UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2024

Commission

File Number: 001-40588

Marti

Technologies, Inc.

Buyukdere

Cd. No:237

Maslak,

34485

Sariyer/Istanbul,

Türkiye

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXPLANTORY

NOTE

Attached

to this Report on Form 6-K as Exhibits 99.1 and 99.2, respectively, are the Management’s Discussion and Analysis of Financial Condition

and Results of Operations and the unaudited interim condensed consolidated financial statements of Marti Technologies, Inc. (the “Company”)

as of and for the six months ended June 30, 2024.

INCORPORATION

BY REFERENCE

The

information included in this Report on Form 6-K, including Exhibit 99.1 and Exhibit 99.2 hereto, is hereby incorporated by reference

into the Company’s Registration Statement on Form F-3 (File No. 333-273543), which was declared effective on September 9, 2024,

and Form S-8 (File No. 333-274779), and shall be a part thereof from the date on which this report is filed, to the extent not superseded

by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

MARTI TECHNOLOGIES,

INC. |

| |

|

|

| Date: September 30, 2024 |

By: |

/s/

Oguz Alper Öktem |

| |

Name: |

Oguz Alper Öktem |

| |

Title: |

Chief

Executive Officer |

Exhibit 99.1

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

following discussion and analysis provides information which our management believes is relevant to an assessment and understanding of

our consolidated results of operations and financial condition. The discussion should be read together with our consolidated financial

statements and the related notes thereto included in our Annual Report on Form 20-F filed on April 16, 2024 with the U.S. Securities

and Exchange Commission (“SEC”) for the fiscal year ended December 31, 2023 (“Annual Report”), our unaudited

interim condensed consolidated financial statements and the related notes thereto accompanying this Report on Form 6-K as of and for

the six months ended June 30, 2024 (“Interim Report”) and our other filings with the SEC (collectively, the Public Filings”).

This discussion may contain forward-looking statements based upon current expectations that involve risks and uncertainties. You should

also review the sections titled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in

our Public Filings for a discussion of important factors that could cause actual results to differ materially from the results described

in or implied by the forward-looking statements contained in the following discussion. The Company’s historical results are not

necessarily indicative of the results that may be expected for any period in the future.

Under

Cayman law, we prepare financial statements on a semi-annual and an annual basis, and we are not required to prepare or file quarterly

financial information. We currently intend to publish our results on a semi-annual and an annual basis, assuming we are subject to the

reporting requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

and qualify as a “foreign private issuer” at the time of publication. We intend to continue to publicly (1) file our audited

annual financial statements on Form 20-F with the SEC and (2) furnish semi-annual financial statements on Form 6-K to the SEC.

Our

Management’s Discussion and Analysis of Financial Condition and Results of Operations included in this document generally discusses

results for the six-month period ended June 30, 2024 and 2023. All references to “we,” “us,” our,” “Marti,”

and the “Company” refer to Marti Technologies, Inc., an exempted company incorporated with limited liability under the laws

of the Cayman Islands, and its subsidiaries.

Operating

Results

Segments

We

manage our business and report our financial results in two reportable segments: Two-wheeled Electric Vehicles and Ride-Hailing. Beginning

with our six months ended June 30, 2023, management determined that our ride-hailing service had developed to a point where, in order

to drive efficiency and better allocate resources, these two segments should be managed and reported individually. See Note 3.3 to our

unaudited condensed consolidated financial statements included in our Interim Report for more information.

Two-wheeled

Electric Vehicle

Our

Two-wheeled Electric Vehicle segment generates revenue from two sources. The significantly greater portion of our revenue in this segment

is generated from the rides of e-mopeds, e-bikes, and e-scooters completed by our riders. Riders pay an unlock fee to begin a ride and

a per minute fee for each minute of the ride. The unlock fee and per minute fee vary by modality, geography, and time of year and may

also be impacted by surges in demand and other micro and macro events. The remainder of our revenue in this segment is generated from

advance e-scooter, e-bike, and e-moped reservations that enable riders to reserve a vehicle prior to commencing a ride. This ensures

that another rider cannot use the vehicle during the reservation period and, therefore, that the vehicle is available when the rider

reaches the vehicle. The reservation fee, which is independent from the per minute fee for each minute of the ride, is charged on a per

minute basis from the time the reservation is made until start of the ride.

Ride-Hailing

Our

Ride-Hailing segment, which launched in October 2022, offers car, motorcycle, and taxi ride-hailing options that connect a marketplace

of riders and drivers over the Marti app. This segment allows us to cater to a broader and more diverse customer base, and to better

meet customer demand for both four- and two-wheeled vehicle driven transportation services.

Key

Factors Affecting Operating Results

We

believe our performance and future success depend on several factors that present significant opportunities for us, but also pose risks

and challenges, including those discussed below and in the section under Item 3.D “Key Information-Risk Factors” in our Annual

Report and any of our subsequent filings with the SEC.

Fleet

expansion and vehicle supply

We

work with a limited number of domestic and international suppliers to procure, assemble, and manufacture shared vehicles and required

spare parts. Any changes in the international trade policies, transportation costs, or disruptions in supply chain may impact our growth

trajectory and existing business. We continue to diversify our network of suppliers, increase localized sourcing with increase scale

and diversify our methods of assembly and manufacturing to mitigate the effects of these factors.

Seasonality

of the business

We

experience seasonality in differing levels across different services and different operating regions across our business. Typically the

second and third quarters of our fiscal year experience increased usage due to favorable weather conditions in the markets that we operate.

Unexpected weather events, including those driven by climate change or other factors can have a material impact on our business. We continue

to diversify our service offering and footprint to mitigate adverse effects of seasonality, in addition to the rebalancing of vehicles

prior to and after major adverse weather warnings from local authorities. For example, we limit our operations in certain regions to

certain periods of the year to maximize the usage of our vehicles in different regions with more favorable weather conditions during

such periods.

Market

perception towards micromobility and shared vehicles

While

some cities adopt micromobility tools easily, others may be unsuitable for or slow to adopt an increase in micromobility alternatives

such as e-scooters, e-mopeds, and e-bikes. Any negative perception about the safety of our vehicles may result in significant decline

in current addressable market size or potential market expansion opportunities. We continue to educate our riders and the public regarding

the measures taken and steps to ensure rider and pedestrian safety.

Regulatory

framework of micromobility

Urban

mobility and transportation is a regulated market in Türkiye and local laws and practices continue to evolve and change as the market

rapidly evolves. Within this framework, we are subject to a multi-tiered licensing process. We are required to procure a national license

from the Ministry of Transportation, followed by city level licenses in each city in which we operate or propose to operate, followed

by the payment of a per-vehicle daily occupancy fee to each district in which we operate. This multi-tiered licensing process requires

us to employ extensive teams to properly navigate all regulatory requirements. Therefore, our relationships with local authorities matter

greatly. Any disturbance in the regulatory environment could have an adverse impact on our ability to penetrate new markets and continue

to effectively operate in our existing markets. We actively collaborate with our regulators at the national, city and district level

to ensure the urban mobility needs of our customers are fulfilled and compliant with applicable laws.

Competition

Our

industry is highly competitive. Our rides consist of standalone commutes, first and last mile complementary rides to public transport,

and leisure rides. We directly compete with companies that offer similar tech-enabled mobility services, including e-scooters, e-bikes,

e-mopeds, car-hailing, motorcycle-hailing, and taxi-hailing.

Marti

is currently the number one urban mobility app in Türkiye across iOS and Android, as measured by the total number of downloads among

all apps in the travel category. However, the size of the broader shared mobility market in Türkiye may attract additional local

and international companies, both within cities and between city transportation, and some of which may have greater brand awareness and/or

financial resources than we do, to enter the space.

