TIDMWYN

RNS Number : 5422D

Wynnstay Group PLC

30 June 2021

30 June 2021

AIM: WYN

Wynnstay Group Plc

("Wynnstay" or the "Group" or the "Company")

Interim Results for the Six Months ended 30 April 2021

Record pre-tax profit as sector confidence returns

KEY POINTS

Financial

-- Record underlying and reported pre-tax profit* results as sector

confidence returns, helped by:

- stronger farmgate prices, greater clarity with the completion

of EU settlement and enactment of UK Agriculture Bill

- balanced business model supplying products to both livestock

and arable farmers

-- Revenue up 9% to GBP249.71m (2020: GBP229.29m), with commodity

price inflation accounting for c.65% of the rise and a combined

first-time contribution of GBP5.5m from two bolt-on acquisitions

-- Underlying pre-tax profit*up 23% to GBP5.53m (2020: GBP4.51m)/

Reported PBT up 25% to GBP5.36m (2020: GBP4.30m)

-- Basic earnings per share, including non-recurring items up

24% to 21.62p (2020: 17.50p)

-- Net cash at 30 April 2021 increased to GBP4.01m on a pre-IFRS

16 basis (excl. leases) (30 April 2020: GBP1.28m) even after

commodity inflation and period of peak working capital utilisation

-- Net assets up to GBP101.05m/GBP5.04 per share at period end

(30 April 2020: GBP96.84m/GBP4.87 per share)

-- Interim dividend up 8.7% to 5.00p (2020: 4.60p)

Operational

-- Agriculture Division - revenue of GBP180.72m (2020: GBP166.41m),

operating profit before non-recurring items up 21% to GBP2.20m

(2020: GBP1.81m)

- feed activity performed very well - manufactured volumes

recovered strongly, buoyed by more normal winter weather

pattern and improved farmgate prices

- weaker performance from arable operations, as expected

- with last year's exceptionally poor planting season and

poor harvest, impacting grain trading and seed sales in

line with national trend

- Glasson activity performed well

-- Specialist Agricultural Merchanting Division - revenue of GBP68.88m

(2020: GBP62.83m), operating profit before non-recurring items

up 13% to GBP3.40m (2020: GBP3.02m)

- strong demand for bagged feed

- recovery in hardware sales as farmers returned to investing

in their businesses

-- Commercial Sales & Marketing Director to join in July - completing

the reorganisation of the senior management structure, and

ESG Manager appointed

-- Two strategic bolt-on acquisitions completed - extending footprint

in the eastern side of England

-- Board appointments - Steve Ellwood became Chairman from March

2021 and Catherine Bradshaw is to join as a non-executive director

on 1 July

Outlook

-- Strong trading conditions support a good outturn in H2, with

farmgate prices firm and 2021 harvest on track to revert to

more normal yield and tonnage

-- The Board remains very confident about the Group's longer term

prospects, supported by strong financial position and growth

initiatives in place

* Underlying pre-tax profit is a non-GAAP (generally accepted

accounting principles) measure and is not intended as a substitute

for GAAP measures and may not be calculated in the same way as

those used by other companies. Refer to Note 14 for an explanation

on how this measure has been calculated and the reasons for its

use.

Gareth Davies, Chief Executive of Wynnstay Group plc,

commented:

"These record interim results reflect strong recovery in farmer

confidence, driven by higher farmgate prices, and clarity provided

by the EU settlement and the landmark Agriculture Act. They also

demonstrate the benefits of the Group's broad spread of activities,

supplying both livestock and arable farmers.

"We made good strategic progress, extending our reach in the

eastern side of England with two bolt-on acquisitions, completing a

major hire for our reorganised senior management team, and creating

a dedicated role in support of the Group's ESG strategy.

"Prospects for the second half of the financial year are very

encouraging, with farmgate prices firm and a good harvest expected.

We will continue to invest in the business to increase the Group's

manufacturing capacity and improve production efficiencies, and

will look for further complementary acquisitions. With our strong

balance sheet and good cash flows, we view the future with

confidence."

Enquiries:

Wynnstay Group Plc Gareth Davies, Chief T: 020 3178 6378 (today)

Executive T: 01691 827 142

Paul Roberts, Finance

Director

KTZ Communications Katie Tzouliadis / Dan T: 020 3178 6378

Mahoney

Shore Capital (Nomad Stephane Auton / Patrick T: 020 7408 4090

and Broker) Castle / John More

CHAIRMAN'S STATEMENT

INTRODUCTION

This is my first interim result statement since becoming

Chairman in March 2021, and I am delighted to report record interim

pre-tax profit. The Group generated underlying pre-tax profit of

GBP5.53m[1] (2020: GBP4.51m), a 23% increase year-on-year, on

revenues of GBP249.71m (2020: GBP229.29m), up 9%. Reported pre-tax

profit increased 25% to GBP5.36m (2020: GBP4.30m).

Three factors helped to deliver this excellent result, improved

farmgate prices, the EU settlement, and the UK Agricultural Bill,

all of which have played a major part in removing uncertainty and

improving farmer sentiment.

These results also demonstrate the resilient nature of our

balanced business model and the benefits of recent growth and

efficiency initiatives. The breadth of the Group's activities,

supplying products into both livestock and arable farming

enterprises, and the natural hedging this establishes provides

significant advantages. In addition, over the last 12 months years,

we have been focusing on increasing our exposure to those

activities where demand is typically more consistent

year-on-year.

The health, safety and welfare of our colleagues, customers and

communities remained priorities in the face of the ongoing

coronavirus crisis. It is greatly encouraging that, in recent

months, there has been some easing of government-imposed

restrictions and I am extremely grateful to every member of our

team for their efforts to ensure the continuity of our business. It

has meant that our farmer customers have continued to be fully

serviced throughout this still difficult period.

We made two strategic bolt-on acquisitions in the period in line

with our growth strategy. They have expanded our footprint in the

eastern side of the UK, and were of the agricultural division of

the Armstrong Richardson Group, which supplies inputs to farmers in

the North East of England, and the fertiliser manufacturing

business and assets of HELM Great Britain Limited, which serves

South Yorkshire and the surrounding area. Both bring new customers

to the Group and staff with significant experience and local

knowledge. I am pleased to welcome the teams, and to report that

both acquisitions are integrating well.

In March 2021, we appointed Paul Jackson as Commercial Sales and

Marketing Director, which marked the completion of the new

management structure put in place at the end of the last financial

year. Paul will take up his position on 5 July 2021, and this new

structure allows for enhanced Group effectiveness, and supports our

future growth and investment plans for the business.

