Asian Shares Rise, Led by Tokyo

03 Octubre 2016 - 10:50PM

Noticias Dow Jones

Asian stock markets were broadly higher early Tuesday, with

Japanese equities leading as solid U.S. manufacturing data helped

weaken the yen.

The Nikkei Stock Average was up 0.8%, Korea's Kospi rose 0.7%

and Singapore's FTSE Straits Times Index gained 0.2%. Chinese

markets are shut for the week. Hong Kong's Hang Seng Index,

however, reversed early gains and was down 0.2%.

"We're up based on a weaker yen," said Alex Furber, senior

client services executive at CMC Markets. "We've had some fairly

positive data on the U.S. side last night, and [some market players

believe] this is a case for a rate hike."

The U.S. September purchasing managers' index -- a key measure

of factory activity—jumped to 51.5, shifting back into expansionary

territory, following a surprise dip to 49.4 in August.

The stronger manufacturing numbers sent the yen down 0.5%

against the dollar, as the market's appetite for risk returned.

Japanese exporters benefited, with Honda Motor rising 2.2%, Olympus

adding 4.1% and Panasonic gaining 1.6%.

The data further supported expectations for an interest-rate

increase by the U.S. Federal Reserve at its December meeting.

According to CME Group's Fedwatch tool, the market expects a 62.1%

probability of a change in rates, which was higher than the

previous day.

Elsewhere in Japan, financial stocks rebounded following a

recent selloff due to concerns about slow growth, low interest

rates and the contagion from a troubled European banking sector.

The Topix banking subsector added 2.1%, while among individual

banks, Mitsubishi UFJ Financial Group gained 2.3% higher and

Sumitomo Mitsui Financial Group rose 2%.

In Australia, stocks were retreating from five-week highs ahead

of the Reserve Bank of Australia's decision on interest rates later

Tuesday, the first under new governor Philip Lowe. The S&P/ASX

200 was last down 0.2%, while in New Zealand, the NZX-50 index was

off 0.4%.

Financial stocks in Australia consolidated after gains in the

previous session. Commonwealth Bank of Australia was 0.4% lower and

Westpac Banking Corporation was down 0.3%.

Meanwhile, commodities prices were mostly lower, as a stronger

dollar made the dollar-denominated products more expensive to buy

for those holding other currencies. Brent crude was down 0.6% at

$50.60 a barrel, while gold was down 0.1% at $1,310.92 a troy

ounce.

Among other currencies, the British pound was relatively stable

against the dollar in Asian trade, off 0.1% recently, after

declining 1.1% Monday. The sterling's decline came after U.K. Prime

Minister Theresa May announced she would trigger Article 50 by the

end of March 2017, formally starting the clock on the country's

two-year deadline to exit from the European Union.

Kosaku Narioka and Kenan Machado contributed to this

article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

October 03, 2016 23:35 ET (03:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

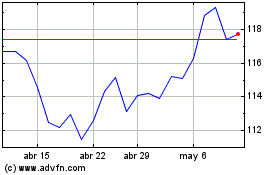

Commonwealth Bank Of Aus... (ASX:CBA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Commonwealth Bank Of Aus... (ASX:CBA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024