Components

of Results of Operations

Revenue

We

provide access to our vehicles for our customers on a per-ride basis over the customer’s desired period of use. Our revenue is

primarily generated from the fees paid by our customers to rent our vehicles less promotions, discounts, and refunds. We also generate

revenue from reservations, where we charge a minute-based fee for reserving a vehicle until start of the ride. For the six months ended

June 30, 2024 and 2023, reservation revenues constituted less than 1.0% of our total revenues.

Cost

of Revenues

Cost

of revenues primarily consists of depreciation and amortization expense, rental vehicles’ maintenance and repair expense, operating

lease expense, battery swap costs, data cost expense, and salaries of operational and logistics staff.

Gross

Profit

Gross

profit represents revenues less cost of revenue.

General

and Administrative

General

and administrative costs represent costs incurred by us for executive and management overhead and administrative and back-office support

functions. These costs primarily consist of salaries, benefits, travel, bonuses, and stock-based compensation, consulting, communication,

network and cloud, email, and IT services expenses, professional service providers, off-site storage and logistics, certain insurance

coverage, and an allocation of office rent and utilities related to our general and administrative divisions. General and administrative

costs are expensed as incurred.

Sales

and Marketing

Sales

and marketing expenses primarily consist of advertising expenses and services marketing costs. Sales and marketing costs are recognized

as they are incurred.

Other

Income / (Expense), Net

Other

income / (expense), net primarily consists of provisional expenses and other non-operational income.

Provision

for Income Taxes

We

account for income taxes using the asset and liability method. Under this method, deferred income tax assets and liabilities are recorded

based on the estimated future tax effects of differences between the financial statement and income tax basis of existing assets and

liabilities. These differences are measured using the enacted statutory tax rates that are expected to apply to taxable income for the

years in which differences are expected to reverse. We recognize the effect on deferred income taxes of a change in tax rates in the

period that includes the enactment date.

We

record a valuation allowance to reduce our deferred tax assets to the net amount that it believes is more-likely-than-not to be realized.

Management considers all available evidence, both positive and negative, including historical levels of income, expectations, and risks

associated with estimates of future taxable income and ongoing tax planning strategies in assessing the need for a valuation allowance.

Under

the provisions of ASC 740-10, Income Taxes, we evaluate uncertain tax positions by reviewing against applicable tax law for all positions

taken by us with respect to tax years for which the statute of limitations is still open. ASC 740-10 provides that a tax benefit from

an uncertain tax position may be recognized when it is more likely than not that the position will be sustained upon examination, including

resolutions of any related appeals or litigation processes, based on the technical merits. We recognize interest and penalties related

to the liability for unrecognized tax benefits, if any, as a component of the income tax expense line in the accompanying unaudited condensed

consolidated statement of operations and comprehensive loss.

Operating

Results

Immaterial

Error Correction

The Group has identified an immaterial error in the previously issued

unaudited interim condensed consolidated financial statements, specifically related to the failure to accrue interest on certain prefunded

notes for the period from January 1 to June 30, 2023. This error was discovered during the preparation of the Interim Report while conducting

a comparative analysis with the unaudited interim condensed consolidated financial statements for the period from January 1 to June 30,

2023. The error was related to timing of recognition and hence it does not impact the consolidated financial statements for the year ended

December 31, 2023.

After evaluating the qualitative and quantitative impacts of this adjustment,

the Group has concluded that the effects on the unaudited interim condensed consolidated financial statements for prior periods are not

material and there is no impact on the current period's unaudited interim condensed consolidated financial statements. The error has been

rectified through a revision of the affected financial statement line items for the six months ended June 30, 2023. Accordingly, retained

earnings as of June 30, 2023 and net loss for the six months ended June 30, 2023, have been revised to reflect the correct amounts. The

error has no impact on the reported cash flows.

The following table provides a summary of the quantitative impact of

the revision for the six months period ended June 30, 2023:

| | |

January 1 - | | |

| | |

Revised January 1 - | |

| | |

June 30, 2023 | | |

Adjustments | | |

June 30, 2023 | |

| Loss from operations | |

| (14,104,051 | ) | |

| - | | |

| (14,104,051 | ) |

| Financial expense | |

| (616,003 | ) | |

| (1,330,321 | ) | |

| (1,946,324 | ) |

| Loss before income tax expense | |

| (12,000,418 | ) | |

| (1,330,321 | ) | |

| (13,330,739 | ) |

| Net loss | |

| (12,000,418 | ) | |

| (1,330,321 | ) | |

| (13,330,739 | ) |

| Net loss attributable to stockholders | |

| (12,000,418 | ) | |

| (1,330,321 | ) | |

| (13,330,739 | ) |

The following table sets forth our results of operations for the periods

presented. The period-to-period comparisons of financial results is not necessarily indicative of future results.

| | |

Six Months Ended June 30, | | |

Period-over-Period Change

Six

Months Ended

June 30,

2024 to 2023 | |

| (in thousands) | |

2024 | | |

2023 | | |

Change ($) | | |

Change (%) | |

| Revenue | |

$ | 8,409 | | |

$ | 9,485 | | |

$ | (1,076 | ) | |

| (11.3 | )% |

| Cost of revenues | |

$ | (9,886 | ) | |

$ | (13,018 | ) | |

$ | 3,132 | | |

| (24.1 | )% |

| Gross profit/(loss) | |

$ | (1,478 | ) | |

$ | (3,533 | ) | |

$ | 2,056 | | |

| (58.2 | )% |

| Research and development expenses | |

$ | (611 | ) | |

$ | (1,500 | ) | |

$ | 889 | | |

| (59.3 | )% |

| General and administrative expenses | |

$ | (9,053 | ) | |

$ | (5,668 | ) | |

$ | (3,385 | ) | |

| 59.7 | % |

| Selling and marketing expenses | |

$ | (6,462 | ) | |

$ | (3,211 | ) | |

$ | (3,251 | ) | |

| 101.3 | % |

| Other income | |

$ | 984 | | |

$ | 374 | | |

$ | 610 | | |

| 163.1 | % |

| Other expenses | |

$ | (1,599 | ) | |

$ | (565 | ) | |

$ | (1,033 | ) | |

| 182.9 | % |

| Loss from operations | |

$ | (18,219 | ) | |

$ | (14,104 | ) | |

$ | (4,115 | ) | |

| 29.2 | % |

| Finance income | |

$ | 559 | | |

$ | 2,720 | | |

$ | (2,161 | ) | |

| (79.5 | )% |

| Finance expense | |

$ | (4,209 | ) | |

$ | (1,946 | ) | |

$ | (2,263 | ) | |

| 116.2 | % |

| Loss before taxes | |

$ | (21,869 | ) | |

$ | (13,331 | ) | |

$ | (8,538 | ) | |

| 64.0 | % |

| Income tax expense | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Net loss for the period | |

$ | (21,869 | ) | |

$ | (13,331 | ) | |

$ | (8,538 | ) | |

| 64.0 | % |

Six

Months Ended June 30, 2024 Compared to Six Months Ended June 30, 2023

Revenue

With

the goal of prioritizing the growth of our ride-hailing service, we currently do not charge a fee for our ride-hailing service, and therefore

did not earn any revenue from the service. Our revenue presented therefore only consists of two-wheeled electric vehicle revenue.

Our

two-wheeled electric vehicle revenue decreased by $1.1 million, or 11.3%, from $9.5 million during the six months ended June 30, 2023

to $8.4 million during the six months ended June 30, 2024, primarily attributable to decreased average daily rides per vehicle as a result

of macroeconomic headwinds in Türkiye, leading to reductions in the purchasing power of our customers. The Consumer Price Index

(“CPI”) increased by 64.8% in 2023 and 71.6% as of the six months of June 30, 2024 compared to the same period in 2023. Due

to a return to orthodox macroeconomic policies, the Turkish Central Bank indicated a decreasing inflation forecast of 38% for 2024. We

responded to local inflation by increasing our prices in excess of inflation, thereby improving our gross profitability at the expense

of demand.

