KR1 plc Investment: RedStone Finance

29 Julio 2021 - 10:00AM

UK Regulatory

TIDMKR1

29 July 2021

KR1 PLC

("KR1" or the "Company")

Investment: RedStone Finance

KR1 plc (KR1:AQSE), a leading digital asset investment company, is pleased to

announce that the Company has invested a total of US$100,000 into the RedStone

project, in return for a-yet-to-be determined amount of RedStone tokens. KR1

invested in this first RedStone financing round, led by Maven 11 and joined by

other prominent investors such as 1kx and Bering Waters.

RedStone is a next-generation cross-chain data oracle technology that offers

fast and cost-efficient access to data, a full historic audit trail and an

insurance-backed decentralised dispute mechanism, that provides users with

recourse in the event of inaccurate data provision. The project utilises

permanent and affordable storage of the Arweave blockchain to keep data and

track reputation, while integrating with a range of EVM-compatible chains such

as Ethereum, Avalanche or Polygon, where the majority of all decentralised

finance activity takes place.

Jakub Wojciechowski, CEO and Founder of RedStone Finance, commented:

"DeFi has experienced a colossal expansion, yet the oracle technology is

lagging behind with the infrastructure created years ago. RedStone is looking

to fill that gap by offering fast, cost-efficient and convenient tools for

providing data to blockchain protocols. I am privileged to be surrounded by a

group of very experienced investors who can help RedStone to reach its full

potential."

George McDonaugh, Managing Director and Co-Founder of KR1, commented:

"RedStone stands out in the crowded world of blockchain oracle solutions in

providing a real edge with regards to cost savings, latency, auditability and

insurance. We are already seeing the project starting to gain traction and we

are thrilled to fund Jakub and his team in his new endeavour."

The Directors of KR1 plc accept responsibility for this announcement.

--ENDS--

For further information please contact:

KR1 PLC

George McDonaugh +44 (0)16 2467 6716

Keld van Schreven

Simon Nicol simon@KR1.io

Peterhouse Capital Limited (AQSE Corporate Adviser)

Mark Anwyl +44 (0)20 7469 0930

Nominis Advisory Ltd (PR Adviser)

Angus Campbell pr@KR1.io

About KR1 plc

KR1 is a leading digital asset investment company supporting early-stage

decentralised and open source blockchain and DeFi projects. Founded in 2016 and

publicly traded in London on the Apex segment of the AQSE Growth Market (KR1:

AQSE), KR1 has built a notable reputation for generating significant returns by

investing in many key projects that are designed to power the decentralised

platforms and protocols that are emerging to form new internet infrastructures.

www.KR1.io

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation EU 596/2014 as it forms part of retained EU law (as

defined in the European Union (Withdrawal) Act 2018).

END

(END) Dow Jones Newswires

July 29, 2021 11:00 ET (15:00 GMT)

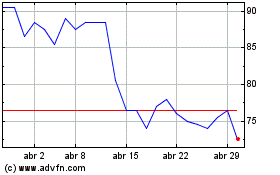

KR1 (AQSE:KR1)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

KR1 (AQSE:KR1)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024