As we emerge from a period of a significant level of general

economic uncertainty, we are confident that Wynnstay is well

positioned in a sector that is emerging from a prolonged period of

inertia created by Brexit uncertainties. We expect to make good

progress with our investment plans and growth initiatives in the

second half of the financial year.

FINANCIAL RESULTS

Revenue for the six months to 30 April 2021 increased by 8.9% on

the same period last year to GBP249.71m (2020: GBP229.29m). We

estimate that commodity price inflation accounted for nearly 65%

(c. GBP13.3m) of the overall increase, with the combined

contribution from the two acquisitions completed in February and

March contributing GBP5.5m. The contribution to Group revenue from

the Agriculture Division increased by 8.6% to GBP180.72m (2020:

GBP166.41m) and from the Specialist Agricultural Merchanting

Division by 9.6% to GBP68.88m (2020: GBP62.83m). Other activity

contributed revenue of GBP0.11m (2020: GBP0.05m).

Adjusted operating profit rose by 19% to GBP5.68m (2020:

GBP4.78m before non-recurring costs, share-based payments and

intangible amortisation). The Agricultural Division contributed

operating profit of GBP2.20m (2020: GBP1.81m), up by 22% on last

year, with this result reflecting improved manufactured feed

volumes and incomes but lower contributions from the arable product

categories following the exceptionally poor harvest last year. The

Specialist Agricultural Merchanting division contributed operating

profit of GBP3.40m (2020: GBP3.02m), up by 13%, reflecting a

continuation of the improving trading conditions evident from the

end of the previous financial year. Other activities incurred an

operating loss of GBP0.12m (2020: loss of GBP0.09m). In line with

prior years, the contribution from our Joint Ventures will be

consolidated in the second half of our full year results.

There have been no non-recurring costs charged in the period

(2019: GBP0.18m) [2] , and net finance costs including IFRS 16

charges were GBP0.11m (2020: GBP0.26m), with this reflecting the

improved average cash position. Share-based payment expenses for

the period increased to GBP0.16m (2020: 0.03m), as a result of the

launch of a successful all employee Save As You Earn option scheme

in the second half of last year.

Reported profit before tax was higher at GBP5.36m (2020:

GBP4.30m). While the effective tax rate for the period at 19.1%

(2020:19.0%) was slightly higher, resulting in a charge of GBP1.03m

(2020: GBP0.82m), it is lower than the 2020 full year effective tax

rate of 20.7% as a result of the Government's 130% Super-deduction

capital allowance on qualifying investment. Profit after tax

increased by 25% to GBP4.34m (2020: GBP3.48m) and basic earnings

per share increased by 24% to 21.62p (2020: 17.50p).

Net assets now exceed GBP100m, and at 30 April 2021 stood 4%

higher year-on-year at GBP101.05m (2020: GBP96.84m). This equates

to GBP5.04 per share (2020: GBP4.87 per share), based on the

weighted average number of shares in issue during the period at

20.06m (2019: 19.90m).

Net cash on a pre IFRS 16 basis (excluding leases) increased

significantly to GBP4.01m (2020: GBP1.28m), despite the commodity

inflation experienced and the Group's cash requirements peaking

during the spring months, particularly in April. Total lease

liabilities amounted to GBP8.86m (2020: GBP10.24m). Strong cash

generation from trading and tight working capital control remain

priorities, and continue to provide a secure underpinning to the

Group's growth plans.

DIVID

The Board is pleased to declare an increased interim dividend of

5.00p per share (2020: 4.60p), up by 8.7% on the equivalent payment

last year. The increased payment reflects the Directors continuing

confidence in prospects for the business and the strong

results.

The interim dividend will be paid on 29 October 2021 to

shareholders on the register at the close of business on 1 October

2021. As in previous years, the Scrip Dividend alternative will

continue to be available, with the last day for election for this

scheme being 15 October 2021.

REVIEW OF OPERATIONS

AGRICULTURE DIVISION

The improving sector sentiment experienced towards the end of

the last financial year continued into the new year. It was

supported by continuing strong farmgate prices for most commodities

and the removal of some of the political uncertainty with the

completion of the Brexit negotiations and clarity evolving over the

details of the future support provisions contained in the new

Agriculture Act.

Feed Products

Manufactured feed volumes recovered strongly, up by 8.5% over

the equivalent period last year, helped by the improvement in

background trading conditions and a more normalised winter weather

pattern. We continued to make progress in the free-range egg feed

market and have further increased customer numbers and tonnage

sold.

Rising commodity prices remain a challenge and careful raw

materials management is required across our manufacturing and

trading operations where margins are likely to come under pressure

as prices continue to rise. Efficiencies in production are

therefore essential. Our substantial three year investment

programme currently under way at our Carmarthen mill will generate

significant benefits, materially increasing our manufacturing

capacity and improving manufacturing throughput.

Arable Products

The weaker performance from our arable operations was expected,

with the anticipated consequences of the poor harvest of 2020 and

the carry-over of autumn seed from 2019, coming through in the

period.

Grainlink, our grain marketing business, experienced a

like-for-like 26% reduction in volumes available to trade. This was

in line with the latest estimates of the overall reduction in UK

wheat and barley production in 2020. However, margins improved and

the positive contribution from the acquisition of the agricultural

division of the Armstrong Richardson Group in February minimised

the financial impact of the contraction in volumes.

Autumn seed plantings by farmers were significantly higher than

the previous year, when many were unable to sow winter cereal seed

due to the prolonged heavy rain. This bodes well for the

forthcoming harvest where a return to more normal volumes is

expected. Reflecting the good autumn planting season, spring cereal

seed sales were lower.

Grass seed sales have been delayed following the dry April

period and then excessive rain in May, but our strong market

presence in this sector will enable us to capitalise once demand

picks up in the later summer period. Demand for fertiliser was more

subdued, reflecting a combination of higher prices and the adverse

spring conditions restricting grass growth.

Glasson Grain

Glasson Grain operates in three main areas, feed raw materials,

fertiliser production and the manufacture of specialist animal feed

products. The business performed strongly overall. Both the feed

raw material and fertiliser activities delivered increased volumes.

Specialist animal feed volumes experienced a reduction in tonnage

as certain categories such as game bird and equine continued to be

impacted by coronavirus- related restrictions. The fertiliser

business was enlarged with the purchase in March 2021 of the HELM

Great Britain Limited processing plant in South Yorkshire. The

acquisition has exceeded its forecast contribution in the first two

months of operation and has added new customers to the Group, which

should benefit other areas of the Group.

SPECIALIST AGRICULTURAL MERCHANTING DIVISION

Specialist Agricultural Merchanting and Youngs Animal Feeds

The Group's chain of 54 depots cater for the needs of farmers

and other rural dwellers and operates very closely with our

Agricultural Division, providing a strong channel to market for our

products.

