Cardano Whales Accumulating – Why Is ADA Bearish?

07 Mayo 2023 - 1:00AM

NEWSBTC

Despite a massive Cardano whale accumulation, ADA, its native

currency, remains bearish, prompting questions about the strength

of the underlying fundamentals and whether the leg up of Q1 2023 is

over. ADA’s volatility has been dropping in recent weeks despite a

slew of positive developments, mainly from on-chain data.

Related Reading: Cardano TVL Climbs By 10% In A Day – Is ADA Set To

Soar Once Again? As an illustration, the coin is down roughly 20%

from April peaks and retesting a local support zone of around

$0.38. Whales Doubling Down, Activity Rising In Cardano Still, even

in these market conditions, there are signs that ADA whales are

accumulating in the ecosystem. Although the reason for the swarm is

unclear, according to IntoTheBlock, large transactions worth

over $100,000 have been made over the past 24 hours, worth around

$10 billion. The bulk sale of this size stands at $20 billion in

the past week. Moreover, data also shows that “large holders”

control 35% of ADA’s total supply. These entities act as a proxy to

institutional players’ and whale activities, showing how they may

be investing and positioning. While it is unclear what knowledge

the Cardano whales have, their activities suggest that they are

buying the dip. This is considering that ADA is still down around

87% from 2021 peaks. Besides whales buying in bulk, Cardano’s

ecosystem is showing promising signs, with the blockchain remaining

one of the most highly developed and used. According

to Santiment, 2.15 billion transactions were processed on

Cardano. Typically, active networks, in both development and use,

point to quality and confidence. The more there are projects and

addresses, the higher the odds of the platform’s coin finding

support. The spike in activity over the past few months, even with

the general market lull, could be due to various non-fungible token

(NFT) and decentralized finance (DeFi) projects launching. Djed, an

algorithmic stablecoin, is already live on the mainnet. DeFi and

NFT projects look to take advantage of Cardano’s EUTXO model. This

system mirrors how Bitcoin functions but adds a layer of smart

contracting, just like Ethereum. However, one of the main

developments of Cardano in recent days is the release of the first

Hydra Head on the mainnet. This layer-2 scaling solution uses state

channels that extend the concept of payment channels. This

technology can drive growth, possibly supporting ADA prices in the

long haul. Related Reading: Cardano Launches First Hydra Head For

L2 Scaling, But Why Is ADA Dropping? ADA Remains Bullish Even with

the recent contraction, Cardano’s long-term prospects look good.

Presently, whales appear to be accumulating, adding over 150

million ADA in just one month. With big players bullish on

the coin, doubling down on dips, ADA prices could recover. In the

medium term, the ceiling remains at $0.46, marking April 2023

highs. -Featured Image From Canva, Chart From TradingView

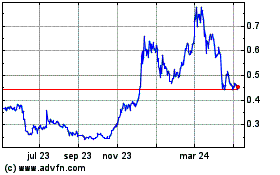

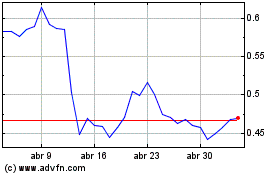

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024