The

number of average daily vehicles deployed increased from 34.4 thousand during the six months ended June 30, 2023 to 34.6 thousand during

the six months ended June 30, 2024, or 0.4%, through a combination of deploying 4 thousand new e-mopeds, retirements of our older generations

of e-scooters, and efficiencies in our battery swapping and repair and maintenance activities to ensure that a greater share of our fleet

is available for rent on the field on a daily basis. While increasing our availability, we also took several profitability enhancing

measures, ceasing operations in lower performing cities and reallocating vehicles to higher performing cities. The positive revenue effect

of the increased number of deployed vehicles to higher performing cities was $0.2 million. TL price increases in excess of currency depreciation

relative to USD and inflation had a positive revenue effect of $3.9 million by increasing average revenue per ride. The price increases

reduced average daily rides per vehicle from 1.24 to 0.79, creating a negative revenue effect of $4.7 million. Lower ride durations produced

a further negative revenue effect of $0.1 million. Foreign exchange rates produced a $0.5 million negative revenue effect.

Cost

of Revenues

Our

cost of revenues decreased by $3.1 million, or 24.1%, from $13.0 million during the six months ended June 30, 2023 to $9.9 million during

the six months ended June 30, 2024, primarily attributable to the decreased operating lease expenses and personnel expenses.

Our

operating lease expense decreased by $0.9 million, or 48.9%, from $1.9 million during the six months ended June 30, 2023 to $1.0 million

during the six months ended June 30, 2024, as a result of ceasing operations in three cities after the six months ended June 30, 2023.

We also reduced our number of vans and motorcycles used for field operations after the six months ended June 30, 2023. Our personnel

expenses decreased by $1.3 million, or 31.0%, from $4.0 million during the six months ended June 30, 2023 to $2.8 million during the

six months ended June 30, 2024, primarily attributable to a 38.9% decrease in the average number of blue-collar employees from 660 during

the six months ended June 30, 2023 to 403 during the six months ended June 30, 2024.

Gross

Profit

Our

gross profit increased by $2.1 million from $(3.3) million during the six months ended June 30, 2023 to $(1.5) million during the six

months ended June 30, 2024, primarily attributable to decreasing operating lease expense with an effect of $1.0 million and personnel

expenses with an effect of $1.3 million. Despite our lower net revenue, due to several profitability enhancing measures, including ceasing

operations in lower performing cities and reallocating vehicles to higher performing cities, and reducing our number of vans and motorcycles

for field operations, we achieved a significant improvement in gross profit.

General

and Administrative

Our

general and administrative expense increased by $3.4 million, or 59.7%, from $5.7 million during the six months ended June 30, 2023 to

$9.1 million during the six months ended June 30, 2024, primarily attributable to consulting and legal expenses related to and following

our public listing, and personnel expenses. Consulting and legal expenses increased by $0.9 million, or 76.1%, from $1.1 million during

the six months ended June 30, 2023 to $2.0 million during the six months ended June 30, 2024. Personnel expenses increased by $2.3 million,

or 67.3%, for the same period, from $3.5 million to $5.8 million primarily attributable to an increase in the size of our ride-hailing

team, new management personnel joining the Company in the run up to and following the listing, and salary adjustments in excess of local

inflation.

Selling

and Marketing

Our

selling and marketing expense increased by $3.3 million, or 101.3%, from $3.2 million during the six months ended June 30, 2023 to $6.5

million during the six months ended June 30, 2024, primarily attributable to social media expense, promotional operating expense, and

advertising consulting expense for our ride-hailing business. Social media expense increased by $0.8 million, or 59.9%, from $1.3 million

during the six months ended June 30, 2023 to $2.2 million during the six months ended June 30, 2024. Promotional operating expense increased

by $0.8 million, or 172.7%, from $0.5 million during the six months ended June 30, 2023 to $1.2 million during the six months ended June

30, 2024 and advertising consulting expense increased by $0.7 million, or 72.9%, from $1.0 million during the six months ended June 30,

2023 to $1.7 million during the six months ended June 30, 2024. The majority of our selling and marketing expenses are attributable to

increasing online and offline marketing and direct rider and driver promotion activities for our ride-hailing services.

Other

Income (Expense), Net

Our

other income (expense), net, increased by $0.4 million, or 221.6%, from $0.2 million expense during the six months ended June 30, 2023

to $0.6 million expense during the six months ended June 30, 2024, primarily attributable to an increase in the subsidies we offer for

our ride-hailing driver fines, which we view as a marketing activity.

Operating

Segments – Results

| | |

Six Months Ended June 30, | | |

Period-over-Period Change

Six

Months Ended

June 30,

2024 to 2023 | |

| (in thousands) | |

2024 | | |

2023 | | |

Change ($) | | |

Change (%) | |

| Two-wheeled electric vehicle – revenue | |

$ | 8,409 | | |

$ | 9,485 | | |

$ | (1,076 | ) | |

| (11.3 | )% |

| Ride-hailing – revenue | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Unallocated - revenue | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Total revenue | |

$ | 8,409 | | |

$ | 9,485 | | |

$ | (1,076 | ) | |

| (11.3 | )% |

| Two-wheeled electric vehicle – cost of revenue | |

$ | (9,886 | ) | |

$ | (13,018 | ) | |

$ | 3,132 | | |

| (24.1 | )% |

| Ride-hailing – cost of revenue | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Unallocated - cost of revenue | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Total cost of revenue | |

$ | (9,886 | ) | |

$ | (13,018 | ) | |

$ | 3,132 | | |

| (24.1 | )% |

| Two-wheeled electric vehicle – selling and marketing expenses | |

$ | (226 | ) | |

$ | (225 | ) | |

$ | (1 | ) | |

| 0.4 | % |

| Ride-hailing – selling and marketing expenses | |

$ | (6,236 | ) | |

$ | (2,986 | ) | |

$ | (3,250 | ) | |

| 108.9 | % |

| Unallocated - selling and marketing expenses | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Total selling and marketing expenses | |

$ | (6,462 | ) | |

$ | (3,211 | ) | |

$ | (3,251 | ) | |

| 101.3 | % |

| Two-wheeled electric vehicle – general and administrative expenses | |

$ | (3,855 | ) | |

$ | (4,443 | ) | |

$ | 589 | | |

| (13.3 | )% |

| Ride-hailing – general and administrative expenses | |

$ | (5,198 | ) | |

$ | (1,225 | ) | |

$ | (3,974 | ) | |

| 324.4 | % |

| Unallocated - general and administrative expenses | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Total general and administrative expenses | |

$ | (9,053 | ) | |

$ | (5,668 | ) | |

$ | (3,385 | ) | |

| 59.7 | % |

| Two-wheeled electric vehicle – research and development expenses | |

$ | (46 | ) | |

$ | – | | |

$ | (46 | ) | |

| 100.0 | % |

| Ride-hailing – research and development expenses | |

$ | (566 | ) | |

$ | – | | |

$ | (566 | ) | |

| 100.0 | % |

| Unallocated - research and development expenses | |

$ | – | | |

$ | (1,500 | ) | |

$ | 1,500 | | |

| (100.0 | )% |

| Total research and development expenses | |

$ | (611 | ) | |

$ | (1,500 | ) | |

$ | 889 | | |

| (59.3 | )% |

| Two-wheeled electric vehicle – other expense | |

$ | (495 | ) | |

$ | – | | |

$ | (495 | ) | |

| 100.0 | % |

| Ride-hailing – other expense | |

$ | (1,104 | ) | |

$ | – | | |

$ | (1,104 | ) | |

| 100.0 | % |

| Unallocated - other expense | |

$ | – | | |

$ | (565 | ) | |

$ | 565 | | |

| (100.0 | )% |

| Total other expense | |

$ | (1,599 | ) | |

$ | (565 | ) | |

$ | (1,033 | ) | |

| 182.9 | % |

| Two-wheeled electric vehicle – other income | |

$ | 984 | | |

$ | – | | |

$ | 984 | | |

| 100.0 | % |

| Ride-hailing – other income | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Unallocated - other income | |

