TIDMPET

RNS Number : 7752A

Petrel Resources PLC

04 June 2021

4(th) June 2021

Petrel Resources plc

("Petrel" or "the Company")

Preliminary Results for the Year Ended 31(st) December 2020

Petrel announces its results for the year ended 31(st) December

2020.

A copy of the Company's Annual Report and Accounts for 2020 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise shareholders will be notified that the Annual

Report will be available on the website at www.petrelresources.com

. Copies of the Annual Report will also be available for collection

from the Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

The Company's Annual General Meeting will be held on 27(th) July

2021 in the Hotel Riu Plaza The Gresham, 23 O'Connell Street Upper,

Dublin 1, D01 C3W7 at 10.00 am.

We are closely monitoring the Coronavirus (COVID-19) situation.

The Board takes its responsibility to safeguard the health of its

shareholders, stakeholders and employees very seriously and so

certain measures will be put in place for the AGM in response to

the COVID-19 pandemic. Details of these measures will be provided

in a letter that will be attached to the Notice of AGM.

E NDS

For further information please visit http://www.petrelresources.com/ or contact:

Enquiries:

Petrel Resources

John Teeling, Chairman +353 (0) 1 833 2833

David Horgan, Director

Nominated Adviser and Broker

Beaumont Cornish - Nominated Adviser

Roland Cornish

Felicity Geidt +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

Blytheweigh - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Madeleine Gordon-Foxwell +44 (0) 207 138 3208

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Ciara Wylie +353 (0) 1 661 4055

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). The person

who arranged for the release of this announcement on behalf of the

Company was Jim Finn, Director.

Statement Accompanying the Preliminary Results

It's very difficult to write a chairman's report fifteen months

into an effective world lockdown of exploration activities.

International travel has ceased, obtaining visas is difficult as

embassies are not staffed, attempts to gain meetings with

authorities are stymied as officials work remotely. Nevertheless

work goes on and deals are worked out over zoom calls.

The stalemate continues over the ownership of 32 million Petrel

shares. These shares are subject to a high court injunction on

their sale. Despite numerous and ongoing discussions with the

original buyers of the shares no progress has been made. The

original buyers, a French based group very experienced in

resources, are either unwilling or unable to clarify ownership and

to give the undertaking necessary to lift the injunction. The

company is committed to and actively involved in attempting to find

a solution. Proposals to date lack clarity on title and funding and

do not address the ownership of 32 million shares.

Petrel has ongoing interest in Iraq and Ghana. The Irish

offshore exploration ground was dropped in the face of an offshore

oil exploration ban on all new licences and in the event of a

discovery on existing licences, the likelihood of years of

opposition to any development. Ireland is now a no-go area for

native fossil fuel development, instead relying on imported oil,

gas and electricity. Within a few years our only indigenous gas

supplier, the Corrib feed will be depleted, so we will be 100%

dependent on supplies of gas from Russia, though UK

interconnectors, and electricity from France, most likely generated

by nuclear power.

Renewables are the future but they are years if not decades away

from being able to supply consistent, stable, cost effective power

to boil a kettle, drive a car or run a manufacturing operation.

Those of us active in the natural resources sector in Ireland have

failed to persuade politicians and the media of the inherent

dangers to supply. I hope I am wrong.

Meanwhile Petrel continues to push its interest in Iraq and

Ghana. For the foreseeable future oil will play a major part in

world economic development. Iraq has some of the best oil deposits

in the world. In a stable era Iraqi oil production would be 2 or 3

times the current under 4 million barrels a day. For more than 20

years Petrel has been in Iraq. Activities have languished in year

past but the addition of an Iraqi director, Riadh Mahomud Hameed

and the contact of French investors led to a re-opening of

contacts. It has been, and remains a difficult and dangerous place

to explore. Led by Riadh we are putting exploration proposals to

the authorities. We are particularly keen to revisit the Merjan

field where we earlier produced development proposals.

Ghana, where Petrel holds a 30% interest (Clontarf 60%, local

interest 10%) in offshore block Tano 2A continues to frustrate.

