KR1 plc Investment: Divergence

08 Julio 2021 - 9:09AM

UK Regulatory

TIDMKR1

8 July 2021

KR1 PLC

("KR1" or the "Company")

Investment: Divergence

KR1 plc (KR1:AQSE), a leading digital asset investment company, is pleased to

announce that the Company has invested a total of US$400,000 into Divergence

("DIVER") in return for 20,666,666.67 DIVER tokens. KR1 led the seed and

private funding round, together with Mechanism Capital, with participation from

other notable funds including P2P Capital, Arrington Capital and Digital

Finance Group.

Divergence is a decentralised platform for volatility hedging and advanced

financial products centred around blockchain-native asset prices. The

Divergence team is currently developing a range of decentralised volatility

derivatives and volatility index products with the aim of becoming the go-to

platform for risk-averse users seeking to hedge both one-sided and two-sided

volatility risks, risk-tolerant users seeking to trade and gain leveraged

exposure to volatility, as well as risk-neutral users seeking to participate as

liquidity providers by funding volatility markets and earning fees.

Lianne Li and Bonna Zhu, both Co-Founders of Divergence, commented:

"From the very beginning, KR1 has shared in, and committed to, the long-term

vision we have for building volatility-based derivatives for the DeFi

ecosystem. We are deeply honoured to have the opportunity of working with the

KR1 team and cannot speak highly enough of their incredible intellectual rigour

and staunch support for every aspect of our endeavours."

Keld van Schreven, Managing Director and Co-Founder of KR1, commented:

"One of crypto's big problems is extreme volatility and Divergence offers an

innovative solution for liquidity providers, market makers and enthused

community members, to allow them to profit from volatility with higher capital

efficiency. With an impressive team, solid incentivisation mechanisms and a

great mission, Divergence is a key part of the new era of the DeFi movement."

The Directors of KR1 plc accept responsibility for this announcement.

--ENDS--

For further information please contact:

KR1 PLC

George McDonaugh +44 (0)16 2467 6716

Keld van Schreven

Simon Nicol simon@KR1.io

Peterhouse Capital Limited (AQSE Corporate Adviser)

Mark Anwyl +44 (0)20 7469 0930

Allie Feuerlein

Nominis Advisory Ltd (PR Adviser)

Angus Campbell pr@KR1.io

About KR1 plc

KR1 is a leading digital asset investment company supporting early-stage

decentralised and open source blockchain and DeFi projects. Founded in 2016 and

publicly traded in London on the APX segment of the AQSE Growth Market (KR1:

AQSE), KR1 has built a notable reputation for generating significant returns by

investing in many key projects that are designed to power the decentralised

platforms and protocols that are emerging to form new internet infrastructures.

www.KR1.io

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation EU 596/2014 as it forms part of retained EU law (as

defined in the European Union (Withdrawal) Act 2018).

END

(END) Dow Jones Newswires

July 08, 2021 10:09 ET (14:09 GMT)

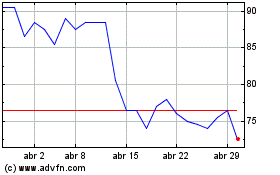

KR1 (AQSE:KR1)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

KR1 (AQSE:KR1)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024