$ | – | | |

$ | 374 | | |

$ | (374 | ) | |

| (100.0 | )% |

| Total other income | |

$ | 984 | | |

$ | 374 | | |

$ | 610 | | |

| 163.1 | % |

| Two-wheeled electric vehicle – financial income | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Ride-hailing – financial income | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Unallocated - financial income | |

$ | 559 | | |

$ | 2,720 | | |

$ | (2,161 | ) | |

| (79.5 | )% |

| Total financial income | |

$ | 559 | | |

$ | 2,720 | | |

$ | (2,161 | ) | |

| (79.5 | )% |

| Two-wheeled electric vehicle – financial expense | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Ride-hailing – financial expense | |

$ | – | | |

$ | – | | |

$ | – | | |

| – | |

| Unallocated - financial expense | |

$ | (4,209 | ) | |

$ | (1,946 | ) | |

$ | (2,263 | ) | |

| 116.2 | % |

| Total financial expense | |

$ | (4,209 | ) | |

$ | (1,946 | ) | |

$ | (2,263 | ) | |

| 116.2 | % |

| Two-wheeled electric vehicle –loss before income tax expense | |

$ | (5,114 | ) | |

$ | (8,202 | ) | |

$ | 3,087 | | |

| (37.6 | )% |

| Ride-hailing – loss before income tax expense | |

$ | (13,104 | ) | |

$ | (4,211 | ) | |

$ | (8,893 | ) | |

| 211.2 | % |

| Unallocated - loss before income tax expense | |

$ | (3,650 | ) | |

$ | (918 | ) | |

$ | (2,732 | ) | |

| 297.5 | % |

| Total loss before income tax expense | |

$ | (21,869 | ) | |

$ | (13,331 | ) | |

$ | (8,538 | ) | |

| 64.0 | % |

Segment

Results – Six Months Ended June 30, 2024 Compared to Six Months Ended June 30, 2023

Two-wheeled

Electric Vehicle Segment

Revenue

Given

we currently do not charge a fee for our ride-hailing service, our revenue presented herein only consists of two-wheeled electric vehicle

revenue. See our previous discussion of our revenue under Operating Results.

Cost

of Revenue

Given

we currently do not charge a fee for our ride-hailing service, our cost of revenue presented herein only consists of two-wheeled electric

vehicle revenue. See our previous discussion of our cost of revenue under Operating Results.

General

and Administrative Expenses

Two-wheeled

electric vehicle general and administrative expense decreased by $0.6 million, or 13.3%, from $4.4 million during the six months ended

June 30, 2023 to $3.9 million during the six months ended June 30, 2024, primarily attributable to a decrease in personnel expenses due

to reducing the size of our two-wheeled electric vehicle team, and focusing both the attention and time of management and central functions

like government relations, finance, and legal away from our two-wheeled electric vehicle business and towards our ride-hailing business.

Personnel expenses decreased by $0.3 million, or 13.5%, from $2.5 million during the six months ended June 30, 2023 to $2.1 million during

the six months ended June 30, 2024.

Selling

and Marketing Expenses

Two-wheeled electric vehicle selling and marketing expense was unchanged

at $0.2 million during the six months ended June 30, 2023 and 2024.

Other

Income (Expense), Net

Two-wheeled

electric vehicle other income (expense), net, increased by $0.5 million, or 100.0%, from zero during the six months ended June 30, 2023

to $0.5 million expense during the six months ended June 30, 2024, primarily attributable to a decrease in longstanding liability of

$0.7 million and a loss of claim income of $0.2 million.

Ride-hailing

Segment

Revenue

With

the goal of prioritizing the growth of our ride-hailing service, we currently do not charge a fee for our ride-hailing service, and therefore

did not earn any revenue from the service.

Cost

of Revenue

There

was no ride-hailing cost of revenue during the six months ended June 30, 2024 and 2023, as our ride-hailing segment did not generate

revenue in the period. $0.8 million of the costs classified as ride-hailing selling and marketing expenses during the six months ended

June 30, 2024, were expenditures directly related to providing the ride-hailing service and would have been categorized as ride-hailing

cost of revenue had the ride-hailing segment monetized.

General

and Administrative Expenses

Ride-hailing

general and administrative expense increased by $4.0 million, or 324.4%, from $1.2 million during the six months ended June 30, 2023

to $5.2 million during the six months ended June 30, 2024 primarily attributable to an increase in personnel expenses, and consulting

and legal expenses related to and following our public listing. Personnel expenses increased by $2.7 million, or 266.9%, from $1.0 million

during the six months ended June 30, 2023 to $3.7 million during the six months ended June 30, 2024. The increase is primarily attributable

to an increase in the size of our ride-hailing team, and changes in the time allocation of management and central functions like government

relations, finance, and legal away from our two-wheeled electric vehicle service and towards our ride-hailing service. Consulting and

legal expenses increased by $0.8 million, or 521.6%, from $0.2 million during the six months ended June 30, 2023 to $1.0 million during

the six months ended June 30, 2024, primarily attributable to higher audit and legal consulting expenses after listing.

Selling

and Marketing Expenses

Ride-hailing

selling and marketing expense increased by $3.3 million, or 108.9%, from $3.0 million during the six months ended June 30, 2023 to $6.2

million during the six months ended June 30, 2024, primarily attributable to social media expense, promotional operating expense, and

advertising consulting expense. Social media expense increased by $0.8 million, or 58.6%, from $1.3 million during the six months ended

June 30, 2023 to $2.1 million during the six months ended June 30, 2024. Promotional operating expense increased by $0.9 million, or

by 280.2%, from $0.3 million during the six months ended June 30, 2023 to $1.2 million during the six months ended June 30, 2024 and

advertising consulting expense increased by $0.8 million, or 95.7%, from $0.9 million during the six months ended June 30, 2023 to $1.7

million during the six months ended June 30, 2024. Our selling and marketing activities include a range of online and offline marketing

actions, and direct rider and driver promotions to encourage the growth of our rider and driver bases.

As

we do not currently charge a fee for our ride-hailing service, costs of delivering the service have been classified as ride-hailing selling

and marketing expenses. Data cost was $0.3 million, as we invested in servers and mapping services, and call center cost was $0.4 million

for driver on-boarding and customer support.

Other

Income (Expense), Net

Ride-hailing

other income (expense), net, was $1.1 million during the six months ended June 30, 2024, primarily attributable to the subsidies we offer

for driver fines, which we view as a marketing activity.

Key

Metrics and Non-GAAP Financial Measures

Our

management reviews the following key business metrics and non-GAAP financial measures, including Adjusted EBITDA and pre-depreciation

contribution per ride, to evaluate our business, measure performance, identify trends affecting our business, formulate business plans,

and make strategic decisions. We believe that, in addition to conventional measures prepared in accordance with U.S. Generally Accepted

Accounting Principles (“GAAP”), certain investors and analysts use this information to evaluate the Company’s core

operating and financial performance and our financial position. We believe these non-GAAP measures are useful to investors in evaluating

our performance by providing an additional tool for investors to use in comparing our financial performance over multiple periods. Nevertheless

our use of Adjusted EBITDA and pre-depreciation contribution per ride has limitations as an analytical tool, and you should not consider

these measures in isolation or as a substitute for analysis of our financial results as reported under GAAP. Other companies may calculate

similarly-titled non-GAAP financial measures differently than us, thereby limiting the usefulness of these non-GAAP financial measures

as a comparative tool. Because of these and other limitations, you should consider our non-GAAP measures only as supplemental to other

GAAP-based financial performance measures, including net loss and gross profit per ride.