Covid has played a significant role in recent delays. Meetings

expected to take place in Europe in spring 2020 were cancelled and

have not yet been reinstated. This 12 year saga shows no sign of

being finalised.

Future

While we continue to engage with the French group and respect

and admire their experience and contacts, we have to move on. Our

focus in the immediate future will be Iraq.

At the same time we will open discussions with groups in other

jurisdictions who might see Petrel as a way to monetise their oil

and gas assets.

John Teeling

Chairman

3rd June 2021

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE FINANCIAL YEARED 31 DECEMBER 2020

2020 2019

EUR EUR

Administrative expenses (399,133) (345,508)

Impairment of exploration and evaluation assets (51,552) (1,613,591)

OPERATING LOSS (450,685) (1,959,099)

LOSS BEFORE TAXATION (450,685) (1,959,099)

Income tax expense - -

LOSS FOR THE FINANCIAL YEAR: all attributable

to equity holders of the parent (450,685) (1,959,099)

Other comprehensive income - -

Items that are or may be reclassified

subsequently to profit or loss - -

Exchange differences - (119,048)

TOTAL COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR (450,685) (2,078,147)

Loss per share - basic and diluted (0.29c) (1.50c)

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2020

2020 2019

EUR EUR

Assets

Non-Current Assets

Intangible assets 931,967 983,969

931,967 983,969

Current Assets

Trade and other receivables 34,994 38,036

Cash and cash equivalents 333,900 367,777

368,894 405,813

Current Liabilities

Trade and other payables (710,541) (629,885)

Net Current Liabilities (341,647) (224,072)

NET ASSETS 590,320 759,897

Equity

Called-up share capital 1,962,981 1,866,827

Capital conversion reserve fund 7,694 7,694

Capital redemption reserve 209,342 209,342

Share premium 21,786,011 21,601,057

Share based payment reserve 26,871 26,871

Translation reserve - 376,154

Retained deficit (23,402,579) (23,328,048)

TOTAL EQUITY 590,320 759,897

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEARED 31 DECEMBER 2020

Capital Capital Share

Redemption Conversion Based

Share Share Reserve Reserve Payment Translation Retained

Capital Premium fund Reserve Reserve Deficit Total

EUR EUR EUR EUR EUR EUR EUR EUR

At 31 December

2018 1,306,966 21,601,057 209,342 7,694 26,871 495,202 (21,368,949) 2,278,183

Shares

issued 559,861 - - - - - - 559,861

Total comprehensive

income

for the

financial

year - - - - - (119,048) (1,959,099) (2,078,147)

--------- ---------- ----------- ----------- -------- ----------- ------------ -----------

At 31 December

2019 1,866,827 21,601,057 209,342 7,694 26,871 376,154 (23,328,048) 759,897

--------- ---------- ----------- ----------- -------- ----------- ------------ -----------

Shares

issued 96,154 184,954 - - - - - 281,108

Total comprehensive

income

for the

financial

year - - - - - - (450,685) (450,685)

Transfer

of reserves (376,154) 376.154 -

--------- ---------- ----------- ----------- -------- ----------- ------------ -----------

At 31 December

2020 1,962,981 21,786,011 209,342 7,694 26,871 - (23,402,579) 590,320

========= ========== =========== =========== ======== =========== ============ ===========

Share premium

Share premium reserve comprises of a premium arising on the

issue of shares. Share issue expenses are expensed through the

statement of comprehensive income when incurred.

Capital redemption reserve

On 25 July 2018 the shareholders approved the buy back and

cancellation of 16,747,368 shares for nominal consideration from

Amira Petroleum N.V., Amira International Holdings Limited and

their advisors. These shares were immediately cancelled upon their

repurchase and the nominal value of these shares were transferred

into the capital redemption reserve.

Capital conversion reserve fund

The ordinary shares of the company were renominalised from

EUR0.0126774 each to EUR0.0125 each in 2001 and the amount by which

the issued share capital of the company was reduced was transferred

to the capital conversion reserve fund.

