Experian Showcases Innovation Using Artificial Intelligence

12 Mayo 2021 - 3:32PM

Business Wire

Industry-leading digital decisioning technology

recognized globally

Experian’s best-in-class digital credit risk decisioning

solutions have garnered industry-wide recognition, winning two

recent awards focused on application excellence in artificial

intelligence. Experian prides itself on using data and new

technologies that solve real-world problems for businesses and

consumers. Experian Decision Analytics garners recognition with two

recent awards, the 2021 AI Excellence Award by Business

Intelligence Group and 2021 CIO 100 Awards.

“We are proud to be recognized by two prestigious institutions

for our work with artificial intelligence,” said Steven Wagner,

Global Managing Director, Experian Decision Analytics. “Experian

remains dedicated to using the latest in advanced analytics to help

businesses build and protect trusted relationships with

customers.”

Experian Decision Analytics was recognized as a winner of the

Artificial Intelligence Excellence Award program by Business

Intelligence Group for its credit and collections decisioning

solution, PowerCurve, which features intelligent agent-customer

assist that processes complex, regulated, and subjective

interactions with customers, revolutionizing how they digitally

interact, on their terms, with lenders. This AI virtual assistant

offers customers 24/7 access to support from their credit provider

– on a financially sensitive transaction such as collections or for

originations processes that require a superior customer experience.

This Business Intelligence Group awards program sets out to

recognize those organizations, products and people who bring

Artificial Intelligence (AI) to life and apply it to solve real

problems.

The CIO 100 Awards, presented by IDG’s CIO, the executive-level

IT media brand providing insight into business technology

leadership, recognized Atlas Credit, a midsized lender

headquartered in Texas, for their use of the Experian Ascend

Intelligence Platform. The platform enabled them to double loan

application acceptance rates while reducing credit losses by up to

20 percent. Atlas Credit uses the tools and data to make instant

decisions, resulting in improved customer satisfaction and higher

booking rates. Using Ascend Intelligence Services, Experian data

scientists rapidly built a machine learning (ML) custom credit risk

model, optimized a decision strategy, and deployed the model in

production, reducing time to impact by six months.

For more information on Experian Decision Analytics, visit

https://www.experian.com/blogs/global-insights/

About Experian

Experian is the world’s leading global information services

company. During life’s big moments — from buying a home or a car to

sending a child to college to growing a business by connecting with

new customers — we empower consumers and our clients to manage

their data with confidence. We help individuals to take financial

control and access financial services, businesses to make smarter

decisions and thrive, lenders to lend more responsibly, and

organizations to prevent identity fraud and crime.

We have 17,800 people operating across 45 countries, and every

day we’re investing in new technologies, talented people and

innovation to help all our clients maximize every opportunity. We

are listed on the London Stock Exchange (EXPN) and are a

constituent of the FTSE 100 Index.

Learn more at or visit our global content hub at our global news

blog for the latest news and insights from the Group.

Experian and the Experian trademarks used herein are trademarks

or registered trademarks of Experian and its affiliates. Other

product and company names mentioned herein are the property of

their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210512005926/en/

Kristie Galvani Rubenstein Public Relations 1 212 805 3005

kgalvani@rubensteinpr.com

Scott Anderson Experian Public Relations 1 714 830 3185

scott.n.anderson@experian.com

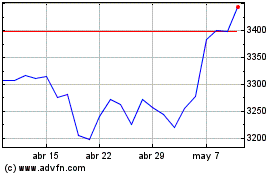

Experian (LSE:EXPN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Experian (LSE:EXPN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024