Total sales increased 10% in the period although sales in the

prior year were affected by the initial introduction of

coronavirus-related trading protocols. Strong demand for our

manufactured bagged feed in the depots was one of the main drivers

of increased revenue and contribution in the period, together with

hardware sales as farmers returned to investing in their businesses

as confidence improved.

During the period, we initiated a major customer research

project, which reviewed depot customer trading preferences and

current habits. This was a major exercise and we were encouraged by

the results, which underlined the valuable role Wynnstay plays

within our rural communities. We will be using the results of our

research to refine the decisions we make, including future

investment in our channels to market and the ongoing roll-out of

our digital trading portal.

Our specialist equine feeds business increased its operating

contribution to Group results following the consolidation of its

activities into three locations at the end of the last financial

year. The re-launch of the Company's manufactured own fibre feed

range under the 'Sweet Meadow' brand has also boosted volumes and

contributed to the improved performance.

JOINT VENTURES AND ASSOCIATES

Results from the Group's joint ventures and associate companies

are not included in this half year report, and in accordance with

established accounting policies will be consolidated into

Wynnstay's full year results.

Environmental, Social and Governance ("ESG")

In February 2021, we created a new management position with

specific responsibility for leading the ongoing development and

implementation of the Group's ESG strategy. We were pleased to

appoint Lewis Davies to the position, and he is working with the

senior management team to ensure our policies and objectives are

effectively embedded across all areas of the Group's operations. He

is also working with the Company's peers to promote increased

sustainability throughout UK agriculture, including as a member of

the sustainability committee of the agrisupply industry's leading

trade association, the Agricultural Industries Confederation

(AIC).

A key pillar in the Group's growth strategy is supporting

customers with the advice, products, and services that are

necessary to adapt to the new environmental and efficiency

priorities set in the UK Agriculture Act. Our own focus on

sustainability will strengthen our ability to support customers'

environmental aims.

The Wynnstay Board is committed to the highest standards of

appropriate corporate and commercial governance to support the

delivery of long term shareholder value and produce positive

outcomes for other stakeholder groups including colleagues,

customers and suppliers.

BOARD CHANGES

Jim McCarthy stepped down as Chairman in March 2021 ahead of his

forthcoming retirement from the Board in July. On behalf of

everyone at Wynnstay, I would like to thank him for his tremendous

service to the Group over 10 years, the last eight as Chairman. His

insights and counsel have contributed significantly to Wynnstay's

development, and we wish him well for the future.

In June 2021, we were very pleased to announce the appointment

of Catherine Bradshaw as an independent Non-executive Director,

which takes effect on 1 July 2021. A qualified chartered

accountant, Catherine has over 20 years' experience in financial

and general management roles, primarily in the food industry. She

is Group Financial Controller of Greencore Group plc, a leading

manufacturer of convenience food in the UK, having joined the FTSE

250 listed business in 2015. Prior to this, she worked in senior

financial positions at Wm Morrison Supermarkets plc, the

supermarket group, and Northern Foods plc, the food manufacturer.

On appointment, Catherine will also assume the role of Chairman of

the Audit and Risk Committee. We welcome Catherine to the Board and

look forward to working with her.

OUTLOOK

Sentiment in the UK agricultural sector has greatly improved and

trading conditions are very encouraging. Farmgate prices remain

strong, immediate Brexit concerns appear behind us, although the

potential for some trade disruptions still exist, and the

coronavirus crisis has been considerably ameliorated with the onset

of vaccination programmes. The Environmental Land Management

Schemes ("ELMS"), published in March by the UK Government, has

provided a framework for our farmer customers to properly plan for

their businesses well into the medium term. We therefore anticipate

sustainable incomes for most farmers in the near term, and that

on-farm investment will be boosted.

Looking at growth prospects for the Group, we are confident that

the business is well-positioned to make progress in this

market-place. Our results for the period have once again

demonstrated the advantages of our balanced business model, which

provides a hedge that helps to smooth sector variations. Our strong

balance sheet and cash flows also provide a robust platform to

support our growth plans, and we will be continuing with our

investment programmes to increase manufacturing capacity and

improve efficiencies. We will also actively review appropriate

acquisition opportunities in line with our growth strategy.

With the UK harvest on track to return to more normal yields and

tonnage and trading conditions strong, we view prospects for the

second half of the financial year very positively.

Steve Ellwood

Chairman

[1] Note 6. Explanation of Non GAAP measure.

(2) Note 7

WYNNSTAY GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 April 2021

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 April 30 April 31 October

2021 2020 2020

Note GBP'000 GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue 249,709 229,288 431,398

Cost of sales (216,413) (197,781) (370,630)

------------ ------------ ------------

Gross profit 33,296 31,507 60,768

Manufacturing, distribution

and selling costs (24,202) (23,333) (46,033)

Administrative expenses (3,604) (3,561) (6,945)

Other operating income 5 185 168 351

------------------------------------- ----- ------------ ------------ ------------

Adjusted operating profit3 6 5,675 4,781 8,141

Amortisation of acquired intangible

assets and share -based payment

expense 7 (197) (44) (132)

Non-recurring items 7 - (185) (1,194)

------------------------------------- ----- ------------ ------------ ------------

Group operating profit 5,478 4,552 6,815

Interest income 51 55 164

Interest expense (165) (310) (436)

Share of profits in joint ventures

and associate accounted for

using the equity method 2 - - 538

Share of tax incurred in by

joint venture and associate - - (100)

Profit before taxation 5,364 4,297 6,981

Taxation 8 (1,027) (817) (1,448)

Profit for the period and other

comprehensive income attributable

to the equity holders 4,337 3,480 5,533

============ ============ ============

Basic earnings per ordinary

share (pence) 21.62 17.50 27.73

Diluted earnings per ordinary

share (pence) 21.30 17.43 27.57

3 Adjusted operating profit is after adding back amortisation of

acquired intangible assets, share-based payment expense and

non-recurring items.

