Ethereum Options Surpass Bitcoin Ahead Of Upcoming Merge

02 Agosto 2022 - 6:00PM

NEWSBTC

Ethereum has been outperforming bitcoin for a while now. The

altcoin had managed to grow so rapidly that it is now about half

the market cap of bitcoin despite being more than 5 years younger.

This outperformance had continued through the bull market and now

even into the bear market. Ethereum has taken one step further to

overtake bitcoin in yet another metric, and that is the amount of

open interest in the asset. Open Interest Flips Bitcoin New data

from Glassnode has shown an interesting development when it comes

to the open interest in both Bitcoin and Ethereum options. Bitcoin

had naturally dominated this metric due to not only being the first

cryptocurrency in the market but also the digital asset with the

most interest from investors, both retail and institutional

investors. Ethereum had quickly surpassed bitcoin in this regard as

its open interest had surged to $5.6 billion across all Put and

Call options, accounting for more than a 47% increase in the last

month. ETH’s popularity during this time and price recovery has

obviously helped in its domination. Bitcoin, on the other hand,

continues to trend around normal levels with $4.3 billion in open

interest. This puts Ethereum ahead more than 30. With also more

than $2.6 billion in Call options and a Put/Call Ratio of 0.26,

Ethereum investors are showing their hand and it is very bullish.

Ethereum Merge Drives Interest The major culprit behind the

recovery in the price of ETH had been the upcoming Merge. After a

stretch of uncertainty regarding whether the upgrade would happen

or would be postponed yet again, Ethereum developers had moved

forward to provide an estimated date for the Merge. ETH price falls

below $1,600 | Source: ETHUSD on TradingView.com With the September

19th date announced, investors had begun to ramp up their holdings

ahead of the Merge. With the new month, the Merge draws closer, and

positive sentiment around the digital asset has grown. Given that

it is arguably one of the biggest updates in the history of crypto,

the positive sentiment from investors is understandable. The Merge

is also behind the growth of Ethereum’s open interest. The bullish

sentiment is in response to the upgrade finally happening next

month. However, it is important to note that the Merge would see

all staked ETH become free to withdraw. This will lead to an influx

of ETH supply into the market, likely tanking the price. By that

point, it’ll not be important how bullish the sentiment is but if

there is enough demand to soak up this new supply. This raises the

question of whether this would be another “buy the rumor, sell the

news” event. One thing is for sure, if it goes the way of Cardano

with the Alonzo hard fork, ETH users should brace for a stretch of

bear market prices. Featured image from Coingape, chart from

TradingView.com Follow Best Owie on Twitter for market insights,

updates, and the occasional funny tweet…

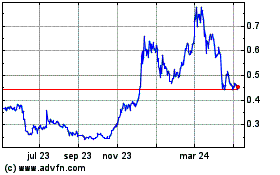

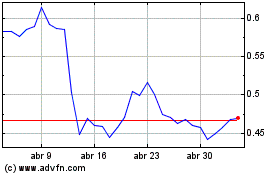

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024