supply

discipline, has witnessed an oil price rally which has gained

momentum in recent months. Drilling activity in the Guyana-Suriname

basin continues to accelerate driven by the industry's focus on

'advantaged barrels' as a result of the unique combination of

prospect sizes, reservoir quality, low carbon intensity and low

breakeven metrics ($25/bbl-$35/bbl), available offshore Guyana. In

this context, and in spite of the access challenges, your Board

remains focused on investment opportunities and deployment of

capital that gives additional exposure to drilling in this prolific

emerging basin.

The current year is shaping up to be a significant period for

exploration and appraisal operations in the Guyana-Suriname basin

with in excess of 12 exploration and appraisal wells scheduled for

the Guyanese sector alone. Westmount's strategy remains one of

offering shareholders exposure to high impact drilling outcomes in

the Guyana-Suriname Basin via material indirect holdings in some

key licences.

The Company's current investment portfolio is now focused on the

continuing 2021 ExxonMobil operated drilling campaign on the Canje

Block - with the drilling outcome of two additional large

independent prospects, Jabillo-1 and Sapote-1, due to be revealed

over the coming months. Westmount remains the only US OTCQB and

London listed junior player offering exposure to drilling offshore

Guyana in 2021, where commercial discovery in one of these wells

could result in transformational value changes for the Company.

GERARD WALSH

Chairman

Notes

(1) CPR by Netherland, Sewell & Associates Inc. ("NSAI")

dated 14 February 2021- published by Ratio Petroleum

(2) JHI's Website https://www.jhiassociates.com

(3) Westwood Global Energy Group

(4) ExxonMobil 2021 Investor Day Presentation

For further information, please contact:

Westmount Energy Limited www.westmountenergy.com

David King, Director Tel: +44 (0) 1534 823059

Anita Weaver

Cenkos Securities plc (Nomad and Broker) Tel: +44 (0) 20 7397 8900

Nicholas Wells/Neil McDonald (Corporate Finance)

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 31 DECEMBER 2020

Six months Six months Year ended

ended ended

31 Dec 2020 31 Dec 2019 30 Jun 2020

(unaudited) (unaudited) (audited)

GBP GBP GBP

Net (loss) / gain

on

financial assets

held

at fair value

through

profit or loss (954,021) (756,794) 201,252

Net (loss) / gain

on

financial

liabilities

held at fair

value through

profit or loss (13,370) 93,169 75,419

Impairment of

intangible

assets - - (33,333)

Finance costs (21,980) (37,189) (54,575)

Administration (319,297)

expenses (165,217) (200,460)

FX (loss) / gain (89,482) (53,036) 17,988

Share options 1,053

(expense)/credit (998) (1,500)

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Operating loss (1,245,068) (955,810) (111,493)

Loss before tax (1,245,068) (955,810) (111,493)

Tax - - -

Comprehensive

loss for

the period /

year (1,245,068) (955,810) (111,493)

================================================================================================================================== ==================================================================== ====================================================================

Basic loss per

share

(pence) (0.91) (1.01) (0.11)

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Diluted loss per

share

(pence) (0.91) (1.01) (0.11)

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

All results are derived from continuing operations.

The Company had no items of other comprehensive income during

the period / year.

CONDENSED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

31 Dec 2020 31 Dec 2019 30 Jun 2020

(unaudited) (unaudited) (audited)

GBP GBP GBP

ASSETS

Non-current

assets

Intangible

assets - 33,333 -

Financial

assets at

fair

value

through

profit or

loss 13,766,866 8,644,384 12,079,736

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

13,766,866 8,677,717 12,079,736

Current assets

Other -

receivables 1,106 1,109

Cash and 2,435,664

cash

equivalents 2,245,047 2,618,986

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

2,246,153 2,620,095 2,435,664

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

Total assets 16,013,019 11,297,812 14,515,400

================================================================================================================================== ================================================================================================================================== ===================================================================

LIABILITIES AND EQUITY

Non-current liabilities

Derivative

financial

instruments - 113,684 -

Borrowings - 362,651 -

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

- 476,335 -

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

Current liabilities

Trade and

other

payables 55,885 54,595 46,406

Derivative

financial

instruments 146,703 1,900 133,333

Borrowings 414,699 12,683 392,718

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

617,287 69,178 572,457

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

Total

liabilities 617,287 545,513 572,457

EQUITY

Share 13,955,623

capital 16,652,482 11,606,743

Share option 443,793

account 444,791 446,346

Retained (456,473)

earnings (1,701,541) (1,300,790)

---------------------------------------------------------------------------------------------------------------------------------- ---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------

Total equity 15,395,732 10,752,299 13,942,943

Total

liabilities

and equity 16,013,019 11,297,812 14,515,400

================================================================================================================================== ================================================================================================================================== ===================================================================

CONDENSED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 31 DECEMBER 2020

Share capital Share option Retained

account account earnings Total equity

GBP GBP GBP GBP

----------------------------- --------------- -------------- ------------- --------------

As at 1 July 2019 5,829,872 444,846 (344,980) 5,929,738

Comprehensive Income Loss

for the year ended 30

June 2020 - - (111,493) (111,493)

Share issue 8,125,751 - - 8,125,751

Transactions with owners

Share options credit - (1,053) - (1,053)

As at 30 June 2020 13,955,623 443,793 (456,473) 13,942,943

------------------------------ --------------- -------------- ------------- --------------

Comprehensive Income

Loss for the period ended

31 December 2020 - - (1,245,068) (1,245,068)

Share issue 2,696,859 - - 2,696,859

Transactions with owners

Share options expensed - 998 - 998

As at 31 December

2020 16,652,482 444,791 (1,701,541) 15,395,732

------------------------------ --------------- -------------- ------------- --------------