| | |

Six Months Ended June 30, | |

| (in thousands, except as otherwise noted) | |

2024 | | |

2023 | |

| Operating Metrics: | |

| | |

| |

| Two-wheeled electric vehicle | |

| | |

| |

| Average Rides per Vehicle per Day | |

| 0.79 | | |

| 1.24 | |

| Average Daily Vehicles Deployed (in thousands) | |

| 35 | | |

| 34 | |

| Total Rides (in millions) | |

| 4.97 | | |

| 7.72 | |

| Net Revenue per Ride | |

$ | 1.69 | | |

$ | 1.23 | |

| Gross Profit per Ride | |

$ | (0.30 | ) | |

$ | (0.46 | ) |

| Fleet Depreciation (in thousands) | |

$ | 4,176 | | |

$ | 4,284 | |

| Ride-hailing | |

| | | |

| | |

| Number of Unique Riders (in thousands) | |

| 1,101 | | |

| 124 | |

| Number of Registered Drivers (in thousands) | |

| 171 | | |

| 41 | |

| Non-GAAP Financial Measures | |

| | | |

| | |

| Adjusted EBITDA (in thousands)(1) | |

$ | (11,328 | ) | |

$ | (8,869 | ) |

| Pre-Depreciation Contribution per Ride | |

$ | 0.54 | | |

$ | 0.10 | |

| (1) |

Adjusted EBITDA includes

both two-wheeled electric vehicles and ride-hailing segments. |

Operating

Metrics

| |

● |

Average Rides per Vehicle

per Day: This metric reflects the number of Total Rides during the relevant time period (please see the metric below), divided

by the Average Daily Vehicles Deployed during the relevant time period (please see the metric below), divided by the number of days

in the relevant time period. We believe this is an important metric for management because it reflects the utilization of each individual

vehicle which is available for use and is therefore a proxy for demand per fleet unit for our service, serving as a key metric for

investors. |

| |

● |

Average Daily Vehicles

Deployed: This metric includes a vehicle that is available for rent, in use, or reserved for future use by a rider during at

least one instance during the day as a deployed vehicle. The metric looks at the total number of such deployed vehicles across each

day of the period, and takes the average of these daily figures as the average daily vehicles deployed. We believe this is an important

metric for management as it increases in line with the total size of our fleet, while also reflecting the share of this fleet that

is available for rent, in use, or reserved for future use on a daily basis. This metric excludes vehicles that are offline due to

repair, maintenance or having run out of battery on the field. As such, this metric also reflects the operating efficiency of our

repair and maintenance and battery swapping teams in making our fleet available for rent by riders. As these available vehicles represent

vehicles that impact revenue for our business, it is an important metric for investors. |

| |

● |

Total Rides: This

metric reflects the total number of rides that have taken place on our vehicles during the relevant time period. We believe this

is an important metric for management as it reflects the size of our business, including both the scale of our fleet which is available

for use, as measured by average daily vehicles deployed, and the fleet’s utilization level, as measured by average daily rides

per vehicle. It is a similarly important metric for investors as it reflects total demand for our service in light of our current

fleet availability. |

| |

● |

Net Revenue per Ride:

The numerator of this metric is our net revenue and the denominator is the number of rides completed by our vehicles, both during

a specific time period. Our net revenue is calculated as the gross revenue received by us from riders, less value added tax, and

less promotional discounts, coupons, and refunds. We believe this is an important metric for management as, under our starting fare

and minute-based pricing model, it reflects both our pricing policy and average ride durations. The metric therefore enables management

to change our pricing policy as may be necessary, including to incentivize shorter or longer ride durations as it may target, to

achieve a specific net revenue per ride figure. This is an important metric for investors because it enables investors to assess

the appropriateness of our pricing policy in light of our cost structure. |

| |

● |

Gross Profit per Ride:

The numerator of this metric is our gross profit during a given time period. This is calculated as our pre-depreciation contribution

(please see the metric below for the calculation of the pre-depreciation contribution), less depreciation during the given time period.

Depreciation reflects the amount of the decline in the book value of the fleet during the given time period, and does not include

disposals or any other changes in book value. Gross profit is divided by the total number of rides completed by our vehicles during

a given time period in order to reflect the gross profit per ride. We believe this is an important metric for management as it enables

us to assess the per ride unit profitability of our service, including all of the revenue we earn and all of the costs we incur to

deliver that service, excluding fixed costs. This also makes it an important metric for investors as it enables investors to assess

the operating health of our business and at what scale of rides we will be able to earn sufficient gross profit to cover our fixed

costs. |

| |

● |

Fleet Depreciation:

This metric reflects the amount of the decline in the book value of our fleet over a given time period, and does not include

disposals or any other changes in book value. We believe this is an important metric for management as it reflects how much we would

have to spend in order to maintain the remaining useful life of our fleet at the start of the given time period in light of the amount

of depreciation incurred during the given time period. This is also an important metric for investors as it reflects how much cash

we would need to produce, either organically from operations or externally through funding, in order to maintain the remaining useful

life of our fleet at the start of the given time period. |

| |

● |

Unique Ride-hailing

Riders: This metric reflects the total number of riders who have completed at least one ride using our car-hailing, motorcycle-hailing,

or taxi-hailing services since we launched our ride-hailing service in October 2022. Unique Ride-hailing Riders are counted only

once upon completing their first rides. We believe this is an important metric both for management and investors as it reflects the

total demand for our ride-hailing services. |

| |

● |

Unique Ride-hailing

Drivers: This metric reflects the total number of drivers who have been onboarded for at least one of our car-hailing, motorcycle-hailing,

or taxi-hailing services since we launched our ride-hailing service in October 2022. Unique Ride-hailing Drivers are counted only

once upon completing the onboarding process. We believe this is an important metric for management as it reflects the scale of our

available drivers available for riders to use. It is a similarly important metric for investors as it reflects the total supply for

our ride-hailing service in light of our driver availability. |

Non-GAAP

Financial Measures and Reconciliations of Non-GAAP Financial Measures

Adjusted

EBITDA: Adjusted EBITDA is calculated by adding depreciation, amortization, taxes, financial expenses (net of financial income) and

one-time charges and non-cash adjustments, to net income (loss). The one-time charges and non-cash adjustments are mainly comprised of

customs tax provision expenses resulting from the one-time amendment of customs duties and lawsuit provision expense which Marti did

not consider the provision to be reflective of its normal cash operations.

Adjustments

for customs tax provision expenses are not normal, recurring expenses because they result from a one-time amendment of our customs duties

to reflect e-scooters imported in finished vehicle form under a single customs duty product code rather than as separate parts with their

corresponding different customs duty product codes. While the then-applicable customs law did not specify in which form e-scooters had

to be imported historically this law has now been revised to reflect the fact that e-scooters must be imported in finished vehicle form.

We will therefore perform all of our imports as finished vehicles moving forward, and do not expect to perform any future amendments

or incur the resulting customs tax provision expenses in the future. The one-time nature of the customs tax provision expense is further

supported by the fact that it is exclusively related to the e-scooters imported.