CONDENSED CONSOLIDATED BALANCE SHEET

For the six months ended 30 April 2021

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 April 30 April 31 October

2021 2020 2020

Note GBP'000 GBP'000 GBP'000

------------------------------------ ----- ------------ -------------------- -------------------------

ASSETS

NON-CURRENT ASSETS

Goodwill 14,417 14,968 14,367

Investment property 2,372 2,372 2,372

Property, plant and equipment 17,654 17,964 17,545

Right-of-use asset 10 10,153 11,264 11,240

Investments accounted for

using the equity method 3,613 3,175 3,611

Intangibles 327 243 225

------------------------------------ ----- ------------ -------------------- -------------------------

48,536 49,986 49,360

------------------------------------ ----- ------------ -------------------- -------------------------

CURRENT ASSETS

Inventories 44,221 42,002 34,190

Trade and other receivables 75,407 75,501 55,850

Financial assets - loans

to joint ventures 3,865 4,929 3,889

Cash and cash equivalents 11 4,991 3,452 19,980

128,484 125,884 113,909

------------------------------------ ----- ------------ -------------------- -------------------------

TOTAL ASSETS 177,020 175,870 163,269

LIABILITIES

CURRENT LIABILITIES

Financial liabilities - borrowings (979) (1,860) (1,572)

Lease Liabilities (3,173) (3,539) (3,483)

Trade and other payables (64,551) (65,202) (52,326)

Current tax liabilities (1,019) (991) (784)

(69,722) (71,592) (58,165)

------------------------------------ ----- ------------ -------------------- -------------------------

NET CURRENT ASSETS 58,762 54,292 55,744

------------------------------------ ----- ------------ -------------------- -------------------------

NON-CURRENT LIABILITIES

Financial liabilities - borrowings - (313) (313) -

Lease liabilities (5,687) (6,701) (6,509)

Trade and other payables (87) (199) (141)

Deferred tax liabilities (474) (228) (276)

(6,248) (7,441) (6,926)

------------------------------------ ----- ------------ -------------------- -------------------------

TOTAL LIABILITIES (75,970) (79,033) (65,091)

------------------------------------ ----- ------------ -------------------- -------------------------

NET ASSETS 101,050 96,837 98,178

------------------------------------ ----- ------------ -------------------- -------------------------

EQUITY

Share capital 14 5,034 5,002 5,013

Share premium 30,998 30,509 30,637

Other reserves 3,686 3,455 3,525

Retained earnings 61,332 57,871 59,003

TOTAL EQUITY 101,050 96,837 98,178

------------------------------------ ----- ------------ -------------------- -------------------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

For the six months ended 30 April 2021

Share Share Other Retained Total

Capital Premium Reserves Earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 November 2019 4,974 30,284 3,429 56,261 94,948

Profit for the period - - - 3,480 3,480

------------------------------ --------- --------- --------------- ----------- ----------

Total comprehensive income

for the period - - - 3,480 3,480

------------------------------ --------- --------- --------------- ----------- ----------

Transactions with owners

of the Company, recognised

directly in equity

Shares issued during the

period 28 225 - - 253

Dividends - - - (1,870) (1,870)

Equity settled share-based

payment transactions - - 26 - 26

------------------------------ --------- --------- --------------- ----------- ----------

Total contributions by and

distributions to owners

of the Group 28 225 26 (1,870) (1,591)

------------------------------ --------- --------- --------------- ----------- ----------

At 30 April 2020 5,002 30,509 3,455 57,871 96,837

------------------------------ --------- --------- --------------- ----------- ----------

Profit for the period - - - 2,053 2,053

------------------------------ --------- --------- --------------- ----------- ----------

Total comprehensive income

for the period - - - 2,053 2,053

------------------------------ --------- --------- --------------- ----------- ----------

Transactions with owners

of the Company, recognised

directly in equity

Shares issued during the

period 11 128 - - 139

Dividends - - - (921) (921)

Equity settled share-based

payment transactions - - 70 - 70

------------------------------ --------- --------- --------------- ----------- ----------

Total contributions by and

distributions to owners

of the Group 11 128 70 (921) (712)

------------------------------ --------- --------- --------------- ----------- ----------

At 31 October 2020 5,013 30,637 3,525 59,003 98,178

------------------------------ --------- --------- --------------- ----------- ----------

Profit for the period - - - 4,337 4,337

------------------------------ --------- --------- --------------- ----------- ----------

Total comprehensive income

for the period - - - 4,337 4,337

------------------------------ --------- --------- --------------- ----------- ----------

Transactions with owners

of the Company, recognised

directly in equity

Shares issued during the

period 21 361 - - 382

Dividends - - - (2,008) (2,008)

Equity settled share-based

payment transactions - - 161 - 161

------------------------------ --------- --------- --------------- ----------- ----------

Total contributions by and

distributions to owners

of the Group 21 361 161 (2,008) (1,465)

------------------------------ --------- --------- --------------- ----------- ----------

At 30 April 2021 5,034 30,998 3,686 61,332 101,050

------------------------------ --------- --------- --------------- ----------- ----------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 30 April 2021

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 April 30 April 31 October

2021 2020 2020

Note GBP'000 GBP'000 GBP'000

-------------------------------- ----- ------------ --------------------- ------------

Cash flow from operating

activities

Cash (used in)/generated

from operations 9 (7,327) (1,062) 20,372

Interest received 51 55 164

Interest paid (165) (310) (436)

Tax paid (594) (720) (1,510)

Net cash (used in)/generated

from operating activities (8,035) (2,037) 18,590

-------------------------------- ----- ------------ --------------------- ------------

Cash flows from investing

activities

Acquisition of subsidiaries

(net of cash acquired) (1,844) (68) (125)

Proceeds on sale of property,

plant and equipment 95 6 194

Purchase of property, plant

and equipment (1,009) (505) (1,058)

Dividends received from

Associates - - 2

Net cash used by investing

activities (2,758) (567) (987)

-------------------------------- ----- ------------ --------------------- ------------

Cash flows from financing

activities

Net proceeds from the issue

of ordinary share capital 382 253 392

Lease payments (1,977) (2,066) (4,362)

Repayments of loans (593) (869) (1,470)

Dividends paid to shareholders (2,008) (1,870) (2,791)

-------------------------------- ----- ------------ --------------------- ------------

Net cash used in financing

activities (4,196) (4,552) (8,231)

-------------------------------- ----- ------------ --------------------- ------------

Net decrease in cash and

cash equivalents (14,989) (7,156) 9,372

-------------------------------- ----- ------------ --------------------- ------------

Cash and cash equivalents

at beginning of period 19,980 10,608 10,608

-------------------------------- ----- ------------ --------------------- ------------

Cash and cash equivalents

at end of period 11 4,991 3,452 19,980

-------------------------------- ----- ------------ --------------------- ------------

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

GENERAL INFORMATION

Wynnstay Group Plc has a number of operations. These are

described in the segment analysis in note 4.

Wynnstay Group Plc is a company incorporated and domiciled in

the United Kingdom. The address of its registered office is shown

in note 3.

1. BASIS OF PREPARATION

The Interim Report was approved by the Board of Directors on 29

June 2021.

The condensed financial statements for the six months to the 30

April 2021 have been prepared in accordance with International

Accounting Standard (IAS) 34 Interim Financial Reporting except as

disclosed in note 2.