Share capital Share option Retained Total

account account earnings equity

GBP GBP GBP GBP

---------------------------- --------------- -------------- ------------- -----------

As at 1 July 2018 4,244,166 363,993 (2,358,395) 2,249,764

Comprehensive Income

Profit for the year ended

30 June 2019 - - 2,013,415 561,080

Share issue 1,585,706 - - 1,585,706

Transactions with owners

Share options

expensed - 80,853 - 80,853

As at 30 June

2019 5,829,872 444,846 (344,980) 5,929,738

----------------------------- --------------- -------------- ------------- -----------

CONDENSED STATEMENT OF CASH FLOWS

FOR THE PERIODED 31 DECEMBER 2020

Six months Six months

ended ended Year ended

31 Dec 31 Dec

2020 2019 30 Jun 2020

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash flows from operating

activities

Total comprehensive loss for

the period / year (1,245,068) (955,810) (111,493)

Adjustments for:

Net loss / (gain) on financial

assets at fair value through

profit or loss 954,021 756,794 (201,252)

Net loss / (gain) on financial

liabilities at fair value

through profit or loss 13,370 (93,169) (75,419)

Impairment of intangible assets - - 33,333

Interest on borrowings 21,980 37,189 54,575

Share options expense/(credit) 998 1,500 (1,053)

Movement in other receivables (1,106) 5,892 7,001

Movement in trade and other 984

payables 9,479 9,173

Purchase of investments (2,997,161) (2,655,381) (5,132,689)

Proceeds from sale of investments 356,011 - -

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Net cash out flow from operating

activities (2,887,476) (2,893,812) (5,426,013)

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Cash flows from financing

activities

Proceeds from issue of ordinary

shares 2,696,859 5,449,424 7,798,303

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Net cash generated from financing

activities 2,696,859 5,449,424 7,798,303

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Net (decrease) / increase

in cash and cash equivalents (190,617) 2,555,612 2,372,290

Cash and cash equivalents

at the beginning of the period

/ year 2,435,664 63,374 63,374

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

Cash and cash equivalents

at the end of the period /

year 2,245,047 2,618,986 2,435,664

---------------------------------------------------------------------------------------------------------------------------------- -------------------------------------------------------------------- --------------------------------------------------------------------

NOTES TO THE UNAUDITED CONDENSED FINANCIAL STATEMENTS

FOR THE PERIODED 31 DECEMBER 2020

1. Accounting Policies

Basis of accounting

The interim financial statements have been prepared in

accordance with the International Accounting

Standard ("IAS") 34, Interim Financial Reporting.

The interim financial statements do not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Company's

annual financial statements for the year ended 30 June 2020. The

annual financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS").

The same accounting policies and methods of computation are

followed in the interim financial statements as in the Company's

annual financial statements for the year ended 30 June 2020.

2. Investments

Six

months Year

Six months ended ended

ended 31 30

31 December December June

2020 2019 2020

(unaudited) (unaudited) (audited)

GBP GBP GBP

Argos Resources

Limited, at market

value 21,300 28,300 24,800

Cost, 1,000,000

shares 310,775 310,775 310,775

(31 December 2019:

1,000,000 shares,

30 June 2020:

1,000,000 shares)

Cataleya Energy

Corporation, at

market

value 4,149,230 4,281,697 4,590,523

Cost, 567,185

shares 4,518,215 4,518,215 4,518,215

(31 December 2019:

567,185, 30 June

2020: 567,185

shares)

Eco Atlantic Oil &

Gas Oil Limited,

at market value 348,000 799,500 359,250

Cost, 1,500,000

shares 240,000 240,000 240,000

(31 December 2019:

1,500,000 shares,

30 June 2020:

1,500,000 shares)

JHI Associates Inc,

at market value 9,245,741 2,577,471 6,353,344

Cost, 5,363,770

shares 7,355,249 2,009,210 4,358,088

31 December 2019:

2,213,770 shares,

30 June 2020:

3,563,770 shares)

Ratio Petroleum

Energy Limited

Partnership

shares, at market

value - 872,306 643,446

Cost, nil shares - 252,144 252,144

(31 December 2019:

1,200,000 shares,

30 June 2020:

1,200,000 shares)

Ratio Petroleum

Energy Limited

Partnership

warrants, at

market value 2,595 85,110 108,373

Cost, 89,653

warrants 48,200 81,060 209,489

(31 December 2019:

166,063, 30 June

2020: 389,653)

Total market value 13,766,866 8,644,384 12,079,736

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Total cost 12,472,439 7,411,404 9,888,711

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Total fair value

adjustment 1,294,427 1,232,980 2,191,025

Reverse prior year

fair value

adjustment (2,191,025) (1,989,774) (1,989,774)

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Current period fair

value movement (896,598) (756,794) 201,251

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Realised loss (57,423) - -

Unrealised (loss) /

gain (896,598) (756,794) 201,251

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

Current period

income statement

impact (954,021) (756,794) 201,251

------------------------------------------------------------------- ---------------------------------------------------------------- -------------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLDVDIAFIL

(END) Dow Jones Newswires

March 30, 2021 02:00 ET (06:00 GMT)

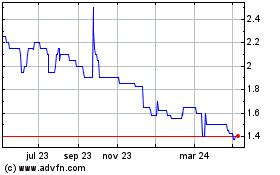

Westmount Energy (LSE:WTE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

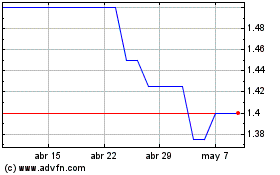

Westmount Energy (LSE:WTE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024