The

following table presents a reconciliation of Adjusted EBITDA to net income (loss), which is the most directly comparable GAAP measure,

for the periods indicated:

| | |

Six Months Ended June 30, | |

| (in thousands) | |

2024 | | |

2023 | |

| Net Loss | |

$ | (21,869 | ) | |

$ | (13,331 | ) |

| Depreciation and Amortization | |

$ | 4,359 | | |

$ | 4,672 | |

| Income Tax Expense | |

$ | -- | | |

$ | -- | |

| Financial Income | |

$ | (559 | ) | |

$ | (2,720 | ) |

| Financial Expense | |

$ | 4,209 | | |

$ | 1,946 | |

| Customs tax provision expense | |

$ | 33 | | |

$ | (78 | ) |

| Lawsuit provision expense | |

$ | 16 | | |

$ | 67 | |

| Stock based compensation expense accrual | |

$ | 2,483 | | |

$ | 574 | |

| Adjusted EBITDA | |

$ | (11,328 | ) | |

$ | (8,869 | ) |

| |

● |

Pre-Depreciation Contribution

per Ride: Pre-depreciation contribution per ride is calculated by adding depreciation per ride to gross profit per ride. The

numerator of this metric is our pre-depreciation contribution, which is calculated as our net revenue (please see the metric above

for the calculation of our net revenue) less all variable costs, excluding depreciation, necessary to make vehicles available for

rent on the field, during a given time period. Our variable costs include the field operations team, the field operations service

vans and motorcycles, the fuel consumed by field operations service vans and motorcycles, the repair and maintenance team, spare

parts, charging station rent, electricity costs, customer service call center costs, field operations control center costs, occupancy

fees paid to municipalities, data costs for servers and the internet connectivity of our vehicles, payment processing costs, invoice

costs, and other operating costs. Pre-depreciation contribution is divided by the total number of rides completed by our vehicles

during a given time period in order to reflect the pre-depreciation contribution per ride. We believe this is an important metric

for management as it lets us assess the efficiency of our field operations and repair and maintenance teams in servicing our vehicles

on the field, distinct from the performance of our vehicle team in increasing the useful life of our vehicles off of the field as

reflected by depreciation. The metric also lets us compute the number of rides after which we pay back the fully loaded cost of our

vehicles, by dividing our fully loaded vehicle cost by our pre-depreciation contribution per ride. This makes it an important metric

for investors to track our operating efficiency and unit economics. |

The

following table presents a reconciliation of pre-depreciation contribution per ride to gross profit per ride in our Two-wheeled Electric

Vehicle segment, which is the most directly comparable GAAP measure, for the periods indicated:

| | |

Six Months Ended June 30, | |

| | |

2024 | | |

2023 | |

| Gross Profit per ride | |

$ | (0.30 | ) | |

$ | (0.46 | ) |

| Depreciation per ride | |

$ | (0.84 | ) | |

$ | (0.56 | ) |

| Pre-Depreciation Contribution Per Ride | |

$ | 0.54 | | |

$ | 0.10 | |

Liquidity

and Capital Resources

Our

principal sources of liquidity have historically consisted of cash generated from operations, capital increases, and various forms of

debt financing. Marti had $9.0 million in cash and cash equivalents as of June 30, 2024.

We

have incurred net losses and negative cash flows from operations since our inception. Our ability to fund working capital, make capital

expenditures, and service our debt will depend on our ability to generate cash from operating activities, which is subject to our future

operating success, and obtain financing on reasonable terms, which is subject to factors beyond our control, including general economic,

political, and financial market conditions.

Until

we can generate sufficient revenue to cover operating expenses, working capital and capital expenditures, we expect to fund cash needs

primarily through a combination of equity and debt financing. If we raise funds by issuing equity securities, dilution to our then-existing

shareholders may result. Any equity securities issued may also provide for rights, preferences or privileges senior to those of holders

of our ordinary shares. If we raise funds by issuing debt securities, such debt securities may have rights, preferences or privileges

senior to those of our preferred shareholders and holders of our ordinary shares.

The

terms of our debt securities or borrowings could impose significant restrictions on our operations and our ability to undertake certain

fundraising activities. The capital markets have in the past, and may in the future, experience periods of volatility and upheaval that

could impact the availability and cost of equity and debt financing.

Sales

of a substantial number of shares of our Ordinary Shares in the public market by securityholders, or the perception that those sales

might occur, could depress the market price of our Ordinary Shares and could impair our ability to raise capital through the sale of

additional equity securities. We are unable to predict the effect that such sales may have on the prevailing market price of our Ordinary

Shares.

We

have concluded that we have adequate resources and liquidity to meet our cash flow requirements for the next twelve months, and we believe

that it is reasonable to apply the going concern basis as the underlying assumption for our unaudited interim condensed consolidated

financial statements. This assessment includes knowledge of our subsequent financial position, the estimated economic outlook and identified

risks and uncertainties in relation thereto. Furthermore, the review of our strategic plan and budget, including expected developments

in liquidity were considered.

In

the future, we may enter into arrangements to acquire or invest in complementary businesses, products, and technologies. We may be required

to seek additional equity or debt financing to consummate such transactions. In the event that we require additional financing, we may

not be able to raise such financing on acceptable terms or at all. If we are unable to raise additional capital or generate cash flows

necessary to expand our operations and invest in continued innovation, we may not be able to compete successfully, which would harm our

business, results of operations, and financial condition.

Cash

Flows

The

following table presents a summary of our unaudited interim condensed consolidated cash flows provided by (used in) operating, investing,

and financing activities for the periods indicated:

| | |

Six Months Ended June 30, | |

| (in thousands) | |

2024 | | |

2023 | |

| Net cash used in/provided by operating activities | |

$ | (10,484 | ) | |

$ | (6,095 | ) |

| Net cash (used in) provided by investing activities | |

$ | (732 | ) | |

$ | (3,994 | ) |

| Net cash provided by financing activities | |

$ | 757 | | |

$ | 3,562 | |

Operating

Activities

Our

net cash used in operating activities was $10.5 million during the six months ended June 30, 2024, primarily consisting of operational

losses from our two-wheeled electric vehicle operations and investments in growing our ride-hailing business. We will continue to invest

aggressively in growing our ride-hailing business and focus on operational efficiency in our two-wheeled electric vehicle business through

the second half of 2024, and we will evaluate the opportunity to expand our fleet no earlier than the summer of 2025.

Our

net cash used by operating activities was $6.1 million during the six months ended June 30, 2023, primarily due to operational losses

in our two-wheeled electric vehicle operations, and investments in achieving the initial scale of our ride-hailing business post launch

in the fourth quarter of 2022.

Investing

Activities

Our

net cash used in investing activities was $0.7 million during the six months ended June 30, 2024, primarily consisting of purchases of

intangible assets.

Our

net cash used in investing activities was $4.0 million during the six months ended June 30, 2023, primarily consisting of purchases of

new vehicles.

Financing

Activities

Our

net cash provided by financing activities was $0.8 million for the six months ended June 30, 2024, driven by the issuance of $7.5 million

convertible notes, the repayment of $2.7 million of term loans, and interest paid of $3.1 million.

Our

net cash provided by financing activities was $3.6 million for the six months ended June 30, 2023, driven by the issuance of $7.5 million

pre-funded notes, the repayment of $3.3 million of term loans, and interest paid of $0.6 million.

Warrant

Redemption

On

January 4, 2024, the Company completed the redemption of its outstanding warrants for a cash redemption price of $0.07 per warrant, totaling

$89,970. In connection with the redemption, the warrants were suspended from trading on the NYSE American prior to 9:00 a.m. Eastern

Time on January 4, 2024, and were delisted pursuant to a Form 25 filed by the NYSE American.

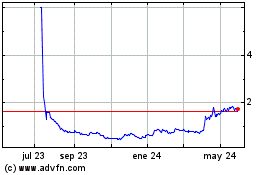

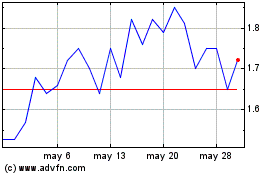

Share

Repurchase Program

On

January 10, 2024, our Board authorized a share repurchase program under which we may repurchase up to $2.5 million of our outstanding

Class A ordinary shares for a period of six months from January 10, 2024 (the “Initial Repurchase Program”). On April 24,

2024, our Board amended the Initial Repurchase Program by extending the term by three months, or until October 9, 2024, and setting a

ceiling price of $3.30 per share (the “Amended Repurchase Program”). Under the Amended Repurchase Program, we may repurchase

Class A ordinary shares in privately negotiated or open-market transactions in accordance with applicable securities laws and regulations,

including Rule 10b-18 of the Securities Exchange Act of 1934, as amended. The Board may periodically review the Amended Repurchase Program

and decide to extend its terms or increase the authorized amount. The Amended Repurchase Program may also be suspended or discontinued

by the Board at any time.