The financial information for the Group for the year ended 31

October 2020 set out above is an extract from the published

financial statements for that year which have been delivered to the

Registrar of Companies. The auditor's report on those financial

statements was not qualified and did not contain statements under

section 498(2) or 498(3) of the Companies Act 2006. The information

contained in this document does not constitute statutory accounts

within the meaning of section 434 of the Companies Act 2006.

The financial information for the six months ended 30 April 2021

and for the six months ended 30 April 2020 are unaudited.

The consolidated financial statements are presented in sterling,

which is also the Group's functional currency. Amounts are rounded

to the nearest thousand, unless otherwise stated.

The condensed consolidated interim financial statements should

be read in conjunction with the annual consolidated financial

statements for the year ended 31 October 2020, which have been

prepared in accordance with IFRS as adopted pursuant to Regulation

(EC) No 1606/2002 as it applies in the European Union.

The Directors have prepared the condensed consolidated interim

financial statements on a going concern basis, having satisfied

themselves from a review of internal budgets and forecasts and

current banking facilities that the Group has adequate resources to

continue in operational existence for the foreseeable future. The

impact of the coronavirus crisis is discussed under 'Critical

accounting estimates and judgements.

2. CONSOLIDATION OF SHARE OF RESULTS IN JOINT VENTURES

The Group has a policy of using audited accounts for the

consolidation of its share of the results of Joint Venture and

Associate activities. No such consolidation has occurred during the

six months to 30 April 2021. Although this is not in accordance

with IFRS the impact on the financial statements is not material.

Relevant results will be accounted for during the second half of

the financial year.

3. SIGNIFICANT ACCOUNTING POLICIES

The condensed financial statements have been prepared under the

historical cost convention other than shared-based payments, which

are included at fair value and certain financial instruments which

are explained in the annual consolidated financial statements for

the year ended 31 October 2020.

The condensed consolidated interim financial statements for the

six months to 30 April 2021 have been prepared on the basis of the

accounting policies expected to be adopted for the year ending 31

October 2021 except for those highlighted in Note 2. These are

anticipated to be consistent with those set out in the Group's

latest annual financial statements for the year ended 31 October

2020. A copy of these financial statements is available from the

Company's Registered Office at Eagle House, Llansantffraid, Powys,

SY22 6AQ.

New standards and interpretations

Other new and amended standards and Interpretations issued by

the IASB that will apply for the rst time in the next annual

nancial statements are not expected to impact the Group as they are

either not relevant to the Group's activities or require accounting

which is consistent with the Group's current accounting

policies.

Critical accounting estimates and judgements

The Group makes certain estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historic experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may di er from

these estimates and assumptions. The estimates and assumptions that

have a signi cant risk of causing a material adjustment to the

carrying amount of assets and liabilities with the next nancial

year are unchanged from those disclosed in the nancial statements

for the year ended 31 October 2020 except in relation to the

outbreak of the coronavirus crisis.

As reported in the financial statements for the year ended 31

Oct 2020, the Group has traded resiliently through the Coronavirus

pandemic operating under modified procedures to ensure the welfare

and safety of colleagues, customers and the communities the

business operates in. No significant impact on the financial

statements of the Group have occurred as a result of the ongoing

situation.

Consideration has been given to the assets and liabilities as at

30 April 2021 and an evaluation has been made that there are no

coronavirus connected impairments to record at the time of

authorising these nancial statements. The situation continues to

evolve and as more information becomes available it is possible

that in the future actual experience may di er and hence these

matters are key judgement for these nancial statements.

4. SEGMENTAL REPORTING

IFRS 8 requires operating segments to be identified on the basis

of internal financial information about the components of the Group

that are regularly reviewed by the chief operating decision-maker

("CODM") to allocate resources to the segments and to assess their

performance.

The chief operating decision-maker has been identified as the

Board of Directors ('the Board'). The Board reviews the Group's

internal reporting in order to assess performance and allocate

resources. The Board has determined that the operating segments,

based on these reports are Agriculture, Specialist Agricultural

Merchanting, and Other.

The Board considers the business from a product/service

perspective. In the Board's opinion, all of the Group's operations

are carried out in the same geographical segment, namely the United

Kingdom.

Agriculture - manufacturing and supply of animal feeds,

fertiliser, seeds and associated agricultural products.

Specialist Agricultural Merchanting - supplies a wide range of

specialist products to farmers, smallholders, and pet owners.

Other - miscellaneous operations not classi ed as Agriculture or

Specialist Agricultural Merchanting.

The Board assesses the performance of the operating segments

based on a measure of operating pro t. Non-recurring costs and

nance income and costs are not included in the segment result that

is assessed by the Board. Other information provided to the Board

is measured in a manner consistent with that in the nancial

statements. No segment is individually reliant on any one

customer.

The segment results for the period ended 30 April 2021 and

comparative periods are as follows:

Agriculture Specialist Other Total

Agricultural

Merchanting

Unaudited for the six months GBP'000 GBP'000 GBP'000 GBP'000

ended

30 April 2021:

------------------------------------ ------------ -------------- -------- ------------

Revenue from external customers 180,716 68,884 109 249,709

Segment results

Group operating profit before

non-recurring items 2,197 3,398 (117) 5,478

Share of result of Joint

Ventures - - - -

2,197 3,398 (117) 5,478

Non-recurring items (note

7) -

Interest income 51

Interest expense (165)

------------

Profit before taxation 5,364

Taxation (1,027)

------------

Profit for the period attributable

to shareholders 4,337

------------

Agriculture Specialist Other Total

Agricultural

Merchanting

Unaudited for the six months GBP'000 GBP'000 GBP'000 GBP'000

ended 30 April 2020 for

continuing operations:

------------------------------------ ------------ -------------- -------- ------------

Revenue from external customers 166,409 62,834 45 229,288

Segment results

Group operating profit before

non-recurring items 1,811 3,017 (91) 4,737

Share of result of Joint

Ventures - - - -

------------------------------------ ------------ -------------- -------- ------------

1,811 3,017 (91) 4,737

Non-recurring items (note

7) (185)

Interest income 55

Interest expense (310)

------------

Profit before taxation 4,297

Taxation (817)

------------

Profit for the period attributable

to shareholders 3,480

------------

Agriculture Specialist Other Total

Agricultural

Merchanting

Audited for the year ended GBP'000 GBP'000 GBP'000 GBP'000

31 October 2020 for continuing

operations:

------------------------------------ ------------ -------------- -------- ------------

