Activist Investor Cevian Capital Now Holds 4.95% Stake in Aviva -- Update

08 Junio 2021 - 5:14AM

Noticias Dow Jones

--Investment firm Cevian Capital now owns 4.95% of Aviva's total

issued share capital

--Shareholders should receive around GBP5 billion of excess

capital from Aviva, Cevian Capital said

--Aviva could achieve savings of at least GBP500 million in

costs, the activist investor said

By Ian Walker, Sabela Ojea

Activist investor Cevian Capital Partners Ltd. on Tuesday said

that it now owns 4.95% of Aviva PLC's issued share capital, and

that the London-listed insurance company should be able to return

around five billion pounds ($7.09 billion) of excess capital to

shareholders next year.

Cevian Capital, which describes itself as a "long-term, hands-on

owner of European listed companies," said it sees the potential for

Aviva to save at least GBP500 million in costs by 2023.

AvivaSA in Turkey

"Aviva now has the potential to become a focused and

well-capitalized market leader that produces profitable growth,

generates significant cash, and is highly appreciated in the equity

markets," said Christer Gardell, managing partner and co-founder of

Cevian Capital.

Aviva shares at 0950 GMT were up 14.50 pence, or 3.5%, at 425.20

pence.

Write to Ian Walker at ian.walker@wsj.com, Sabela Ojea at

sabela.ojea@wsj.com

(END) Dow Jones Newswires

June 08, 2021 06:08 ET (10:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

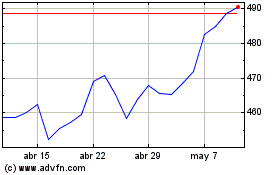

Aviva (LSE:AV.)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

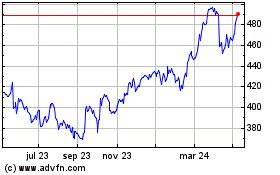

Aviva (LSE:AV.)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024