Nokia launches share buyback program to offset the dilutive effect of the Infinera acquisition

22 Noviembre 2024 - 4:15AM

UK Regulatory

Nokia launches share buyback program to offset the dilutive effect

of the Infinera acquisition

Nokia Corporation

Stock Exchange Release

22 November 2024 at 12:15 EET

Nokia launches share buyback program to offset the

dilutive effect of the Infinera acquisition

Espoo, Finland – In line with the announcement made on 27 June

2024, Nokia Corporation ("Nokia" or the "Company") has today

decided to launch a share buyback program to offset the dilutive

effect of issuing new shares to the shareholders of Infinera

Corporation and from Infinera’s existing share-based incentives.

The daily buyback volume is expected to increase following the

completion of the Infinera acquisition, and the program will be

terminated if the acquisition is cancelled.

The main terms of the share buyback program:

• The program targets to

repurchase 150 million shares, for an aggregate purchase price not

exceeding EUR 900 million.

• The repurchases will start

at the earliest on 25 November 2024 and end latest by 31 December

2025.

• The purpose of the

repurchases is to reduce Nokia’s capital to offset the dilution

from issuing additional shares. The repurchased shares will be

cancelled accordingly. The repurchases will be funded using the

Company's funds in the reserve for invested unrestricted equity and

the repurchases will reduce the Company's total unrestricted

equity.

• The repurchases are based

on the authorization granted to the Board of Directors by Nokia's

Annual General Meeting on 3 April 2024. The maximum number of

shares that can be repurchased under the program is 150 million

shares corresponding to approximately 3% of the total number of

shares in Nokia.

• The shares will be acquired

through public trading on the regulated market of Nasdaq Helsinki

and select multilateral trading facilities. No repurchases will be

made in the United States. Nokia has appointed a third-party broker

as the lead-manager for the buyback program. The lead-manager will

make trading decisions independently of and without influence from

Nokia. The repurchases will be carried out in accordance with the

so-called safe harbour rules referred to in Article 5 of the EU

Market Abuse Regulation (EU N:o 596/2014).

• The price payable per share

shall be determined in public trading on the relevant trading venue

at the time of the repurchase, in compliance with the price and

volume limits applicable under the safe harbour rules.

The program may be terminated prior to its scheduled end date

and Nokia will in such case issue a stock exchange release to this

effect.

About Nokia

At Nokia, we create technology that helps the world act

together.

As a B2B technology innovation leader, we are pioneering

networks that sense, think and act by leveraging our work across

mobile, fixed and cloud networks. In addition, we create value with

intellectual property and long-term research, led by the

award-winning Nokia Bell Labs.

With truly open architectures that seamlessly integrate into any

ecosystem, our high-performance networks create new opportunities

for monetization and scale. Service providers, enterprises and

partners worldwide trust Nokia to deliver secure, reliable, and

sustainable networks today – and work with us to create the digital

services and applications of the future.

Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: press.services@nokia.com

Maria Vaismaa, Global Head of External Communications

Nokia

Investor Relations

Phone: +358 40 803 4080

Email: investor.relations@nokia.com

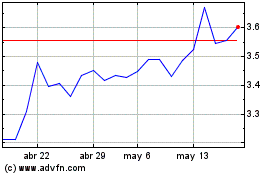

Nokia (BIT:1NOKIA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

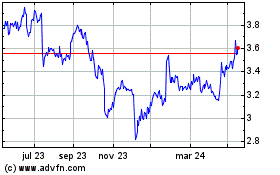

Nokia (BIT:1NOKIA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024