Revenue from external customers 302,580 128,807 11 431,398

Segment results

Group operating profit before

non-recurring items 2,411 5,728 (130) 8,009

Share of result of Joint

Ventures 471 53 14 538

------------------------------------ ------------ -------------- -------- ------------

2,882 5,781 (116) 8,547

Non-recurring items (note

7) (1,194)

Interest income 164

Interest expense (436)

------------

Profit before taxation 7,081

Taxation (1,548)

------------

Profit for the year attributable

to shareholders 5,533

------------

5. OTHER OPERATING INCOME

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 April 2021 30 April 31 October

2020 2020

GBP'000 GBP'000 GBP'000

--------------- --------------- ------------ ------------

Rental Income 185 168 351

6. ALTERNATIVE PERFORMANCE MEASURES

On the Board's preferred alternative performance measures

referred to as Adjusted operating profit and Underlying pre-tax

profits which are respectively, Group operating profit adding back

amortisation of acquired intangible assets, share-based payment

expense and non-recurring items, and the Group profit before tax

adding back share-based payment expense, non-recurring items and

including the value of the share of tax incurred by joint ventures

and associates. On these measures the Group achieved Adjusted

operating profit of GBP5.68m (2020: GBP4.78m) and Underlying

pre-tax profits of GBP5.53m (2020: GBP4.51m).

Reconciliation with the reported income statement for this

measure, Operating profit before non-recurring items and Underlying

pre-tax profit and the Profit before tax shown on the Condensed

Statement of Comprehensive Income, together with reasons for their

use is given below.

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 April 30 April 31 October

2021 2020 2020

GBP'000 GBP'000 GBP'000

----------------------------------------- ------------ ------------ ------------

Profit before tax 5,364 4,297 6,981

Share of tax incurred by joint ventures

and associate - - 100

Non-recurring items (note 7) - 185 1,194

Net finance costs 114 255 272

Share of results from joint ventures

before tax - - (538)

----------------------------------------- ------------ ------------ ------------

Operating profit before non-recurring

items (note 8) 5,478 4,737 8,009

Share of results from joint ventures

and associate before tax - - 538

----------------------------------------- ------------ ------------ ------------

Segment results plus share of results

from joint ventures and associate

before tax (note 4) 5,478 4,737 8,547

Share-based payments 161 26 96

Net finance charges (114) (255) (272)

----------------------------------------- ------------ ------------ ------------

Underlying pre-tax profit 5,525 4,508 8,371

----------------------------------------- ------------ ------------ ------------

Profit before tax 5,364 4,297 6,981

Share of results from joint ventures - - (538)

Share of tax incurred by joint ventures - - 100

Net finance charges 114 255 272

Share-based payments 161 26 96

Amortisation of intangibles 36 18 36

Non-recurring items (note 7) - 185 1,194

----------------------------------------- ------------ ------------ ------------

Adjusted operating profit 5,675 4,781 8,141

----------------------------------------- ------------ ------------ ------------

The Board uses alternative performance measures as it believes

the underlying commercial performance of the current trading

activities is better reflected, and provides investors and other

users of the accounts with an improved view of likely future

performance by making adjustments to the IFRS results for the

following reasons:

-- Share of results from joint ventures and associate

Provides a fuller understanding of activities directly under

management control and those incorporated from joint ventures.

-- The add back of tax incurred by joint ventures and

associate

The Board believes the incorporation of the gross result of

these entities provides a fuller understanding of their combined

contribution to the Group performance.

-- Net finance charges

Provides an understanding of results before interest received

and paid.

-- Share-based payments

This charge is calculated using a standard valuation model, with

the assessed non-cash cost each year varying depending on new

scheme invitations and the number of leavers from live schemes.

These variables can create a volatile non-cash charge to the income

statement, which is not directly connected to the trading

performance of the business.

-- Amortisation of acquired intangible assets

This charge relates to intangible assets created from prior

business combinations, hence provides a fuller understanding of

current operating performance.

-- Non-recurring items

The Group's accounting policies include the separate

identification of non-recurring material items on the face of the

income statement, which the Board believes could cause a

misinterpretation of trading performance if not disclosed.

7. AMORTISATION OF ACQUIRED INTANGIBLE ASSETS AND SHARE-BASED PAYMENTS AND NON-RECURRING ITEMS

Unaudited Unaudited Audited

six months six months Year

ended ended ended

30 April 2021 30 April 31 October

2020 2020

GBP'000 GBP'000 GBP'000

----------------------------- ----------------------------------- ------------ ------------

Amortisation of acquired

intangible assets and

share-based payments

Amortisation of intangibles 36 18 36

Cost of share-based

reward 161 26 96

----------------------------- ----------------------------------- ------------ ------------

197 44 132

----------------------------- ----------------------------------- ------------ ------------

Non-recurring items

Business re-organisation

costs - 185 185

Goodwill and Investment

impairment - - 601

Huyton depot closure

costs - - 256

Decommission of Selby

seed plant - - 152

- 185 1,194

----------------------------- ----------------------------------- ------------ ------------

Business re-organisation costs relate to the redundancy related

expenses of colleagues leaving the business as a result of

re-organising operations. The goodwill impairment relates to the

Grainlink cash generating unit, for

additional information see note 13 in the financial statements 31 October 2020.

Huyton depot store closure costs comprise redundancy costs and

costs associated with exiting the leased premises. Decommission of

Selby seed plant relates to the costs of vacating a leased property

and transferring the plant and machinery to a new location.

8. TAXATION

The tax charge for the six months ended 30 April 2021 and 30

April 2020 is based on an apportionment of the estimated tax charge

for the full year.

The effective tax rate is 19.1% (6 months ended 30 April 2020:

19.0%) which is higher than the standard rate of 19.0% (2020:

19.0%).

9. CASH (USED IN)/GENERATED FROM OPERATIONS

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 April 2021 30 April 31 October

2020 2020

GBP'000 GBP'000 GBP'000

------------------------------------- --------------- ------------ ------------------------

Profit for the period 4,337 3,480 5,533

Adjustments for:

Taxation 1,027 817 1,448

Investment and goodwill

impairment - - 601

Depreciation of tangible

fixed assets 1,042 1,138 2,290

Amortisation of other intangible

fixed assets 36 18 36

Amortisation of right-use-assets 1,932 1,856 3,888

(Profit) on disposal of

property, plant and equipment (77) (6) (142)

Loss on disposal of right-of-use

asset - - 25

Investment revaluation (2) - -

Interest income (51) (55) (164)

Interest expense 165 310 436

Share of results of joint

ventures and associate - - (438)

Share-based payment expense 161 26 96

Changes in working capital

(excluding effects of acquisitions

and disposals of subsidiaries)

Increase/(decrease) in short

term loan to joint venture 24 (516) 524

(Increase)/decrease in inventories (8,254) 237 8,049

(Increase)/decrease in trade

and other receivables (19,557) (11,596) 8,055

Increase/(decrease) in trade

and other payables 11,890 3,229 (9,865)

Cash (used in)/generated

from operations (7,327) (1,062) 20,372

------------------------------------- --------------- ------------ ------------------------

During the six months to 30 April 2021, the Group purchased

property, plant and equipment of GBP1,854,000 (2020: GBP1,839,000)

of which GBP845,000 relates to right-of-use assets (2020:

GBP1,334,000).