Share based payment reserve

The share based payment reserve arises on the grant of share

options under the share option plan.

Translation Reserve

The translation reserve arises from the translation of foreign

operations. A transfer from the translation reserve to retained

deficit occurred during the year as a result of the impairment of

the related intangible assets.

Retained deficit

Retained deficit comprises of losses incurred in the current and

prior years.

PETREL RESOURCES PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE FINANCIAL YEARED 31 DECEMBER 2020

2020 2019

EUR EUR

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the financial year (450,685) (1,959,099)

Impairment charge 51,552 1,613,591

Foreign exchange 4,623 -

OPERATING CASHFLOW BEFORE

MOVEMENTS IN WORKING CAPITAL (394,510) (345,508)

Movements in working capital:

Increase/(Decrease) in trade and other payables 80,656 (47,730)

Decrease in trade and other receivables 3,042 19,980

CASH USED IN OPERATIONS (310,812) (373,258)

NET CASH USED IN OPERATING ACTIVITIES (310,812) (373,258)

INVESTING ACTIVITIES

Receipts/(Payments) for exploration and evaluation assets 450 (150,870)

NET CASH USED IN INVESTING ACTIVITIES 450 (150,870)

FINANCING ACTIVITIES

Shares issued 281,108 559,861

NET CASH GENERATED FROM FINANCING ACTIVITIES 281,108 559,861

NET (DECREASE)/INCREASE IN CASH AND CASH EQUIVALENTS (29,254) 35,733

Cash and cash equivalents at beginning of financial year 367,777 329,503

Effect of exchange rate changes on cash held in

foreign currencies (4,623) 2,541

Cash and cash equivalents at end of financial year 333,900 367,777

NOTES:

1. ACCOUNTING POLICIES

There were no changes in accounting policies from those used to

prepare the Group's Annual Report for financial year ended 31

December 2019. The financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union.

2. LOSS PER SHARE

2020 2019

EUR EUR

Loss per share - basic and diluted (0.29c) (1.50c)

Basic loss per share

The earnings and weighted average number of ordinary shares used

in the calculation of basic loss per share are as follows:

2020 2019

EUR EUR

Loss for the financial year attributable to

equity holders (450,685) (1,959,099)

2020 2019

Number Number

Weighted average number of ordinary shares

for the

purpose of basic earnings per share 153,961,544 130,647,568

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

3. GOING CONCERN

The Group incurred a loss for the financial year of EUR450,685

(2019: loss of EUR1,959,099) and had net current liabilities of

EUR341,647 (2019: EUR224,072) and a retained earnings deficit of

EUR23,402,579 (2019 deficit of EUR23,328,048) at the balance sheet

date. These conditions as well as those noted below, represent a

material uncertainty that may cast significant doubt on the Group

and Company's ability to continue as a going concern.

Included in current liabilities is an amount of EUR677,531

(2019: EUR587,531) owed to key management personnel in respect of

remuneration due at the balance sheet date. Key management have

confirmed that they will not seek settlement of these amounts in

cash for a period of at least one year after the date of approval

of the financial statements or until the Group has generated

sufficient funds from its operations after paying its third party

creditors.

The Group and Company had a cash balance of EUR333,900 (2019:

EUR367,777) at the balance sheet date. The directors have prepared

cashflow projections for a period of at least twelve months from

the date of approval of these financial statements which indicate

that additional finance may be required to fund working capital

requirements and develop existing projects. The cashflow

projections include any anticipated impacts of the Covid-19

pandemic on the Group and Company. As the Group is not revenue or

cash generating it relies on raising capital from the public

market. The Group completed capital raisings during the year.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include the adjustments that would

result if the Group and Company were unable to continue as a going

concern.