PFG

Credit Agreement

In

January 2021, Marti Delaware entered into that certain Loan and Security Agreement with PFG, which was modified by that certain Joinder

and Modification No. 1 to Loan and Security Agreement, dated as of November 24, 2021, that certain Consent, Waiver and Amendment Agreement,

dated as of July 29, 2022 and the Waiver and Modification No. 2 to Loan and Security Agreement and Modification No. 2 to Annex D of the

PFG Consent dated as of December 23, 2022 (as modified, the “Loan Agreement”).

The

Loan Agreement provides for delayed draw term loans up to an aggregate amount of $20,000,000 at a fixed rate of 10.25% and is secured

by substantially all of our assets. We make monthly principal and interest payments to PFG pursuant to the agreements. The outstanding

balance of the loan as of June 30, 2024 and 2023, was $4.0 million and $10.0 million, respectively.

Pre-Fund

Subscription Agreements

In

connection with the execution of the business combination agreement, dated July 29, 2022, as amended, we entered into a convertible note

subscription agreement (the “Pre-Fund Subscription Agreement”), pursuant to which Farragut purchased $15 million in unsecured

convertible promissory notes, Sumed Equity purchased $1.0 million in unsecured convertible promissory notes, European Bank for Reconstruction

and Development purchased $1.0 million in unsecured convertible promissory notes, and AutoTech purchased $500,000 in unsecured convertible

promissory notes (collectively, the “Pre-Fund Notes”). The Pre-Fund Notes converted into convertible notes at the closing

of the business combination on July 10, 2023. The counterparties to certain of the Pre-Fund Subscription Agreement were directors, officers

or affiliates of the Company. See “Certain Relationships and Related Party Transactions — Marti Relationships

and Related Party Transactions — Pre-Funded Notes” in our Annual Report.

Convertible

Note Subscription Agreements

Pre-funded

notes which were classified under long-term financial liabilities account amounting to $19,274,415 became convertible notes as of the

closing date of July 10, 2023. In addition to that, the Company had net proceeds of $35,500,000 from private investment in public equity

(“PIPE”) financing as convertible notes at the closing date of the business combination.

Investment

amount (USD) | | |

Agreement

Date | |

|

| | 10,000,000 | | |

July 10, 2023 | |

405 MSTV I LP |

| | 10,000,000 | | |

July 10, 2023 | |

Keystone Group, L.P. |

| | 1,000,000 | | |

July 10, 2023 | |

Gramercy Emerging Markets Dynamic Credit Fund |

| | 1,500,000 | | |

July 10, 2023 | |

Gramercy Multi-Asset Fund LP |

| | 3,700,000 | | |

July 10, 2023 | |

Weiss – Brookdale Global Opportunity Fund (“BGO”) |

| | 6,300,000 | | |

July 10, 2023 | |

Weiss – Brookdale International Partners, L.P. (“BIP”) |

| | 3,000,000 | | |

July 10, 2023 | |

B Riley |

| | 16,395,421 | | |

July 10, 2023 | |

Farragut Square Global Master Fund, LP. |

| | 1,193,901 | | |

July 10, 2023 | |

Sumed Equity Ltd. |

| | 1,123,395 | | |

July 10, 2023 | |

European Bank for Reconstruction and Development |

| | 561,698 | | |

July 10, 2023 | |

Autotech Fund II, L.P. |

| | 54,774,415 | | |

| |

|

Balances of the convertible notes, including accrued interest, as of

June 30, 2024 were as follows:

| Convertible notes balance (USD) | | |

|

| | 10,492,000 | | |

405 MSTV I LP |

| | 10,492,000 | | |

Keystone Group, L.P. |

| | 1,049,201 | | |

Gramercy Emerging Markets Dynamic Credit Fund |

| | 1,573,800 | | |

Gramercy Multi-Asset Fund LP |

| | 3,370,582 | | |

Weiss – Brookdale Global Opportunity Fund (“BGO”) |

| | 6,098,501 | | |

Weiss – Brookdale International Partners, L.P. (“BIP”) |

| | 17,202,076 | | |

Farragut Square Global Master Fund, LP. |

| | 1,252,641 | | |

Sumed Equity Ltd. |

| | 1,178,667 | | |

European Bank for Reconstruction and Development |

| | 589,334 | | |

Autotech Fund II, L.P. |

| | 1,573,800 | | |

Callaway Capital Management, LLC |

| | 7,671,875 | | |

405 MSTV I, L.P. |

| | 62,544,477 | | |

|

Callaway

Subscription Agreement

On May 4, 2023 (prior to the closing of the business

combination), Galata Acquisition Corp. (now known as the Company) and Callaway Capital Management LLC (“Callaway”) entered

into a convertible note subscription agreement, as amended on January 10, 2024 (the “Callaway Subscription Agreement”). Callaway

is an affiliate of Daniel Freifeld, a director of the Company. Pursuant to the terms of the Callaway Subscription Agreement, Callaway

or its designee has the option (the “Callaway Option”) (but not the obligation) to subscribe for up to $40,000,000 aggregate

principal amount of convertible notes (the “Convertible Notes”), which are convertible into the Company’s Class A ordinary

shares during the period beginning on the closing date of the business combination, which occurred on July 10, 2023 (the “Closing

Date”), and the fifteen (15) months after the Closing Date (the “Subscription End Date”), provided that the Subscription

End Date shall be automatically extended by three (3) months for each issuance of $5,000,000 of the aggregate principal amount of the

Convertible Notes subscribed by Callaway following the date thereof.

On September 23, 2024, the Company and Callaway

agreed upon a form of convertible note subscription agreement (the “Amended and Restated Subscription Agreement”) to, among

other things, reflect the agreements between the Company and Callaway set forth in the Commitment Letter Amendment (as defined below)

with the intent that further subscriptions subject to the Callaway Option would be pursuant to such form.

Callaway

Commitment Letter

On March 22, 2024, Callaway provided a commitment letter to the Company

(the “Commitment Letter”) in order to evidence its commitment to (i) subscribe for the Convertibles Notes in an aggregate

principal amount of $15,000,000 with the relevant closing date occurring on or before March 22, 2025 and (ii) timely deliver the relevant

purchase price as described in the Callaway Subscription Agreement.

On September 19, 2024, the Company and Callaway

entered into an amendment to the Commitment Letter (the “Commitment Letter Amendment”) whereby (i) Callaway agreed to further

exercise, or to cause its designees to further exercise, the Callaway Option in the aggregate amount of $18,500,000 of principal Convertible

Notes (the “Amended Commitment Amount”), with (A) $7,500,000 of such principal amount to be exercised on or before March 22,

2025 and (B) an additional $11,000,000 of such principal amount to be exercised on or before July 1, 2026; (ii) the Company agreed to

(A) reserve for issuance to Callaway a number of Class A ordinary shares equal to twenty percent (20%) of the portion of the Amended Commitment

Amount paid on the closing date of any subscription in satisfaction of the Amended Commitment Amount, with such Class A ordinary shares

to be issued pursuant to terms set forth in the Commitment Letter Amendment and (B) issue to any subscriber of Convertible Notes in satisfaction

of the Amended Commitment Amount or, following the full satisfaction of the Amended Commitment Amount, in satisfaction of the Remaining

Option Amount (as defined below) a number of Class A ordinary shares equal to ten percent (10%) of the portion of the Amended Commitment

Amount, or Remaining Option Amount, as applicable, paid on the closing date of such subscription; and (iii) the Company and Callaway agreed

that the outside date of the Callaway Option shall be further extended to July 1, 2027.