10. LEASES

The following tables shows the movement in right-of-use assets

and lease liabilities, along with the aging of the lease

liabilities.

Right-of-use assets Land and Property, plant Total

buildings and equipment

GBP'000 GBP'000 GBP'000

--------------------- ----------- ---------------- --------

At 1 November 2019 7,684 4,638 12,322

Additions 241 1,093 1,334

Amortisation (1,578) (814) (2,392)

At 30 April 2020 6,347 4,917 11,264

--------------------- ----------- ---------------- --------

Additions 729 768 1,497

Amortisation (785) (711) (1,496)

Disposal (25) - (25)

--------------------- ----------- ---------------- --------

At 31 October 2020 6,266 4,974 11,240

--------------------- ----------- ---------------- --------

Additions 400 445 845

Amortisation (1,120) (812) (1,932)

At 30 April 2021 5,546 4,607 10,153

--------------------- ----------- ---------------- --------

Lease liabilities Land and Property, plant Total

buildings and equipment

GBP'000 GBP'000 GBP'000

-------------------- ----------- ---------------- --------

At 1 November 2019 7,684 3,839 11,523

Additions 241 1,093 1,334

Interest expense 171 71 242

Lease payments (1,489) (1,370) (2,859)

At 30 April 2020 6,607 3,633 10,240

-------------------- ----------- ---------------- --------

Additions 729 768 1,497

Interest expense (19) 72 53

Lease payments (1,001) (772) (1,773)

Disposal (25) - (25)

-------------------- ----------- ---------------- --------

At 31 October 2020 6,291 3,701 9,992

-------------------- ----------- ---------------- --------

Additions 424 238 662

Interest expense 71 67 138

Lease payments (1,184) (748) (1,932)

At 30 April 2021 5,602 3,258 8,860

-------------------- ----------- ---------------- --------

Within 1 year 1-2 years 2-5 years Over 5 years Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------------- ---------- ---------- ------------- --------

Lease liabilities 3,173 2,631 3,056 - 8,860

11. NET CASH

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 April 30 April 31 October

2021 2020 2020

GBP'000 GBP'000 GBP'000

-------------------------------- ------------ ------------ ------------

Cash and cash equivalents per

balance sheet 4,991 3,452 19,980

Cash and cash equivalents per

cash flow statement 4,991 3,452 19,980

Bank loans due within one year

or on demand (306) (1,176) (897)

Loan capital (673) (684) (675)

Net cash due within one year 4,012 1,592 18,408

Bank loans due after one year - (313) -

Total net cash 4,012 1,279 18,408

-------------------------------- ------------ ------------ ------------

12. FINANCIAL INSTRUMENTS

The Group is exposed through its operation to the following

financial risks:

-- Credit risk

-- Interest rate risk

-- Foreign exchange risk

-- Other market price risk

-- Liquidity risk

The principal financial instruments used the Group, from which

financial instrument risk arises, are as follows:

-- Trade receivables

-- Cash and cash equivalents

-- Investments in quoted equity securities

-- Trade and other payables

-- Bank overdrafts

-- Floating-rate bank loans

-- Forward currency contracts

-- Lease liabilities

All financial instruments in 2021 and 2020 were denominated in

Sterling. There is no significant foreign exchange risk in respect

of these instruments. Further quantitative information in respect

of these risks is presents in the Group's annual financial

statements 31 October 2020.

Financial instruments not measured at fair value includes cash

and cash equivalents, trade and other receivables, trade and other

payables, loans and borrowings, and lease liabilities. Due to their

short-term nature, the carrying value of cash and cash equivalents,

trade and other receivables, and trade and other payables

approximates their fair value.

IFRS 13 requires nancial instruments that are measured at fair

value to be classi ed according to the valuation technique

used:

-- Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities

-- Level 2 - inputs, other than level 1 inputs, that are

observable for the asset or liability, either directly (i.e. as

prices) or indirectly (i.e. derived form prices)

-- Level 3 - unobservable inputs

All derivative nancial assets and liabilities are classi ed as

Level 1 instruments as they are quoted market prices.

Contingent consideration is measured at fair value using Level 3

inputs such as entity projections of future probability. The amount

recognised relates to the ongoing pro tability of the business

acquired and criteria for this are set out in the sale and purchase

agreements. Consequently, adjustments would only be made if the

business did not perform as originally anticipated, and further

sensitivity analysis is not considered to be required.

Transfers between levels are deemed to have occurred at the end

of the reporting period. There were no transfers between levels in

the above hierarchy in the period.

Fair value Amortised cost

Unaudited Unaudited Audited Unaudited Unaudited Audited

six six year six six year

months months ended months months ended

ended ended 31 ended ended 31

30 30 October 30 30 October

April April 2020 April April 2020

2021 2020 2021 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- ---------- ---------- --------- ---------- ---------- ---------

Financial assets

Cash

and

cash

equivalents - - - 4,991 3,452 19,980

Trade

and

other

receivables - - - 75,180 75,316 55,757

Derivatives 227 185 93 - - -

227 185 93 80,171 78,768 75,737

---------------- ---------- ---------- --------- ---------- ---------- ---------

Financial labilities

Trade

and

other

payables - - - 63,029 62,166 51,303

Loans

and

borrowing - - - 979 2,173 1.572

Deferred

and

contingent

consideration 592 286 229 - - -

Derivatives 214 79 263 - - -

806 365 492 64,008 64,339 52,875

---------------- ---------- ---------- --------- ---------- ---------- ---------

13. EARNINGS PER SHARE

Basic earnings per 25p ordinary share has been calculated by

dividing profit for the period attributable to ordinary

shareholders by the weighted average number of ordinary shares in

issue during the period. For diluted earnings per share the

weighted average number of ordinary shares is adjusted to assume

conversion of all dilutive potential ordinary shares (share options

and warrants) taking into account their exercise price in

comparison with the actual average share price during the year.