4. INTANGIBLE ASSETS

Exploration and evaluation assets: 2020 2019

EUR EUR

Cost:

Opening balance 983,969 2,523,279

Additions - 195,870

Disposals (450) -

Exchange translation adjustment - (121,589)

Impairment (51,552) (1,613,591)

Closing balance 931,967 983,969

Segmental Analysis 2020 2019

EUR EUR

Ghana 931,967 931,967

Ireland - 52,002

Iraq - -

931,967 983,969

Exploration and evaluation assets relate to expenditure incurred

in exploration in Ireland and Ghana. The directors are aware that

by its nature there is an inherent uncertainty in Exploration and

evaluation assets and therefore inherent uncertainty in relation to

the carrying value of capitalized exploration and evaluation

assets.

Due to legislative uncertainty since 2017, exacerbated by the

Taoiseach's public statements in September 2019 against the issue

of new Atlantic oil exploration licenses, Petrel has discontinued

farm-out discussions with a gas super-major. Also, the board

reluctantly dropped our 100% owned and operated Frontier

Exploration License (FEL) 3/14, despite multiple identified

targets. Similarly, the board decided not to apply to convert our

prospective Licensing Option (LO) 16/24 into a Frontier Exploration

License. Accordingly, the directors have impaired in full all

expenditure relating to the above mentioned licenses, resulting in

an impairment charge of EUR51,552 in the current year and

EUR1,613,591 in the prior year.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanian government.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

-- Licence obligations;

-- Funding requirements;

-- Political and legal risks, including title to licence, profit sharing and taxation;

-- Exchange note risk;

-- Political risk;

-- Financial risk management; and

-- Geological and development risks.

Directors' remuneration of EURNil (2019: EUR30,000) and salaries

of EURNil (2019: EUR15,000) were capitalised as exploration and

evaluation expenditure during the financial year.

5. SHARE CAPITAL

2020 2019

EUR EUR

Authorised:

800,000,000 ordinary shares of EUR0.0125 10,000,000 10,000,000

Allotted, called-up and fully

paid:

Number Share Share

Capital Premium

EUR EUR

At 1 January 2019 104,557,246 1,306,966 21,601,057

Issued during the financial

year 44,788,913 559,861 -

At 31 December 2019 149,346,159 1,866,827 21,601,057

At 1 January 2020 149,346,159 1,866,827 21,601,057

Issued during the financial

year 7,692,308 96,154 184,954

At 31 December 2020 157,038,467 1,962,981 21,786,011

Movements in share capital

On 30 July 2019 a total of 44,788,913 shares were placed at a

price of 1.25 cents per share. Proceeds were used to provide

additional working capital and fund development costs.

On 26 May 2020 a total of 7,692,308 shares were placed at a

price of 3.25 pence per share. Proceeds were used to provide

additional working capital and fund development costs.

6. POST BALANCE SHEET EVENTS

There were no material post balance sheet events affecting the

Company or Group.

7. ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held on 27(th) July

2021 in the Hotel Riu Plaza The Gresham, 23 O'Connell Street Upper,

Dublin 1, D01 C3W7 at 10.00 am.

8. GENERAL INFORMATION

The financial information set out above does not constitute the

Company's financial statements for the year ended 31 December 2020.

The financial information for 2019 is derived from the financial

statements for 2019 which have been delivered to the Companies

Registration Office. The auditors have reported on 2019 statements;

their report was unqualified with an emphasis of matter in respect

of considering the adequacy of the disclosures made in the

financial statements concerning the valuation of intangible assets,

investment in subsidiaries and amounts due by group undertakings.

The financial statements for 2020 will be delivered to the

Companies Registration Office.

A copy of the Company's Annual Report and Accounts for 2020 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise shareholders will be notified that the Annual

Report will be available on the website at www.petrelresources.com

. Copies of the Annual Report will also be available for collection

from the Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EADKDESPFEFA

(END) Dow Jones Newswires

June 04, 2021 02:00 ET (06:00 GMT)

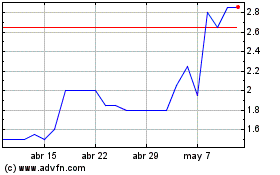

Petrel Resources (LSE:PET)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Petrel Resources (LSE:PET)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024