Following the full satisfaction of the Amended

Commitment Amount, the Company and Callaway both acknowledge and agree that the remaining amount of the Callaway Option is $14,000,000

(the “Remaining Option Amount”).

Additional Subscriptions

On March 22, 2024, Marti and 405 MSTV I, L.P.

(an existing investor in the Convertible Notes, “MSTV”) entered into a convertible note subscription agreement whereby MSTV

subscribed for an aggregate principal amount of $7,500,000 in the Convertible Notes, which was deemed as a partial exercise of the Callaway

Option.

On September 23, 2024, the Company, Callaway, as a commitment party,

and MSTV and New Holland Tactical Alpha Fund LP, as subscribers (collectively, the “Subscribers”) entered into a subscription

agreement on the form of the Amended and Restated Subscription Agreement pursuant to which the Subscribers subscribed for an aggregate

principal amount of $2,000,000 of Convertible Notes and an aggregate of 121,212 Class A ordinary shares (the “Subscription”).

The Subscription was deemed as a partial exercise of the Amended Commitment Amount.

Off-Balance

Sheet Arrangements

We

did not have any off-balance sheet arrangements as of June 30, 2024.

Research

and Development, Patents, and Licenses, etc.

Intellectual

Property

Our

intellectual property rights are valuable to our business. We have confidentiality procedures to protect our intellectual property rights,

including but not limited to, non-disclosure agreements, intellectual property assignment agreements, and employee non-disclosures. We

have an ongoing trademark registration program pursuant to which we register our brand name and logos in Türkiye and will expand

to the other countries to the extent we determine appropriate.

As

of June 30, 2024, we held ten registered trademarks in Türkiye. In addition, we have registered domain names for websites that we

use in our business, such as www.marti.tech and other variations. We also control our intellectual property through specific terms of

use on our mobile application and website.

In

February 2024, we completed the acquisition of all of the intellectual property and software assets of Zoba, the leading AI-powered SaaS

platform offering dynamic fleet optimization algorithms for two-wheeled electric vehicle rental operators, as part of the operational

efficiency actions that we are continuing to take in 2024. Zoba dynamically optimizes where vehicles are deployed and when operational

tasks, such as battery swaps, rebalances, and pick-ups, occur to maximize ridership and minimize vehicle operational inefficiencies.

We

intend to pursue additional intellectual property protection to the extent we believe it would be beneficial and cost-effective for our

business. Despite our efforts to protect our intellectual property rights, they may not be respected in the future or may be invalidated,

circumvented, or challenged. See “Risk Factors —Risks Related to Our Intellectual Property and Technology — We

may be a party to intellectual property rights claims and other litigation that are expensive to support, and if resolved adversely,

could have a significant impact on us and our shareholders.” and “Risk Factors— Risks Related to Our Intellectual

Property and Technology — If we are unable to protect our intellectual property, the value of our brand and other

intangible assets may be diminished, and our business may be adversely affected.” in our Annual Report.

Critical

Accounting Estimates

The

preparation of unaudited interim condensed consolidated financial statements in conformity with GAAP requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities at the date of the unaudited interim condensed consolidated

financial statements, the reported amounts of revenues and expenses during the reporting period, and the disclosure of contingent assets

and liabilities at the date of the unaudited interim condensed consolidated financial statements.

Significant

items subject to estimates and assumptions include those related to useful lives of property and equipment, including electric moped,

electric bikes and electric scooters, legal contingencies, valuation allowance for deferred income taxes, determination of contract term

of rental building and vehicle related to right of use assets and the valuation of stock-based compensation. Actual results could differ

from those estimates.

We

based our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances,

the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent

from other sources. Due to the inherent uncertainty involved in making these estimates, actual results reported in future periods could

differ from our estimates.

We

believed that the following critical accounting policies reflect the more significant judgments, estimates, and assumptions used in the

preparation of our consolidated financial statements. For additional information, see the disclosure included in “Note 3 — Summary

of Significant Accounting Policies” in the notes to our unaudited interim condensed consolidated financial statements included

in our Interim Report.

Revenue

Recognition

For

the six months ended June 30, 2024 and 2023, we recognized revenue from rides taken by individual users of the Marti App as part of our

rental business, which we account for pursuant to ASC 842, Leases. Sales taxes, including value added taxes, are excluded from reported

revenue.

Rental

Our

technology platform enables users to participate in our Rental program. To use a vehicle, the user contracts with us via acceptance of

the Marti User Agreement (“MuA”). Under the MuA, users agree that we retain the applicable fee as consideration for the renting

of our vehicles.

Riders

pay on a per-ride basis with a valid credit card or prepaid card and/or from the preloaded wallet balances. The user must use the Marti

App to rent the vehicles and must end the ride on the Marti App to conclude the trip. Our performance obligation is to provide access

to the vehicles over the user’s desired period of use. The transaction price of each ride is generally determined based upon the

period of use and a predetermined rate per minute agreed to by the user prior to renting the vehicle. We account for these revenues as

operating lease revenue pursuant to ASC 842, Leases, and records revenue upon completion of each ride. We treat any credit, coupon, or

rider incentive as a reduction to the revenue for the ride in the period to which it relates. When customers fund a preloaded wallet

balance, the revenue is deferred until rides are actually taken by the user for the corresponding amounts.

We

may also issue, at our sole discretion, credits to customers for future rides issued as promotional codes. The value of those credits

is recorded as reduction of revenues when the credits are used by customers. Customer credits are not material to our operations.

Stock-Based

Compensation

Stock-based

compensation expense is allocated based on (i) the cost center to which the award holder belongs for employees and (ii) the service rendered

to us for third-party consultants.

We

periodically granted stock-based awards, including but not limited to, restricted ordinary shares, restricted share units and share options

to eligible employees and directors.

Stock-based

awards granted to employees and directors are measured at the grant date fair value of the awards, and are recognized as compensation

expense using the straight-line method over the requisite service period, which is generally the vesting period. Forfeitures are accounted

for when they occur.

A

change in any of the terms or conditions of stock-based awards is accounted for as a modification of the awards. We calculated incremental

compensation cost of a modification as the excess of the fair value of the modified awards over the fair value of the original awards

immediately before its terms are modified at the modification date. For vested awards, we recognized incremental compensation cost in

the period the modification occurs. For awards not being fully vested, we recognized the sum of the incremental compensation cost and

the remaining unrecognized compensation cost for the original awards over the remaining requisite service period after modification.

Property

and Equipment

Property

and equipment consist of equipment, furniture and fixtures, and rental electric scooters, electric bikes, and electric mopeds. Property

and equipment are stated at cost less accumulated depreciation. Depreciation is calculated using a straight-line method over the estimated

useful life of the related asset.

Depreciation

for property and equipment commences once they are ready for their intended use. Maintenance and repairs are charged to expense as incurred,

and improvements and betterments are capitalized. When assets are retired or otherwise disposed of, the cost and accumulated depreciation

are removed from the unaudited interim condensed consolidated balance sheet and any resulting gain or loss is reflected in the unaudited

interim condensed consolidated statement of operations in the period realized.

The

table below, shows the useful lives for the depreciation calculation using the straight-line method:

| Rental electric scooters | |

2 – 3 years |

| Rental electric bikes | |

2 – 3 years |

| Rental electric mopeds | |

3 – 4 years |

| Furniture and fixtures | |

7 years |

| Leasehold improvements | |

1 – 5 years |

Recent

Accounting Pronouncements

For

a discussion of recently issued accounting standards, see “Note 3 — Summary of significant accounting policies

— Recently issued accounting standards” to the notes to our unaudited interim condensed consolidated financial

statements included in our Interim Report.

Emerging

Growth Company Accounting Election

Section

102(b)(1) of the JOBS Act exempts emerging growth companies from being required to comply with new or revised financial accounting standards

until private companies are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company

can choose not to take advantage of the extended transition period and comply with the requirements that apply to non-emerging growth