Unaudited Unaudited

six months six months

ended ended

30 April 2021 30 April 2020

------------------------------------ --------------- ---------------

Weighted average number of shares

in issue: basic 20,055,501 19,896,621

Earnings per share: basic 21.62 17.50

Weighted average number of shares

in issue: diluted 20,365,205 19,978,002

Earnings per share: diluted 21.30 17.43

14. SHARE CAPITAL

Number of shares Total

000s GBP000's

----------------------------------- ----------------- ---------

Allotted and fully paid: ordinary

shares 25p each

Balance at 31 October 2019 19,896 4,974

Issue of shares 111 28

----------------------------------- ----------------- ---------

Balances at 30 April 2020 20,007 5,002

Issue of shares 44 11

----------------------------------- ----------------- ---------

Balances at 31 October 2020 20,051 5,013

Issue of shares 86 21

----------------------------------- ----------------- ---------

Balances at 30 April 2021 20,137 5,034

----------------------------------- ----------------- ---------

The shares issued in the period related to 24,000 company share

options (2020: GBPnil) and 62,000 (2020: 111,000) shares allotted

to shareholders exercising their rights to receive dividends under

the Company's scrip dividend scheme. No other shares were allocated

during the current or prior period.

As at 30 April 2021 a total of 20,137,000 shares are in issue

(2020: 20,007,000).

15. DIVIDS

During the period ended 30 April 2021 an amount of GBP2,008,000

(2020: GBP1,870,000) was charged to reserves in respect of equity

dividends paid. An interim dividend of 5.00p per share (2020:

4.60p) will be paid on 29 October 2021 to shareholders on the

register on the 1 October 2021. New elections to receive Scrip

Dividends should be made in writing to the Company's Registrars

before 15 October 2021.

16. OTHER RESERVES

Included in Other reserves are share-based payments; as the

Group issues equity-settled share-based payments to certain

employees. Equity-settled share-based payments are measured at fair

value at the date of the grant. The fair value determined at the

grant date of the equity-settled share-based payments is expensed

on a straight-line basis over the vesting period, based on the

Group's estimate of shares that will eventually vest.

The Group operates a number of share option and 'Save As You

Earn' schemes and fair value is measured by use of a recognised

valuation model. The expected life used in the model has been

adjusted, based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations.

At the 30 April 2021 the ESOP Trust, which is consolidated

within the Group financial statements, held 16,834 (2020: 16,834)

Ordinary Shares in the Group.

17. GROUP FINANCIAL COMMITMENTS

During the period, the Group was released from a bank guarantee

in relation to an Associate company, therefore as at the 30 April

2021, the Group did not have any contingent liabilities in respect

of bank guarantees of its Associates (2020: GBP125,000).

18. CAPITAL COMMITMENTS

As at 30 April 2021 the Group had capital commitments as

follows:

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 April 2021 30 April 31 October

2020 2020

GBP'000 GBP'000 GBP'000

----------------------------------- --------------- ------------ ------------

Contracts placed for future

capital expenditure not provided

in the financial statements 20 38 264

19. RELATED PARTIES

Transactions between the Company and its subsidiaries, which are

related parties have been eliminated on consolidation and are not

disclosed in this note. Transactions between the Group and its

Joint Ventures are described below:

Transaction value Balance outstanding

Unaudited Unaudited Audited Unaudited Unaudited Audited

six months six months year six months six months year

ended ended ended ended ended ended

30 April 30 April 31 October 30 April 30 April 31 October

2021 2020 2020 2021 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ------------ ------------ ------------ ------------ ------------ ------------

Sales of goods

to joint ventures 2,952 2,786 5,467 572 1,019 427

Purchases of

goods from joint

ventures 155 35 139 (44) 6 (5)

Loans with joint

ventures (24) 1,840 (524) 3,865 4,929 3,889

-------------------- ------------ ------------ ------------ ------------ ------------ ------------

20. BUSINESS COMBINATION NOTE

HELM Great Britain Limited

On 3 March 2021, Glasson Grain Limited entered into a business

combination and acquired 100% of the Fertiliser manufacturing

business and certain assets of HELM Group legally know as HELM

Great Britain Limited.

The provisional consideration is GBP1,658,000 which is

represented by GBP1,658,000 paid during the year for certain

assets.

Amounts included in the Consolidated Statement of Comprehensive

Income period to 30 April 2021 are revenues of GBP4,134,000 and

profit before tax of GBP168,000.

Agricultural division of Armstrong Richardson & Co.

Limited

On 12 February 2021, Wynnstay (Agricultural Supplies) Limited

entered into a business combination and acquired 100% of the trade

and certain assets of Armstrong Richardson & Co. Limited.

The provisional consideration is GBP548,000 which is represented

by GBP154,000 paid during the year for certain assets and goodwill

and contingent consideration of GBP50,000 relating to goodwill and

deferred consideration of GBP344,000 for inventory, which is

expected to be paid by 12 February 2023. The consideration payable

is dependent on the employee retention and future product

volume.

The fair value of the contingent consideration has been based on

management expectation of future performance of the business and

could range from GBPnil to GBP50,000.

Amounts included in the Consolidated Statement of Comprehensive

Income period to 30 April 2021 are revenues of GBP1,401,000 and

profit before tax of GBP14,000.

The goodwill represents future sales opportunities and is not

expected to be deductible for tax purposes.

HELM Great Agricultural Total

Britain Limited division

of Armstrong

Richardson

& Co. Limited

GBP'000 GBP'000 GBP'000

------------------------------- ----------------- --------------- --------

Provision for fair value

of asset acquired

Goodwill - 50 50

Intangibles - 138 138

Property, plant and equipment 225 16 241

Inventories 1,433 344 1,777

------------------------------- ----------------- --------------- --------

Provisional consideration 1,658 548 2,206

Contingent and deferred - (394) (394)

------------------------------- ----------------- --------------- --------

Settled in cash at completion 1,658 154 1,812

------------------------------- ----------------- --------------- --------

Acquisition costs of GBP17,000 arose as a result of the above

transactions, these have been recognised as part of administrative

expenses.

Both acquisitions were parts of larger legal entities and

therefore the historic sales, gross profit and profit before tax in

the period prior to the acquisition is not publicly available.

The business combination accounting will be finalised 12 months

from the date of acquisition.

Contingent and deferred considering of GBP32,000 was paid during

the six-month period to 30 April 2021 relating to prior period

acquisitions, resulting in a total outflow of GBP1,844,000 in the

six month period to 30 April 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEUFIUEFSEDM

(END) Dow Jones Newswires

June 30, 2021 02:00 ET (06:00 GMT)

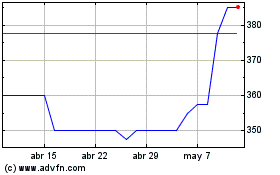

Wynnstay (LSE:WYN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Wynnstay (LSE:WYN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024